For years, iconic NFT collections like CryptoPunks, Bored Ape Yacht Club, and Pudgy Penguins have faced the same old problem: liquidity. These assets have been treated as collectibles rather than productive financial instruments — valuable, but static.

Now, TokenWorks is changing that narrative.

Their experiment in “DeFi-fying” NFTs — starting with PunkStrategy — turns blue-chip NFTs into self-sustaining financial machines.

Within just a few weeks, PunkStrategy proved something few thought possible: those “static JPEGs” can, in fact, generate real liquidity and yield.

1.Origins & Position in the NFT/DeFi Landscape

1.1 The Current State of the NFT Market

After the explosive NFT boom of 2021, the market went through a long correction. Liquidity dried up, many collections became worthless, and the “profile-picture era” came to an end.

By late 2024 and into 2025, the market began shifting from purely collectible art toward utility-driven NFTs — gaming assets, membership passes, phygital collectibles, tickets, and access tokens.

According to the 2025 NFT Market Report, 38% of total trading volume now comes from NFT gaming.

The challenge, however, remains liquidity. NFTs are inherently illiquid — owning one doesn’t mean you can sell it instantly.

That’s why various NFT-Fi models — staking, tokenization, fractionalization, ERC-404 experiments — have tried to merge NFTs with DeFi. Yet, most have failed to build a sustainable loop.

This is where TokenWorks and its NFTStrategy framework introduce a completely new approach: turning NFTs into yield-generating financial assets.

1.2 What Are TokenWorks and NFTStrategy?

TokenWorks is the development team behind PunkStrategy and NFTStrategy — two mechanisms designed to “DeFi-fy” NFTs by transforming them from static collectibles into dynamic, cash-flowing assets.

They began with PunkStrategy ($PNKSTR), using CryptoPunks — the OG symbol of the NFT world — as the testing ground.

The mechanism quickly proved its viability: through a feedback loop of trading fees ↔ NFT buybacks ↔ resales ↔ token burns, PunkStrategy created real buying pressure on the underlying NFT while maintaining an internal capital cycle.

After just a few weeks, $PNKSTR’s market cap surged to nearly $300 million, drawing significant community attention.

Now, TokenWorks is expanding the concept through NFTStrategy — a generalized framework that allows any NFT collection (BAYC, Pudgy Penguins, Meebits, etc.) to launch its own “strategy token” and recreate a similar economic flywheel.

The ultimate goal?

To build an NFT financialization layer, where every collection becomes a mini DeFi protocol that generates liquidity and sustains its own value autonomously.

2.Mechanism and Technical Architecture

2.1 The Objective: Tokenize Every NFT Collection

NFTStrategy is the modular, permissionless expansion of PunkStrategy.

It enables any ERC-721 collection to issue its own Strategy Token (STR) — effectively turning every NFT ecosystem into a self-operating DeFi model.

The key insight: holders don’t need to stake or manage anything themselves — the mechanism runs automatically through the token’s trading activity.

2.2 How the Mechanism Works

Each NFT collection corresponds to a specific Strategy Token: e.g., Bored Ape → $APESTR, Pudgy Penguins → $PUDGYSTR, etc.

Here’s the basic loop:

- A 10% transaction fee is applied to every swap.

8% accumulates as ETH in the protocol vault.

1% goes to the original NFT creator as on-chain royalties.

1% is used to buy & burn $PNKSTR, maintaining the ecosystem link.

- Once the vault holds enough ETH to purchase the floor NFT, the protocol automatically buys it.

- The NFT is relisted at +20% above the purchase price.

- When it sells, the ETH proceeds are used to buy & burn the Strategy Token, completing the loop.

This creates a self-sustaining liquidity cycle between tokens, ETH, and NFTs.

2.3 Key Technical Features

- Launch Cap: Every NFTStrategy token starts with a $50,000 market cap, seeded with full initial liquidity to prevent manipulation.

- Anti-Sniping Mechanism: Transaction fees start as high as 95% in the first minute post-launch, gradually lowering to 10%, protecting against bots.

- Royalty Distribution: A share of protocol revenue flows back to the original NFT creators — a first for any DeFi flywheel model.

3.The Three-Layer Value Structure of TokenWorks

3.1 Layer 1 – TokenWorks Layer (Meta Layer)

This is the base infrastructure coordinating all Strategy Protocols. TokenWorks acts as the underlying DeFi engine, providing the tools and architecture for NFT projects or communities to easily deploy their own strategies.

3.2 Layer 2 – PunkStrategy Layer (Genesis Layer)

The original model that started it all.

Every NFTStrategy transaction routes 1% of its fee back to buy and burn $PNKSTR, effectively turning PunkStrategy into the liquidity hub of the entire system. The more NFTStrategy tokens exist → the higher total volume → the stronger buy pressure for $PNKSTR.

3.3 Layer 3 – NFTStrategy Layer (Expansion Layer)

This is the user-facing layer where collections deploy their tokens, traders interact, and liquidity circulates — generating the main market activity for the TokenWorks ecosystem.

4.NFT Collections Already Live

TokenWorks debuted with PunkStrategy, the flagship experiment based on CryptoPunks, powered by $PNKSTR — now serving as the foundation for all future NFTStrategy protocols.

After validating the model, TokenWorks expanded to five other major NFT collections:

- $APESTR – Bored Ape Yacht Club (~116 ETH floor)

- $PUDGYSTR – Pudgy Penguins (~130 ETH floor)

- $BIRBSTR – Moonbirds (~38.25 ETH floor)

- $MEEBSTR – Meebits (~10.4 ETH floor)

- $DICKSTR – CryptoDickButts (~17.5 ETH floor)

TokenWorks confirmed more Strategy Tokens are launching daily, spanning collections from Chromie Squiggles and CrypToadz to Goblintown, Checks, Max Pain (Xcopy), Good Vibes Club, and Milady — bridging OG art NFTs with meme culture assets.

This expansion signals TokenWorks’ long-term ambition: building an NFT-Fi framework that can financialize any collection, regardless of scale or artistic style.

According to their roadmap:

- Phase 1: TokenWorks directly launches major blue-chip NFT strategies (completed).

- Phase 2: NFT collection owners can create their own Strategy Tokens.

- Phase 3: Fully permissionless — anyone can pay a fee to deploy a token for their favorite NFT, transforming TokenWorks into a true DeFi infrastructure layer for NFTs.

5.Risks & Legal Concerns

While the NFTStrategy concept is fascinating, TokenWorks faces several systemic and regulatory challenges.

5.1 Unofficial Associations

Most NFT collections (BAYC, Pudgy Penguins, CryptoPunks, etc.) have no official partnership with TokenWorks.

If rights holders object to brand or image usage, TokenWorks may be forced to rebrand or halt related tokens.

In essence, NFTStrategy leverages the image and brand equity of existing IPs without explicit licensing — similar to “wrapped asset” models.

This could trigger DMCA complaints or legal disputes, requiring structural adjustments.

5.2 Market Risks

- Liquidity Dependence: When volume dries up → fewer fees → no NFT buys → no burns → token price collapses.

- Pump & Dump Potential: The $50K initial cap is vulnerable to manipulation.

- Speculative Narrative: The “tokenized floor” story only works in a bullish NFT market.

5.3 Flywheel Fragility

The loop (“fees → ETH → NFT buy → burn”) works only with continuous inflows.

Once it stalls, a death spiral can occur: price drops → lower volume → fewer burns → deeper decline.

Other structural issues include:

- Token prices over-pumping relative to the underlying NFT.

- Capital rotating to “hotter” NFTStrategy tokens, starving smaller ones.

- Meta saturation — once novelty fades, ecosystem-wide volume may decline.

6.Could NFTStrategy Become the Next Meta?

6.1 TokenWorks Is “DeFi-fying the NFT Layer”

At its core, TokenWorks is pioneering the idea of NFTs as programmable markets — turning each collection into a self-contained micro-economy.

This evolution mirrors how DeFi transformed ETH, stETH, and LP tokens into productive yield assets.

If the model proves sustainable, TokenWorks could become the liquidity middleware between NFTs and DeFi, much like how Uniswap became the foundation for ERC-20 tokens in 2020.

6.2 Relationship With Blue-Chip NFTs

On the one hand, TokenWorks leverages the brand power of major collections to attract attention and capital.

On the other hand, it pressures traditional NFT projects to rethink their secondary-market strategies.

If NFTStrategy demonstrates real value, NFTs without their own tokens may be seen as “financially incomplete,” pushing creators to issue native tokens — similar to how Blur forced OpenSea to revamp its royalty model.

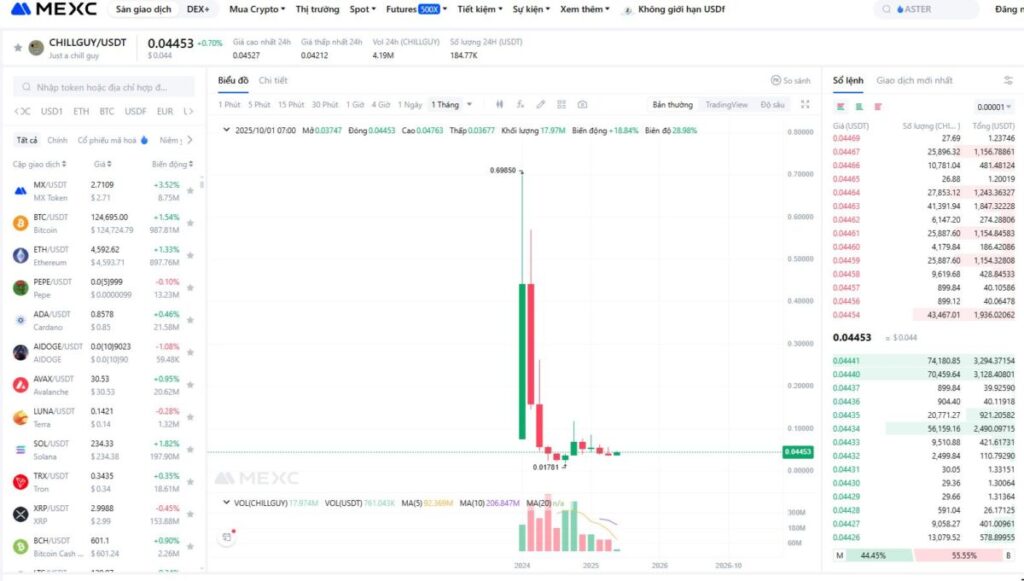

A legal dispute between author Phillip Banks and the development team of the memecoin Chill Guy ($CHILLGUY), which led to a sharp drop in the value of the coin.

6.3 The Social Consensus Factor

TokenWorks is playing a high-stakes social game.

If communities feel their brand is being exploited, backlash could follow.

But if holders see genuine floor price support, they’ll amplify the narrative instead.

Ultimately, TokenWorks’ success depends on community perception — a variable far less predictable than market trends.

6.4 Expansion & Future Directions

- Community-Deployed Strategy Tokens: In Phase 3, anyone can deploy a token for their favorite NFT collection, turning TokenWorks into a launchpad for NFT-linked tokens, spawning hundreds of community-driven micro-projects.

- DeFi Integrations: Strategy Tokens could soon serve as collateral for lending or staking, earning $PNKSTR rewards and deepening on-chain utility.

- Transparent On-Chain Data: Each NFT buy/sell event is recorded on-chain, creating a proof-of-activity layer for NFT market intelligence and performance tracking over time.

7.Conclusion

NFTStrategy isn’t just another DeFi product — it’s an economic experiment exploring how collectible assets can sustain real liquidity and intrinsic value.

Through TokenWorks, the market is witnessing a bold attempt to reprogram how NFTs generate and preserve worth.

If the model holds, NFTStrategy could usher in an entirely new meta — NFT-Fi — where each collection evolves from a static collectible into a self-running financial engine with its own internal cash flow.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly

Join MEXC and Get up to $10,000 Bonus!

Sign Up