New Evidence of the Mid-Cycle Crash Points to Large-Scale Sales by Short-Term Holders. A spectacular “Black Monday” occurred on August 5, leading to massive drops in the value of digital assets and stocks. An occurrence known as “correlation-1” caused all this chaos by causing normally uncorrelated assets to exhibit nearly perfect positive correlation in their price movements.

Not even Bitcoin was able to escape this market chaos. Prices fell from moreover $58,000 to less than $50,000 on that doomed Monday, marking the cycle’s greatest decline.

Cryptocurrency Investors Facing Their Greatest Paper Losses Since FTX Disaster

Glassnode says In the wake of this week’s precipitous price decline, short-term holders of Bitcoin were put under a great deal of pressure. Since these holders maintain their Bitcoin for up to 155 days, they are particularly susceptible to fluctuations in the market. This is in contrast to long-term holders (LTHs), who store their assets for longer than this amount of time.

The decrease in the market that occurred recently highlights the pressure that is being placed on traders who are too leveraged and indicates the magnitude of the present strain that is being placed on STHs, who are currently incurring their worst unrealized losses since the collapse of FTX.

As of right now, just seven percent of the supply of STH is displaying a profit, which is similar to the sell-off that occurred in August of 2023. Considering that this number is more than one standard deviation below the norm over the long term, it indicates that recent investors are experiencing substantial financial difficulties.

SOPR Dives to Unprecedented Lows

In light of the fact that the Short-Term Holder SOPR has reached remarkable lows, which reflects an average loss of -10% for new investors, Glassnode brought attention to a potentially problematic pattern. With just seventy trading days in the history of the market exhibiting a lower value, this signifies the beginning of a surrender phase.

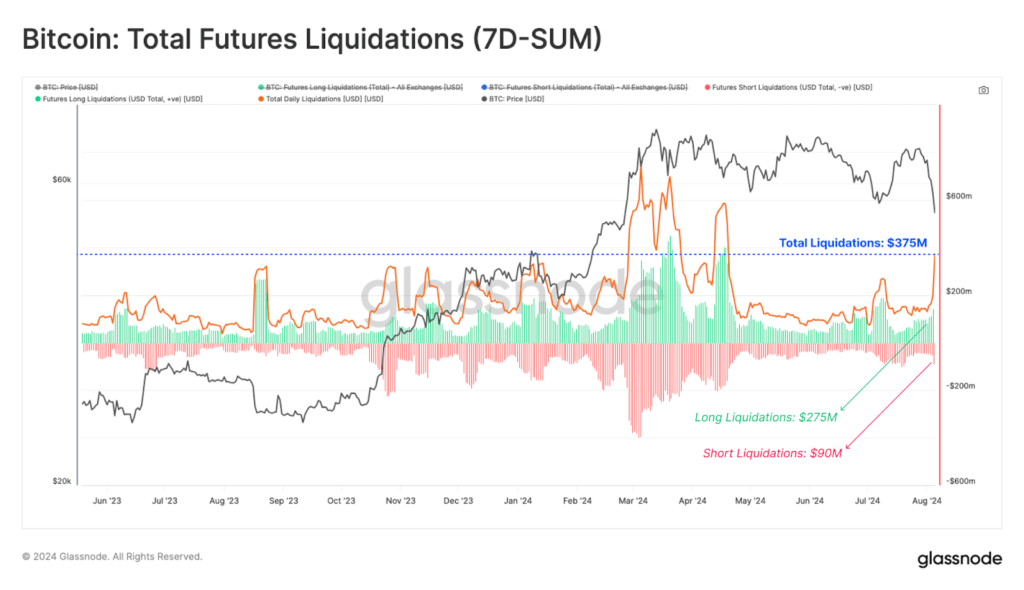

According to market sentiment, a large number of forced liquidations occurred in the derivatives markets, resulting in the closure of long positions worth $275 million.

The sum was increased to $365 million due to the liquidation of $90 million worth of short contracts. The enormous scale of the liquidation event highlights how the market pushed leveraged speculators out. Bitcoin has recovered from its August 5 plunge below $50,000 and is now trading above $57,410, according to the most recent data.

Join MEXC and Get up to $10,000 Bonus!

Sign Up