Key Insights:

- Inflows to crypto exchanges represent digital assets deposited, which signal potential shifts in market prices and investor sentiment.

- Outflows involve assets leaving exchanges, often reflecting investor strategies for security or trade optimization.

- Monitoring these flows provides crucial data for predicting market movements and forming robust trading strategies.

Inflows on cryptocurrency exchanges, indicating the volume of digital assets deposited, serve as a barometer for investor interest and market liquidity. These movements are critical for understanding prospective price changes and overall market health. Higher inflows generally suggest increased trading activity, which can significantly affect cryptocurrency prices and trends. Conversely, reduced inflows may reflect a drop in investor confidence or market engagement.

Understanding Types of Inflows

The primary inflows include trading activity, transfers from external wallets, and fiat currency deposits. Each type provides insight into the market’s condition. For instance, substantial fiat deposits often suggest new capital entering the market, potentially driving up cryptocurrency prices. Meanwhile, transfers from external wallets to exchanges typically increase before significant trading events, indicating that many investors might be preparing to sell or trade large amounts.

Impact of Outflows on Market Sentiment

Outflows, or the transfer of digital assets off exchanges, often indicate plans for long-term storage or fears of potential security issues within exchanges. A high volume of outflows can reduce the liquid asset supply on the market, possibly leading to price increases due to heightened scarcity. Abrupt spikes in outflows might signal widespread intent to sell cryptocurrencies, affecting market liquidity and investor sentiment adversely.

Examining Types of Outflows

Cryptocurrency outflows commonly include withdrawals to personal wallets, transfers to decentralized finance (DeFi) platforms, and conversions to fiat currencies. These outflows reflect various investor needs, from securing assets against potential exchange compromises to engaging with burgeoning DeFi applications. Each movement type offers insights into current market behaviors and future trends.

Strategic Monitoring of Cryptocurrency Flows

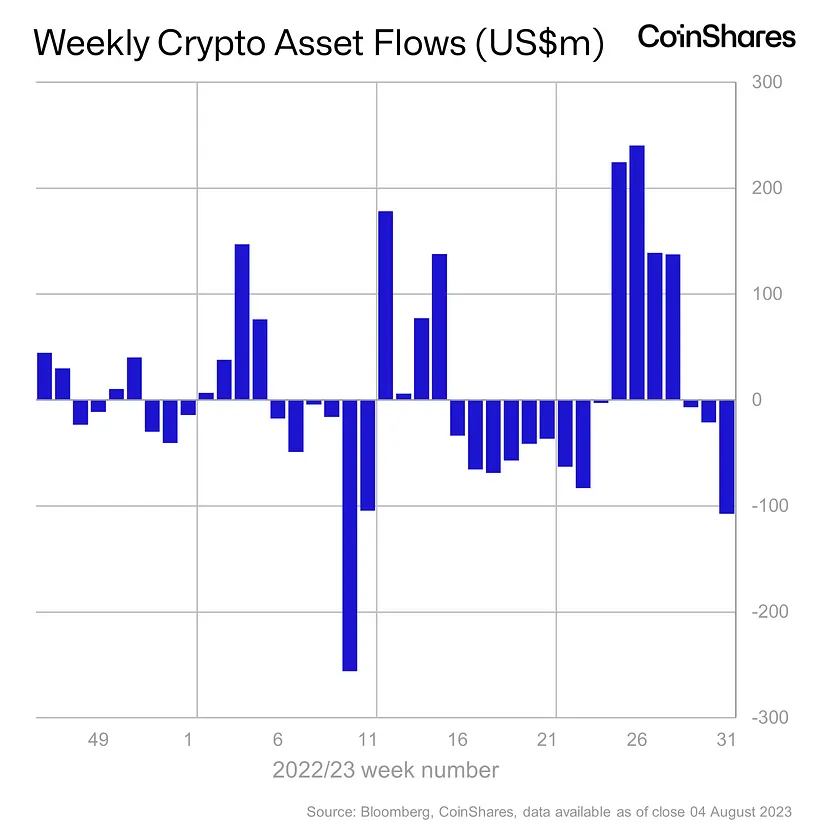

Platforms like CoinMetrics and Glassnode provide comprehensive metrics on these flows, allowing analysts to track how assets move between external addresses and exchange wallets. By examining the net flow of Bitcoin and other cryptocurrencies, for instance, traders can gauge the market’s selling pressure and overall momentum. A positive net inflow suggests increased selling potential, whereas a negative net flow indicates stronger buying pressure, typically pushing prices upward.

Implications for Crypto Trading Strategies

Both inflows and outflows are instrumental in shaping traders’ strategies. Rapid increases in inflows can suggest bullish market conditions, prompting traders to acquire positions in anticipation of price ascents. On the other hand, significant outflows compared to inflows might hint at bearish sentiment, guiding traders to secure profits by selling off positions or to brace for value dips by shorting the market.

Conclusion

Monitoring inflows and outflows on cryptocurrency exchanges offers traders and investors a critical tool for navigating the volatile crypto markets. These metrics not only help predict price movements but also provide deeper insight into the broader market sentiment, guiding strategic decisions that align with emerging trends and investor behaviors.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!