Introduction: A Tumultuous Start for WLFI

World Liberty Financial (WLFI), a new decentralized finance (DeFi) token linked to the Trump family and backed by high-profile figures like Tron founder Justin Sun, launched with huge expectations. Within days, however, controversy erupted after Sun’s wallet was blacklisted following a $9 million WLFI transfer.

The move raised questions about token restrictions, investor rights, and price manipulation at a time when WLFI’s value was already plunging. Investors are now asking: Why was Justin Sun’s wallet blacklisted, and what does this mean for the future of WLFI?

This article explores the background of WLFI, the blacklisting incident, its impact on token prices, community reactions, and how traders can still gain exposure to WLFI — including through major exchanges like MEXC.

What Is World Liberty Financial (WLFI)?

World Liberty Financial (WLFI) is a new DeFi project that claims to support USD-based stablecoins and strengthen the U.S. dollar’s global dominance.

Key facts about WLFI:

- Launched in early September 2025.

- Linked to former U.S. President Donald Trump’s circle, which fueled both hype and controversy.

- Justin Sun, the billionaire founder of Tron and investor in numerous blockchain projects, was an early WLFI presale participant.

- Marketed as a long-term DeFi initiative with features like token burns, buyback programs, and decentralized lending.

The project entered exchanges with massive attention, surging briefly to $0.32 before collapsing below $0.18 within its first week of trading.

Justin Sun’s $9 Million WLFI Transfer

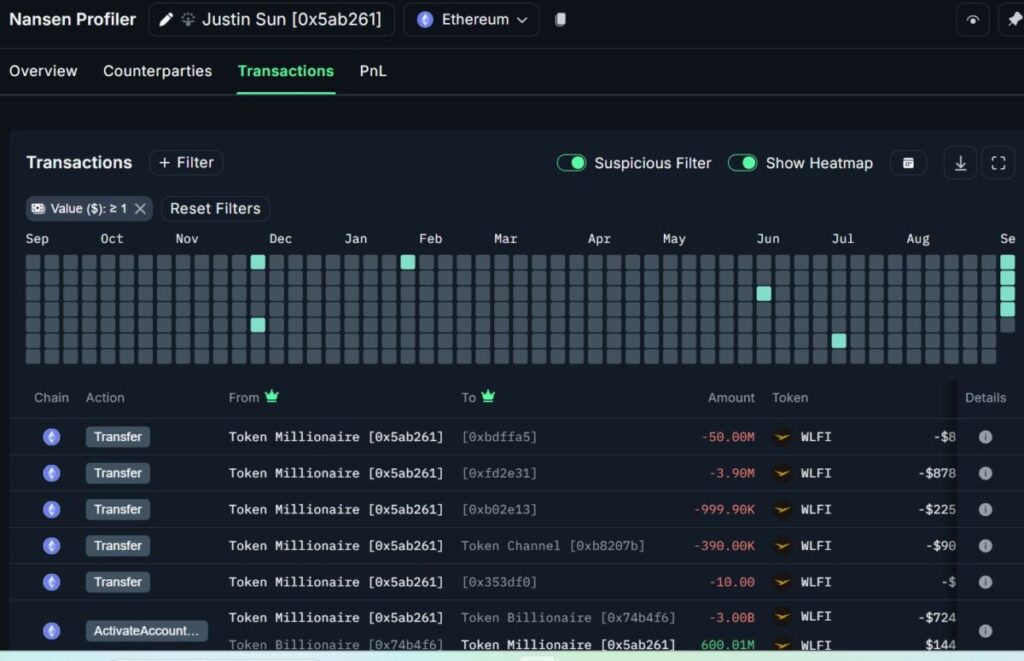

According to onchain data from Arkham and Nansen, Justin Sun’s WLFI wallet executed a 50 million token transfer valued at $9 million to crypto exchange HTX (formerly Huobi).

Soon after, the wallet was blacklisted by World Liberty Financial, meaning it was restricted from trading WLFI.

This development shocked the crypto community for several reasons:

- Sun is a major early backer of WLFI. Blocking his wallet sends mixed signals about fairness.

- Transparency concerns. Why would a DeFi project blacklist wallets when decentralization is supposed to prevent censorship?

- Impact on confidence. Retail traders worried that if Sun’s wallet could be blacklisted, theirs could too.

Why Was Justin Sun’s Wallet Blacklisted?

The exact reason remains unclear, but analysts have proposed several possibilities:

1. Vesting and Token Warrants

Early investors like Justin Sun may have received vesting agreements prohibiting early sales. By transferring to an exchange, his wallet may have triggered an automatic blacklist to enforce lock-up rules.

2. Price Manipulation Concerns

WLFI had already lost over 20% in value. Some speculate that the blacklist was a measure to prevent large early investors from dumping tokens and further crashing the price.

3. Technical Safeguard or Error

Sun claimed the transfer was simply a deposit test and redistribution to another address, not an actual sale. If true, the blacklist may have been triggered by mistake or protocol rules.

Justin Sun’s Response

Justin Sun quickly denied that the transfer was part of a sell-off. In a post on X (formerly Twitter), written in Mandarin, he clarified:

- The transfers were routine tests with very small WLFI amounts.

- Funds were moved between his own addresses and not sold.

- The transactions had no impact on the market.

Sun also reiterated his commitment to WLFI, stating:

“We have no plans to sell our unlocked tokens anytime soon. The long-term vision here is too powerful, and I’m fully aligned with the mission.”

His response helped calm some fears but did not stop WLFI’s steep decline.

WLFI Price Impact: A Steep Drop

Following the blacklisting news:

- WLFI dropped over 22% in a single day, trading below $0.18.

- Sentiment on CoinMarketCap placed WLFI among the 10 most bearish tokens by community outlook.

- Exchange volumes showed heavy trading in South Korea, suggesting strong speculative interest despite risks.

The timing couldn’t have been worse for WLFI, which was still in its first week of public trading.

World Liberty’s Price-Stabilization Efforts

Facing mounting criticism, World Liberty Financial took steps to stabilize its token:

- Token Burn

On Wednesday, the project burned 47 million WLFI tokens, reducing circulating supply. Burns are designed to increase scarcity and, in theory, support prices. - Buyback Program Proposal

World Liberty is considering a buyback funded by protocol fees, with purchased tokens permanently burned. This could provide ongoing supply reduction. - Public Messaging

The project emphasized its long-term vision and assured users that restrictions were meant to protect retail investors from sharp dumps.

Despite these measures, WLFI’s total supply remains near 100 billion, meaning supply pressure will remain an issue unless large burns continue.

Investor Sentiment: Confidence Eroding

Investor confidence has been shaken by:

- Price volatility (a 40% drop within days).

- Blacklist controversy, raising censorship fears.

- Trump connection, which some view as politically risky.

Analysts at Compass Point warned that WLFI could be “another catalyst that decimates retail traders,” highlighting the dangers of projects that blend politics, speculation, and centralized control.

Broader Implications for DeFi

The WLFI incident has sparked wider debates in the crypto community:

- Decentralization vs. Control – Should DeFi projects have the power to blacklist wallets?

- Transparency Issues – Investors demand clarity on vesting schedules and blacklisting rules.

- Reputation Risk – Political ties and high-profile figures like Justin Sun attract attention but also raise credibility concerns.

For many, WLFI is becoming a case study in how not to launch a token, especially one with claims of decentralization.

Where to Buy and Trade WLFI

Despite controversy, WLFI remains actively traded across major exchanges.

One of the safest and most liquid platforms to trade WLFI is MEXC, a global exchange known for:

- Strong liquidity in altcoins and new listings.

- Low trading fees compared to many competitors.

- Futures trading pairs for WLFI/USDT, allowing traders to go long or short.

- User-friendly interface and accessibility across 170+ countries.

For investors looking to gain exposure to WLFI, MEXC offers spot and futures options, making it one of the most reliable platforms during this volatile period.

Future Outlook: What’s Next for WLFI?

The road ahead for WLFI is uncertain. Several factors will determine its trajectory:

- Transparency from the Team

World Liberty must clarify its blacklist rules, vesting agreements, and governance mechanisms to restore trust. - Market Confidence

Unless WLFI stabilizes, it risks being labeled as another pump-and-dump project. Sustained burns and buybacks could help. - Justin Sun’s Role

As one of the highest-profile backers, Sun’s continued support (or lack thereof) will heavily influence sentiment. - Political Risk

WLFI’s ties to Donald Trump may attract media attention but also polarize investors, especially in regions where political associations matter.

Conclusion: Lessons from the WLFI Blacklist

The blacklisting of Justin Sun’s WLFI wallet after a $9 million transfer has raised serious concerns about fairness, decentralization, and market manipulation in World Liberty Financial.

While Sun insists the transfers were routine, the controversy has already taken a toll: WLFI’s price has dropped over 40% since launch, and investor confidence is shaky.

For traders, WLFI represents both high risk and high opportunity. Its backing by political figures and crypto billionaires could drive hype, but centralization fears and volatility remain major red flags.

If you’re considering trading WLFI, platforms like MEXC provide reliable access, liquidity, and futures options — but proceed with caution, and only risk what you can afford to lose.

Join MEXC and Get up to $10,000 Bonus!

Sign Up