If there’s any valuable lesson I have learned in my 2 decades of existence it is none other than the fact that in many cases, the simplest and most ignored symbols, signs, and incidents are the most powerful and significant things in Life.

Since this priceless secret touches all facets of our daily lives, it is undeniable that when you also learn and realize it, it will skateboard your Crypto trading activities while others are still on the cycling level. Then what’s the secret?

The simplest, but most powerful trading secret in cryptocurrency is trading psychology.

At this stage, I would love to analyze what trading psychology is about for you, but explaining it without you understanding its concept is like giving you the sink without bait or hook. For you to catch your fish, here is the bait:

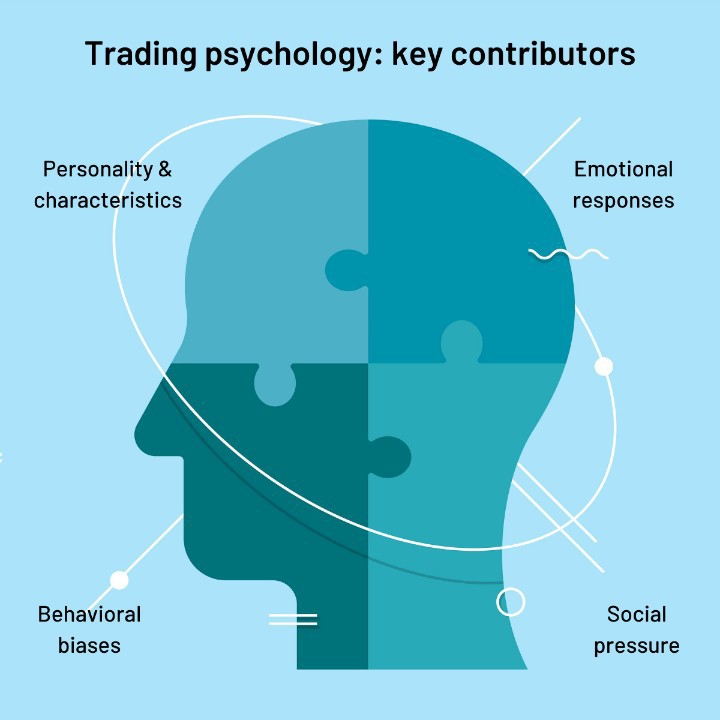

The Concept of Trading Psychology

Trading psychology is the mental and emotional state of being when you are trading cryptocurrency. It’s not limited to Cryptocurrency, as other areas like forex, DeFi, and NFT require a deep psychological sophistication and application.

This is simple but powerful. Like I contemplate. When Crypto gurus, enthusiasts, or whales say you need more than money for investing in trading, this is what they mean.

Having known what trading psychology entails, then what are they? How can you identify the trading psychology and conform to it?

Below is the List of Trading Psychology

The Psychology of Fear

Fear is of two types. They are the fear of uncertainty called FUD and the fear of Losing out called FOLO.

The former is caused by a lack of adequate and effective research, while the latter is caused by greediness or abject poverty. This is why it’s good to have another source of income aside from Crypto. FOLO can make you lose all that you had in one Night.

It’s good to always want more in Life so you can give more, but bad to lack the tactics of knowing when to surrender or compromise, especially for a sporadic period of time. This game is a game of both fundamental and technical analysis, But greediness will always make you forsake the former and concentrate only on the latter. Eventually, you may find yourself On the other side of the chart.

The Psychology of Anger

What is inside us depicts and describes us better than what’s outside. Some things you should not do when you’re in a rage include negotiation, uttering a single word, driving, or operating any movable devices. Maybe they forget to tell you not to trade. I am telling you this today, even from an experience. Anger gives no options to a Man, and limits you to only the current action. With this, you can’t predict or analyze the market ahead.

The Psychology of Disappointment

Disappointment stems from just experiencing anxiety or depression due to human behavior directed towards someone or a change in the cause of direction of an expectation. Whatever it is, don’t go into trading during this moment. Cryptocurrency itself is a game of disappointment, and that’s why Crypto gurus advise that only venture into trade what you can afford because you may be expecting a profit and end up losing.

How to Control These Psychologies

Adequate Research

Through adequate and extensive research, you’re able to distinguish between the real and scam coin or token. Deeper knowledge like Tokenomics of the coins or tokens is essential for you, and they are only obtainable through proper Research.

Record keeping

Always put chronological records of your trading activities. Ranging from profits to losses should be recorded in a certain ledger to keep track of whether you’re progressing or declining.

Risk Management Strategy

I hate losing money, but I have never seen a millionaire who hasn’t lost thousands of dollars and a billionaire who hasn’t lost millions.

This statement was made by Robert Kiyosaki in one of his notable interviews. To have the big whale in cryptocurrency you need to take the big risk. Forget the sugar-coated words that you’re going to make money every day and not going to lose a dime, it’s a white lie. There’s both profit and loss in there, but learning Risk Management Strategy will help you minimize the loss ratio.

Focus

Fear, greediness, anger, and disappointment, or any of the four is enough to distract you from the market while trading. Another Distraction called multitasking is enough to make you lose out on the trade. A friend of mine fainted In Front of me when he lost all his funds while attending to customers and at the same time trading his coin. Don’t mock him but learn from him.

Conclusion

While this content does explain what trading psychology is, its types, and probable solutions you can apply to solve the problems, however, there are some human natures that if found immutable should not venture into Crypto trading. Find out about this nature here.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!