In crypto, narratives drive both liquidity and investor sentiment. Catch the right trend, and your chance of multiplying assets grows significantly; go the wrong way, and you risk “buying the top” or missing explosive moves. So how do we know which narrative is leading the market, which sector is attracting capital and attention? This guide breaks down practical ways to identify crypto trends.

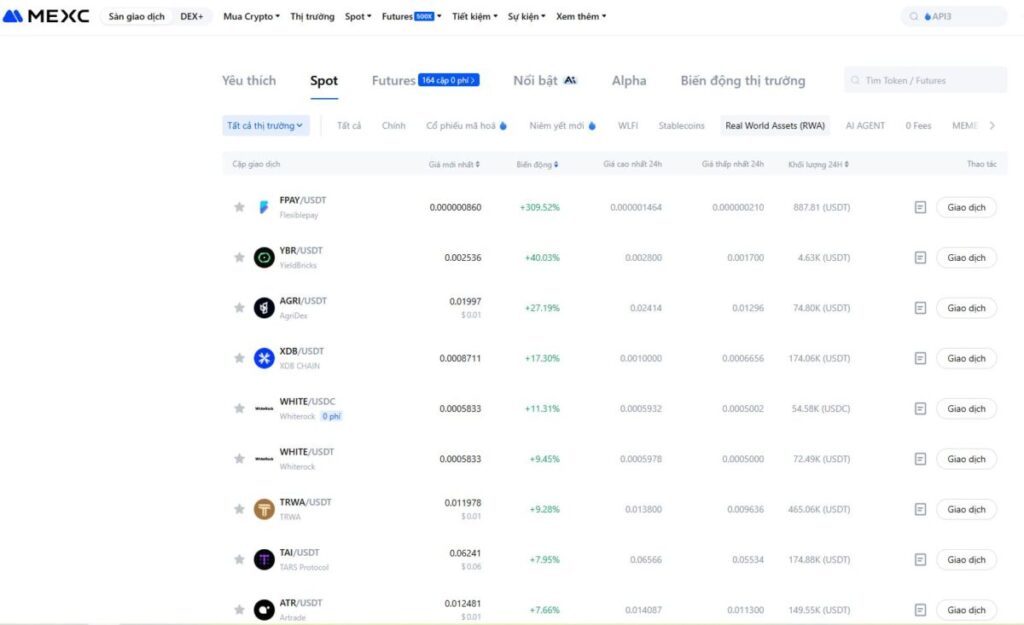

1.Check the Top Gainers on Exchanges

The first and most obvious signal is strong price performance. When a trend emerges, leading projects pump hard and often drag the rest of the sector with them.

For example, during the AI-Agent narrative, tokens like $VIRTUAL and $AI16Z led the rally, followed by a wave of AI-Agent projects. Similarly, memecoins like $WIF and $TRUMP set the tone and pulled smaller meme plays along.

Exchanges like MEXC are usually among the first to list high-volume pairs. Their Top Gainers section is updated frequently and highlights tokens with strong inflows — making it one of the most effective ways to spot which sectors are heating up.

For Example: As seen in the chart, RWA (Real World Assets) is currently one of the strongest market narratives, with most RWA tokens showing higher growth than other sectors.

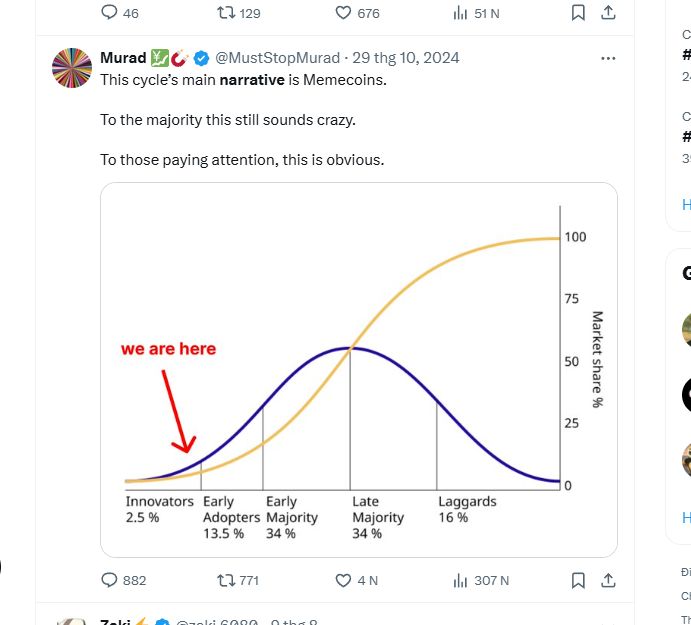

2.Track Social Media Signals

The next step is monitoring crypto communities, groups, and KOLs. Narratives tend to trend on social platforms before they hit the mainstream. If you see certain keywords, discussions, or bullish news repeated for days across different sources, it’s usually a sign that narrative is attracting fresh capital.

Recent examples include terms like DATs and Buyback tokens, which gained momentum after being consistently mentioned by trusted crypto KOLs.

For example: Murad, one of the most influential KOLs in crypto, has repeatedly highlighted the memecoin trend.

3.Use Research Tools and Institutional Reports

Dedicated tools and research platforms can help track market narratives more systematically.

- Kaito AI, Cookie, etc. measure mindshare and show what the community is focusing on, helping you spot emerging narratives early.

- Professional research from firms like Dephil Digital, Messari, Wintermute, and others often includes in-depth trend analysis and market forecasts.

Combining both sources gives a clearer picture of which narratives are gaining real traction.

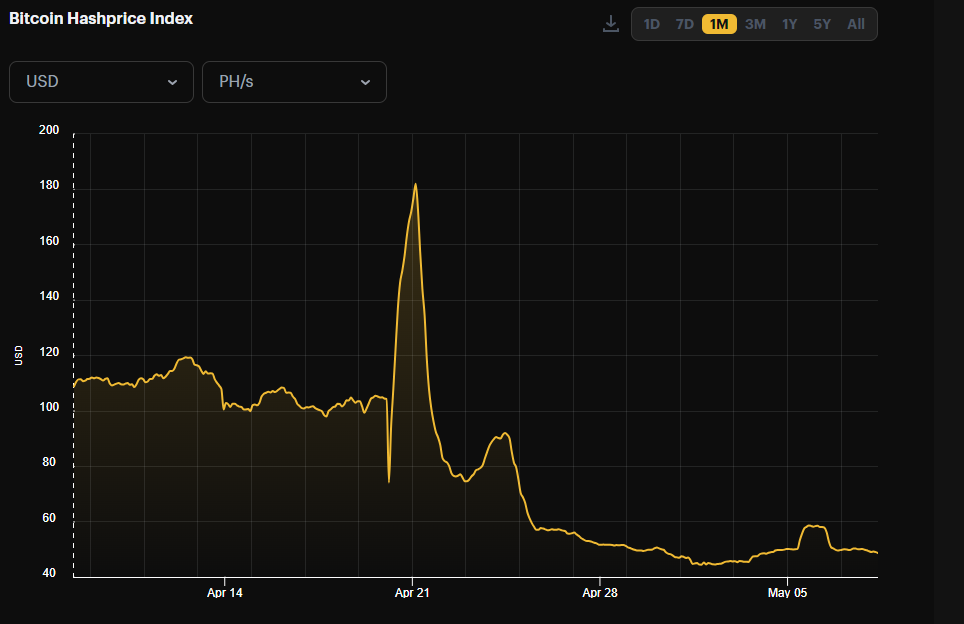

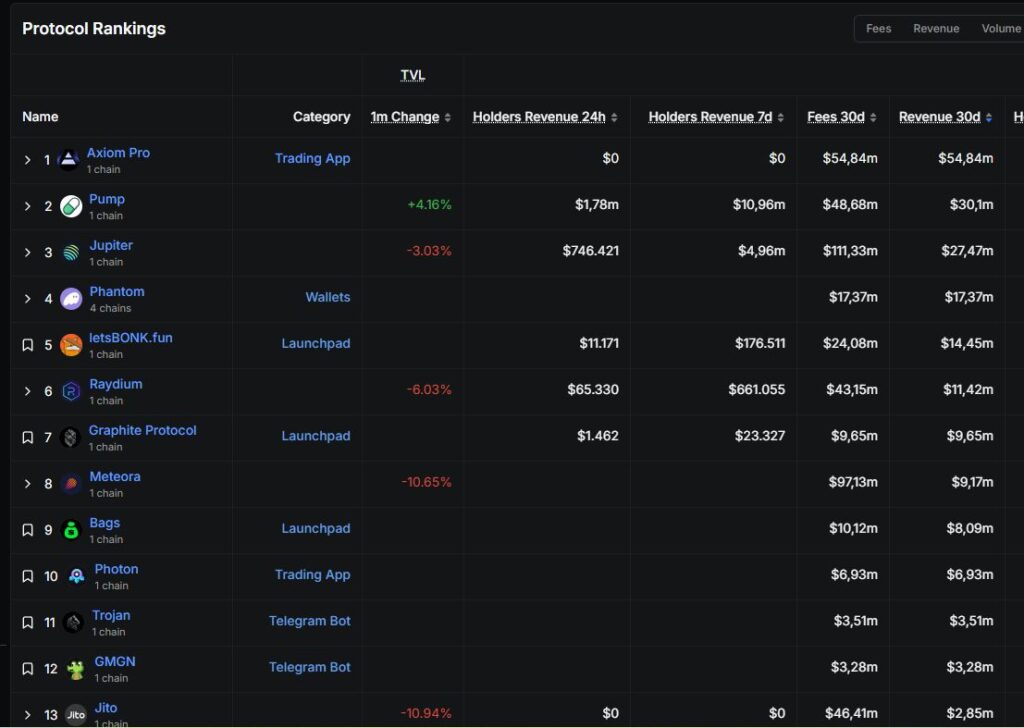

4.Analyze On-Chain Data

Finally, on-chain metrics often confirm whether a trend is backed by real adoption and capital:

- TVL (Total Value Locked), revenue, fees → show if the sector is generating sustainable growth.

- Smart money & whales accumulation → signals confidence in the upside potential of tokens tied to that narrative.

Tools like DefiLlama, CryptoQuant, and Nansen are excellent for tracking these metrics and validating whether a trend is truly strong or just hype.

For Example: Not long ago, we had the “battle” of memecoin launchpad platforms between Pumpfun and Letsbonk, which caused the on-chain metrics of these two platforms to skyrocket.

5.Conclusion

Focusing on projects within the current major narrative often leads to better returns. However, timing is crucial — always ask: is the trend still early, or has it peaked already? Combine narrative research with overall market conditions to form the best strategy.

Disclaimer:

This content is for educational purposes only and does not constitute investment, financial, legal, or tax advice. MEXC Learn does not provide recommendations to buy, sell, or hold any asset. Please do your own research, understand the risks, and invest responsibly. MEXC is not responsible for investment decisions made by users.

Join MEXC and Get up to $10,000 Bonus!

Sign Up