After the halving event, Bitcoin’s (BTC) mining revenue fell to all-time lows, sparking questions about the network’s security and miners’ capacity to make money. The amount of money made from mining Bitcoin (BTC) each day has dropped significantly, from an average of almost $6 million in early 2024 to less than $3 million currently with the decline in question transpiring after the Bitcoin (BTC) halving that took place on April 20, 2024.

This event lowered the block reward from 6.25 BTC to 3.125 BTC, thereby halving the miners’ block reward income in effect. The euphoria was short-lived despite a small spike in transaction costs on April 20th, when the launch of a new token standard named Runes protocol caused the daily transaction fees to reach an all-time high of $78.3 million.

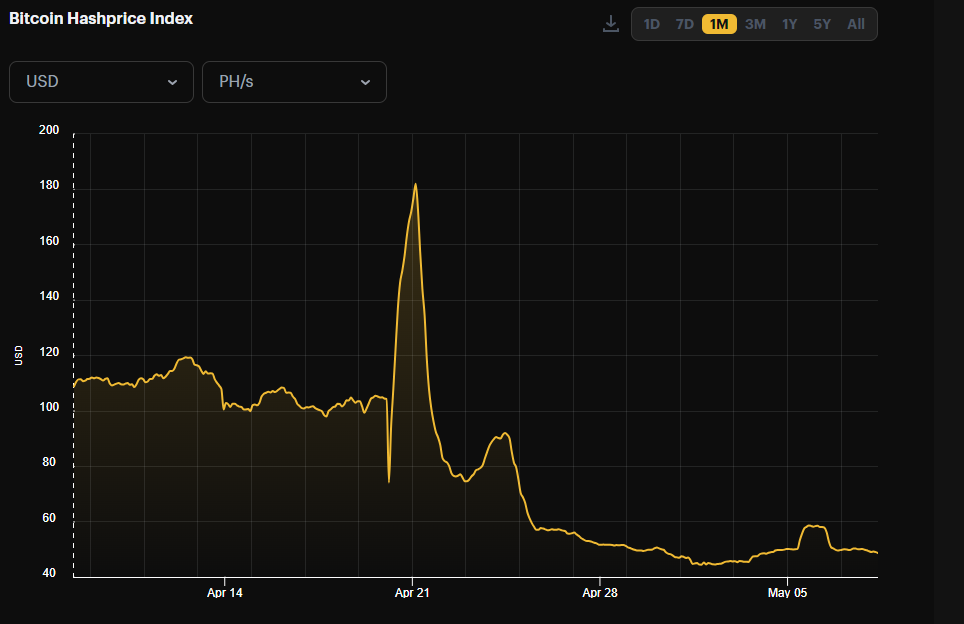

Hashprice—a gauge used by miners to assess the profitability within their operations rose to $182/PH/Day the day following the halving, but since then, Runes activity and transaction fees have decreased resulting in an all-time low of $49/PH/Day on May 07, 2024v as measured against the Hashprice.

What Next For Bitcoin Investors?

The main worry resulting from lower mining profitability is that the hash rate, that is, the total amount of computing power required to mine and process transactions on the blockchain of Bitcoin (BTC) may drop. A lower hashrate indicates that there are fewer miners protecting the network, which can make it more susceptible to attacks like the 51% attack, in which a hacker may be able to take control of a large portion of the hash rate and sway transaction verification.

Because of advances in technology and more efficient mining hardware, the overall hashrate has not dropped proportionately to the loss in mining revenue. Hashing power could be concentrated within larger mining operations if smaller or less productive miners leave the market as a result of the profitability squeeze. Because of its centralization, the network may be more vulnerable to planned assaults or malfunctions, increasing the chance of security breaches.

After halving occurrences in the past, the price of Bitcoin (BTC) has typically increased, possibly offsetting the decreased block rewards. The particulars of each halved mean, however, can produce different results. High levels of inflation and economic instability are present during the current halving, which may have a different effect on Bitcoin’s (BTC) price than in the past.

To stay lucrative, miners have had to reconsider their tactics due to the decrease in mining incentives. To save operating costs, many have resorted to replacing their outdated equipment with more energy-efficient alternatives.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!