Key Points:

- Hong Kong’s new stablecoin regulations aim to mitigate risks and promote financial stability in the digital currency market.

- HKMA’s licensing requirements for stablecoin issuers reflect a cautious yet progressive approach to cryptocurrency regulation.

- The regulatory framework underscores Hong Kong’s commitment to fostering innovation while ensuring consumer protection and financial integrity.

The Hong Kong Monetary Authority (HKMA) is finalizing a regulatory regime for stablecoin issuers. This marks a significant step in the city’s approach to digital currency regulation. This move also follows a thorough consultation process initiated in January 2022. It aims to bring stability and oversight to the burgeoning stablecoin market.

Hong Kong’s Strategic Approach to Stablecoin Regulation

The HKMA has released a thirty-page consultation paper, inviting public comment until February 24. This paper outlines a proposed framework where stablecoin issuers operating in Hong Kong must obtain a license from the monetary authority. Furthermore, the move signifies Hong Kong’s proactive stance in addressing the complexities of the cryptocurrency market. It ensures that stablecoin issuers have “full backing” for all their circulating coins.

The initiative comes after Terra’s algorithmic UST stablecoin collapsed, which was only partially backed before its downfall in mid-2022. The HKMA highlighted this incident as a crucial learning point, underscoring the urgency for effective stablecoin regulation. The proposed regulations are designed to prevent such crises in the future by ensuring that stablecoin issuers adhere to strict financial and operational standards.

Integrating Stablecoins into Traditional Finance

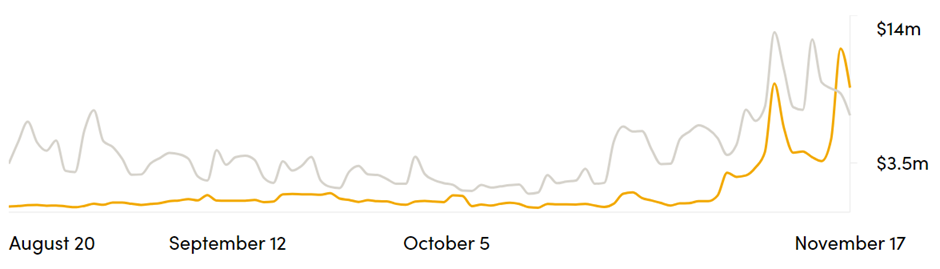

The HKMA recognizes stablecoins as a “key channel” through which risks associated with cryptocurrencies could spill over into the traditional financial system. As such, stablecoins, a significant source of liquidity in the crypto market, will play an essential role in bridging the gap between digital and fiat currencies. The total market capitalization of stablecoins has already crossed $130 billion, as per DeFiLlama, indicating their growing influence in the financial ecosystem.

Conclusion

Hong Kong’s establishment of a regulatory regime for stablecoin issuers is a landmark move in the city’s journey to becoming a global hub for crypto. This initiative, spearheaded by the HKMA, showcases Hong Kong’s dedication to sustainably nurturing virtual asset innovations, balancing the potential risks and benefits. By addressing key concerns such as monetary and financial stability, consumer protection, and the prevention of money laundering and terrorist financing, Hong Kong is setting a precedent for other nations to follow.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!