Key Points:

- Bitcoin transaction fees hit a new high, surpassing Ethereum’s, on November 16, 2023.

- Bitcoin’s fee surge reflects a 700% annual and 1000% monthly increase.

- Increased fees offer Bitcoin miners a diversified revenue stream ahead of Halving.

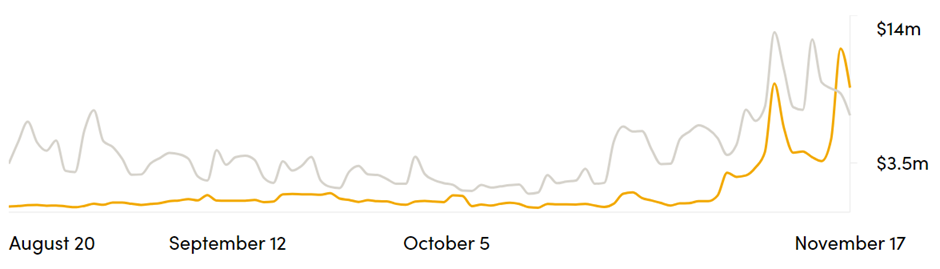

Bitcoin has recently surpassed Ethereum in daily transaction fees, marking a significant shift in the crypto landscape. This notable event occurred on November 16, 2023, when Bitcoin’s transaction fees soared to $11.63 million, overtaking Ethereum’s fees, which stood at $8.44 million. This development, notable for being the first such occurrence in three months, underlines the robust activity surrounding Bitcoin.

Bitcoin’s Remarkable Rise in Transaction Fees

In the weeks leading up to this shift, Bitcoin had been at the center of much attention in cryptocurrency. Anticipation of a potential approval for a Bitcoin Exchange Traded Fund (ETF) contributed to a bullish outlook among analysts. The cryptocurrency maintained its resilience, consistently holding above the $35,000 mark. However, the sudden rise in transaction fees was an unexpected yet significant development.

The data, sourced from CryptoFees.info, revealed that while Ethereum had previously reached a three-month peak in transaction fees, amounting to $12.79 million on November 9, it experienced a considerable decline. Conversely, Bitcoin displayed an upward trend. Even though Bitcoin’s fees saw a slight dip from its peak to around $8.85 million, it still managed to eclipse Ethereum’s fees, which dropped to $6.87 million.

Since the beginning of November, Bitcoin’s daily transaction fees have shown a marked upward trajectory. Remarkably, the recent spike in fees represents an annual increase of over 700% and a staggering 1000% rise every month. This surge in transaction fees comes at a pivotal time, especially as miners have expressed concerns about 2023 being one of the least profitable years. Moreover, with the anticipated Bitcoin Halving event in the first quarter of 2024, set to reduce block subsidies from 6.25 BTC to 3.125 BTC, the increase in transaction fees is viewed positively.

Miners Embrace New Revenue Opportunities Amidst Fee Surge

The rise in transaction fees is a welcome development for Bitcoin miners, offering a potential new revenue stream. As these fees increase, they form a significant portion of miners’ income, possibly accounting for 20% -30 % of the total block reward. This shift indicates a diversifying revenue model for miners, who traditionally relied heavily on block rewards.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!