Bitcoin, the leading cryptocurrency, surged to a new local high of $64,000 on Wednesday before experiencing a rapid 8.2% decline, triggering a wave of liquidations across the digital asset market. This price movement marked the first time Bitcoin had surpassed the $60,000 barrier since November 2021.

According to data from MEXC, Bitcoin saw a significant increase of over 12% in the past 24 hours, reaching $64,000 on Wednesday morning.

This surge was primarily fueled by strong demand from institutional investors, who have been pouring record amounts of money into Bitcoin exchange-traded funds (ETFs).

BlackRock’s IBIT Records Massive Investment Inflows

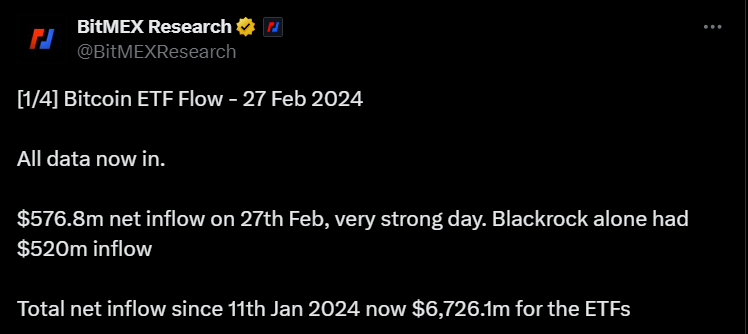

BlackRock’s IBIT, the largest spot Bitcoin ETF in the U.S., recorded record daily inflows of $520.2 million on Tuesday, surpassing the previous high of $493.1 million set on Feb. 13, according to BitMEX Research.

IBIT accounted for 90% of the total net inflows of $576.8 million for all U.S.-spot Bitcoin ETFs on Tuesday, despite facing competition from other funds such as Fidelity’s FBTC and Ark Invest 21 Shares’ ARKB.

Since the launch of the first U.S.-listed spot Bitcoin ETF on Jan. 11, the total net inflows have reached $6.7 billion, indicating a growing appetite for exposure to Bitcoin among institutional investors.

These ETFs allow investors to buy and sell Bitcoin without having to deal with the technical and regulatory challenges of holding the cryptocurrency directly.

Traders at High Alert Ahead of Halving

Another factor contributing to Bitcoin’s price increase was the anticipation of the upcoming halving event, expected to occur on April 20.

Halving is a process that reduces the amount of new Bitcoin created and distributed to miners every 10 minutes, aiming to control Bitcoin’s inflation by making it scarcer and more valuable over time.

Market research firm K33 reported that Bitcoin miners have been increasing their accumulation rate ahead of the halving, indicating that they are holding more of their rewards instead of selling them.

In the past three months, publicly listed Bitcoin miners have kept an estimated 29% of all Bitcoin rewards, significantly higher than the January-November average of 2.5%.

K33 also noted that based on historical data from the previous three halving cycles, Bitcoin tends to rally leading up to the halving and then consolidate.

The firm stated, “For the previous three halving cycles, Bitcoin’s average pre-halving 50-day return sits at a solid 30%. Interestingly, all halvings have been followed by a modest 50-day performance, with Bitcoin, on average, seeing a 50-day post-halving return of 3%.”

$700 Million Gets Wiped Out Amid Volatility

However, Bitcoin’s rally was met with volatility, as the price sharply dropped from $64,000 to $58,700 on Wednesday afternoon, leading to the liquidation of over $702 million worth of leveraged trading positions, according to CoinGlass data.

This sell-off also affected other crypto assets, such as Ethereum, BNB Coin, and Cardano, which fell by 8.8%, 6.3%, and 9.7%, respectively.

Bitcoin Enters Overheated Conditions

As mentioned, Bitcoin surged to the $64,000 mark as traders prepared for the benchmark cryptocurrency to mint a fresh all-time high above the $69,000 peak.

The cryptocurrency has been in a parabolic state for the past week, surging by about 20% in the past five days. However, this has rapidly sent the cryptocurrency into overheated or overbought conditions as market sentiment flashes “extreme greed.”

That said, we should expect a slight retracement over the coming days for Bitcoin to ease out of the stated conditions, especially as February comes to an end. Any major pullback should likely be arrested by the $55,000–$54,700 axis.

Overall, the market sentiment remains very bullish as investors await the next catalyst for Bitcoin’s price movement.

BTC Statistics Data

BTC Current Price: $51,900

Market Cap: $1.023T

BTC Circulating Supply: 19.6M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up