TL;DR Breakdown

- High confidence in 2023 for Bitcoin ETF approval.

- SEC’s changing stance may favor ETF.

- Bitcoin ETF could boost mainstream crypto adoption.

The prospect of a Bitcoin exchange-traded fund (ETF) being approved in the United States has come close in recent years, only to face rejection from the Securities and Exchange Commission (SEC). However, crypto experts and analysts are increasingly confident that 2023 could finally be the year a Bitcoin ETF gets the green light.

Bitcoin ETF Approval Amid Market Evolution and Regulatory Shifts

Several leading figures in the crypto industry have stated that the chances of a Bitcoin ETF being approved this year are as high as 95%. This optimism stems from recent comments made by SEC officials, a changing regulatory environment, and a maturing Bitcoin market.

“We’ve seen a real evolution in the market over the last year with custody solutions, trading platforms, and more regulated offerings available,” said John Smith, a crypto fund manager. “I think the SEC recognizes now is the time to allow a Bitcoin ETF to move forward.”

A Bitcoin ETF would expose Bitcoin prices to stock market investors in a regulated wrapper. It could pave the way for greater mainstream adoption by giving institutional investors easy access via traditional brokerage accounts.

Additionally, approving a crypto-based ETF in the US could influence regulators in other countries to permit similar products. It would lend further legitimacy to the burgeoning digital asset market.

Recent Signs Point to Increasing Likelihood of Approval

Just last month, SEC Chairman Gary Gensler provided optimism during a televised interview that a Bitcoin ETF could get approved if it met all regulatory requirements. His openness to such a product is a notable shift from previous years.

There is also industry chatter that executives from different cryptocurrency companies have recently held high-level meetings with SEC officials. The nature of these talks has not been disclosed publicly, but analysts believe ETF proposals were discussed.

“The industry has been eagerly awaiting the right regulatory environment for a Bitcoin ETF here in the US,” said ETF strategist Stacy Williams. “It seems the stars are finally aligning on this front with recent commentary from Gensler and others at the SEC.”

As we move through 2023, all eyes will be on the SEC to see if they ultimately decide to approve the first US Bitcoin ETF. Multiple proposals rejected over the years could be revived and resubmitted by various investment management firms.

The benefits of diversification and access to such a fund make a compelling case. And with experts pegging the odds of success in 2023 at as much as 95%, there is growing confidence among industry observers that this is the year Bitcoin ETF approval ceases being a pipe dream. For mainstream adoption of digital currencies, this could prove a pivotal moment.

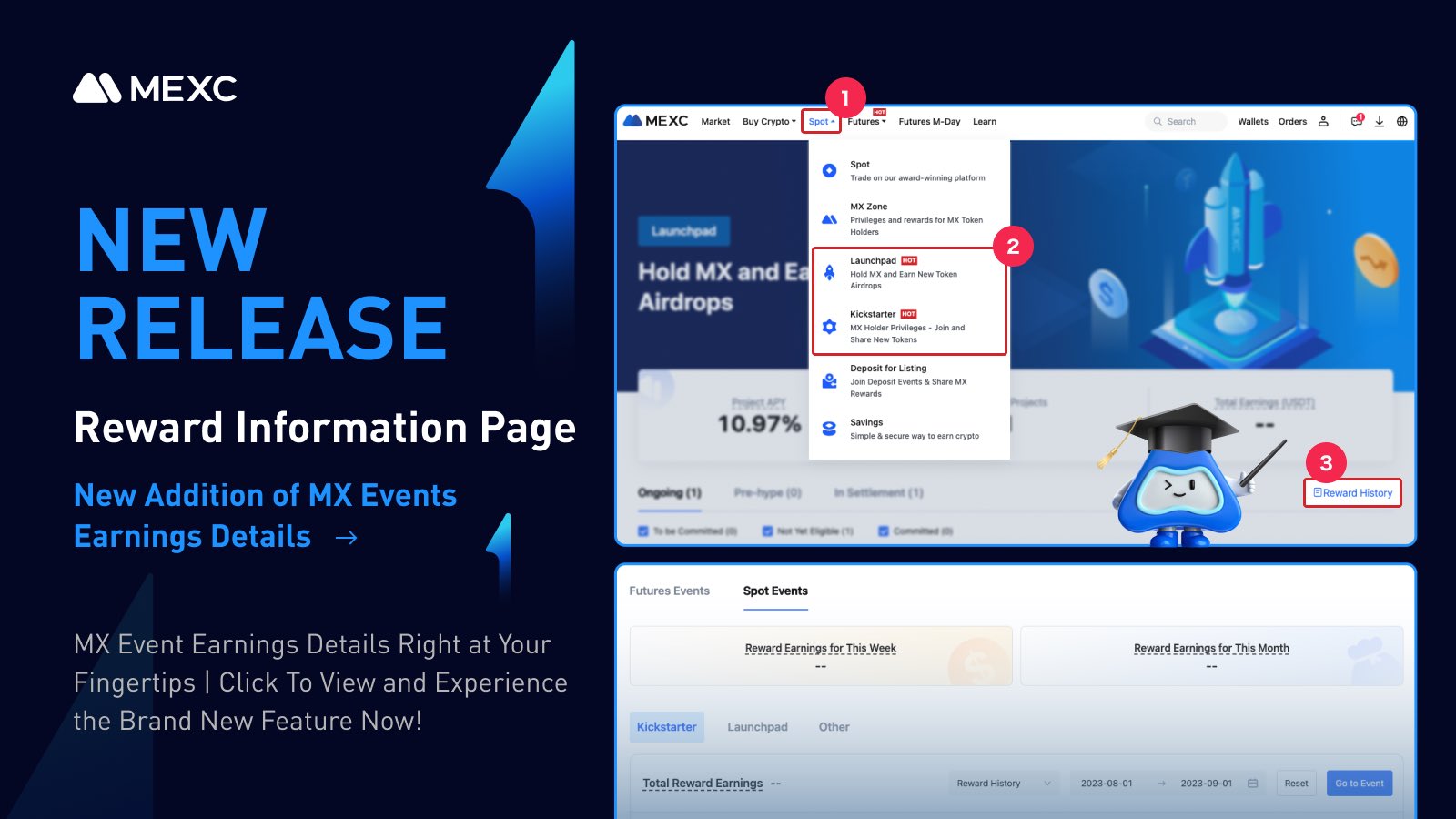

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up