Story Highlights:

- USDT’s high liquidity enhances its widespread acceptance in the crypto market.

- USDC’s transparency and regulatory compliance build trust among users.

- Both USDT and USDC integrate seamlessly with major DeFi protocols.

Stablecoins have become crucial in the cryptocurrency world, offering stability amid the volatility of traditional cryptocurrencies. The most well-known stablecoins are USD Coin (USDC) and Tether (USDT). Both aim to maintain a stable value relative to the U.S. dollar but have distinct features and issuers.

What are stablecoins, and how do they work?

Stablecoins are cryptocurrencies designed to minimize price volatility by pegging their value to a stable asset, often the U.S. dollar. They provide the benefits of cryptocurrencies, such as fast cross-border transactions, while reducing the risk of price fluctuations.

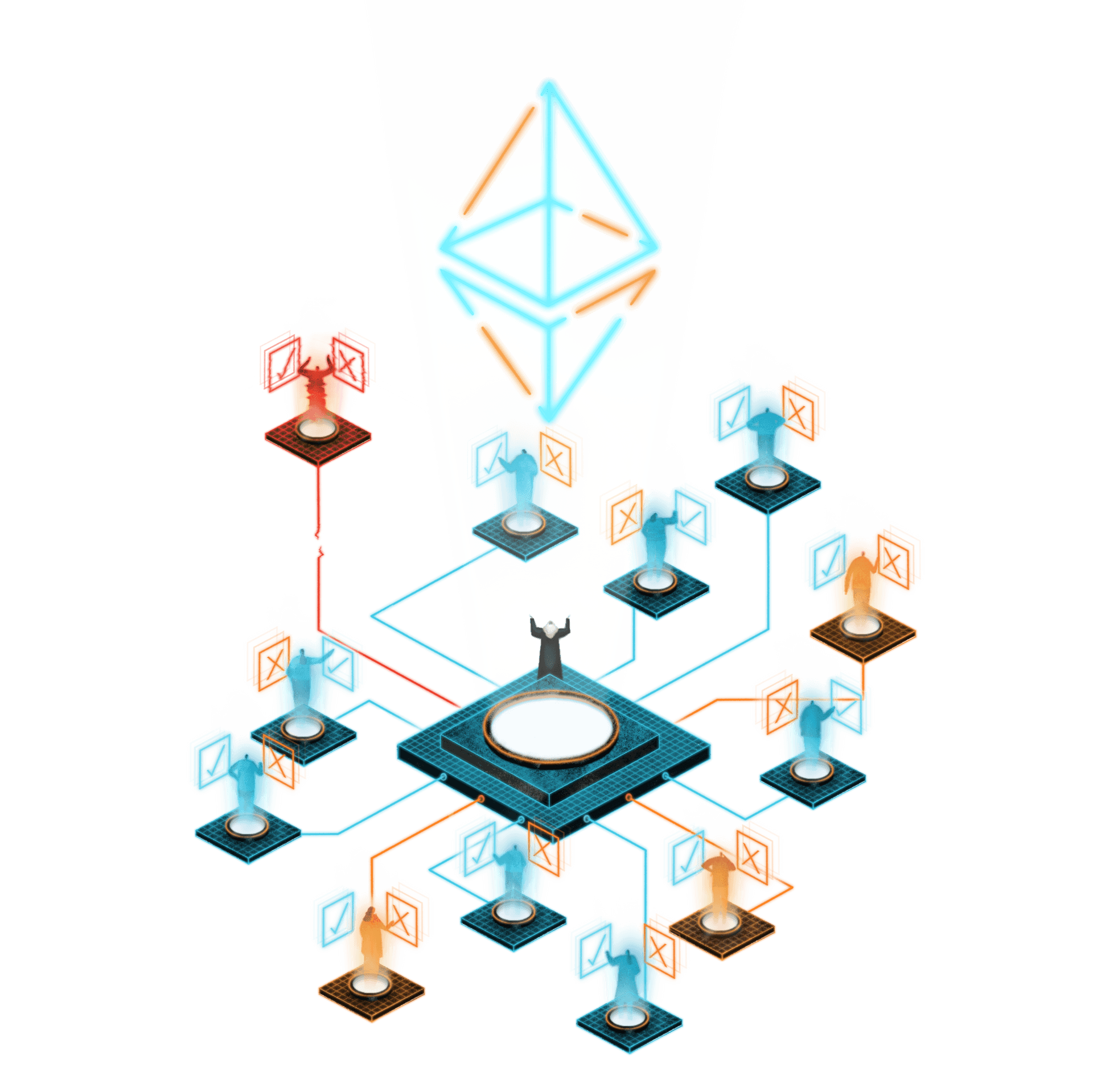

Fiat-backed stablecoins are the most popular, pegged to fiat currencies like the U.S. dollar or euro. The two most well-known fiat-backed stablecoins, USDC and USDT, are pegged to the U.S. dollar. Both are used in centralized finance (CeFi) and decentralized finance (DeFi) on exchanges, wallets, and decentralized applications (DApps).

As the stablecoin market grows, regulatory bodies worldwide scrutinize these digital assets to ensure compliance with financial laws. Instances of stablecoins deviating from their peg, concerns about audits, transparency, and the sufficiency of reserves backing stablecoins have sparked regulatory scrutiny. This scrutiny aims to protect investors and maintain financial system stability.

What is USDT

Tether (USDT) is a pioneering stablecoin introduced in 2014 by Tether Limited. It was created to provide stability and liquidity by pegging its value to the U.S. dollar at a 1:1 ratio.

USDT operates on multiple blockchain platforms, including Ethereum, Tron, and others, enhancing its accessibility and interoperability. One of USDT’s key strengths is its high liquidity and widespread acceptance across various cryptocurrency exchanges and trading platforms. This popularity contributes to its stability and reliability as a medium of exchange and store of value within the crypto ecosystem.

However, USDT has faced scrutiny and controversy regarding its transparency and level of backing. While Tether Limited claims that every USDT token is fully backed by an equivalent amount of U.S. dollars in reserve, concerns have been raised about the company’s ability to provide proper audits and transparency into its reserves.

Despite these challenges, USDT continues to play a significant role in the cryptocurrency market, offering users a stable and widely accepted digital asset that bridges traditional finance and cryptocurrencies.

What is USDC

Launched in 2018, USDC is a joint effort between Coinbase and Circle. It aims to provide a reliable and fully backed digital asset pegged to the U.S. dollar. USDC is managed by Centre, a consortium co-founded by Coinbase and Circle.

USDC’s key feature is its fully reserved structure, with each token backed 1:1 by U.S. dollars held in reserve. This includes ~80% in short-dated U.S. Treasuries and ~20% in cash deposits within the U.S. banking system. This ensures a direct correlation between the circulating supply of USDC tokens and the underlying fiat currency. This transparency is further reinforced by regular audits conducted by reputable third-party firms, enhancing trust and confidence among users.

Initially built on the Ethereum blockchain as an ERC-20 token, USDC has since expanded to other blockchain networks. As of May 2024, USDC is natively supported on 16 blockchain networks: Algorand, Arbitrum, Avalanche, Base, Celo, Ethereum, Flow, Hedera, Near, Noble, OP Mainnet, Polkadot, Polygon PoS, Solana, Stellar, and zkSync.

With its emphasis on regulatory compliance, transparency, and stability, USDC has gained widespread adoption and usage across the cryptocurrency ecosystem. It serves as a reliable medium of exchange, store of value, and unit of account for individuals and businesses alike.

Benefits and use cases of USDT and USDC

USDC and USDT offer distinct benefits and use cases. USDC, issued by the Centre Consortium, prioritizes transparency and regulatory compliance, ensuring each token is fully backed by equivalent assets in the U.S. banking system. This commitment enhances trust among users, institutional investors, and enterprises.

USDT’s high liquidity and widespread acceptance make it a preferred choice for businesses to streamline operations and manage financial transactions efficiently. Many businesses use USDT for treasury management and payment processing, as well as as a stable medium of exchange for international trade. Its compatibility with various blockchain networks, including Ethereum, offers seamless integration into DeFi protocols and wallets, expanding its utility and adoption.

Major cryptocurrency exchanges such as MEXC Global, Coinbase, and Kraken support both USDC and USDT for trading pairs, providing liquidity for peer-to-peer transactions and facilitating seamless trading experiences. DeFi protocols like Compound, Aave, and MakerDAO integrate USDC and USDT as collateral assets, enabling users to borrow, lend, and earn interest on their holdings.

Both USDC and USDT are popular among individual users, and their unique features and functionalities also attract institutional investors and businesses. Hedge funds, asset managers, and other institutional investors use USDC and USDT for portfolio diversification, risk management, and hedging against market volatility.

Fintech companies and remittance service providers leverage USDC and USDT for cross-border payments, offering faster and more cost-effective alternatives to traditional remittance channels. Corporations and businesses use USDC and USDT as part of their treasury management strategies, providing stability and liquidity for managing cash reserves and facilitating international transactions.

Differences between USDC and USDT stablecoins

USDC and USDT differ in several aspects, including issuing entities, transparency, blockchain compatibility, regulatory compliance, stability, liquidity, use cases, and market adoption.

- Issuing Entities: USDT is issued by Tether Limited, while USDC is issued by Centre, a consortium co-founded by Coinbase and Circle.

- Transparency: USDC emphasizes transparency with regular audits and a fully reserved structure. USDT has faced scrutiny over its transparency and reserve audits.

- Blockchain Compatibility: Both USDT and USDC are compatible with multiple blockchain networks, including Ethereum. USDC has expanded to 16 blockchain networks, enhancing its accessibility.

- Regulatory Compliance: USDC prioritizes regulatory compliance, enhancing trust among users and regulators. USDT has faced regulatory scrutiny but remains widely used.

- Stability and Liquidity: Both stablecoins aim to maintain a 1:1 peg with the U.S. dollar. USDT’s high liquidity makes it a preferred choice for trading and transactions. USDC’s transparency and regulatory compliance enhance its stability.

- Use Cases: USDC is favored for its transparency and regulatory compliance, making it suitable for institutional investors and enterprises. USDT’s high liquidity and widespread acceptance make it ideal for businesses and trading.

- Market Adoption: Both stablecoins are widely adopted across the cryptocurrency ecosystem and integrated into major exchanges, DeFi protocols, and wallets.

As the crypto industry grows, stablecoins like USDT and USDC will continue to play an integral role in digital payments, DeFi applications, real-world asset tokenization, and global remittances.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!