Tether, the world’s largest stablecoin issuer, has released its latest assurance opinion from BDO, a leading auditing firm. The report confirms the accuracy of Tether’s Consolidated Reserves Report (CRR) and provides a detailed breakdown of its assets as of December 31, 2023.

According to the report, Tether had a remarkable Q4, with a net profit of $2.85 billion. Most of this profit came from net operating income, mainly from interest earned on US Treasury securities. The rest came from appreciation in gold and bitcoin reserves.

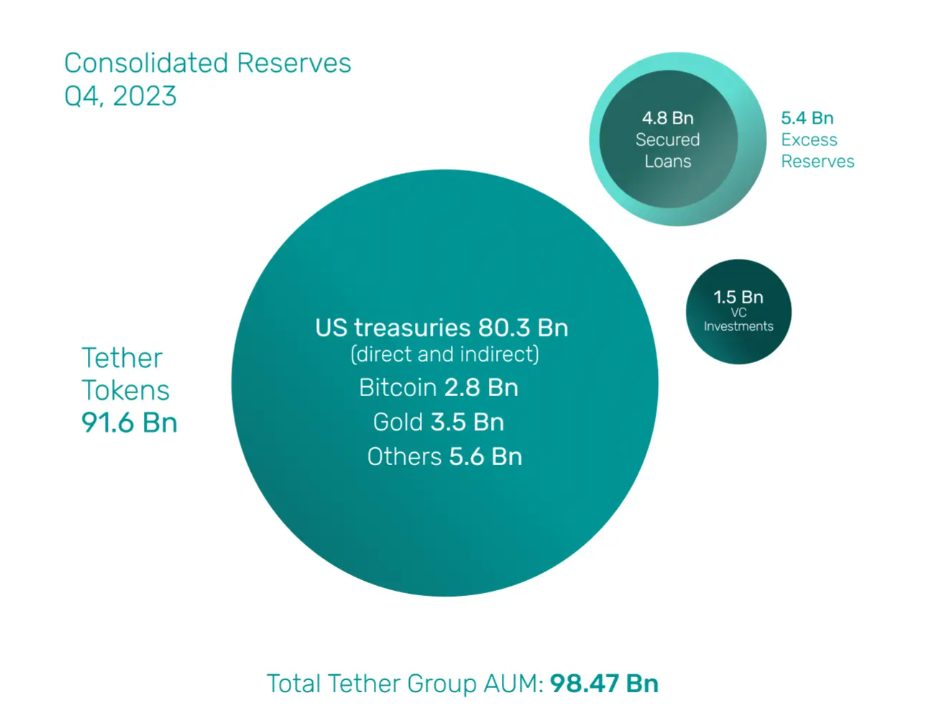

Tether also increased its excess reserves, which are undistributed accumulated profits, by $2.2 billion to reach $5.4 billion. Tether used some of these reserves (about $640 million) to invest in projects such as mining, AI infrastructure, and P2P telecommunications under a new segregated VC umbrella. This ensures that these investments do not affect the token reserves.

Addressing concerns from the community, Tether proudly announced the complete removal of the risk associated with secured loans from the token reserves. The undistributed accumulated profits, or excess reserves, totaling $4.8 billion, fully cover the outstanding secured loans of the same amount, as confirmed by the BDO attestation.

Tether also addressed one of the main concerns of the crypto community, which is the risk associated with secured loans from token reserves. The report shows that Tether’s excess reserves fully cover the outstanding secured loans, as verified by BDO.

Tether Bags $6.2 Billion Profit in 2023

For the full year of 2023, Tether’s net profit was $6.2 billion, with $4 billion from net operating income and $2.2 billion from various asset classes, including gold, bitcoin, and other investments. Tether also achieved new record highs in direct and indirect ownership of US Treasury securities, totaling $80.3 billion.

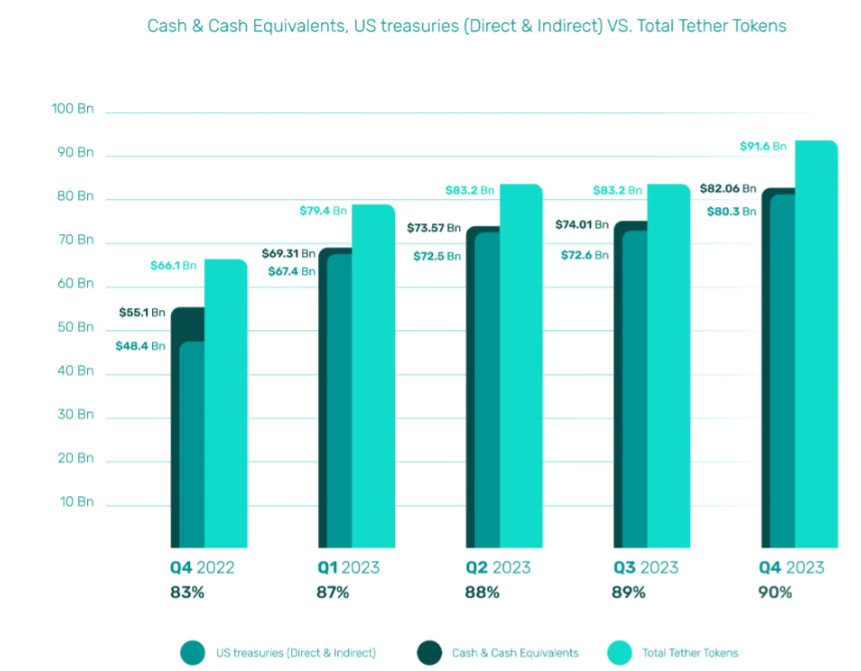

Tether maintained its transparency and stability by issuing tokens backed by 90% cash and cash equivalents. The CRR shows that Tether’s consolidated assets exceed its liabilities, with a total of $97 billion in assets and $91.4 billion in liabilities. Tether also invested $642.55 million in sustainable energy and other long-term proprietary investments.

Tether’s CEO, Paolo Ardoino, commented on the report, saying:

“Tether’s Q4 attestation underscores our commitment to transparency, stability, and responsible financial management. Achieving the highest percentage of reserves in cash and cash equivalents reflects our dedication to liquidity and stability.”

Tether’s Minting Activity Sparks Surge for Bitcoin

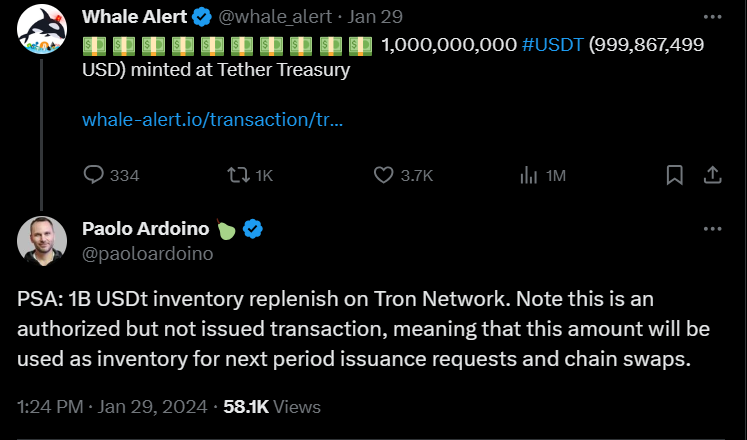

The report also coincides with the recent surge in Tether’s minting activity, which has sparked discussions in the crypto community. Some institutional investors see this as a sign of increased demand for Bitcoin, which could lead to a significant price increase.

Interestingly, Bitcoin’s value surged past $43,000 on January 29, following Tether’s creation of 1 billion USDT. The extensive minting spree, amounting to 13 billion USDT since October 20, 2023, aligns with the upward price action observed in the cryptocurrency market in recent months.

Despite the recent correction in the cryptocurrency market, the confluence of Tether’s minting activities, increasing institutional investment, and the upcoming Bitcoin halving presents a bullish picture. Historically, large-scale Tether minting events have been closely linked with significant price increases in Bitcoin.

The recent minting raises questions about potential volatility in the near future. Investors are closely watching the developments and preparing for potential market shifts in the coming months.

USDT Statistics Data

USDT Current Price: $0.9999

Market Cap: $96.2B

24-Hour Volume: $41.5B

USDT Circulating Supply: 96.2B

Total Supply: 99.6B

USDT Market Ranking: #3

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!