In this article, you will explore the futures trading basics with our MEXC Academy editors. This simple guide will help you to easily understand the derivatives market.

Futures are a form of derivative contracts that require the trading sides to complete a transaction of an asset at a fixed date and rate in the future. The buyer and seller have to follow the price set when the future contract is booked. This condition means that the price decided in the contract must be paid, regardless of the asset’s current price.

Future contracts can be for any physical commodities or any financial instrument. These contracts are detailed enough to list the quantities of the assets covered by the contract. Future contracts are commonly traded on futures exchanges like those offered by MEXC Exchange.

Futures are a common tool for hedging against falling market prices. Traders also use them to protect their regular trades from price fluctuations.

How Futures Work?

Futures contracts let traders fix the price of the asset in the contract. This asset can be any commonly traded commodity like oil, gold, silver, corn, sugar, and cotton. The underlying asset can also be shares, currency pairs, cryptocurrency, and treasury bonds.

A futures contract would lock in the price of any of these assets at a future date. A standard future contract has a maturity date, also known as its expiry and set price. The maturity date or month is commonly used to identify futures. For instance, corn futures contracts expiring in January are called January corn futures.

As a future contract buyer, you will be bound to take ownership of the commodity or asset at the contract’s maturity. This ownership can be in cash terms and doesn’t always have to be physical asset ownership.

The main point to remember is that buyers can sell their futures contract to someone else and free themselves from their contractual obligation.

How to enter a futures trading terminal at MEXC?

Follow the guidelines below to use the MEXC web page to buy crypto futures:

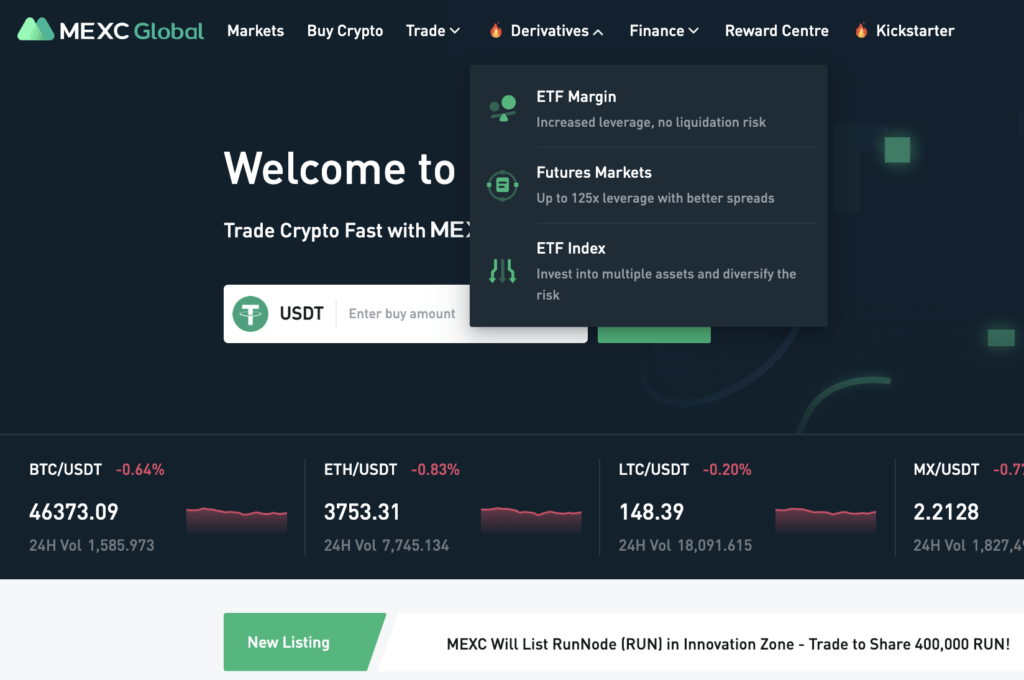

- To trade in crypto futures on the MEXC web portal, open MEXC Main page, point cursor on “Derivatives” at the top menu and then choose “Futures” in drop-down menu or just click this link.

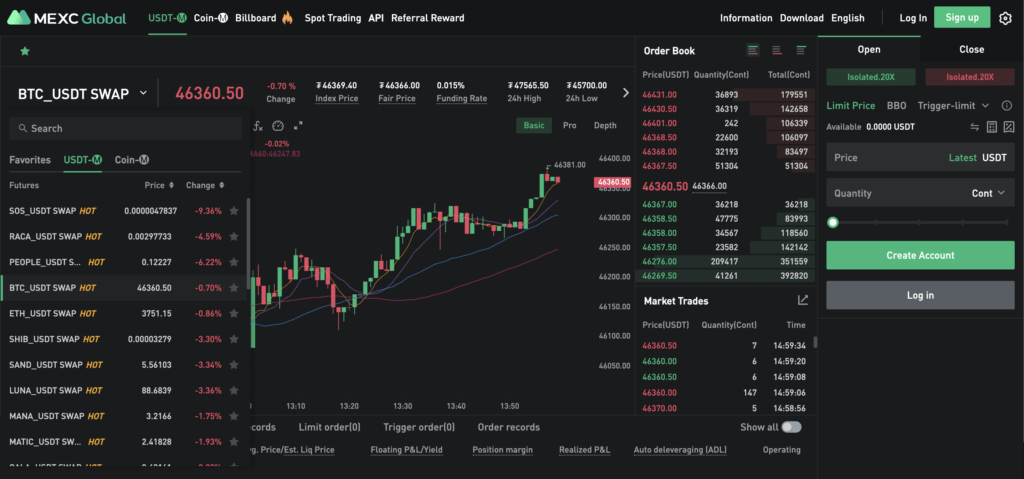

MEXC Futures Trading Terminal provides all required tools for every trader for free. Terminal is user-friendly and provides all needed information at a glance.

- The menu bar at the top allows you to pick the trading pair of futures that you want to trade.

- The bottom part of the screen holds your position and order details

- An order book is located right from to let you get an overview of what other brokerages are buying and selling so that you know what is happening in the markets at the moment.

- The right of the screen has the order placement button.

Trading Futures on the MEXC

To start trading on MEXC Futures, you have to transfer funds from your spot account to your derivatives (contract) account to trade futures.

When booking an order, you specify the price and quantity of assets you want to trade and confirm by pressing the “Buy/Long” or “Sell/Short” options

- The futures options offer different leverage rates on different trading combos.

- The MEXC Exchange supports leverages of up to 125x the trade. The maximum leverage depends on the initial and maintenance margin.

- The Exchange allows user to change their long and short positions in cross margin modes. For instance, the long position is 30x, and the short position is 90x. To hedge against risk, the trader can adjust the trade leverage from 90x to 30x.

- The platform supports traders with different margin preferences by offering different margin modes.

- The cross-margin mode shares margins with two positions opened against the same cryptocurrency. Any profit or loss from a position can be used to adjust against the balance of the other trade.

- The isolated margin only accepts margin against a position opened. In case of loss, the trade will only lose against the specific position on settlement. This leaves the balance of the cryptocurrency untouched. This is the best option for all new traders since it protects the main crypto coin balance.

- As a default setting, all traders start trading in isolated margin mode.

Why traders choose Futures?

Future trading offers a lot of advantages that appeal to all investors. Since they are financial derivatives that base their value on a financial or physical asset, they are excellent for risk management and hedging in cryptocurrency mining and trading. This risk cushioning makes futures trading more risk efficient.

Join MEXC and Get up to $10,000 Bonus!

Sign Up