Key Insights:

- Uniswap v4 aims to refine the platform with core code enhancements, security upgrades, and gas optimizations for a Q3 2024 launch.

- The anticipation of Uniswap v4 coincides with significant growth, including a 26.2% increase in daily users and an 83% rise in protocol fees.

- Challenges loom for Uniswap with the rise of MEV bots and arbitrage transactions, potentially complicating the trading landscape.

Uniswap is gearing up to launch its fourth iteration, Uniswap v4, scheduled for Q3 2024. This upgrade is in its initial phases, focusing on refining the core code, enhancing security measures, and optimizing gas usage.

The next steps will involve rigorous audits, with the team inviting professional scrutiny and community participation through audit competitions. Amid this development, Uniswap has witnessed a notable increase in user engagement and revenue, with daily active users climbing by 26.2% and protocol fees soaring by 83%.

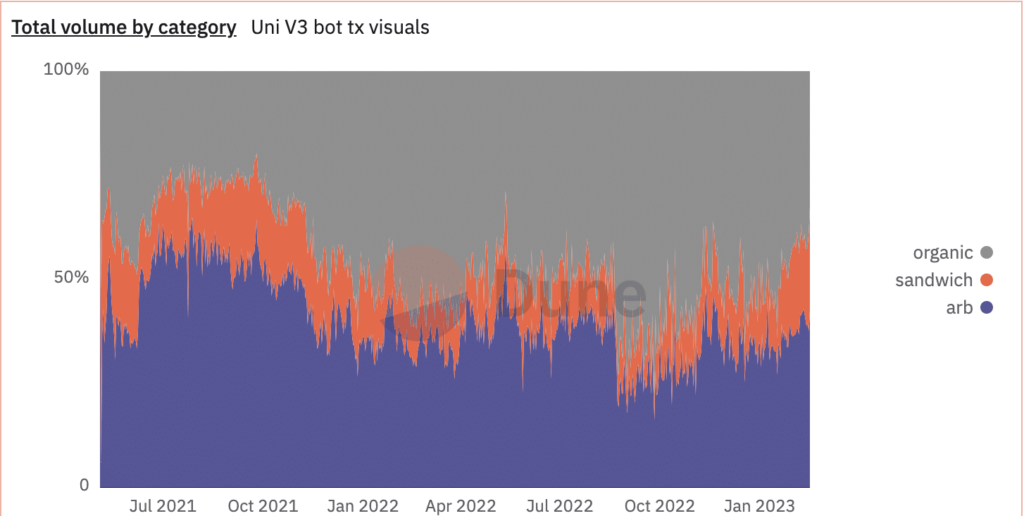

However, the platform faces challenges from the rise of MEV bots and arbitrage transactions. These bots exploit transaction order and execution for profit, while arbitrage transactions leverage price discrepancies across platforms. Such activities could disrupt the trading environment, introducing complexity and possible market manipulation concerns.

Uniswap v4 Aims to Better Serve the Community

Uniswap’s strategic focus on developing Uniswap v4 demonstrates its commitment to advancing the decentralized finance ecosystem. The platform has already seen considerable user activity and financial performance growth. These achievements underscore the community’s confidence and the potential impact of the forthcoming upgrade on the platform’s ecosystem. Moreover, the increase in protocol fees highlights the economic viability and sustainability of the Uniswap platform, providing essential funding for future developments and enhancements.

However, MEV bots and arbitrage opportunities present a nuanced challenge. These elements introduce a level of sophistication and potential for manipulation that could affect market dynamics. Traders may face increased competition and the risk of front-running, where these automated systems could influence the outcome of transactions. This situation underscores the need for continuous innovation and adaptation within the DeFi space to maintain a fair and efficient trading environment.

In conclusion, as Uniswap gears up for the launch of its v4 upgrade, the platform is navigating through a landscape marked by remarkable growth and emerging challenges. With its focus on security enhancements and user engagement, Uniswap aims to solidify its position as a leading decentralized exchange despite the hurdles posed by MEV bots and arbitrage activities.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up