Introduction

Decentralized Finance (DeFi) is a revolutionary force that has been reshaping the traditional financial industry. Built on blockchain technology, DeFi offers a borderless, permissionless, and trustless approach to financial services. In this article, we will explore the latest trends and developments in the DeFi space, including the rise of yield farming, the growth of decentralized exchanges, and the ever-expanding DeFi protocol ecosystem.

The DeFi Phenomenon

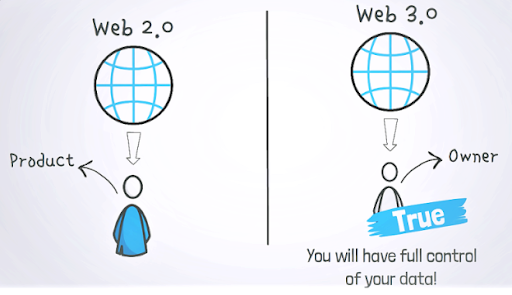

DeFi is a collective term for a wide range of blockchain-based financial applications and services that aim to eliminate intermediaries and enhance financial accessibility. It leverages smart contracts and decentralized ledgers to provide traditional financial services, such as lending, borrowing, trading, and earning interest, in a completely decentralized manner.

1. Yield Farming: The Rise of DeFi Liquidity Mining

One of the most prominent trends in DeFi is the concept of yield farming, also known as liquidity mining. Yield farming allows users to earn passive income by providing liquidity to decentralized platforms, such as automated market makers (AMMs) like Uniswap, SushiSwap, and Curve. Users can stake their cryptocurrency assets in liquidity pools and, in return, receive rewards in the form of interest or governance tokens.

The process of yield farming has become highly competitive, with DeFi projects continually innovating to attract liquidity providers. This trend has not only generated interest but has also allowed users to earn substantial returns on their crypto assets.

2. Decentralized Exchanges (DEXs): The Future of Trading

Decentralized exchanges have experienced substantial growth and are redefining how cryptocurrency trading occurs. DEXs facilitate peer-to-peer trading of digital assets without the need for intermediaries. They provide users with greater control over their funds and security while trading.

Platforms like Uniswap, PancakeSwap, and SushiSwap have gained immense popularity, with their trading volumes rivaling those of centralized exchanges. DEXs have introduced innovative features such as automated market-making algorithms, liquidity pools, and yield farming incentives, making them a core element of the DeFi ecosystem.

3. The Expanding DeFi Protocol Ecosystem

The DeFi protocol landscape continues to evolve and expand. These protocols, powered by smart contracts, offer a wide array of financial services. Some notable trends within this ecosystem include:

a. Lending and Borrowing Protocols: Platforms like Aave, Compound, and MakerDAO provide users with the ability to lend their assets and earn interest or borrow against their holdings.

b. Derivatives Markets: DeFi projects have started to explore decentralized derivatives markets, enabling users to trade options, futures, and other derivative products.

c. Stablecoins: Stablecoins like DAI and USDC have become the backbone of DeFi, offering stability and liquidity for traders and lenders within the ecosystem.

d. Decentralized Oracles: Chainlink, Band Protocol, and others are providing decentralized data oracles to ensure that smart contracts have access to reliable, real-world information.

Challenges and Considerations

While DeFi offers exciting opportunities, it also comes with certain challenges and considerations:

- Security Risks: DeFi platforms are not immune to hacks and vulnerabilities, which have led to significant financial losses. Auditing and security measures are crucial.

- Regulatory Uncertainty: DeFi operates in a rapidly changing regulatory landscape. Furthermore, governments worldwide are working to establish their positions on these platforms.

- Scalability: As DeFi grows, scalability becomes a key concern. The Ethereum network, where many DeFi applications are built, has faced congestion and high gas fees.

- User Experience: DeFi platforms need to improve the user experience to attract mainstream adoption, making the technology more accessible to non-technical users.

Conclusion

DeFi is a dynamic and rapidly evolving sector of the blockchain space. The trends discussed, such as yield farming, decentralized exchanges, and the expansion of DeFi protocols, highlight the growing interest and innovation in this space. As DeFi continues to disrupt traditional finance, participants need to stay informed. You must also exercise caution and embrace the opportunities presented by this transformative technology. The future of finance is increasingly decentralized, and the world of DeFi is at its forefront.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!