Key Insights:

- Trump’s latest NFT collection sold $2M worth but saw low-volume sales.

- Resale restrictions and regulatory challenges may affect future market performance.

- Market volatility and cautious consumer behavior could hinder long-term success.

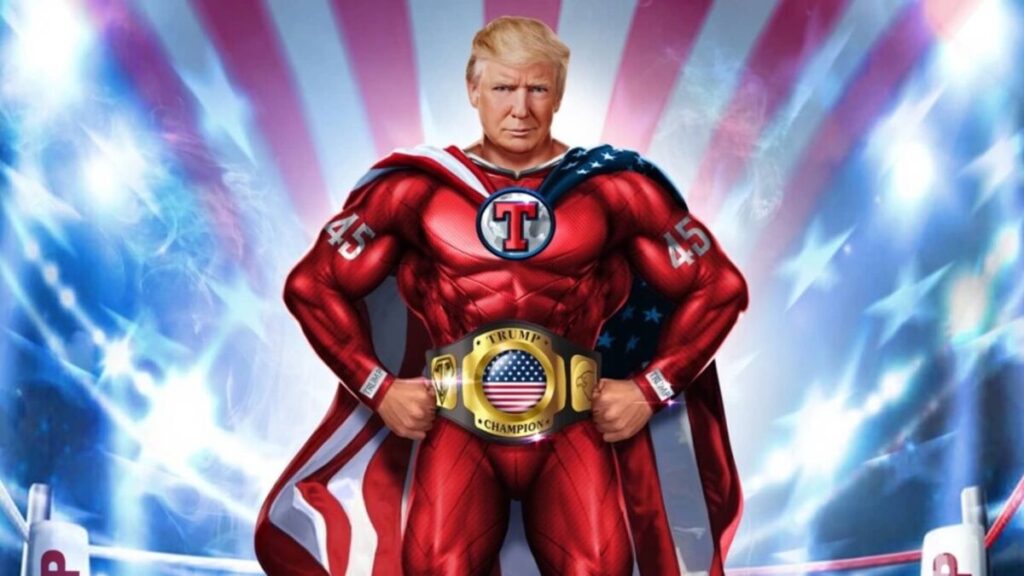

Former President Donald Trump’s latest NFT collect, “America First Edition,” generated sales of over $2 million on the first day. However, only 20,700 out of a possible 360,000 NFTs were sold. The earnings do sound impressive, but such a low quantity signals possible poor market demand.

These are utterly unimpressive sales, especially when compared to the leading NFT collections, such as CryptoPunks, which had lower sales in the same period. The large difference between potential and actual sales suggests the collection might have some issues sustaining interest and success in the long run.

NFT Market Volatility Affects Sales Performance

The NFT market has seen substantial fluctuations, particularly for celebrity and political-themed collections. Trump’s previous NFT collections sold out quickly, but the current release has a much larger supply. The strategy seems to be met with caution, with only 5.7% of the NFTs sold shortly after launch. This slow sales pace indicates limited consumer enthusiasm, raising concerns about the collection’s future prospects.

Experts suggest that this broader release approach may affect future engagement in crypto investing and collecting. Trump’s team may need to reassess their strategy to ensure the collection’s viability in a volatile market.

Potential Earnings and Fund Allocation

If all “America First Edition” NFTs sell out, the collection could generate approximately $35.6 million. Each NFT is priced at $99. However, with current sales far below this potential, concerns are growing about the venture’s efficiency. Importantly, the funds raised will not be used for Trump’s presidential campaign but may be allocated toward perks for NFT buyers, including exclusive events and unique merchandise.

This allocation strategy could influence buyer decisions, as some may question the long-term value of their investment. Ensuring transparency in fund allocation could be crucial for maintaining buyer confidence.

Resale Restrictions Pose Challenges for Investors

Investors in Trump’s latest NFT collection face a two-year restriction on resale. These digital cards cannot be transferred to secondary marketplaces until January 31, 2025. This resale limitation is similar to those in Trump’s previous collections. The restriction aims to stabilize market fluctuations and preserve value. However, it may deter potential buyers seeking immediate returns, potentially complicating marketplace dynamics.

Regulatory Challenges Impair the Functioning of NFT Marketplaces

The NFT market is under increasing regulatory scrutiny. At least one major marketplace where Trump’s collection was available, Open Sea, has received a Wells Notice from the U.S. Securities and Exchange Commission. This may mean some NFTs could be considered securities. That is a potential regulatory change in how NFTs will be regarded and may affect platforms and creators. There is a shift in the regulatory landscape, and participants will have to be more circumspect in their dealings.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up