Summary

Tesla (TSLA), as a leading global electric vehicle manufacturer, has always been the focus of investors’ attention. As a globally renowned digital asset trading platform, MEXC has also launched a stock futures trading function, allowing users to trade popular US stocks, including Tesla, through cryptocurrency.

TL;DR

- Tesla stock (stock code: TSLA) is an equity stake securities listed by Tesla on the NASDAQ stock exchange.

- The Tesla stock contract traded on the MEXC platform is not a direct purchase of Tesla’s actual stock, but a derivative contract.

- On MEXC, you can trade TSLAUSDT perpetual futures — with 1–25× leverage — directly in USDT, no U.S. stock account required.

- If you are a beginner, start with 2–3× leverage and use strict stop-loss discipline.

1. Tesla stock basics

1.1 What is Tesla stock?

Tesla stock (stock code: TSLA) is an equity stake securities listed by Tesla on the NASDAQ stock exchange. Holding Tesla stock means you own a portion of the company’s ownership. Tesla is led by Elon Musk and is one of the world’s largest electric vehicle manufacturers, as well as involved in energy storage, solar energy and other fields.

1.2 Investment value of Tesla stock

The reason why Tesla’s stock is favored by investors is mainly based on the following factors:

Industry Leadership : Tesla dominates the electric vehicle market with strong brand influence and technological advantages. The company continues to launch innovative products, from Model 3 to Cybertruck, each of which has attracted widespread attention in the market.

Huge growth potential : With the increasing global emphasis on clean energy, the electric vehicle market is expected to continue to expand. As an industry pioneer, Tesla is expected to reap long-term benefits from this trend.

Technological innovation capability : Tesla continues to invest in research and development in core areas such as autonomous driving technology and battery technology, and these technological breakthroughs may bring additional growth momentum to the company.

Diversified business layout : In addition to car manufacturing, Tesla is also expanding its business in energy storage, charging networks and other fields, creating multiple sources of revenue for the company.

1.3 Tesla stock risk factors

Investing in Tesla’s stock also involves certain risks. The most significant feature is the high volatility of the stock price, which means investors may face significant short-term price fluctuations. In addition, the company’s valuation is high, and the Price-To-Earnings Ratio is usually much higher than that of traditional automakers, making the stock price more sensitive to negative news. Factors such as intensified competition, regulatory changes, and production challenges may all affect Tesla’s stock price performance.

2. What is MEXC US stock futures trading?

2.1 Differences between MEXC US stock futures trading and traditional stocks

The Tesla stock contract traded on the MEXC platform is not a direct purchase of Tesla’s actual stock, but a derivative contract. This contract allows you to profit by predicting the rise and fall of Tesla’s stock price without actually owning the stock.

2.2 Advantages of MEXC US stock futures trading

futures trading has multiple advantages. Firstly, it has higher capital efficiency. Through leverage, you can participate in larger-scale transactions with less capital. Secondly, it has strong trading flexibility, allowing for two-way trading and profit opportunities regardless of market fluctuations. Thirdly, it trades 24 hours a day without being limited by traditional stock market trading hours. Finally, the entry threshold is low, allowing participation with cryptocurrency without the need to open a traditional securities account.

3. Introduction to MEXC platform

MEXC is a global digital asset trading platform established in 2018, headquartered in Singapore. The platform provides various trading services such as spot trading, futures trading, and leveraged trading for global users, supporting the trading of hundreds of cryptocurrencies and tokenized stocks. MEXC is known for its high liquidity, low transaction fees, and rich trading products.

4. How to trade Tesla stock contracts on MEXC

4.1 Register a MEXC account and Complete identity verification

First, visit the MEXC official website or download the MEXC official APP. Click the registration button and complete the registration with your email or phone number. Set a strong password and enable two-factor authentication (2FA) to improve account security. After completing the email or phone verification, you will successfully create a MEXC account.Than,it is recommended to complete KYC identity verification.

4.2 Recharge funds and Transfer to the contract account

MEXC supports multiple recharge methods. You can transfer cryptocurrencies such as USDT and BTC from other wallets or exchanges to your MEXC account through cryptocurrency recharge. Before trading Tesla stock contracts, funds need to be transferred from the spot account to the contract account.

4.3 Find the Tesla stock contract and Set up trading parameters

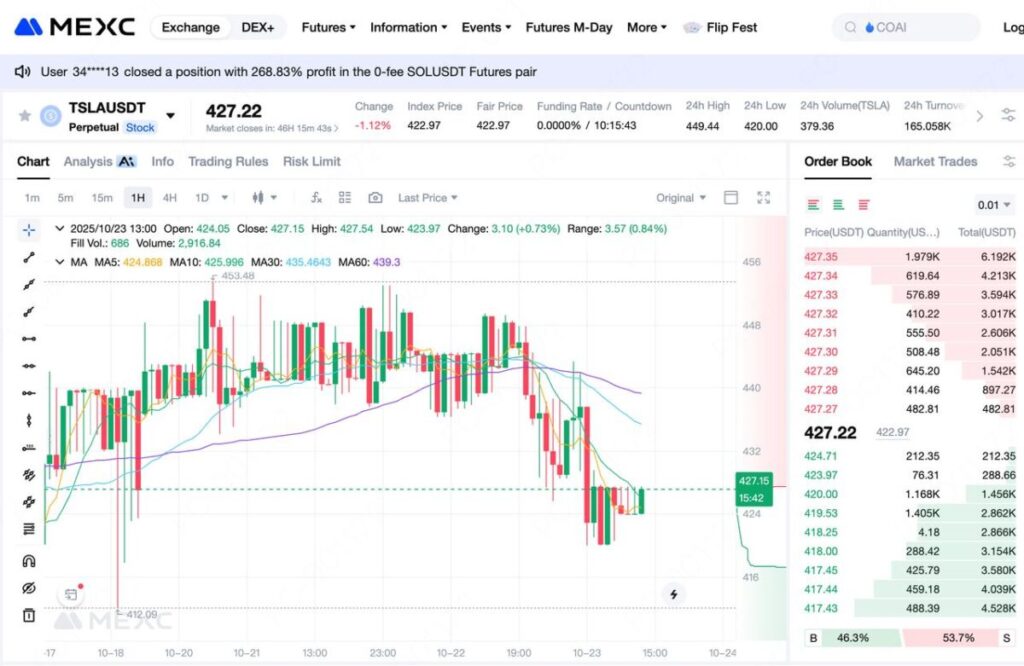

Finding Tesla contracts on the MEXC platform is easy. Go to the futures trading page and search for “TSLA” or “Tesla” in the trading pair list. Select the Tesla perpetual contract (usually displayed as TSLAUSDT). At this point, you will see Tesla’s real-time price chart, depth chart, and trading interface.

Before placing an order, several key parameters need to be set. Firstly, choose the leverage ratio. It is recommended for beginners to start with a lower ratio, such as 5x or 10x, and gradually increase as experience increases. Secondly, choose the order type, including market order (immediately executed at the current market price) and limit order (set the expected price and automatically executed when the price is reached). Finally, enter the number of trades, that is, the number of contracts you want to open.

5. Trading strategies and risk management

5.1 Technical analysis methods

Successful futures trading cannot be separated from effective technical analysis. Trend analysis is fundamental, using tools such as Moving Average and trend lines to determine the overall trend direction of stock prices. Identifying support and resistance levels is also important, as these key price levels often affect stock price trends. Technical indicators such as RSI, MACD, Bollinger Bands, etc. can help determine overbought and oversold conditions and potential reversal signals. K-line pattern analysis can predict short-term price trends by studying K-line chart patterns.

5.2 Key points of fundamental analysis

In addition to technical analysis, it is equally important to understand Tesla’s fundamentals. Pay attention to the company’s quarterly financial report, focusing on core data such as revenue, profit, and delivery volume. Industry dynamics such as electric vehicle market trends, competitor movements, and policy changes will all affect the stock price. Management dynamics, especially Elon Musk’s remarks and actions, often cause stock price fluctuations. In addition, macroeconomic factors such as interest rate changes and economic growth expectations will also affect Tesla’s stock price.

5.3 Risk control recommendations

futures trading has high risks and risk management must be done well. Reasonable use of leverage is the primary principle. Beginners should start with low leverage to avoid excessive leverage leading to liquidation. Setting stop-loss is an important means of protecting the principal. Clear stop-loss points should be set for each transaction to control single losses within an acceptable range. Diversification of investment is also crucial. Do not invest all funds in a single transaction and maintain the diversity of investment portfolio. Finally, positioning should be controlled. It is recommended to open no more than 10-20% of the total funds at a time to avoid heavy trading.

5.4 Common Trading Misconceptions

Many traders are prone to fall into some common misunderstandings. Frequent trading often leads to the accumulation of transaction fees and decision fatigue, and one should patiently wait for high-quality trading opportunities. Emotional trading is another big taboo. Do not rush to double down and try to break even just because of one loss, nor be overconfident because of continuous profits. Ignoring risk management, not setting stop losses, and excessive use of leverage can all lead to serious losses. Blindly following the trend is also very dangerous. Do not blindly enter the market just because you hear some news or see others making profits. You should have your own analysis and judgment.

6. Safety tips

6.1 Account security

Protecting account security is the top priority for transactions. It is necessary to enable two-factor authentication (2FA), and it is best to use applications such as Google Authenticator instead of SMS verification. Use a strong password that includes uppercase and lowercase letters, numbers, and special characters, and change it regularly. Do not log in to trading accounts in public places or using public WiFi to avoid information leakage. Regularly check account activity records and contact customer service immediately if any abnormalities are found.

6.2 Prevention of fraud

Cryptocurrency fraud is quite common and requires increased vigilance. Only access the platform through the MEXC official website or application, and be wary of phishing websites. Do not believe investment advice or so-called “insider information” that promises high returns. MEXC officials will not proactively contact users to ask for passwords or verification codes. If you encounter such situations, you should report them immediately. Beware of fake customer service and investment groups on social media, as official channels usually have authentication logos.

7.Frequently Asked Questions (FAQ)

Q1:How much capital is needed to trade Tesla contracts on MEXC?

MEXC does not set a fixed minimum deposit amount, but considering the risk and margin requirements of futures trading, it is recommended to prepare at least 100-500 USDT as the starting capital. The actual required capital depends on the leverage ratio you choose and the number of contracts you want to open. However, to avoid the risk of liquidation, it is recommended to keep sufficient capital buffers.

Q2:Is MEXC’s Tesla stock contract traded 24/7?

Yes, MEXC’s stock futures trading is conducted 24/7 and is not limited by traditional US stock market trading hours.

Q3:Will trading Tesla contracts result in stock dividends?

No. The derivative contracts of Tesla stocks traded on MEXC are not actual stocks, so they do not enjoy the rights of stock holders, including dividends and voting rights.

Q4:What is liquidation? How to avoid it?

Liquidation refers to the system forcing position squaring when the market price moves in an unfavorable direction, causing your account margin to be insufficient to maintain the current position. Methods to avoid liquidation include: using lower leverage multiples to reduce risk exposure; setting stop-loss orders to automatically position squaring when losses reach a certain level; maintaining sufficient balance in the account as a buffer; avoiding full positions and retaining some funds to cope with market fluctuations; closely monitoring positions and adjusting strategies in a timely manner.

Q5:How to choose the appropriate leverage ratio?

The choice of leverage ratio should be based on your experience level, risk tolerance, and the certainty of market judgment.

8.Conclusion

Trading Tesla stock contracts on MEXC provides investors with a flexible and convenient way to participate in the US stock market. By using cryptocurrency as a trading medium, the entry threshold for traditional stock investment is lowered, while providing functions such as leverage and two-way trading, increasing the diversity of trading strategies.

However, futures trading itself carries high risks, especially when using leverage, where even small market fluctuations can lead to significant losses. Successful trading requires solid market analysis skills, strict risk management, and good psychological qualities. It is recommended that beginners start with small amounts of capital and low leverage, gradually accumulate experience, and not rush for success.

Join MEXC and Get up to $10,000 Bonus!

Sign Up