Author: Seeyounxtsummer-Syns

BlockMasonry

1.0 Concept and Regulatory Framework of Security Token Offerings (STOs)

1.1 Concept of Securities

To grasp the fundamental concept of securities, it is pertinent to refer to the Capital Market and Financial Investment Act (hereinafter referred to as the “Capital Market Act”).

Article 4 (1) of the Capital Market Act: Definition of Securities – Securities refer to financial investment products issued by domestic or foreign nationals, excluding any additional obligation to pay, other than the monetary consideration paid simultaneously with acquisition, (excluding obligations arising from exercising the right to make transactions on the underlying asset) that investors do not bear. [Amended on May 28, 2013, July 24, 2015]

Article 3 (1) of the Capital Market Act: Definition of Financial Investment Product – Financial investment products refer to rights acquired by agreeing to pay or paying a total amount of money or other property with present or future monetary or other property values, to gain profits or avoid losses, where the total amount paid or to be paid exceeds the total amount of money or other property recoverable from or recoverable by the right acquired. [Amended on July 25, 2011, May 28, 2013]

United States – Securities Act of 1933

Referring to the United States Securities Act of 1933, it is evident that it broadly defines securities and financial investment products.

The term “security” means any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, investment contract, voting-trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security, certificate of deposit, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as a “security”, or any certificate of interest or participation in, temporary or interim certificate for, receipt for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing.

Investment Contract exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived solely from the efforts of the promoter of a third party.

The concept of securities encompasses various types of instruments that facilitate trading, transfer, and gifting, such as certificates (currency securities – promissory notes, bills of exchange), commodity securities (warehouse receipts, etc.), and capital securities (stocks, bonds, etc.).

The concept of securities, as commonly used today, was established through the Securities Act of the United States during the implementation of New Deal policies aimed at economic recovery following the stock market crash of 1923. Under the U.S. Securities Act, the term “security” includes various instruments based on securities, such as stocks, bonds, bills of exchange, debt securities and certificates, trust certificates for profit-sharing agreements, warrants, transferable shares, investment contracts, deposit certificates for securities, shares in oil, gas, or other mineral rights, and so forth.

Thus, the concept of securities under domestic(South Korea) and international capital market laws can be explained as follows.

It is described as a right purchased to gain profit or avoid loss, despite the possibility of losing the principal, with the understanding that only the amount paid will be lost. An example is illustrated through stocks, where ownership in an organization such as a limited company/corporation with separate management rights and ownership rights is held. Even if the company fails, investors do not incur losses exceeding the amount paid, illustrating the concept of securities under capital market law.

In the early 20th century, the demand for investments in stocks and similar instruments surged among the American public, leading to a proliferation of securities issuance. At the time, securities issuance and sales were perceived as a relatively easy means to generate profits. However, risks associated with unregulated securities trading, including information asymmetry, fraud, and insolvency of loan securities, were recognized as significant issues within the market. Consequently, following the Wall Street Crash of 1929, the United States began implementing complex procedures and stringent sanctions for the distribution, issuance, and sale of securities to mitigate the risks associated with large-scale losses. The establishment of securities laws and the Securities Exchange Act in the early 1930s, along with the creation of securities regulators, aimed to strengthen legal regulations and supervision. Through the historical ups and downs of the securities market, a system for the current strict regulations and laws related to securities has been established, confirming the concept of the securities market as it exists today under capital market law.

1.2 Types of Securities

Based on the economic nature of the property rights represented, securities can be classified into the following three categories:

Currency Securities – Securities representing claims to currency such as promissory notes and bills of exchange.

Commodity Securities – Securities representing ownership of goods such as warehouse receipts.

Capital Securities – Securities representing the facts of investment and the rights of investors such as stocks and bonds.

Six types of securities under the Securities Exchange Act:

Debt Securities: Instruments indicating the right to claim payments such as national bonds and debentures.

Equity Securities: Instruments indicating ownership stakes (stocks), subscription rights, or rights to acquire ownership stakes.

Income Securities: Instruments indicating the right to income from trusts.

Investment Contract Securities: Instruments indicating the right to profit or loss sharing resulting from joint ventures where specific investors invest money with others (including other investors) and primarily derive profits or losses from joint ventures performed by others.

Derivative Combination Securities: Instruments indicating the right to receive or recover money determined in advance through correlation with variations in the price, interest rate, index, unit, or index derived from underlying assets.

Securities Deposit Receipts: Instruments indicating rights related to securities deposited by a recipient outside the country where the securities were issued.

Investment Contract Securities (ICS) vs. Howey Test

The predominant aspect of tokenizing virtual assets lies in Investment Contract Securities (ICS). In the United States, its definition has been established through federal case law and interpretations. Securities laws and regulations in the United States extensively define securities and provide numerous examples, particularly concerning Investment Contracts. This aspect primarily raises concerns regarding virtual assets-related legislation associated with STOs.

Since the specific definition of an Investment Contract about securities is not explicitly provided, its definition and criteria have been established through interpretations of federal case law.

In fact, in 2019, the Securities and Exchange Commission (SEC) of the United States announced that the security status of virtual assets should be assessed according to the Howey Test, through the publication of the “Framework for ‘Investment Contract’ Analysis of Digital Assets.” Therefore, by comparing the Howey Test with precedents and definitions concerning Investment Contract Securities, we can gain a better understanding of the concept of tokenized securities in the form of Investment Contract Securities.

Howey Test

“Investment Contract exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived solely from the efforts of the promoter of a third party”

1. Investment of Money: When funds are contributed with the expectation of receiving profits or returns, typically in the form of virtual assets or cryptocurrency.

2. In a Common Enterprise: When the funds contributed by investors are pooled together and used to finance a common venture or enterprise, often facilitated through blockchain-based platforms or decentralized autonomous organizations (DAOs).

3. Derived from the Efforts of Others: When the generation of profits or returns relies predominantly on the managerial or entrepreneurial efforts of others, such as developers, promoters, or operators of the underlying project or venture, within the context of virtual asset investments.

4. Reasonable Expectation of Profits: When investors anticipate the potential for financial gain or returns on their investment, which may result from various factors including market trends, technological advancements, or the successful development and adoption of the underlying virtual asset or blockchain project.

Investment Contract Securities (Republic of Korea)

“An investment contract security refers to a contractual right indicating the investment of funds or equivalent assets by a specific investor into a joint venture with others (including other investors), primarily where the profits and losses resulting from the joint venture’s performance are attributed”

1. Joint Venture: When there is a horizontal or vertical relevance in terms of profitability.

2. Investment of Money or Equivalent Assets: When funds or similar assets are invested.

3. Primarily Performed by Others: The success of the venture is contingent upon the issuer.

4. Contractual Right to Profits and Losses Resulting from the Venture’s Performance: Promise of profit distribution.

Through this comparison, the Howey Test establishes the concept of securities through the term “Money.” However, through numerous precedents and cases within the United States, it is evident that virtual assets, aside from money, may also fall within the purview of securities due to the expanded application of the concept inherent in asset securities. Therefore, let us delve into precisely what Security Token Offerings (STOs) entail.

1.3 STO (Security Token Offering)

STO (Security Token Offering) signifies the convergence of the digital asset and securities industries, aimed at overcoming the limitations of traditional securities markets by issuing securities digitized on a blockchain-based distributed ledger technology (DLT). In South Korea, various terms such as securities tokens, security tokens, or tokenized securities were used interchangeably, but through the consensus process of the Financial Services Commission, the term “token securities” has been unified. To gain a clear conceptual understanding of STO, let’s delve into the concepts of Security (S), Token (T), and Offering (O).

1. S (Security)

The ‘S’ in STO, as described earlier, denotes securities under capital market law. It primarily encompasses debt securities with payment claims, such as bonds, securities deposit certificates, or profit securities. Concerning virtual assets related to STOs, investment contract securities, which involve investing money or equivalent assets into joint ventures and attributing profits and losses according to the venture’s outcomes, are also prominent.

Therefore, it is evident that the ‘S’ in STO mainly refers to securities under capital market law, specifically including profit securities or investment contract securities as detailed earlier. The regulatory direction of token securities overseas slightly differs from that of South Korea’s current regulations. Token securities issued by cryptocurrency companies operating in South Korea cannot be recognized as token securities due to the absence of clear regulation under current law.

In contrast, in the United States or Europe, the regulatory direction for token securities has been established and applied within existing legislation and guidelines for issuing token securities. In 2017, the United States issued its first token security (Blockchain Capital) and allows token security issuance within regulatory frameworks through Regulation D (Private Offering Rules). Additionally, in Europe, token securities can be issued without a securities prospectus for amounts up to 8 million euros.

Token securities, as subjects of capital market law regulation, are already shaping new markets through established regulations and interest in Europe and the United States, evidenced by guidelines for token securities and fractional investment in assets. In the United States, various applications such as tokenization of government bonds, issuance of token securities by cryptocurrency companies, and tokenization of real-world assets (RWAs) are being conducted within clear regulatory guidelines. However, in South Korea, where there are no clear guidelines for token securities regulations, relatively few applications have emerged.

2. T (Token)

The essence of a token (T) security lies in it being a security rather than merely a token. In other words, the primary focus of tokenized digital asset securities is on the concept of securities rather than tokenization. This distinction can be understood through the conceptual difference between tokens and coins, often confused in the industry. Tokens like Ethereum, which are primarily used for payment purposes like legal tender when purchasing goods or services, are not considered tokens in the context of securities.

In the digital asset industry, virtual assets can generally be categorized into three main types:

Payment Tokens: Digital assets used as a medium of exchange, akin to legal tender, primarily for conveying monetary value, such as BTC.

Utility Tokens: Digital assets used within blockchain-based platforms like Dapps (Decentralized Applications) for accessing services.

Security Tokens: Digital assets linking financial investment products like real estate, shipping, real assets, stocks, bonds, and bills to blockchain-based tokens.

Utility Token vs. Utility Coin

Coins are fundamentally issued and circulated within their own blockchain networks (mainnets). For instance, Ethereum (ETH) and Bitcoin (BTC) are only issued and circulated within their respective blockchain networks. Transferring Ethereum on the Bitcoin network or vice versa is impossible, indicating that these assets are network-dependent, and thus, defined as coins.

On the other hand, tokens do not have their own independent mainnet. Stablecoins like USDT and USDC, which are issued and circulated across multiple blockchain networks, enabling transfers and payments without relying on a single blockchain network, are considered tokens rather than coins.

The delineation of utility tokens and utility coins further illustrates this distinction. Utility coins are tethered to their own blockchain networks, while utility tokens can operate and interoperate as smart contracts or DApps (Decentralized Applications) across different blockchain platforms.

Securities vs. Tokens

Currently, securities are defined in various forms, including physical securities documented on paper and securities recorded on distributed ledger systems, referred to as electronic securities. In 2019, the South Korean government introduced the Electronic Securities Act, prohibiting physical securities of listed companies and allowing the issuance and circulation of securities such as stocks and bonds exclusively through electronic securities.

On the other hand, the crux of token securities is securities. Security tokens refer to digital assets linking financial investment products such as real estate, shipping, real assets, stocks, bonds, and bills to blockchain-based tokens, digitizing securities under capital market law. The term “token securities” does not solely rely on tokens but emphasizes securities, indicating a new form of securities issuance using blockchain technology within the framework of securities regulations. Considering the designation of token securities by the Financial Services Commission in 2023, token securities represent securities digitized through blockchain technology, enabling them to be more systematic and legally compliant investment targets than virtual asset investments. Token securities utilize blockchain technology as a giant ledger to register newly issued securities, disregarding the form of token issuance.

3. O (Offering)

Offering fundamentally implies issuance. Thus, token securities refer to being registered with institutions or blockchain networks for trading or sale, allowing securities to be traded or sold to the public. The issuance methods can vary widely, including stocks, coins, token securities, and more.

Types of Offerings/Fundraising

IPO (Initial Public Offering): The process where unlisted companies sell their stocks to the public and disclose financial information to list on the KOSPI or KOSDAQ.

ICO (Initial Coin Offering): Issuing blockchain-based coins and selling them to investors to raise funds.

IEO/IDO (Initial Exchange/Dex Offering): When a business issues blockchain-based coins and lists them on exchanges, it is termed IEO; when issued on decentralized platforms, it’s referred to as IDO.

STO (Security Token Offering): Issuing securities digitized on a blockchain-based distributed ledger technology (DLT) or blockchain to overcome the limitations of traditional securities markets.

STOs enable distributed ownership and can contain a wider range of contracts compared to traditional securities. While STOs are not yet subject to clear regulations compared to IPOs, they are expected to comply with certain levels of investor protection and disclosure obligations under capital market law. While ICOs brought about ecosystem innovation in the cryptocurrency coin market, the lack of clear regulatory frameworks resulted in numerous fraudulent investment schemes. STOs aim to address these vulnerabilities of ICOs by issuing various securities in both digital ecosystems and the real economy under clear regulatory frameworks. This makes STOs, or token security offerings, a more systematic and legally compliant investment option, emphasizing securities rather than tokens.

2.0 Background of Domestic (South Korea) STO Promotion

According to the World Economic Forum (WEF) 2023 report, the tokenization market of global assets is projected to show an annual growth rate of 62%, reaching a market value of $24 trillion by 2027. Furthermore, an article from the Virtual Currency Symposium of Citigroup in March 30, 2023, predicts that the global market value of tokenized securities by 2030 will exceed $4-5 trillion, indicating rapid growth. While it remains to be seen whether these projections will materialize, STOs are recognized as a definite area of interest due to their potential to lead significant growth in the upcoming Fourth Industrial Revolution. Let’s delve into the background driving the promotion of STOs.

2.1 Innovative Nature of Distributed Ledger Technology (DLT) / Purpose of Digitizing Markets through Tokenization

Fundamentally, tokenized securities embrace the advantages of distributed ledger technology (DLT) of blockchain while applying it to existing legal securities frameworks. This entails adopting tokenized securities in the form of tokens that meet the requirements of a distributed ledger, accepting the digitization (electronic registration) of securities under the Electronic Securities Act, and ensuring the rights of tokenized securities through the tokenization of physical assets by verifying and validating the occurrence, modification, and extinction of rights in compliance with legal regulations. This process examines whether the form of securities issued prevents unauthorized manipulation or alteration of securities contracts, thereby satisfying the harmonization of legal frameworks under existing securities laws as a primary goal of the background driving the promotion of tokenized securities.

RWA vs. STO

How does the current status of Real World Assets (RWA), a concept similar to tokenized securities, fare? RWAs refer to the tokenization of not only tangible assets such as real estate and artwork but also intangible assets like bonds and stocks onto the blockchain. Tokenizing assets offers numerous advantages in transactions. Blockchain networks operate on a peer-to-peer (P2P) decentralized network basis, reducing transaction costs and speeding up transaction times due to the absence of intermediaries. Additionally, participants can engage in transactions involving their physical assets around the clock, with ownership transfers occurring transparently. Furthermore, the function of “fractional investment” where ownership of assets is divided into tokens allows for the fractional ownership of assets, facilitating liquidity for illiquid assets.

According to RWA.xyz, the market capitalization of RWA tangible assets based on US bonds in the DeFi (Decentralized Finance) market soared from approximately $11.93 million in January of last year to $77.41 million (about 113 billion KRW) in just 10 months, foreshadowing the emergence of a new digital market through tokenization. The number of RWA token holders also increased from around 17,900 in August last year to 41,300 in just one year. According to additional statistics from BCG (Boston Consulting Group), the asset tokenization market is expected to grow to around $16 trillion by 2030. Global financial firms and asset management companies such as BlackRock, Goldman Sachs, and Barclays are showing considerable interest in using distributed ledger technology to transparently track token asset issuance and transaction records, enabling smoother and faster liquidity compared to traditional physical assets.

At first glance, RWAs and tokenized securities may seem similar concepts. However, while tokenized securities refer to the concept of tokenized “securities” traded within capital market regulations, RWAs encompass not only securities but also the tokenization of existing tangible and intangible real-world assets, representing a slightly broader scope than tokenized securities. However, considering the possibility of market innovation through the digitization of RWAs and blockchain technology globally, the revitalization of the market through tokenization and the technological innovation of blockchain, the promotion of various digital markets through tokens, is recognized as one of the significant driving forces behind STOs in South Korea.

2.2 Establishment of Legal Regulations / Strengthening Investor Protection

The basic direction of promoting tokenized securities issuance is to balance the innovativeness of tokenized securities with the investor protection objectives of capital market laws. In light of the emphasis on the risks of virtual asset markets through traditional ICOs, governments are establishing various legal application points, such as ensuring stability and protecting investor rights through the distributed ledger technology of blockchain, allowing multiple participants to verify transaction records and not requiring separate virtual assets for issuing or trading tokenized securities under the Investment Contract Securities Act. Thus, tokenized securities meeting these requirements inherently apply legal protection mechanisms similar to traditional electronic securities under the Electronic Securities Act, strengthening the establishment of legal regulations for tokenized securities.

According to a press release from the Financial Services Commission on February 6, 2023, the innovativeness of tokenized securities highlights the ability to tokenize various rights that were difficult to issue under the traditional electronic securities system centered on financial institutions such as securities firms. By accepting the advantages of tokenized securities, it is possible to address unresolved information asymmetry among the public, establish market order within legal frameworks from existing Web 2.0 businesses to Web 3.0 virtual asset businesses, protect investors from indiscriminate virtual asset and securities investments, and ensure the proper issuance and distribution of tokenized securities within the legal jurisdiction, which can be understood as a major driving force behind domestic STOs.

2.3 Fractional Investment in Assets / Purpose of Activating Capital Liquidity

Starting from the first half of 2024, the Financial Services Commission designated the irregular securities market of the Korea Exchange as an innovative financial service. This news entails the designation of a regulatory sandbox for fractional investments in response to this new market, allowing the Korea Exchange to establish a market for the competitive trading of irregular securities within the stock market. The regulatory sandbox temporarily exempts new products or services from existing legal regulations for a certain period when they are launched in the market. Irregular securities primarily include investment contract securities and non-cash trust income securities, representing a new form of securities suitable for formalizing tokenized securities, allowing multiple investors to purchase rights to high-value tangible assets such as artwork or real estate in defined units.

The market for fractional investment products through STOs addresses the liquidity issues faced by existing investors. For instance, real estate investment typically requires significant capital, making it challenging for individual investors with limited funds or even those with sufficient capital to invest in real estate deals involving large amounts of money. To alleviate such burdens, government and corporate initiatives toward blockchain-based STO facilitate practical fractional investments from the public through various new platform services. Fractional investment involves dividing high-value real assets into designated units on platforms provided by token issuance or cooperation companies, attracting small-scale capital investments from multiple investors and distributing profits to investors in proportion to their investments in the targeted assets.

From the perspective of fractional investments by both individual investors and large corporations or institutional investors, diversification of fundraising through STOs appears as a highly attractive pursuit. Typically, corporate fundraising involves borrowing from banks, issuing bonds, or issuing stocks. While each method of fundraising has its advantages and disadvantages, fundraising through STOs based on decentralized blockchain technology effectively addresses liquidity issues in traditional business models, offering solutions to the capital liquidity problems faced by businesses. For example, the fundraising process for venture capital (VC) firms typically involves raising investment from venture capital and angel investors, followed by capital raising through third-party allocation of shares. In such cases, companies usually aim for an IPO within a certain period to fulfill their mission. However, blockchain technology offers transparency, stability, and liquidity in fundraising

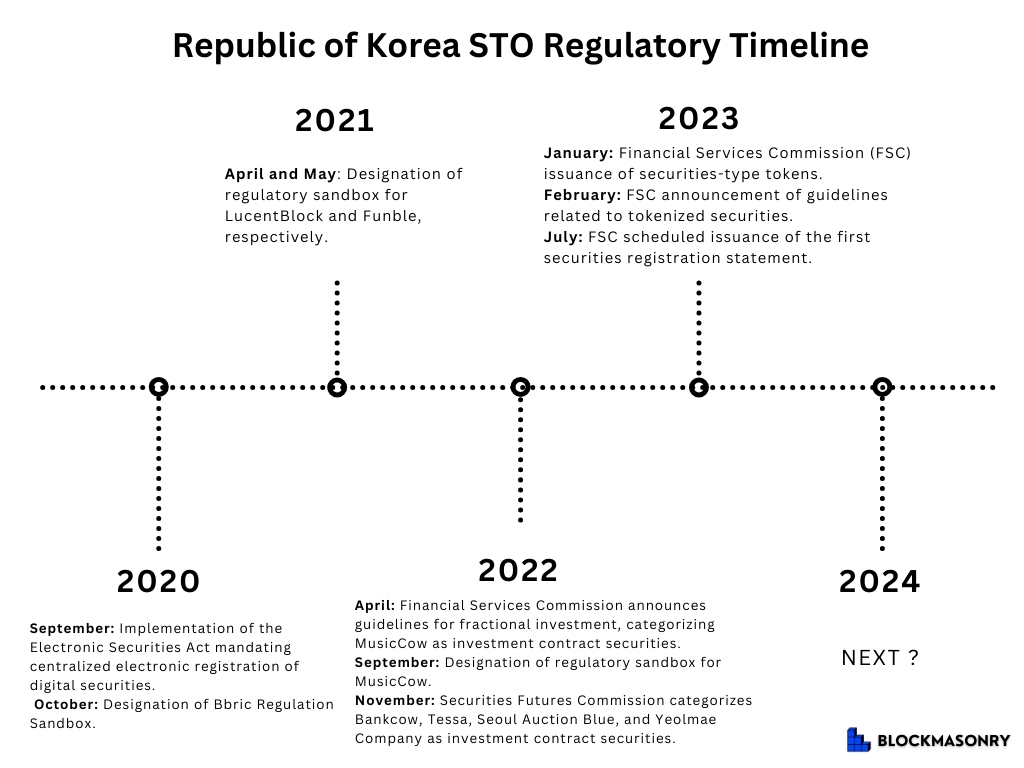

Republic of Korea STO (Security Token Offering) Regulatory Timeline

In the current domestic securities industry, STO-related ventures are emerging as significant revenue streams, garnering substantial expectations and attention within the market. Due to the deterioration of the domestic corporate operating environment resulting from interest rate hikes and economic downturns in 2022, the operational revenues of domestic securities firms have also significantly declined. Despite experiencing continuous growth from 2016 to 2021, the net operating income of domestic securities firms plummeted by 25% in 2022, recording 18 trillion KRW, and the Return on Equity (ROE), which had risen to 11.5% in 2021, reportedly dropped to 7% in 2022, a decline of 4.6% from the previous year. Amidst the anticipated prolonged trend of tightening policies and economic slowdown, securities firms, which have been seeking revenue diversification due to the growth constraints in traditional brokerage business segments, view the new STO business within the robust regulatory and legal frameworks of blockchain technology as a highly promising business model that aligns with the evolving market landscape in both the short and long terms. Through the timeline of domestic STO regulatory frameworks, a brief overview of the current status of STO regulations leading to the domestic legalization of STOs by 2024 can be observed.

Current Trends in STO Business within the South Korea Securities Industry

Securities firms fundamentally engage in the sale and competition of similar financial products such as stocks and funds. From the perspective of customers, purchasing Korean stocks from different securities firms, whether from Korea Investment & Securities, KB Securities, or Hana Securities, carries the same significance. Consequently, securities firms are actively advancing various improvements within their platforms, whether through marketing expenditures, fee reductions, or customer attraction.

Upon the establishment of regulatory frameworks for securities related to the STO market, various changes are expected among securities firms alongside the market evolution of tokenized securities. Should a specific securities firm identify and issue tokenized securities products with excellent user interfaces that customers can actively utilize, it is anticipated that the said firm could seize significant market dominance opportunities.

Should securities firms commence offering exclusive financial products through STOs that are unavailable elsewhere, it is foreseen that the securities market will undergo a significant reorganization accompanied by explosive liquidity growth. Tokenization of various assets, including movies, ships, and even livestock, centered around fractional investments and securitization through blockchain technology of underlying tangible assets, is envisioned to become a vital driving force behind the development, innovation, and formation of the current and future markets within the financial industry.

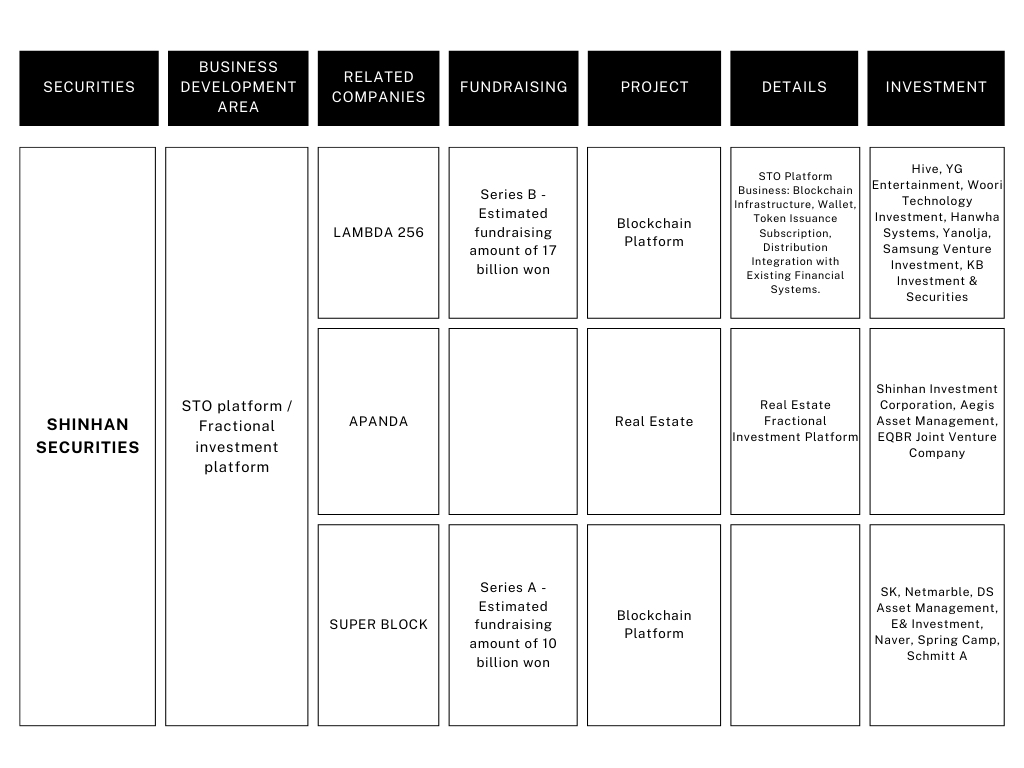

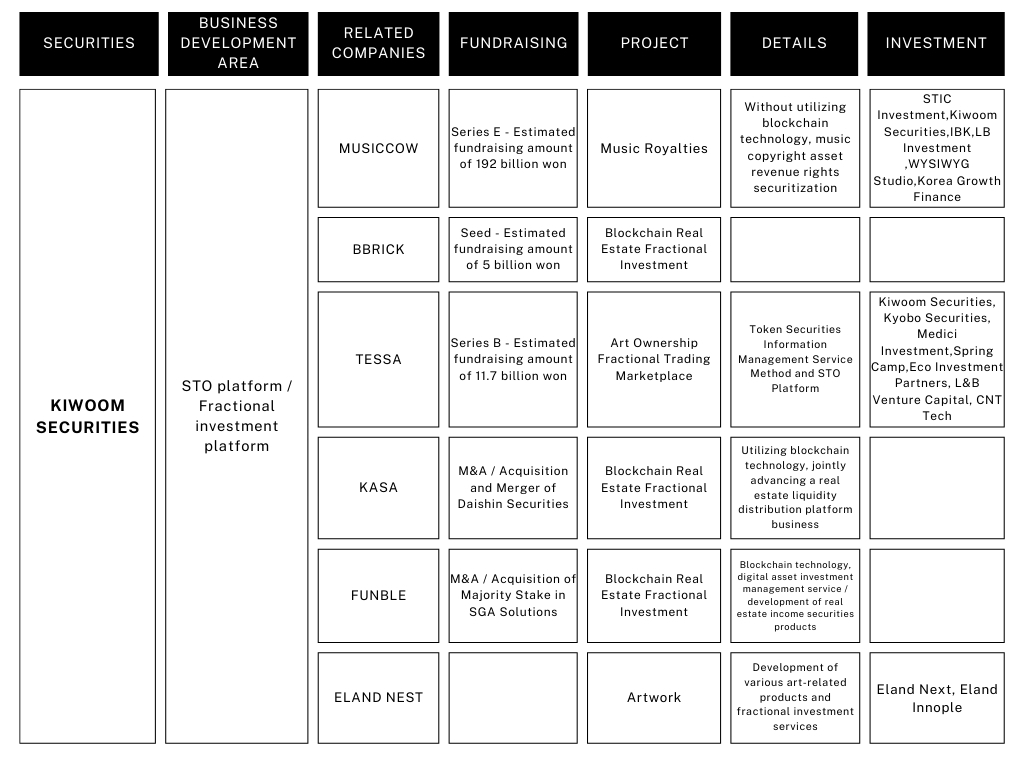

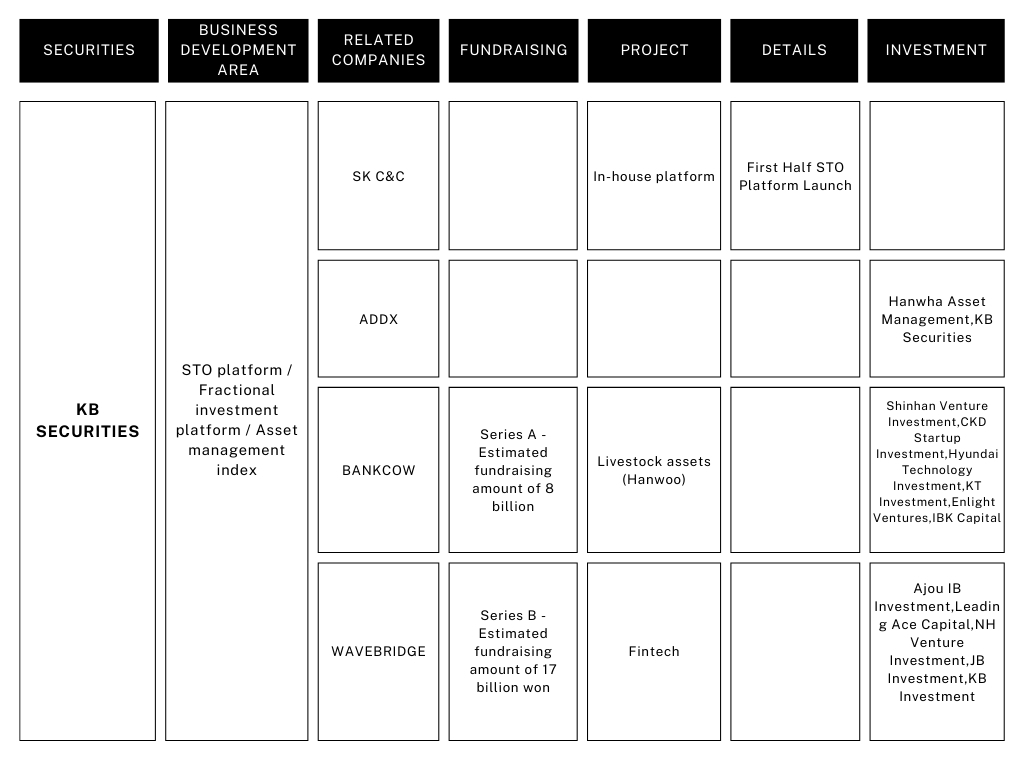

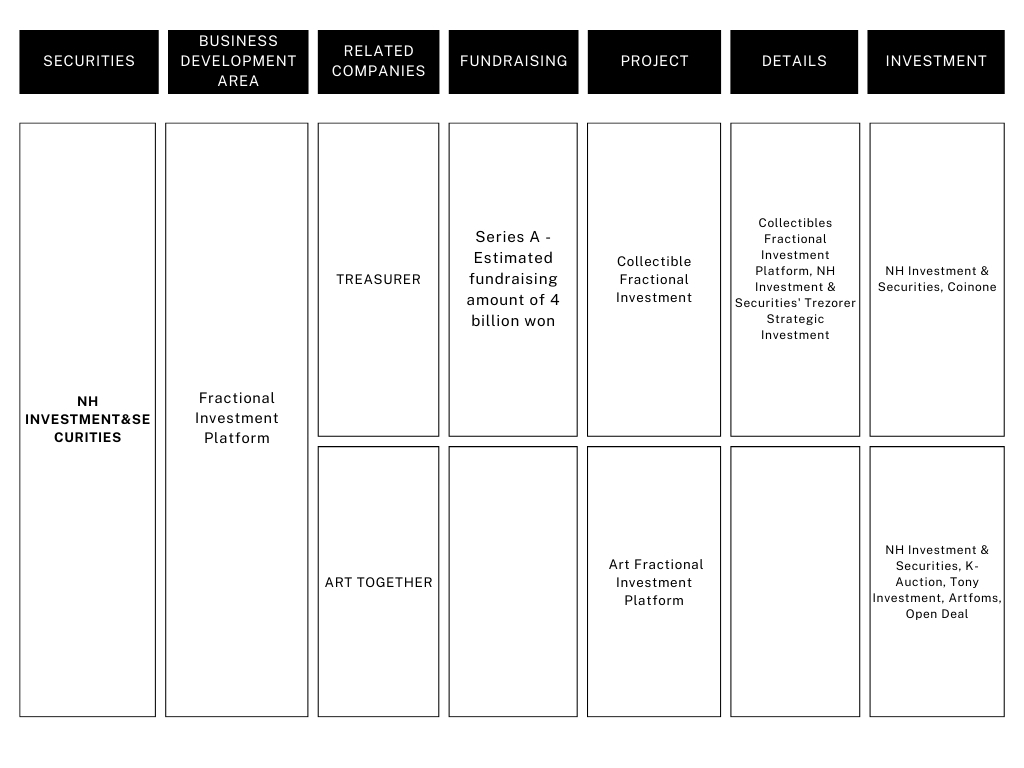

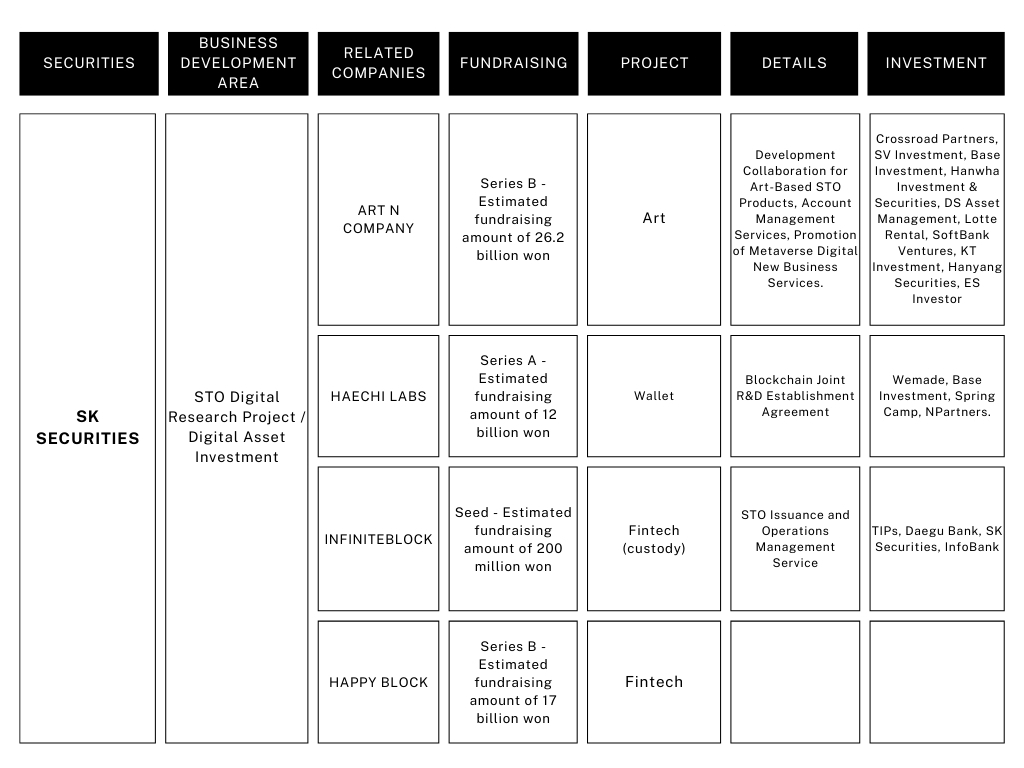

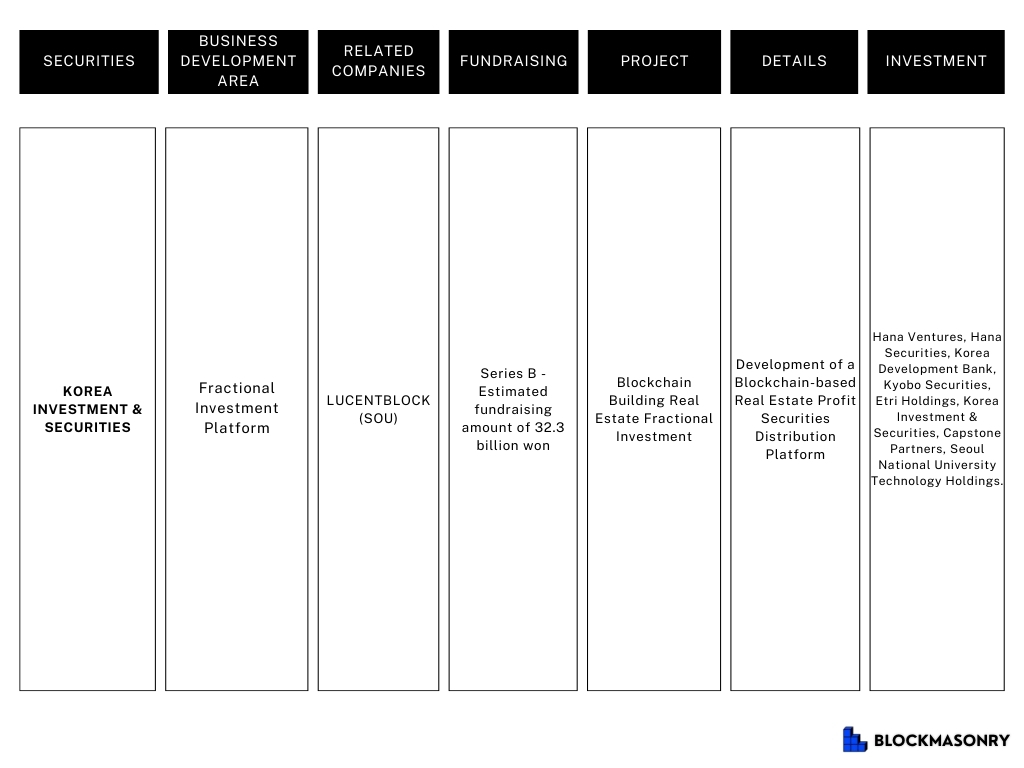

Therefore, the table below provides insights into the current trends in STO-related activities and projects by domestic (South Korea) securities firms.

As the domestic Security Token Offering (STO) regime becomes clearer, domestic securities firms are proactively responding among STO market participants by developing STO platforms and entering into business agreements with fractional investment firms to preemptively seize market opportunities. KB Securities and Shinhan Investment Corp are preparing their own STO platform services through collaboration with platform companies. Since STO platforms are likely to target closed networks such as private blockchains, collaboration with platform companies for platform construction is also crucial for infrastructure expansion.

SK Securities appears to be constructing a token securities account management system capable of issuance and liquidation. It has been forming partnerships with various fractional investment firms, developing token securities issuance and distribution, and digital research projects. Together with experts in various fields such as blockchain and financial technology, SK Securities aims to build infrastructure to provide diverse stakeholders with new value, thereby constructing the next-generation digital financial ecosystem.

The close relationship between securities firms and fractional investment firms has become increasingly important with the application of the principle of separating the issuance and distribution of token securities. Hence, cooperation between securities firms and fractional investment firms is a key factor for the current success of the STO market. The domestic STO regime aims to prevent conflicts of interest between issuers of token securities and operators of distribution markets and protect investors. To this end, regulations prohibit issuers of token securities from directly distributing token securities issued in the over-the-counter market. However, through the financial regulatory sandbox, there are ongoing tests under limited conditions to assess the possibility of issuing and distributing fractional investment securities concurrently. Depending on the results, partial adjustments to the regulations may be considered in the future. In fact, among the five companies classified by the Financial Services Commission as offering fractional investment products, companies such as ArtTogether and Yeolmae Company have completed the submission of investment contract security registration statements, preparing for the upcoming token securities market.

Therefore, after incorporation into the regulatory framework, fractional investment platforms maintaining token securities issuance services are expected to require integration with distribution platforms where issued token securities will be traded. Moreover, in addition to facilitating token securities distribution, business agreements with securities firms offer the advantage of securing many participants during the issuance stage. Since securities firms also consider holding a variety of asset-based token securities crucial for enhancing market competitiveness as distribution platforms, it is anticipated that collaboration with fractional investment firms will further expand throughout the STO business implementation preparation process.

4.0 STO Challenge & Future Plans

As the amendment for the issuance and distribution of token securities has been pending in the National Assembly for a year, it is urgent to legislate for the establishment of legal frameworks for these token securities and business infrastructures in South Korea. This urgency stems from the anticipation that comprehensive regulations and legal environments are crucial for the explosive growth of the Korean Security Token Offering (STO) market. Currently, various stakeholders and entities, including banks, securities firms, fractional investment entrepreneurs, and blockchain infrastructure companies, are swiftly entering the token securities market. However, to actively pursue related businesses, there is an emphasis on the urgent need for legislative foundations.

In South Korea, only electronic securities are currently traded under the law. Therefore, considering the background of promoting token securities, it is anticipated that establishing a comprehensive framework for protecting various stakeholders and setting the overall framework related to securities during the distribution process will be crucial for market revitalization. In practice, both token securities issuers and financial institutions are pointed out as the major factors hindering the activation of the token securities market, primarily due to domestic regulatory uncertainties. Therefore, considering that token securities also lack perfect guidelines and relevant legislation, the future trends of companies or agile government actions are predicted to be crucial for market activation. Although the proposed amendment to the Capital Markets Act allowing token securities issuance and trading was submitted in July 2023, a somewhat conservative perspective should be maintained regarding the timing of the legislation. This caution arises from the possibility that after the upcoming general election in 2024 and subsequent changes in the composition of the National Assembly, previously submitted bills may become ineffective, necessitating their resubmission.

Nevertheless, despite the current market dynamics and the significant interest of related companies in the market, even under a new government, considering the revision of laws, movements towards substantial industry development and business initiatives regarding token securities are highly promising. In South Korea, various major securities firms have established STO consortia and are continuously exploring the potential of the token securities market through ongoing business agreements and startup acquisitions. While it is expected to take more time to establish detailed regulations and technical standards necessary for token securities, expeditiously establishing safe and clear regulatory mechanisms is essential. This will create an environment conducive to the development of the industry and the deployment of various infrastructures for various market participants entering the domestic token securities market, thereby fostering anticipation for significant new digital financial innovations based on token securities in the future. Therefore, the core of the Korean STO token securities lies not in technology but in regulatory frameworks. With the designation of innovative financial services and approval of investment contract securities issuance in 2024, it is anticipated that by 2025, the establishment of a token securities regulatory foundation for various rights will lead to new financial innovations and the establishment of diverse infrastructures in the domestic financial market.

Crypto education is essential.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!