Key Takeaways

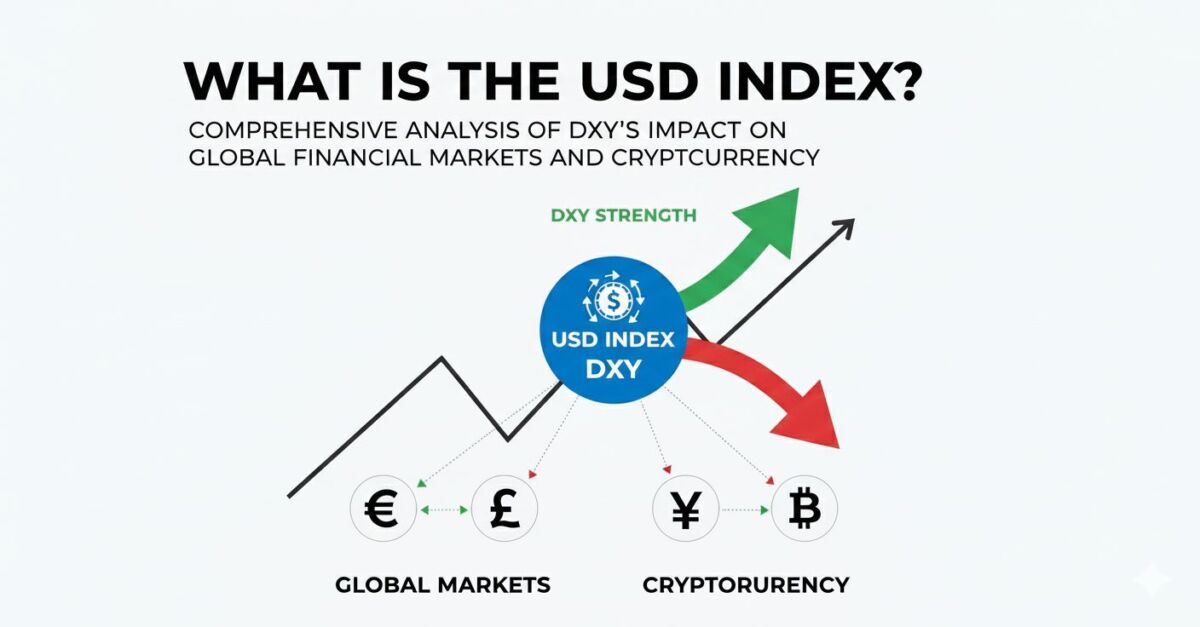

- The USD Index (US Dollar Index, DXY) is a comprehensive indicator measuring the US dollar’s strength against a basket of major currencies

- The USD Index comprises six major currencies, with the euro accounting for the highest weight at 57.6%

- A rising USD Index typically signals a strengthening dollar, creating negative pressure on emerging markets, commodities, and cryptocurrencies

- Federal Reserve monetary policy is one of the most critical factors influencing the USD Index

- The cryptocurrency market exhibits a significant negative correlation with the USD Index

- Investors can optimize portfolio allocation and risk management by monitoring the USD Index

I. Understanding the USD Index

1.1 Definition of the USD Index

The USD Index (also known as DXY or USDX) is a comprehensive indicator introduced by the Intercontinental Exchange (ICE) that measures the US dollar’s exchange rate changes against a basket of major international currencies. This index was first launched in March 1973 with a baseline value set at 100.00.

The USD Index reflects the overall strength of the US dollar in the international foreign exchange market. When the USD Index rises, it indicates the dollar is appreciating relative to other major currencies; conversely, when the USD Index falls, it signals dollar depreciation.

1.2 Composition of the USD Index

The USD Index consists of six major currencies with the following weights:

- Euro (EUR): 57.6%

- Japanese Yen (JPY): 13.6%

- British Pound (GBP): 11.9%

- Canadian Dollar (CAD): 9.1%

- Swedish Krona (SEK): 4.2%

- Swiss Franc (CHF): 3.6%

The weight distribution shows that the euro dominates the USD Index, meaning EUR/USD exchange rate changes have the most significant impact on the index.

1.3 Calculation Method

The USD Index calculation employs a geometric weighted average formula:

DXY = 50.14348112 × EUR/USD^(-0.576) × USD/JPY^(0.136) × GBP/USD^(-0.119) × USD/CAD^(0.091) × USD/SEK^(0.042) × USD/CHF^(0.036)

This formula ensures each currency impacts the index according to its weight.

II. Historical Evolution of the USD Index

2.1 Birth After Bretton Woods Collapse

The USD Index was born in 1973, right after the collapse of the Bretton Woods system. Previously, the global monetary system centered on the US dollar, with the dollar pegged to gold and other currencies pegged to the dollar. After President Nixon announced the dollar’s decoupling from gold in 1971, major currencies began implementing floating exchange rate systems, and the USD Index emerged as an essential tool for measuring dollar value.

2.2 Key Historical Milestones

Early 1980s Peak: The USD Index reached a historic high of 164.72 in early 1985, primarily due to Federal Reserve Chairman Paul Volcker’s high interest rate policy to combat inflation.

2008 Global Financial Crisis: During the crisis, the dollar was sought as a safe-haven asset, causing the USD Index to surge significantly.

2020 COVID-19 Pandemic: The index spiked above 102 during the pandemic’s early stages, then retreated due to the Fed’s massive quantitative easing policies.

2022-2023 Rate Hike Cycle: The Fed’s aggressive rate increases pushed the USD Index above 114, reaching a 20-year high.

2.3 Current Position

As of 2025, after the strong rally in 2022-2023, the USD Index has retreated from its peak as the Federal Reserve’s monetary policy shifted, currently fluctuating in the 100-106 range. Markets widely expect the Fed to continue adjusting interest rate policies, which will significantly impact USD Index trends.

III. Core Factors Influencing the USD Index

3.1 Federal Reserve Monetary Policy

Federal Reserve monetary policy is the most important factor affecting the USD Index, including:

Interest Rate Policy: When the Fed raises the federal funds rate, US dollar asset yields increase, attracting international capital inflows and pushing the dollar higher, thereby increasing the USD Index. Conversely, rate cuts lead to USD Index declines.

Quantitative Easing (QE) and Quantitative Tightening (QT): Large-scale asset purchase programs increase dollar supply, leading to depreciation; balance sheet reduction tightens dollar liquidity, supporting a stronger dollar.

Forward Guidance: Fed officials’ speeches and policy statements guide market expectations, influencing USD Index trends in advance.

3.2 US Economic Data

Key economic indicators directly influence market expectations for Fed policy:

Inflation Data: CPI (Consumer Price Index) and PCE (Personal Consumption Expenditures) data exceeding expectations typically favor the dollar, as they may prompt the Fed to maintain or raise rates.

Employment Data: Strong non-farm payroll numbers, unemployment rates, and wage growth support dollar strength.

GDP Growth Rate: Robust economic growth enhances dollar attractiveness.

Manufacturing and Services PMI: Leading indicators reflecting economic vitality.

3.3 Geopolitical Risks

As the world’s primary reserve currency and safe-haven asset, the dollar often strengthens during periods of geopolitical tension:

- International conflicts and wars

- Global trade frictions

- Political uncertainty

These factors prompt investors to seek dollar assets as safe havens, boosting the USD Index.

3.4 Other Major Economies’ Policies

Since the USD Index is a relative indicator, policies from the European Central Bank, Bank of Japan, and other major central banks are equally important:

ECB Policy: Due to the euro’s highest weight in the USD Index, ECB interest rate decisions have enormous impact. When the ECB raises rates, the euro strengthens and the USD Index falls.

BOJ Policy: Prolonged ultra-loose monetary policy has kept the yen continuously depreciating, indirectly supporting the USD Index.

Bank of England Policy: Pound sterling movements also significantly affect the USD Index.

IV. USD Index Impact on Global Financial Markets

4.1 Foreign Exchange Market Impact

The USD Index is a core indicator in forex markets, directly influencing major currency pair trends:

Major Currency Pairs: EUR/USD, GBP/USD, and other pairs show negative correlation with the USD Index. When the index rises, these pairs decline.

Emerging Market Currencies: Emerging market currencies are extremely sensitive to USD Index changes. When the index strengthens, emerging market currencies often face depreciation pressure, potentially triggering capital outflows and financial turmoil.

4.2 Commodity Market Impact

Commodities are typically priced in US dollars, showing negative correlation with the USD Index:

Gold: Rising USD Index usually leads to falling gold prices, as a stronger dollar reduces gold’s attractiveness as a store of value.

Oil: The USD Index and oil prices are negatively correlated. A stronger dollar makes dollar-denominated crude oil more expensive for holders of other currencies, suppressing demand.

Industrial Metals: Copper, aluminum, and other industrial metal prices are also affected by the USD Index, with a stronger dollar typically suppressing metal prices.

4.3 Stock Market Impact

The USD Index’s impact on stock markets is complex and multidimensional:

US Stock Market: A stronger dollar is unfavorable for US multinational companies’ overseas revenues, potentially suppressing stock prices. However, a strong dollar may also reflect robust US economic performance, supporting stock markets.

Emerging Market Stocks: Rising USD Index is typically unfavorable for emerging market stocks, as it leads to capital outflows and increased financing costs.

European and Japanese Stock Markets: Currency depreciation benefits export-oriented companies, potentially boosting stock markets.

4.4 Bond Market Impact

US Treasuries: When the USD Index rises, US Treasuries become more attractive to international investors, but simultaneously the Fed may maintain high rates, causing bond prices to fall.

Emerging Market Bonds: A stronger dollar increases the burden of repaying dollar-denominated debt, raising default risk and causing emerging market bond prices to decline.

4.5 International Trade Impact

US Trade Balance: A stronger dollar makes US exports more expensive and imports cheaper, potentially widening the trade deficit.

Global Trade Flows: USD Index changes affect countries’ import-export competitiveness, reshaping global trade patterns.

V. Deep Impact of USD Index on Cryptocurrency Markets

5.1 Negative Correlation Between USD Index and Bitcoin

Research shows the USD Index exhibits significant negative correlation with Bitcoin prices. Main reasons include:

Liquidity Environment: Rising USD Index typically accompanies Fed tightening policies, global liquidity contraction, and selling pressure on risk assets including cryptocurrencies.

Risk Appetite Shift: When the dollar strengthens, investors tend to reduce risk exposure, moving from cryptocurrencies and other high-risk assets to safe assets like dollar cash or US Treasuries.

Purchasing Power Factors: For non-US dollar region investors, a stronger dollar means higher costs to purchase dollar-denominated Bitcoin, suppressing demand.

5.2 Historical Data Verification

During 2022 USD Index Surge: The index rose from around 95 at the year-start to 114 in September; Bitcoin prices fell from approximately $47,000 to near $15,000, declining over 68%.

During 2023 USD Index Retreat: The index fell from its peak to the 100-105 range; Bitcoin prices rebounded from lows to above $42,000.

2024-2025 Trends: As the USD Index oscillated at high levels and gradually retreated, Bitcoin broke through all-time highs, verifying the negative correlation.

5.3 Impact on Overall Crypto Market

The USD Index affects not only Bitcoin but the entire cryptocurrency ecosystem:

Altcoins: Typically more sensitive to USD Index changes than Bitcoin, with greater volatility. When the index rises, altcoin declines often exceed Bitcoin’s.

Stablecoin Demand: When the dollar strengthens, demand for dollar stablecoins like USDT and USDC may increase as temporary safe havens for investors.

DeFi Protocols: Lending rates, liquidity pool yields, etc., are all affected by the USD Index. A stronger dollar leads to overall crypto market liquidity decline, potentially increasing DeFi protocol borrowing costs.

NFT Market: As high-risk speculative assets, NFT markets often suffer severely when the USD Index rises.

5.4 Transmission Mechanism Analysis

Main transmission paths for USD Index impact on crypto markets:

- Monetary Policy Transmission: Fed tightening policy → USD Index rises → Global liquidity tightens → Cryptocurrency prices fall

- Risk Appetite Transmission: USD Index rises → Risk-off sentiment increases → Capital flows out of risk assets → Cryptocurrency selling

- Capital Cost Transmission: Dollar interest rates rise → Opportunity cost of holding zero-yield assets (like Bitcoin) increases → Cryptocurrency demand decreases

- Technical Transmission: USD Index breaks key technical levels → Triggers algorithmic trading → Crypto market chain reaction

5.5 Strategies for Crypto Investors

Monitor USD Index Key Levels:

- 100 points: Psychological threshold

- 105 points: Strong support/resistance level

- Above 110 points: Extremely strong dollar zone

Use Correlation for Hedging:

- Reduce positions or short cryptocurrencies when USD Index rise is expected

- Increase crypto asset allocation when USD Index falls

Focus on Fed Policy Signals:

- FOMC meeting statements

- Economic data releases

- Fed officials’ speeches

Diversify Investment Portfolio:

- Don’t allocate all funds to cryptocurrencies

- Hold some dollar assets or gold as hedges

VI. Optimizing Investment Decisions Using USD Index

6.1 USD Index as Macro Indicator

Investors should incorporate the USD Index into macro analysis frameworks:

Trend Judgment: Assess long-term, medium-term, and short-term dollar trends to predict impacts on various assets.

Inflection Point Identification: USD Index breakouts at key support or resistance levels often signal major market turning points.

Correlation Analysis: Combine USD Index with historical correlations of other assets to forecast price movements.

6.2 Technical Analysis Applications

Support and Resistance Levels:

- 100.00: Important psychological level

- Historical highs and lows

- Fibonacci retracement levels

Trend Lines and Channels: Identify USD Index uptrends or downtrends.

Technical Indicators:

- RSI (Relative Strength Index): Judge overbought/oversold conditions

- MACD: Identify momentum changes

- Bollinger Bands: Assess volatility

6.3 Cross-Market Arbitrage Opportunities

Forex Arbitrage: Utilize relationships between USD Index and major currency pairs for arbitrage trading.

Commodity Futures Arbitrage: Establish hedge positions between USD Index and commodities.

Cryptocurrency Arbitrage: Execute directional trades through crypto futures or options when USD Index trends are clear.

6.4 Risk Management

Stop-Loss Settings: Set stop-losses based on USD Index key levels.

Position Management: Reduce positions when USD Index volatility increases.

Hedging Strategies: Use USD Index futures or options to hedge currency risk.

VII. Future Outlook for USD Index

7.1 Short-Term Outlook (2025)

Fed Policy Path: Markets expect the Fed may implement 1-2 rate cuts in 2025, potentially pressuring the USD Index.

Economic Data Impact: US economic growth slowdown may weaken the dollar, but may still maintain resilience relative to other major economies.

Geopolitical Factors: Global uncertainty may continue supporting dollar safe-haven demand.

Expected Range: 100-108

7.2 Medium-Term Outlook (2025-2027)

Interest Rate Differential Changes: Interest rate spreads between the US and other major economies will be key. If the ECB and BOJ begin normalizing monetary policies, narrowing spreads may weaken the dollar.

US Fiscal Situation: Expanding fiscal deficits and debt may erode long-term dollar confidence.

Reserve Currency Status: De-dollarization trends may gradually affect dollar demand, though short-term dollar hegemony remains difficult to shake.

7.3 Long-Term Structural Changes

Digital Currency Challenges: Development of central bank digital currencies (CBDCs) may transform the international monetary system.

Multipolarization Trends: Dispersion of global economic and political power may weaken single currency hegemony.

Climate and Energy Transition: New energy revolution may change commodity pricing mechanisms, affecting the dollar’s role in international trade.

VIII. Common Investor Misconceptions

8.1 Over-Reliance on Single Indicator

While important, the USD Index shouldn’t be the only reference. Investors need to comprehensively consider:

- Other macroeconomic indicators

- Market sentiment and capital flows

- Industry and individual stock fundamentals

8.2 Ignoring Time Lag Effects

USD Index changes have lagged effects on other markets, potentially taking weeks or months to fully manifest. Investors shouldn’t expect immediate reactions.

8.3 Mechanically Applying Correlations

USD Index correlations with other assets aren’t fixed and may weaken or even reverse under specific market conditions. Investors need to continuously monitor correlation changes.

8.4 Overlooking Weight Bias

Due to the euro’s excessive weight, the USD Index largely reflects dollar strength against the euro, with limited representation of other currencies and markets.

FAQ (Frequently Asked Questions)

Q1: What’s the difference between the USD Index and the dollar exchange rate?

A: The USD Index is a comprehensive indicator of the dollar against a basket of six major currencies, reflecting overall dollar strength; whereas dollar exchange rates typically refer to the dollar’s rate against a single currency, such as USD/CNY. The USD Index provides a more comprehensive dollar value assessment perspective.

Q2: What does USD Index 100 mean?

A: USD Index 100 is an important psychological threshold. Since the index baseline was set at 100 in March 1973, a current index of 100 means the dollar’s purchasing power relative to the baseline period is essentially unchanged. Breaking above or falling below 100 often attracts market attention and is viewed as a watershed for dollar strength.

Q3: Can ordinary investors directly trade the USD Index?

A: Yes. Investors can trade the USD Index through:

- Futures Contracts: DXY futures on the Intercontinental Exchange (ICE)

- ETF Products: Such as UUP (long USD Index), UDN (short USD Index)

- Contracts for Difference (CFD): USD Index CFDs through forex brokers

- Options: Trade USD Index options for directional or volatility plays

Q4: What impact does a rising USD Index have on Chinese investors?

A: Main impacts include:

- RMB Depreciation Pressure: Usually leads to RMB depreciation against the dollar, affecting exchange rate risk

- Overseas Asset Allocation: Dollar asset appreciation, increased cost of purchasing dollar assets

- A-Share Market: May lead to foreign capital outflows, pressuring stock markets

- Commodity Prices: Import costs (like crude oil) in RMB terms may rise

- Study Abroad and Travel Costs: Increased costs for US education and tourism

Q5: How often should cryptocurrency investors check the USD Index?

A: Recommended frequency depends on investment style:

- Day Traders: Need real-time monitoring of USD Index changes and important data releases

- Short-Term Traders: Check daily opening, closing, and key levels

- Medium/Long-Term Investors: Weekly trend reviews, monitoring monthly and quarterly movements

- All Investors: Must pay attention during FOMC meetings and major economic data releases

Q6: What are the historical high and low points of the USD Index?

A:

- Historical High: 164.72 (February 1985)

- Historical Low: 70.698 (March 2008) The current USD Index is far below its historical peak, operating in the historical mid-range.

Q7: Why isn’t the Chinese yuan in the USD Index?

A: The USD Index composition was established in 1973, selecting primarily freely floating currencies and major US trading partner currencies. The RMB only began exchange rate reform in 2005, achieving limited floating, and at that time China’s economic scale and international trade position were far from current levels. Although RMB internationalization has significantly advanced, the USD Index composition has remained essentially unchanged since launch, maintaining historical comparability. New USD indexes including the RMB may emerge in the future.

Q8: Is the relationship between USD Index and gold absolute?

A: No. While the USD Index and gold prices typically show negative correlation, this correlation isn’t 100%:

- Concurrent Rises: Under extreme risk-off sentiment, both dollar and gold may rise simultaneously

- Weakening Correlation: In certain periods, their movements may decouple

- Other Factors: Geopolitics, real interest rates, inflation expectations also independently affect gold prices Investors should analyze comprehensively, not simply apply negative correlation.

Q9: How to determine if the USD Index is overbought or oversold?

A: Methods include:

- RSI Indicator: RSI > 70 typically considered overbought, RSI < 30 oversold

- Historical Range: Compare with USD Index operating range over past 5-10 years

- Bollinger Bands: Price touching upper band may indicate overbought, lower band oversold

- Market Sentiment Indicators: Such as excessively high dollar long positions may signal pullback Note that overbought doesn’t mean immediate decline, oversold doesn’t mean immediate rebound; combine with other factors for comprehensive judgment.

Q10: Is there a time lag in USD Index’s impact on Bitcoin?

A: Yes, time lag effects typically exist:

- Immediate Reaction: During major Fed decisions or economic data releases, crypto markets may react within minutes

- Short-Term Lag: General USD Index changes may take hours to days to fully reflect in crypto markets

- Medium-Term Lag: Trending USD Index changes may impact crypto markets over weeks to months

- Delayed Amplification: Sometimes crypto markets show limited initial reaction but subsequently accelerate declines or rallies

Investors should focus on USD Index trend changes rather than just short-term fluctuations.

Conclusion

The USD Index, as a core indicator measuring overall dollar strength, has profound impacts on global financial markets and cryptocurrency markets. Understanding the USD Index’s composition, influencing factors, and transmission mechanisms is crucial for investors to optimize investment decisions and manage risks.

For cryptocurrency investors, the USD Index is an indispensable macro indicator. The negative correlation between the USD Index and Bitcoin, as well as the broader crypto market, provides investors with an important reference framework. By monitoring USD Index trends combined with Fed policies and economic data, investors can better grasp crypto market trends and turning points.

In the future, with the evolution of the global monetary system, development of digital currencies, and changes in geopolitical landscapes, the USD Index’s importance may adjust, but in the foreseeable future, it will remain one of the most important indicators in global financial markets. Investors should continuously monitor USD Index dynamics and use it as a key reference for investment decisions.

Disclaimer: This article is reposted content and reflects the opinions of the original author. This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up