In this Telegram AMA recap, you’ll find insights about the POPCORN project. In an event hosted by SenHo from MEXC, you will meet Michael Kisselgof (co-founder of Popcorn).

Introduction:

Hey everyone! I’m the co-founder of Popcorn, a crypto OG, a DeFi degen, and a philanthropist. I started my career at Credit Suisse Private Banking, then move to corporate strategy at SAP, then started my first crypto project back in 2017 to fund bio r&d with tokenized intellectual property.

Questions from the community:

Sen Ho: What is Popcorn? Can you share with us more in detail?

Mischa🍿 : Popcorn is a multi-chain DeFi wealth manager offering exposure to liquid asset strategies that simultaneously fund nonprofits and social impact organizations determined by PopcornDAO, AND at no additional cost to the user. We makes it super simple to:

- Deposit your crypto

- Optimize your yield

- And create positive global impact

We’re live on Ethereum, Polygon, Arbitrum, and BNB chain, with more chains to come. We create novel asset strategies where you can earn competitive yield on your crypto while creating real-world impact at the same time!

Join our Twitter:

Sen Ho: What triggers you to launch Popcorn? What are some of the real-world problems/ pain points that Popcorn aims to solve?

Mischa🍿 : We realized that we could use the existing DeFi infrastructure, and ultimately open source technology, to design a new asset class, one that allows you to earn noble yield on your crypto assets while creating real-world impact.

Before Popcorn I was farming some Compound and Yearn, so I was familiar with DeFi, but it wasn’t until I met my partner where I realized we could take advantage of some of the yield-generating protocols out there, enhance them with our smart contracts, and donate a portion of the fees that you would typically pay another other DeFi protocol, but this fee would be used for philanthropy.

We wanted to bake in philanthropy into the protocol. And that’s what we did.

Sen Ho: What is the role of the $POP token in Popcorn? Would you tell us more about its tokenomics?

Mischa🍿 : Sure, POP is a governance token and is required to participate in Popcorn philanthropy. POP holders make up PopcornDAO, our community that helps facilitate beneficiary nominations and grant elections.

POP holders must stake POP to receive vote locked POP, vlPOP, to participate in governance. POP stakers can also propose and vote on adjusting smart contract parameters and other DeFi related activity such as increasing liquidity mining rewards.

For a full explanation of our token economics I suggest reading our gitbook:

https://popcorn-dao.gitbook.io/popcorndao-gitbook/our-tech/pop-token

Sen Ho: Are there any exciting news or updates with regards to Popcorn that you would like to share with the users?

Mischa🍿 : Yes!

First I’d like to say you can find all of our products on the app -> www.popcorndao.finance

Again, we create advanced yield-generating strategies with automated philanthropy with no additional cost or friction to the end user.

Some of our products:

3X – a yield optimizer that automates yield farming on USD and non-USD denominated stablecoins DAI, USDC, USDT, sUSD, agEUR, EURT, and EURS.

Butter – a yield optimizer that automates yield farming on USD denominated stablecoins FRAX, RAI, mUSD, and alUSD

Underlying protocols used by Butter and 3X include Set Protocol for managing the underlying basket of tokens, Curve’s AMM and gauge system which is the source of the yield, and

Yearn which functions to automate yield accrual.

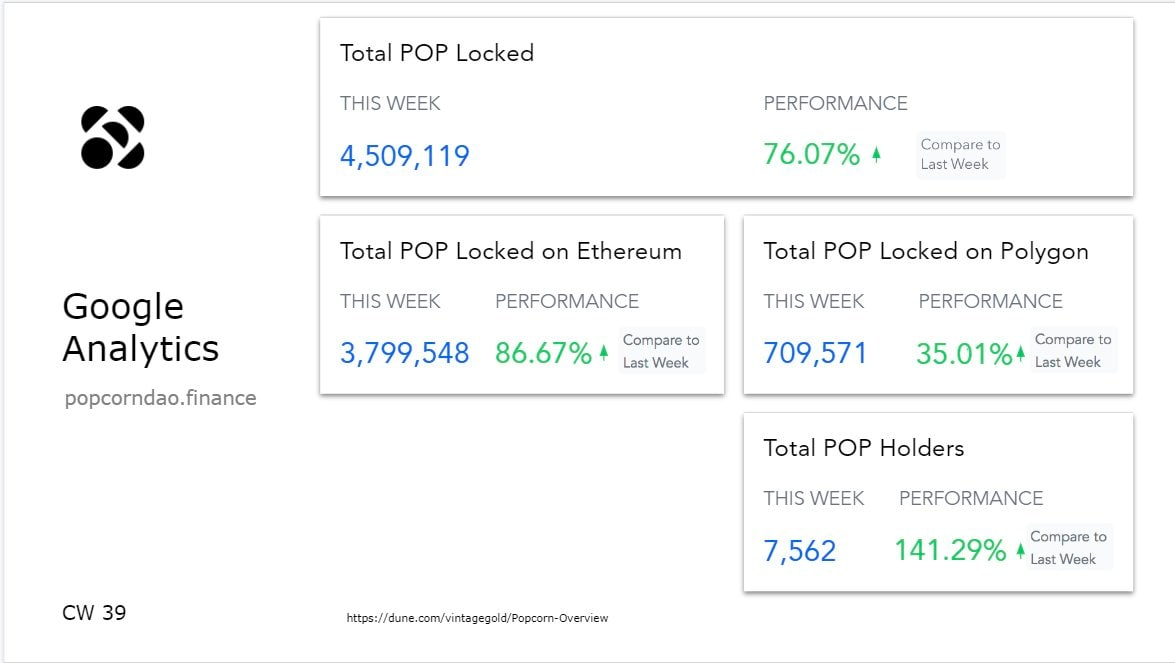

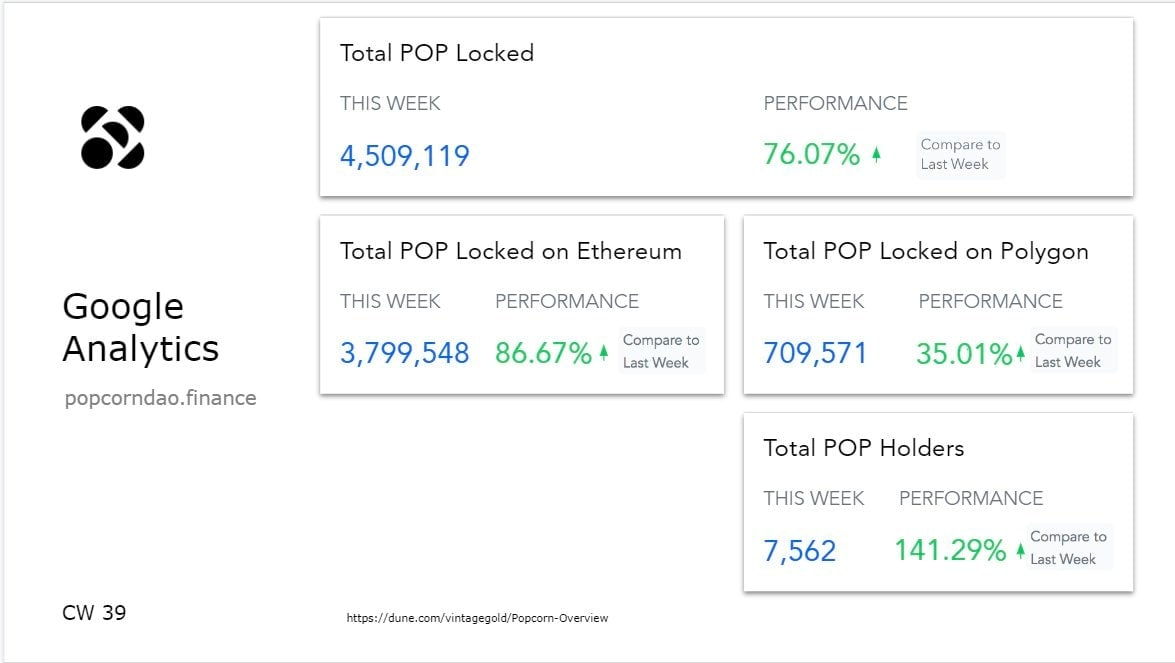

What’s really exciting is that adoption continues to increase! You can look at our analytics for proof:

We also just airdropped roughly 5K users from strategic DAOs we collaborate with, and will be announcing on medium tomorrow

We’re also announcing a Bored Ape Yacht Club collaboration where we partnered to donate to BAYC holder-recommended nonprofits.

AND our Sweet Vaults, or novel single asset vault strategies, will be released soon, meaning you will be able to deposit even more stable and non-stable coin assets into Popcorn and earn very competitive yield

That’s only the half of it, but for the sake of time, I’ll stop there

Sen Ho: If you were to summarize your project in ONE word, what would it be? Why?

Mischa🍿 : how about 3 words, which is our slogan. Yield that counts watch this video

Free-asking Session

Q1. Without sufficient fund any project can not carry out their development whatever it is good. To me the main priority is to have sufficient funds to run a project. Is your team financially able to carry out this project? How this project generate revenue for both project & users?

Mischa🍿 :

We are. We raised ~$11.5M in 2021 from reputable Venture Capital such as JUMP, Kenetic, New Form, XBTO, Big Brain Holdings, Amino capital amongst others, as well from a liquidity bootstrap event we held on Copper Launch. We also have a strong team, some of which have worked on OG projects such as MakerDAO, arguably the founders of DeFi. I, myself, have worked in crypto since 2016 when I started my first project called IKU, a biotech focused protocol designed to tokenize bio r&d as a funding and licensing mechanism to accelerate drug discovery.

Popcorn generates revenue by administering a fee on protocol transactions which are then used to fund PopcornDAO determined nonprofits and social impact organizations. POP holders collectively decide which nonprofits receive funding by participating in beneficiary governance and grant elections. POP holders are required to stake their POP to receive vote locked POP, or vlPOP, to participate in governance. We drew inspiration from Convex as well as Curve on token design.

Theoretically we can also direct protocol fees to POP stakers to optimize incentive alignment even further. Meaning theoretically, we can generate revenue for our users 🤫😏

Ultimately our goal is to become one of the largest benefactors for social good in the world, and we will achieve this goal by creating novel asset strategies that are decentralized, non-custodial, and fully audited that allow anyone to generate competitive yield on their crypto assets while simultaneously funding nonprofits and social impact organizations.

Q2. How Can we get benefits by holding your $POPCORN token? Do you have any incentive or rewards program for long-term holders? @Setu6262

Mischa🍿 :

If you buy POP, you can farm POP on www.popcorndao.finance

Meaning, you can stake POP to earn more POP as we’ve allocated 1,800,000 to our liquidity mining program.

In fact, if you mint 3X and Butter, derivative tokens of our yield optimizers respectively, you can stake and earn POP as well. The same goes for staking LP tokens, meaning you if you add liquidity to POP/USDC pools on Uniswap, you can take the LP token and stake it to earn POP.

Why would you want to do any of this? Because not only are you earning more $ in POP, but you are earning more governance power in PopcornDAO. The more POP you have and stake, the more influence you have on PopcornDAO. This means you have more influence on beneficiary nominations, grant elections, and DeFi adjustment to the protocol or token.

We are looking to implement vote mining as well, meaning every time you vote you will earn POP.

If you have any ideas for Popcorn on how we can add more valute to the protocol and POP token, please submit them on forum.popcorn.network

Q3. Can you list 2-3 killer features of POPCORN project that makes it ahead of its competitors? What is the competitive advantage your platform has that you feel most confident about? @Paulo34347

Mischa🍿 :

Thanks for the question @Paulo34347. I believe we are the only project in the DeFi space that not only is able to creat novel asset strategies, but ALSO donate to social impact AT THE SAME TIME. THere’s a lot of impact focused project out there that distribute grants and very much mission aligned with Popcorn, but we are the only yield generating protocol that bakes philanthropy into the core of the protocol.

FYI Bloomberg estimates that ESG AUM will reach $50T by 2025. The market is exponentially growing and we believe we’ve planted the flag as the decentralized and non-custodial, impact-focused DeFi protocol that anyone can use to generate yield on their crypto AND fund nonprofits. Just by virtue of transacting on Popcorn, you are doing good.

Q4. Are you planning to Burn / Buyback Tokens to increase their value and What is your Utility Token in the ecosystem and Where is token listed on the exchange market for me to buy. Can I give token smart contract? @DeeCartwright

Mischa🍿 :

We’ve already bought a significant amount of $POP as a proposal passed earlier this year: https://snapshot.org/#/popcorn-snapshot.eth/proposal/0x42a789371c5a6e0bddd40acde9ed885340077221b2e8188c6f27af3167b2d54

Burns and buybacks are determined by PopcornDAO, so if this is something the community wants, then we can submit it for a vote.

I’ll refer to my previous answer on the value and utility of POP:

if you buy POP, you can farm POP on www.popcorndao.finance

Meaning, you can stake POP to earn more POP as we’ve allocated 1,800,000 to our liquidity mining program.

In fact, if you mint 3X and Butter, derivative tokens of our yield optimizers respectively, you can stake and earn POP as well. The same goes for staking LP tokens, meaning you if you add liquidity to POP/USDC pools on Uniswap, you can take the LP token and stake it to earn POP.

Why would you want to do any of this? Because not only are you earning more $ in POP, but you are earning more governance power in PopcornDAO. The more POP you have and stake, the more influence you have on PopcornDAO. This means you have more influence on beneficiary nominations, grant elections, and DeFi adjustment to the protocol or token.

We are looking to implement vote mining as well, meaning every time you vote you will earn POP.

If you have any ideas for Popcorn on how we can add more valute to the protocol and POP token, please submit them on forum.popcorn.network

Q5. Only getting users, holders etc is not everything. In my opinion, a project needs to deal with solving a real world issue or problem What is the problem that your project primarily focuses on? @WilfredCobur

Mischa🍿 :

We are decentralized. We are non-custodial. We abide by the first principles of blockchain. No one willl ever shut us down. The code is immutable. Once Popcorn builds enough momentum, the flywheel effect from everyone involved, from Popcorn’s users to its nonprofits, will go exponential. We want everyone to earn noble yield while creating real-world impact. This is why I believe Popcorn will 10,000X we are already on our way!

Trying to find MEXC AMAs recaps?

It’s easy! Explore them in a special section of our MEXC blog. Find insights for other recently listed projects at MEXC

Join MEXC and Start Trading Today!