Ethereum, the world’s second-largest cryptocurrency, has experienced a surge in price ahead of the upcoming Shanghai hard fork upgrade. The upgrade, which will reportedly go live on April 12, is expected to increase liquidity and demand by allowing validators to withdraw previously staked coins.

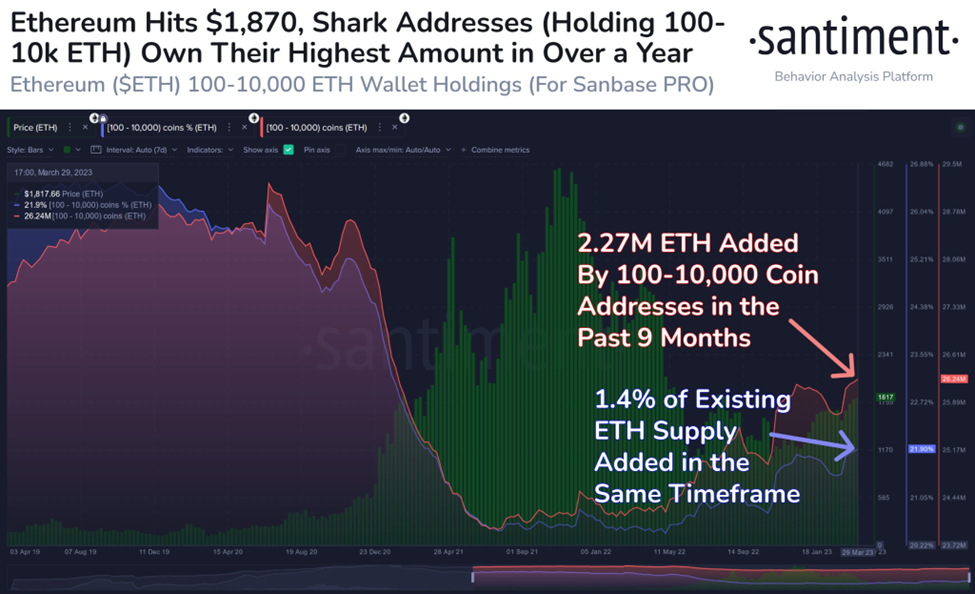

Sharks Continue to Accumulate Ethereum Ahead of the Upgrade

Ethereum’s recent rally has left many investors excited about the cryptocurrency’s future prospects. The surge in price ahead of the Shanghai hard fork upgrade is a bullish sign, and it appears that the sharks have taken note, according to on-chain analytics platform Santiment. These entities have been accumulating Ethereum since last summer, indicating that they are confident in the cryptocurrency’s future.

But what exactly are sharks, and how do they differ from whales? In the world of cryptocurrency, the terms “shark” and “whale” are technical jargon used to describe entities that hold large amounts of a particular cryptocurrency. While the definitions can vary, in general, sharks hold between 100 and 10,000 units of cryptocurrency, while whales hold more than 10,000 units.

The movements of both sharks and whales can have a visible influence on the price of a cryptocurrency, although whales tend to have a much greater impact. This is because they hold a much larger percentage of the total supply of the cryptocurrency in question. However, the accumulation of Ethereum by sharks is still viewed as a bullish sign, as it indicates that these entities believe in the cryptocurrency’s long-term potential.

Shanghai Upgrade Partly Responsible for Price Rally

In addition to the accumulation of Ethereum by sharks, there are other factors that are contributing to the cryptocurrency’s positive momentum. The upcoming Shanghai hard fork upgrade, for example, is expected to increase liquidity and demand by allowing validators to withdraw staked coins. This will make Ethereum an even more attractive investment opportunity, driving up demand and potentially pushing the price even higher.

However, there are also potential risks to Ethereum’s bullish run. For example, if the cryptocurrency fails to break above the crucial $2,000 level, it may face resistance from sellers, leading to a price correction. In addition, there is always the risk of regulatory intervention, as governments around the world are still grappling with how to regulate cryptocurrencies.

Despite these risks, the overall sentiment in the market is positive, and there is optimism about Ethereum’s future prospects. As the second-largest cryptocurrency by market cap, Ethereum has established itself as a major player in the crypto space. With the upcoming hard fork upgrade, increased demand, and the accumulation of Ethereum by sharks, there are plenty of reasons for investors to be excited about the cryptocurrency’s future.

Putting It All Together

Ethereum’s recent surge in price is a positive sign for the cryptocurrency’s future prospects. The accumulation of Ethereum by sharks, combined with the upcoming Shanghai hard fork upgrade, is driving increased demand and making the cryptocurrency an attractive investment opportunity. While there are potential risks to Ethereum’s bullish run, the overall sentiment in the market is positive, and investors are optimistic about the cryptocurrency’s future.

Viewing Ethereum’s Price Action

Ethereum has just tapped its highest point in close to eight months after the blue-chip cryptocurrency scaled the $1,900 mark. The cryptocurrency peaked at $1,942.50 on April 5 before retracing slightly to the $1,900 round figure. This rally comes after weeks of stagnation around the $1,845-$1,720 zone since mid-March.

Moving forward, ETH bulls will need to defend the existing market sentiment, especially in the run-up to the $2,000 mark. Capitulation to the resistance level, as mentioned earlier, will likely trigger a sharp correction to the $1,800 support. Let’s see how it plays out!

ETH Statistics Data

Current Price of ETH: $1,900 (Check out the Live Price here)

Market Cap of ETH: $228B

Circulating Supply of ETH: 120.4M

Total Supply of ETH: 120.4M

Market Ranking: #2

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about cryptocurrency industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!