The entire Ethereum saga has always been about scaling… what began with congested mempools resulting in gas fees of several thousands of dollars to sidechains followed by Ethereum Layer 2 (L2) rollups. The simple narrative was this: in order for Ethereum to continue to serve as the backbone of Web3, it needed to scale, maintain its security, and decentralize. And today, we are living in the period where this scaling is happening.

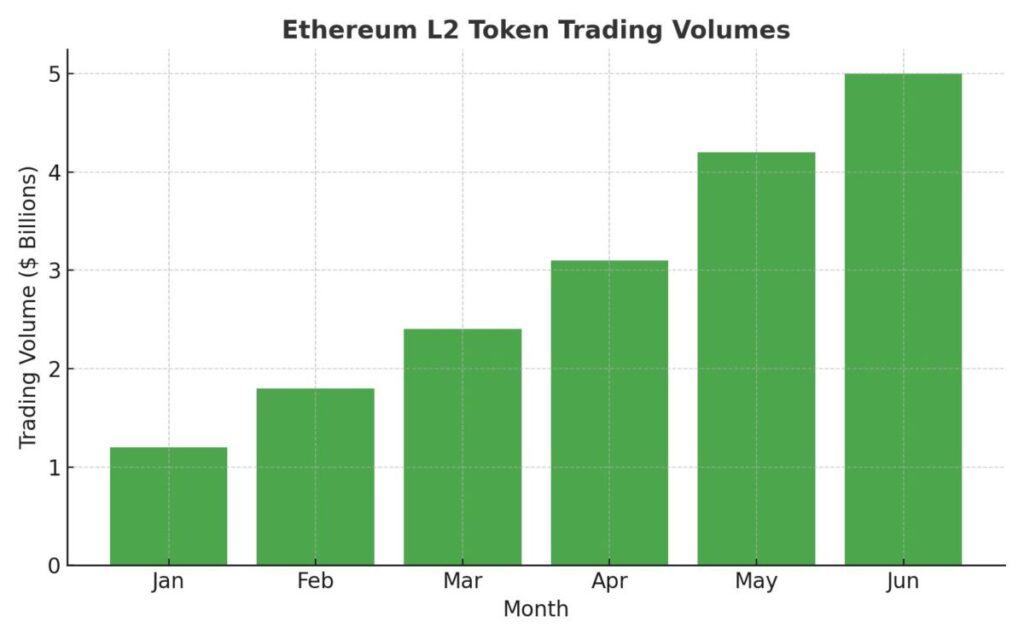

As L2 ecosystems have expanded, traders have profited; this shift has been more than simply technical, it has been financial. New opportunities, tighter spreads, and more liquidity have all grown within the Ethereum L2 eco-systems. Exchanges such as MEXC are capitalizing on this transformation for users to not just be observers but are able to leverage the opportunity for the next wave of growth.

1.The L2 Explosion: More Users, More Transactions, More Liquidity

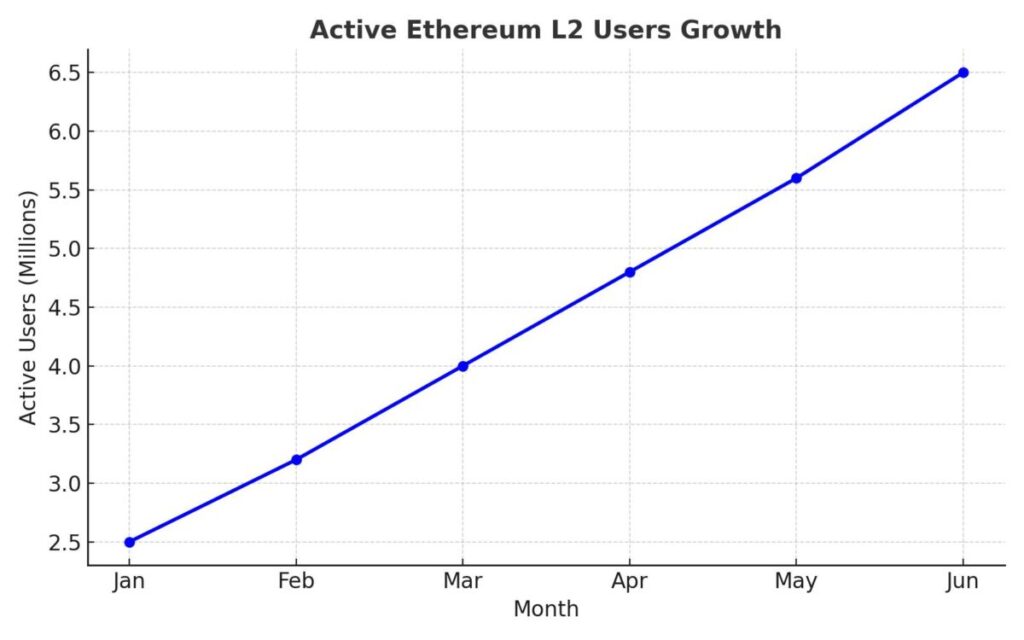

We begin with user adoption. On-chain data indicates the number of active users across L2s like Arbitrum, Optimism, zkSync and Base has been steadily increasing. The number of weekly active addresses across Ethereum rollups surpassed a million, and in a few cases, daily transaction counts across some L2s are above some L1 Ethereum networks.

And why is this important to traders? In short, liquidity comes with users. When more people use L2s for faster and cheaper transactions, trading pairs match better, have less slippage, and are more efficient. It’s textbook network effects – more use means better markets.

A contemporary example is the launch of Coinbase’s Base network in 2023. The launch wasn’t a new technical integration milestone, but on-boarded thousands of retail participants who may have been otherwise turned off by the gas fees associated with Ethereum. A few months later, we saw a revival of DeFi, meme coins, and the NFT markets. The same influx of users did not merely keep the activity on-chain, it had knock-on effects, demonstrated by centralized exchanges like the MEXC exhibited higher demand for L2-native tokens.

2.Economics of L2 Adoption

On the broader level, Ethereum’s L2 scaling solutions are not just about lower fees, but about changing token economics across DeFi and GameFi.

- Cheaper Transactions: More Transactions. When the cost to interact with DeFi goes from $20 per swap to a few cents, activity explodes. For traders, there are more opportunities for arbitrage, scalping, and niche strategy exploration.

- New Token Launchpads: Some of the most interesting projects being launched today are choosing L2s as their launchpad, and that users can interact without being priced out. A win for MEXC as a centralized exchange is that it is an early to market listing, to give its traders all the benefits of the growth stories from the start.

- Liquidity Migration: Big protocols are moving to L2s. Uniswap, Aave, and Curve are all expanding into rollups, taking on deep liquidity pools with them. For centralized exchanges, liquidity migration to L2s creates trading ecosystems to integrate and support.

It is therefore no surprise that Ethereum L2 tokens are amongst the most traded assets on MEXC, engaging both retail and institutional traders.

3.How MEXC Captures this Opportunity

MEXC is not merely observing the L2 boom; it is also building bridges to enable traders to capture the upside

Full L2 Listings: MEXC frequently deploys new tokens native to L2—whether they are Arbitrum, Optimism, zkSync, Base, it doesn’t matter and in the earliest stages of development. This is greatly advantageous for traders as they don’t have to chase liquidity in a bunch of different areas; liquidity is aggregated and centralized on MEXC.

Liquidity and Fees: Fast movers need fast exchanges. With deep liquidity pools, MEXC has competitive fees and allows customers to execute large orders without significant slippage. For assets, such as those in L2, that have the potential for explosive movement, this is a key advantage.

Derivatives: In addition to spot trading, MEXC supports futures contracts and perpetual contracts associated with L2 ecosystems. Traders can hedge positions, take leveraged exposure, or short overextended tokens. MEXC is more than just a listing platform; it offers an extensive toolkit to trade volatility.

Lower Barriers to Entry: Let’s recognize that many traders exploring L2 opportunities likely have not been well-acquainted with trades on-chain, and are not total hardcore DeFi and Web3 natives. MEXC has brought new assets into a familiar trading environment which lowers the barriers for the retail user who wants to participate in L2 opportunities without worrying about bridges, wallets, and complex DeFi interfaces.

4.Case Study: The Success of Arbitrum’s Airdrop and Trading Mania

Think back to the ARB airdrop in early 2023. ARB flipped to be 1 of the most traded tokens on CEXs and DEXs almost overnight. The surge in retail participants combined with a host of DeFi projects launching on Arbitrum, contributed to huge trading volumes.

On MEXC, ARB trading pairs enjoyed deep liquidity and high user engagement allowing traders to take advantage of price volatility. Notably, MEXC didn’t just support ARB either, but rolled out pairs for all the associated ecosystem tokens allowing them to benefit from the entire wave of momentum.

This example, and others like it, illustrates how exchanges are crucial in the L2 growth ecosystem – they don’t just react to L2 growth, but embedded in the ecosystem – they help proliferate that growth by providing connections to liquid markets.

5.Traders’ Edge: Following Active Users as a Signal

If you are anywhere near the crypto markets and you are tracking active user metrics on L2s, this is becoming just as important as watching Bitcoin dominance or Ethereum gas fees. Active addresses and transaction counts are usually leading indicators for demand for tokens.

5.1 So here’s why

- User Growth → Demand for Tokens

When millions of new addresses step into Arbitrum or Base, those once-new users will naturally need to find, acquire, and utilize native tokens for gas fees, governance, or DeFi, which can be easy or hard depending on the technical complexities. At some point, they will use exchanges like MEXC to convert USD or USDT into ARB, OP or BTC and trade the tokens around the market.

- Ecosystem Growth → Depth of Market

More users → More projects. If more projects exist, then more tokens exist. Each new token for trading brings new opportunities to MEXC traders.

- Volatility = Opportunity

Adoption that is growing quickly typically brings significant price volatility. Wild fluctuations in price are, for traders with experience, opportunities to persistently funnel trading volume; assuming sound reasoning regarding volatility and proper risk management.

MEXC is unique in this space since they can provide access to these new opportunities quickly, reducing the risk of users missing meaningful inflection points for arbitrage trading.

6.Ethereum L2s: Not Just Trading

It’s also worth noting that L2 growth has applications beyond trading and speculation. GameFi, social apps, and protocols for real-world assets (RWA) are increasing in native applications on L2 networks. The emergence of on-chain games and tokens relative to sports, etc. is one example that not only results in trading volume but brings entirely new demographics to gasless trading.

As ecosystems evolve, so does trader behavior. On MEXC, this looks like broader markets where niche tokens are able to find global liquidity more quickly than ever.

7.Importance of the Bigger Picture

Understanding what Ethereum’s scaling journey means goes beyond transaction capacity… it extends to possibilities. The L2 rollup networks showed their value when network traffic increased, expanding Ethereum into a fully functioning global settlement layer. Traders taking advantage of this journey are in much better positions to profit, while the exchanges that understand and can create infrastructures that support it, such as MEXC.

While traditional markets suffer, crypto traders find alternatives. Ethereum L2s provide actively traded volatility and a sign of growth. With MEXC, you can be assured that the opportunities are accessible, liquid, and flexible.

8.Takeaway

Ethereum’s next growth phase is happening not on its base layer, but on its Layer 2 ecosystems. Traders can benefit from being active users on the L2 networks which create liquidity that can lead to innovation and volatility across the network. The success of Arbitrum, Optimism, zkSync, and Base is not just a technical development; it is an opportunity for the market.

In this way, MEXC positions itself as a bridge to the ecosystems, since traders can take advantage of this trend through early listings, deep liquidity and flexible trading products. For anyone that is committed to representing the future of Ethereum, observing L2 adoption is essential and trading on MEXC is the easiest way to stay ahead.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up