The broader cryptocurrency market and Bitcoin experienced a sharp selloff on Wednesday after the latest US inflation data came in hotter than anticipated, reigniting concerns about more aggressive monetary policy tightening from the Federal Reserve.

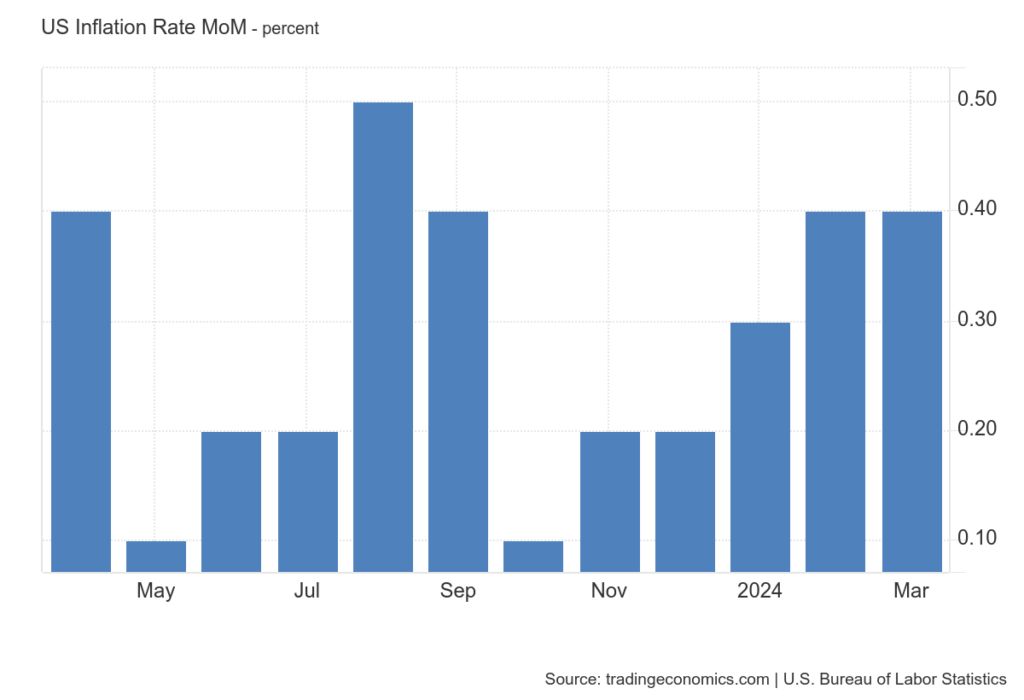

The flagship cryptocurrency was trading around $70,000 earlier in the day, but the price dropped as low as $67,450 after the US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.4% in March, above economists’ expectations of 0.3%. The year-over-year inflation rate reached 3.5%, up from February’s 3.4% reading.

The higher-than-expected inflation figures suggest that price pressures remain elevated in the US economy, potentially prompting the Federal Reserve to maintain its hawkish monetary policy stance for longer. The concerning data fueled sell-offs across risk assets, including cryptocurrencies, as investors anticipated the Fed’s response.

Market Selloff in Reaction

In reaction to the hotter inflation report, the total cryptocurrency market capitalization dropped by around 5% over the past 24 hours, standing at $2.53 trillion at the time of writing. The 24-hour trading volume also decreased by over 7.3% at the time of writing to $92.4 billion, according to CoinMarketCap data.

The latest CPI data revealed that core inflation, which excludes volatile food and energy prices, accelerated by 0.4% on a monthly basis and rose 3.8% year-over-year, signaling broader inflationary trends in the economy.

The persistent inflationary pressures have created a dilemma for the Federal Reserve, as market participants had previously anticipated three interest rate cuts this year. However, several Fed officials have expressed skepticism about the need for rate cuts and suggested the possibility of rate hikes if inflation remains stubbornly high.

Cautious Market Sentiment Prevails

In light of the uncertain economic outlook and the potential for further monetary policy tightening, cautious sentiment has taken hold in the cryptocurrency market. Investors are closely monitoring economic data releases, speeches from Fed officials, and any signals that could shed light on the central bank’s future policy moves.

The sharp reaction to the CPI report underscores the sensitivity of the cryptocurrency market to macroeconomic factors and highlights the importance of monitoring broader economic conditions in addition to industry-specific developments.

As the market digests the latest inflation data and its implications, volatility is expected to persist in the near term. However, many industry experts remain optimistic about the long-term prospects of Bitcoin and the broader cryptocurrency ecosystem, citing their potential for innovation, decentralization, and adoption as alternative assets and payment systems.

Bitcoin Remains Biased Towards the Upside

Despite the prevailing bearish market sentiment, Bitcoin maintains a bullish outlook. At the time of this writing, Bitcoin has recovered completely from its CPI-induced descent recorded on April 10 as traders remain focused on reclaiming the $73,000 handle.

That said, Bitcoin should remain in bullish territory as long as it remains above the $67,570 support threshold in the meantime. All this is as the Bitcoin halving approaches, promising record-level volatility. Likewise, analysts expect to see a notable slump immediately after the halving, followed by a possible rebound to record highs (above $75,000).

BTC Statistics Data

BTC Current Price: $70,000

Market Cap: $1.37T

BTC Circulating Supply: 19.6M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!