Bitcoin has closed out its strongest September on record as of September 19, 2025, marking a historic milestone that defies the cryptocurrency’s traditionally weak autumn performance. Trading at $116,309 with a 0.9% daily gain and a range between $114,866 to $117,292, Bitcoin’s exceptional September performance positions it for potential breakouts toward Fibonacci targets at $128K-$135K as Q4 2025 approaches.

The historic September performance coincides with a critical supply dynamic shift, as over 72% of circulating Bitcoin is now classified as illiquid, representing the highest proportion of non-trading BTC in the asset’s history. This supply crunch, combined with continued exchange outflows and institutional accumulation, suggests reduced sell-side pressure that could propel Bitcoin toward levels exceeding $150,000 by the end of 2025.

September has historically been Bitcoin’s worst-performing month, making 2025’s breakout performance particularly significant for market psychology and technical momentum heading into the traditionally stronger Q4 period. The combination of seasonal pattern reversal, supply constraint dynamics, and institutional adoption trends creates a compelling fundamental backdrop for sustained price appreciation through year-end.

1.Breaking Historical Patterns: September 2025 vs Past Performance

1.1 The September Curse Finally Broken

Bitcoin’s reputation for poor September performance stems from consistent historical weakness during the month, with previous years showing average declines of 4-6% during September. The 2025 reversal represents more than statistical anomaly—it signals fundamental shifts in market structure, institutional participation, and global macroeconomic conditions that are reshaping Bitcoin’s seasonal behavior patterns.

The exceptional September performance reflects several converging factors: successful Federal Reserve rate cuts removing macroeconomic headwinds, continued institutional adoption through corporate treasury strategies, and technical momentum building from summer accumulation phases. This combination has overwhelmed traditional September selling pressure and established new seasonal dynamics.

Historical analysis shows that when Bitcoin breaks negative seasonal patterns, the reversals often lead to sustained momentum in subsequent months. The Q4 period typically provides Bitcoin’s strongest quarterly performance, suggesting that September’s historic strength could amplify traditional year-end rallies rather than substituting for them.

1.2 Institutional Participation Changes Market Dynamics

The 2025 September performance differs from previous years due to dramatically increased institutional participation through Bitcoin ETFs, corporate treasury adoptions, and sophisticated investment strategies that operate independently of retail seasonal patterns. Professional money management operates on different cycles and criteria than retail investors who historically drove September weakness.

Corporate treasury strategies and institutional dollar-cost averaging programs provide consistent buying pressure that counteracts seasonal retail selling patterns. Companies like MicroStrategy and newer corporate adopters maintain systematic accumulation programs that operate independently of traditional crypto market seasonality.

The maturation of Bitcoin derivatives markets also enables institutional investors to maintain exposure while hedging specific risks, reducing the need for outright selling during traditionally weak periods. This sophisticated risk management capability fundamentally alters historical seasonal patterns by providing alternatives to simple buy-and-sell strategies.

Technical Momentum and Market Structure Evolution

Bitcoin’s current technical setup shows $115,000 acting as strong support, with consistent buying interest absorbing any selling pressure around this level. The daily trading range of $114,866 to $117,292 demonstrates contained volatility within an overall upward trend structure that supports continued momentum.

Technical indicators suggest the historic September performance has established a new baseline for Bitcoin valuations, with previous resistance levels now functioning as support. This structural shift indicates that September’s gains represent sustainable value discovery rather than temporary speculative excess.

Volume analysis during September shows consistent institutional-style accumulation rather than speculative retail activity, providing confidence that recent gains have solid fundamental support and reduced likelihood of sharp reversals that characterized previous cycle peaks.

2.Supply Shock Dynamics: 72% of Bitcoin Now Illiquid

2.1 Understanding Illiquid Supply Metrics

The classification of 72% of Bitcoin as illiquid represents coins that haven’t moved from their addresses for extended periods, typically 155 days or more. This metric indicates long-term holder conviction and reduced availability of Bitcoin for active trading, creating supply constraints that support higher prices when demand increases.

The current 72% illiquid ratio exceeds previous cycle peaks and suggests institutional-grade holding behavior has become dominant across the Bitcoin ecosystem. Unlike retail investors who frequently trade based on price movements, institutional holders maintain strategic positions based on long-term allocation decisions and portfolio construction requirements.

Analysis shows that periods of high illiquid supply ratios often precede significant price appreciation phases, as reduced selling supply meets steady or increasing demand from new market participants. The current supply dynamics suggest Bitcoin’s price discovery mechanism operates in an increasingly constrained environment.

2.2 Exchange Outflow Trends Accelerate Supply Shortage

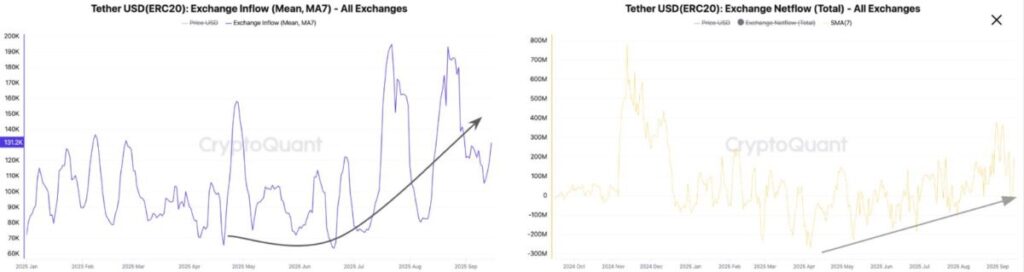

Continued Bitcoin outflows from exchanges complement the illiquid supply trend, indicating investors are moving coins to long-term storage rather than maintaining them in trading positions. This behavior typically signals confidence in continued price appreciation and reduced likelihood of near-term selling.

Exchange outflows during September 2025 have maintained elevated levels despite Bitcoin’s strong price performance, suggesting accumulation continues even at higher price levels. This pattern differs from previous cycles where outflows typically slowed as prices appreciated, indicating more sophisticated investor behavior and long-term conviction.

The combination of high illiquid supply ratios and continued exchange outflows creates a supply shock dynamic where available Bitcoin for purchase becomes increasingly scarce. This scarcity premium supports higher valuations and reduces downside volatility during market corrections.

2.3 Long-Term Supply Trajectory Implications

Projections suggest Bitcoin’s illiquid supply could reach 8.3 million coins by 2032, representing approximately 40% of total Bitcoin supply and indicating continued maturation toward a store-of-value asset class rather than actively traded currency. This evolution supports higher per-unit valuations as Bitcoin transitions toward reserve asset characteristics.

The trend toward increased illiquidity reflects Bitcoin’s evolution from speculative trading vehicle to institutional reserve asset, similar to how gold functions in traditional portfolio construction. This transformation supports sustained higher price levels and reduced volatility as trading supply becomes more concentrated among professional market makers.

If current illiquid supply trends continue, analysts project Bitcoin could exceed $150,000 by end of 2025, with the supply constraint becoming a primary driver of price appreciation independent of broader cryptocurrency market conditions or macroeconomic factors.

3.How to Trade Bitcoin’s Historic Momentum on MEXC

3.1 Capitalizing on Fibonacci Target Levels

MEXC provides comprehensive Bitcoin trading infrastructure designed to capture momentum from Bitcoin’s historic September performance toward technical targets:

Strategic Entry Points:

– BTC/USDT: Primary Bitcoin exposure with institutional-grade liquidity around $116K levels

– Bitcoin Futures: Leveraged positions targeting $128K-$135K Fibonacci levels

– Dollar-Cost Averaging: Systematic accumulation strategies during support retests

Technical Level Management:

Use limit orders to enter positions near $115K support with targets at $128K-$135K Fibonacci extension levels. Historical analysis suggests Bitcoin often achieves Fibonacci targets during strong trending phases, providing clear risk-reward frameworks for position management.

Momentum Breakout Strategies:

Deploy conditional orders above $118K to capture acceleration toward higher Fibonacci targets. September’s historic performance suggests reduced resistance at previous cycle highs, potentially enabling rapid moves toward $128K-$135K levels.

Risk Management for Extended Bull Market

Position Sizing for Volatility:

Despite Bitcoin’s historic September performance, maintain disciplined position sizing that accounts for potential volatility around key psychological levels like $120K and $125K. Use [portfolio management tools] to monitor overall crypto exposure and maintain appropriate diversification.

Stop-Loss Strategies:

Implement trailing stops that adjust with momentum while protecting against significant reversals. Place initial stops below $115K support, adjusting upward as Bitcoin achieves higher Fibonacci levels.

Timeline-Based Profit Taking:

Structure profit-taking strategies around Q4 seasonality and year-end institutional rebalancing cycles. Historical patterns suggest Bitcoin’s strongest performance often occurs in October-December, providing framework for strategic position management.

4.Advanced Strategies for Supply-Constrained Markets

4.1 Supply Shock Trading:

The 72% illiquid supply dynamic creates unique trading opportunities where sudden demand increases can generate disproportionate price responses. Monitor on-chain metrics for changes in exchange flows and whale accumulation patterns that could trigger supply squeeze events.

4.2 Cross-Market Arbitrage:

Utilize MEXC’s comprehensive cryptocurrency offerings to implement strategies that benefit from Bitcoin’s supply constraints affecting broader market dynamics. Strong Bitcoin performance often creates relative value opportunities in Bitcoin-paired altcoin markets.

4.3 Institutional Flow Following:

Track institutional accumulation patterns and corporate treasury announcements for additional buying catalysts that could accelerate Bitcoin’s move toward $150K projections. Time entries around known institutional rebalancing periods and corporate earnings announcements.

5.Market Outlook: Q4 2025 and Beyond

5.1 Seasonal Strength Entering Q4

Bitcoin’s historic September performance entering traditionally strong Q4 seasonality creates compelling momentum for continued appreciation. Historical analysis shows that strong September performance often amplifies Q4 gains rather than substituting for them, suggesting potential for accelerated appreciation toward year-end.

The combination of broken negative seasonality with entering positive seasonal patterns provides dual momentum factors that could drive Bitcoin toward upper Fibonacci targets at $128K-$135K during Q4 2025. This seasonal alignment rarely occurs and historically produces significant price appreciation.

Corporate treasury strategies and institutional year-end rebalancing could provide additional buying pressure during Q4, as institutions adjust allocations based on full-year performance and strategic positioning for 2026. Bitcoin’s strong year-to-date performance makes it attractive for institutional momentum strategies.

5.2 Technical Target Achievement Probabilities

Fibonacci analysis suggests $128K-$135K represents natural technical targets based on Bitcoin’s current trend structure and historical retracement patterns. The achievement of these levels would establish new trading ranges and support structures for 2026 price action.

Volume profile analysis indicates limited resistance between current levels and $128K, suggesting the path of least resistance favors continued upward momentum. The historic September performance has cleared psychological barriers that previously provided resistance around $120K levels.

Options market positioning shows increased bullish sentiment with call open interest concentrated around $120K-$130K strikes, indicating professional traders are positioning for continued appreciation rather than hedging downside risk.

5.3 Long-Term Supply Trajectory Impact

The projection of $150K+ Bitcoin by end of 2025 reflects supply constraint dynamics that operate independently of traditional price discovery mechanisms. As illiquid supply approaches 75% of total Bitcoin, price discovery occurs within increasingly thin active trading supply.

This supply evolution toward reserve asset characteristics suggests Bitcoin’s volatility may continue decreasing while trend persistence increases. Institutional-style holding behavior becomes dominant, creating more predictable long-term appreciation patterns with reduced speculative excess.

The maturation toward reserve asset status supports higher baseline valuations and reduced likelihood of significant bear market corrections. Bitcoin’s evolution mirrors historical patterns of store-of-value assets that maintain value during economic uncertainty while appreciating during growth periods.

6.Conclusion

Bitcoin’s historic September 2025 performance represents more than statistical anomaly—it signals fundamental transformation in market structure, institutional participation, and supply dynamics that support sustained appreciation toward technical targets at $128K-$135K. The combination of broken negative seasonality entering traditionally strong Q4 patterns creates compelling momentum for continued gains.

The supply shock dynamic with 72% of Bitcoin now illiquid provides structural support for higher valuations while reducing downside volatility during potential corrections. This evolution toward reserve asset characteristics supports analyst projections of $150K+ Bitcoin by year-end while establishing more stable long-term appreciation patterns.

MEXC’s comprehensive Bitcoin trading infrastructure enables sophisticated strategies to capitalize on historic momentum while managing risks inherent in extended bull market conditions. The platform’s combination of spot, derivatives, and automated trading tools provides multiple approaches for participating in Bitcoin’s transformation toward institutional-grade reserve asset status.

The historic September performance validates long-term Bitcoin investment theses while creating near-term trading opportunities for those who understand the technical and fundamental factors driving continued appreciation. As Bitcoin breaks traditional seasonal patterns and achieves new supply constraint dynamics, the remainder of 2025 could establish new paradigms for cryptocurrency market behavior.

Success in this environment requires understanding both the technical momentum toward Fibonacci targets and the fundamental supply dynamics supporting sustained appreciation. The combination of historic performance, supply constraints, and seasonal tailwinds creates unique opportunities for strategic positioning as Bitcoin continues its evolution toward global reserve asset status.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up-1-1-211x150.jpg)