1. Project Introduction

Across protocol is a cross-chain bridging protocol that allows users to execute nearly instant transactions between chains. It achieves cost-effective, fast and secure transfer of assets between chains by using UMA optimistic oracles, bonded relayers, and single-sided liquidity pools.

Currently, Across Protocol has supported public chains such as Ethereum, Arbitrum, Optimism, and Polygon, including cross-chain transfers of ETH/WETH, WBTC, DAI, USDC, BOBA, BADGER, BALANCER, and UMA.

Compared with other cross-chain protocols, Across protocol has the following highlights:

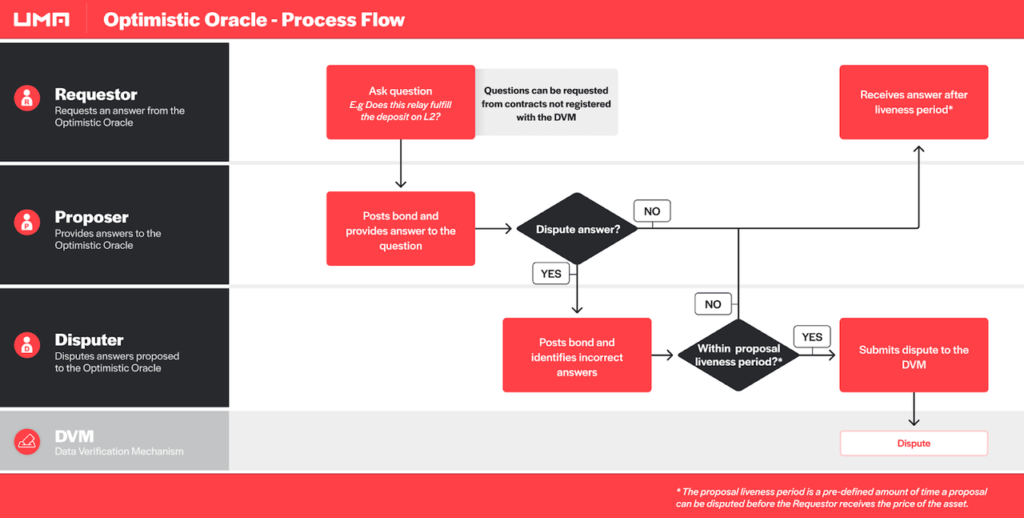

1. Optimistic Oracle

Across uses UMA’s Optimistic Oracle, which allows futures to request and receive data information quickly, and allows smart futures to bring off-chain data onto the chain.

2. Smart Futures and Auditing

Across Protocol is a cross-chain protocol incubated by Risk Labs, a development team of UMA, which is also a decentralized financial future platform. The development team has strong technical strength, strong anti-attack capabilities, and rich experience in blockchain instances. So far there is no security issues in the previous product development and operation.

Across’s cross-chain security issues ensure guarantees. It is reported that the code Across runs has no complexity that can hide vulnerabilities, and thus smart futures are relatively secure. According to DUNE data, there are currently more than $56.18 million of TVL bound in Across, and it has exceeded cross-chain multi-million-dollar amounts.

3. Hub-and-Spoke Model Architecture

Across proposes an innovative hub-and-spoke model architecture, which is a technical innovation and attempt based on safety considerations. While it does not need to establish a liquidity pool on Layer 2, most of the funds are protected by Layer 1, which has a higher security.

2. Tokenomics

The total supply of ACX issued is 1 billion, and the allocation is as follows:

125 million for airdrops, of which 20 million for Community, 15 million for Early Bridge Users,

70 million for Liquidity Providers, and the remaining for Bridge Traveler Program.

250 million tokens for Strategic Partnerships and Fund-Raise, of which 150 million tokens for $UMA token swap with Risk Labs, and 100 million tokens for Strategic fundraise.

100 million for Protocol Rewards, of which 25 million for Referral program and 75 million are for Reward locking program to incentivize LPs.

525 million for Across DAO Treasury Reserve

According to the official news from Across Protocol, ACX will be officially launched and circulated at 12:00 (UTC) on November 28, and will be first listed on centralized trading platforms such as MEXC.

3. Funding and Investors

According to the official website, Across Protocol has raised $10 million in a funding round, with investment institutions include Hack VC, Placeholder, Blockchain Capital, etc. It is reported that this funding round is carried out in the form of purchasing 50 million ACX from Risk Labs according to the Success Token plan. The ACX will be unlocked on June 30, 2025. When it expires, the call option will be implemented and the corresponding ACX will be returned.

4. Project Analysis

The cross-chain protocol has become a rigidly-needed product in the blockchain ecology. There are endless projects on this track, and security loopholes continue to appear. Especially in the past two years, there have been many stolen security incidents, which have caused huge losses to the bridge protocol, investors, and users. The security of the cross-chain bridge is placed in an extremely important position. The security of Across is currently generally recognized by community users. According to the feedback from community users’ actual experiences, Across is simple to use, easy to operate, owns relatively low transaction fees, and subsequently fast transaction speed. Hence, it has certain market competitive advantages.

According to the tokenomics, Across has reserved a large number of Tokens for marketing and referral programs. Users enter their wallet addresses to generate a unique referral link. While users click on their own referral link and complete bridge transfer on Across, the respective referral will be rewarded with ACX, which is expected to bring more users to the Across community. According to the latest DUNE data, Across users have reached more than 137,344.

In terms of funding, most projects are funded in the primary market at a discounted price. Across adopts the Success Token solution, which was originally proposed by UMA as a funding solution, which allows funds to be raised without token discounts. Investment institutions pay a fair market price for Across, and Across provides institutions with Token and call options. The option part is only valuable when the Token value rises, which is also expected to benefit the entire community.

However, Across has a lot of community airdrop chips, so we need to be alert to the risk of smashing the secondary market. Although its cross-chain security has a certain lead compared with competing products, it still needs further inspection by the market and users.

Relevant Links:

Website:https://across.to/

Twitter:https://twitter.com/AcrossProtocol

Discord:https://discord.com/invite/across

Medium:https://medium.com/@AcrossProtocol

Docs:https://discord.com/invite/across

Note: This article was written by users of MEXC community and is only for information sharing, without constituting any investment advice.

Join MEXC and Start Trading Today!