Why saving still matters

Savings are the single most reliable tool for financial freedom. Whether you want a safety cushion, a down payment, or a retirement nest egg, the habit of saving turns today’s small choices into tomorrow’s options. The web is full of flashy get-rich schemes. Real resilience comes from steady saving, smart allocation, and a plan you can stick with.

This guide walks through what savings are, why they matter, practical strategies to grow them, how inflation affects your choices, whether crypto should be part of the plan, and how to choose a platform including why MEXC can be a sensible place to start for crypto-aware savers.

What are savings

Savings is the portion of your income you deliberately set aside instead of spending now. That money can sit in a bank account, short-term bonds, retirement accounts, or be invested. The goal is the same: preserve purchasing power and build optionality for future needs.

Savings are not the same as investing. Saving prioritizes safety and liquidity. Investing accepts risk for higher long-term returns. A balanced personal finance plan uses both.

Why savings are important

Savings provide a financial safety net, give you freedom to make choices, and force discipline. Here are the most important reasons to keep saving:

- Emergency cushion. Unplanned costs happen. A liquid emergency fund prevents debt and panic.

- Freedom and flexibility. Savings let you change jobs, fund education, start a business, or take a planned risk.

- Retirement security. The earlier you start, the more you benefit from compounding.

- Financial discipline. Regular saving builds healthy money habits.

Practical, proven strategies to grow your savings

1) Start with a clear budget

A budget is not a straitjacket, it’s information. Track income and expenses for a month, separate needs from wants, and choose a saving target. The 50/30/20 rule is a simple starting point: 50% to needs, 30% to wants, 20% to savings and debt repayment. Tailor it to your situation.

2) Make goals SMART

Define specific, measurable, achievable, relevant, and time-bound goals. “Save $8,000 for an emergency fund in 12 months” beats “save more” because it gives you a target and a timeline.

3) Build the emergency fund first

Aim for 3–6 months of essential expenses. For variable-income workers or those with dependents, more is safer. Keep this fund liquid a savings account or a short-term government money market is fine.

4) Automate the process

Set up automatic transfers the day you get paid. Automation removes choice and friction, which makes saving a default behavior.

5) Reduce recurring drains and increase income

Small habit changes add up: cancel unused subscriptions, renegotiate services, cook at home. At the same time, consider side income freelance work, tutoring, or a small online business can accelerate progress.

6) Ladder and diversify your short-term savings

If you’re saving for a goal in 1–5 years, prioritize high-quality, liquid instruments: high-yield savings accounts, short-term government bills, certificates of deposit, or regulated money market funds. Laddering maturity dates reduces reinvestment risk.

Inflation: what it means for your savings

Inflation reduces purchasing power. If your cash return is lower than inflation, you’re losing value in real terms. To fight this:

- Track the real rate of return (nominal return minus inflation).

- Use inflation-protected bonds where available (e.g., TIPS).

- Move surplus savings into slightly higher-yield, low-risk instruments rather than leaving everything in a low-interest account.

- Keep your emergency fund liquid; invest longer-term savings in assets that can outpace inflation.

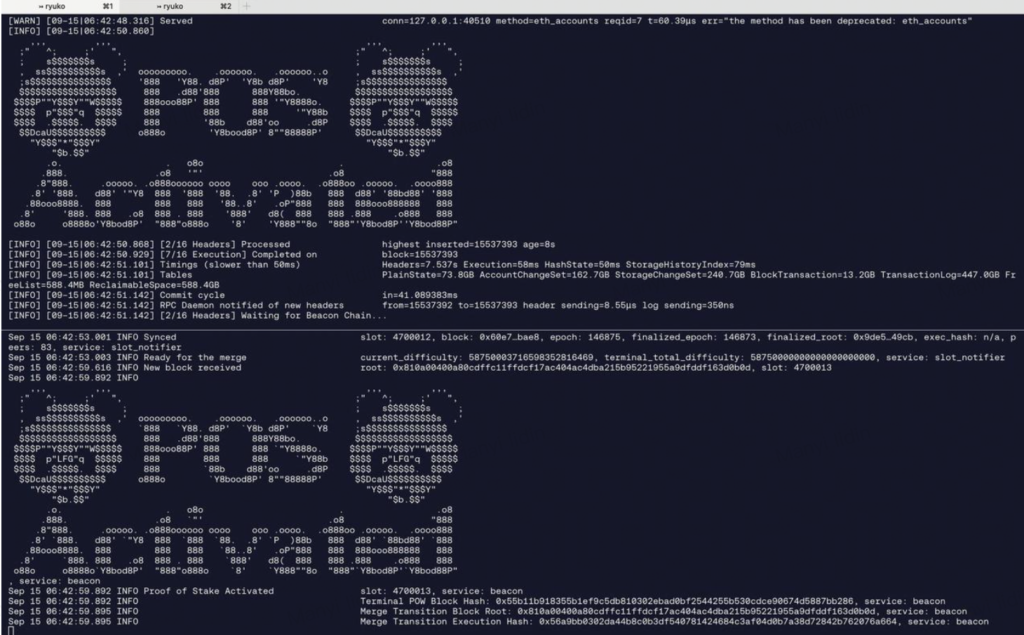

Should you put part of your savings in crypto?

Crypto can be part of a diversified strategy, but it must be treated differently from cash or short-term bonds.

- Risk profile. Crypto is highly volatile. Only a small portion of savings money you can afford to see swing dramatically should go here.

- Time horizon. For core savings and emergency funds, prefer liquid, stable instruments. For money you won’t need for years, a measured crypto allocation may make sense.

- Approach. Dollar-cost averaging (DCA) reduces timing risk. Avoid leverage for savings.

- Security. Use reputable platforms, enable strong account protections, and consider cold custody for large, long-term positions.

If you’re considering tokenized Treasuries or yield products, prefer regulated, transparent offerings with clear custody and audited backing. These give exposure to real-world yields while preserving the on-chain convenience many users want.

How to choose where to park your savings (safety checklist)

When evaluating any platform or instrument, check the following:

- Custody and insurance. Who holds the assets? Is there insurance or an insurance fund?

- Regulation and transparency. Is the product issued by a regulated vehicle? Are audits public?

- Liquidity. Can you exit quickly without huge slippage?

- Fees and yield mechanics. Know where the yield comes from and what fees eat into returns.

- Operational history. Platform reliability, uptime, and user reviews matter.

- Access to fiat rails. Good on/off ramps make life easier when you need cash.

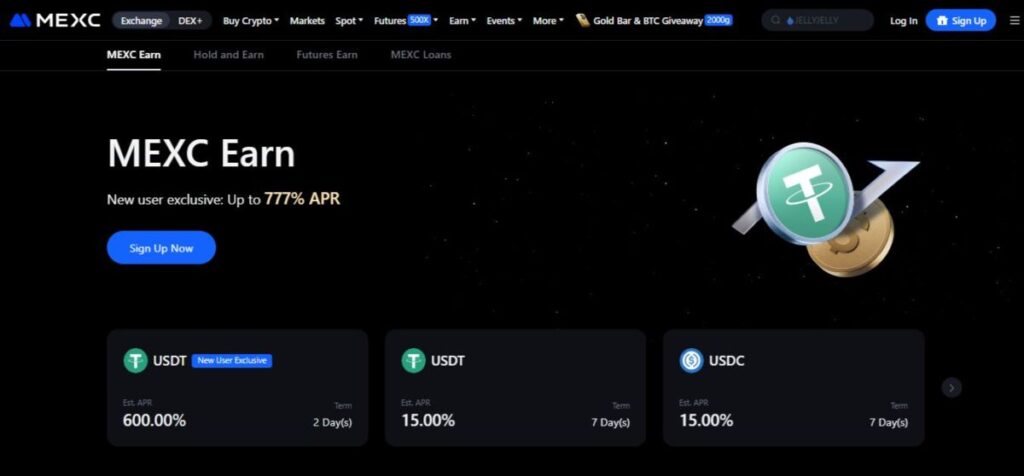

Why MEXC is a best option for crypto-aware savers

If you decide to allocate a portion of your savings to crypto, where you park it matters. MEXC has evolved from a simple trading venue into a comprehensive savings hub.

- MEXC Savings: Unlike a traditional bank offering 0.5%, MEXC offers “Flexible” and “Locked” savings products for stablecoins (USDT/USDC) and major assets (BTC/ETH). This allows your idle assets to earn yield while you sleep.

- Launchpool Opportunities: MEXC allows users to stake their savings (MX or USDT) to farm new tokens for free. This is effectively a “dividend” on your savings that traditional banks cannot match.

- Safety & Liquidity: With a long operational track record and strong security measures, MEXC provides the liquidity needed to enter or exit positions instantly crucial for an emergency fund that might be held in stablecoins. Click Here to make account and starting saving from today.

Quick action checklist : what to do this week

Track your last two months of spending to build a realistic budget.

Set one short-term goal (emergency fund) and one medium-term goal (down payment, course, travel).

Automate transfers to hit those goals.

If you’re adding crypto, start small: 1–5% of your savings, use DCA, and avoid leverage.

Verify the custody, audits, and withdrawal process on any platform you plan to use.

Conclusion

Growing savings is less about tricks and more about consistent choices. Start with clear goals, automate, protect the emergency fund, and then allocate surplus with intent. Crypto and tokenized real-world assets can play a role, but they are tools not replacements for a disciplined savings plan.

Disclaimer

This article is educational and does not constitute financial or investment advice. Personal circumstances vary. Consider speaking with a licensed financial advisor before making major financial decisions. Always confirm platform details and regulatory status with official sources.

Join MEXC and Get up to $10,000 Bonus!

Sign Up