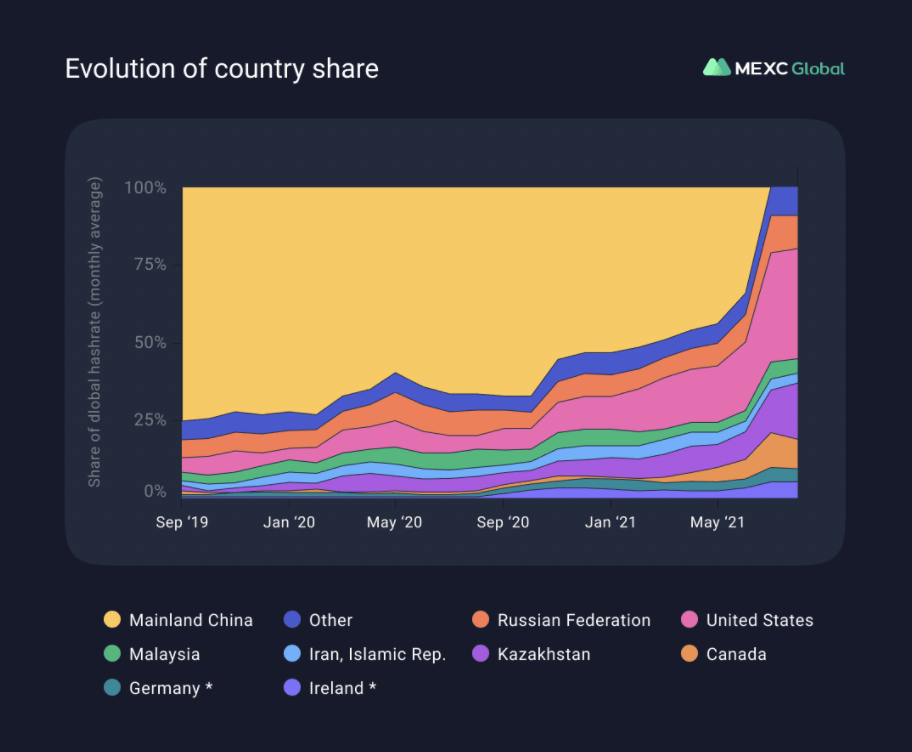

The socio-economic difficulties that have struck Kazakhstan recently and resulted in a severe shortage of electricity have significantly impacted the local cryptocurrency market. The most affected were miners who were forced to embark on a mass exodus from the country back in December. They accounted for 18% of the global Bitcoin mining market. Over the last two years, Kazakhstan has become a hotspot for thousands of miners, while the share of the global hashrate grew by over 13 times.

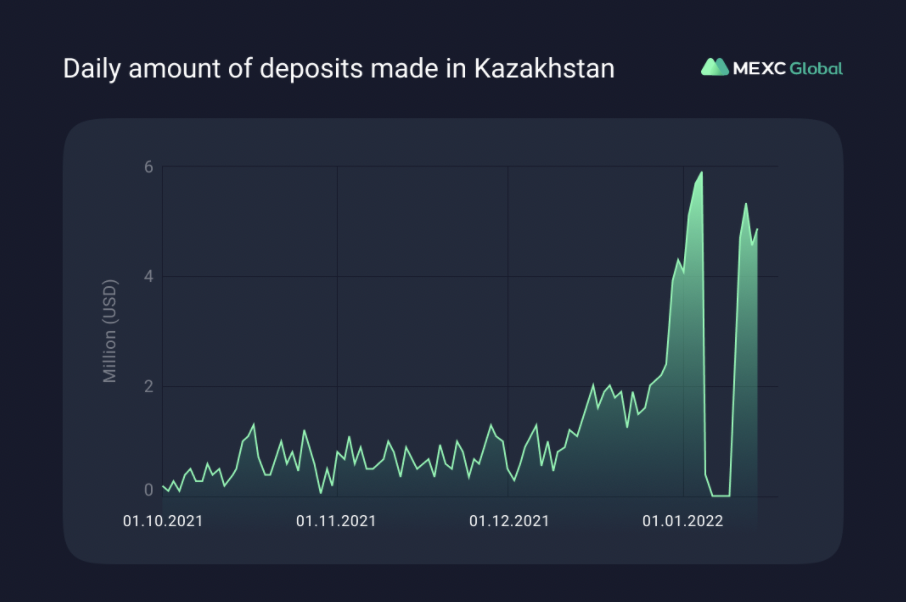

The events have also had an impact on the holders of digital assets. Our research results indicate that the number of deposits made by users from Kazakhstan has gone up starting from the middle of October of 2021, likely being the result of an ongoing migration of miners in the face of the impending energy crisis in the country. At the end of September, rumors surfaced throughout local media that the authorities in Kazakhstan could limit BTC mining or halt such activities.

The combined volume of cryptocurrencies transferred by local users to the MEXC exchange within the period of a month amounted to over $80 million, doubling the total recorded in 2021, and marking a 4-fold increase over the previous month.

Data regarding the movements of digital assets on exchange wallets over the period of December 15, 2021, to January 15, 2022, has been taken into account during statistical analysis and revealed a significant increase in key metrics in the period from December 30 to January 5 of 2022. Peak values were attained on January 4, which was the day before the disconnection of the internet across the country. Local users transferred $5.9 million to the MEXC exchange the same day. As a retrospective figure, the total amount of deposits made by users from Kazakhstan amounted to $883,000 dollars on January 4 in 2021.

A mere 398 transactions were recorded in the period from December 30, 2020, to January 5, 2021, which is typical for the given region in the post-holiday period. A total of 2,786 transactions were carried out in the same period in 2022.

The average amount of deposits was $4,870. Data indicates that 67% of users from Kazakhstan preferred Bitcoin (BTC), another 18% opted for ETH, while 7% transferred USDT to the exchange, but did not carry out any transactions. On-chain data does not make it possible to determine whether the cryptocurrencies that were transferred to the exchange had previously been purchased on other platforms, such as local exchangers, or if they were user holdings.

The period of internet blackout in the country also coincided with near-zero trading and exchange activity among users from Kazakhstan, as VPN services were inaccessible. Once internet connection was re-established on January 10, user activity levels also returned to previous values, with the average daily volume of balance transfers made by residents of Kazakhstan reaching $3.2 million, as seen at the end of December of 2021.

Interest in Cryptocurrencies Is Directly Proportional to Levels of Socio-Political Tension

The historical experience of events that have taken place in many countries highlights that the degree of trust in the authorities and the national currency declines in periods of political and economic instability. The result is a massive outflow of funds from banks and a proportional increase in the interest of the population in alternative sources of value-preservation, such as gold, foreign or digital currencies, which are less susceptible to state control.

Such phenomena were witnessed in China, Belarus, Turkey, and Argentina, where citizens rushed to stock up on cryptocurrencies amidst socio-political instability and conflicts in their countries, fearing for the safety of their fiat funds. The decrease in bank interest rates in Russia and the imposition of a tax on bank deposits have led to a massive outflow of funds from banks and increased interest in digital assets. In 2020, many exchanges recorded a sharp increase in Russian users and deposits made by residents of the country.

The situation in Kazakhstan was aggravated by the prolonged internet blackout, which disrupted the operation of banks and banking applications. Considering the continued interest in cryptocurrency purchases by local users and the absence of a ban on digital asset trading in the country, it is likely that the number of owners of digital assets in Kazakhstan will continue to grow.

The findings suggest that cryptocurrencies and cash may be the only reliable means of storing funds under authoritarian regimes. Should proper measures be taken for storage, it is unlikely that users will lose access to their funds. In such cases, the safety and security of investments will be independent of internet availability, the operations of banks, political or economic situations.

Considering the findings, users may still prefer digital assets as long-term savings instruments, while cash will be used for immediate spending needs.

Join MEXC and Start Trading Today!