We have followed privacy coins and DeFi projects for many years. We pay close attention to Zcash (ZEC), a classic privacy asset. Recently, the ZEC price jumped to about 700 USD. It rose 50% in the last 7 days. In the same time, Bitcoin moved only about 2%.

This strong rise is not tied to the broader market. It comes from the coming network halving and from growing global demand for privacy under tighter rules.

(Source:Mexc )

On MEXC, ZEC trading volume rose 36% in the last 24 hours to 2.3 billion USD. This shows strong interest in this “digital privacy shield.” This article explains ZEC’s core basics, the forces behind the rally, key risks, and how to buy ZEC on MEXC. We hope this helps you ride the wave of the privacy revolution.

ZEC Basics: Core Tech and Ecosystem

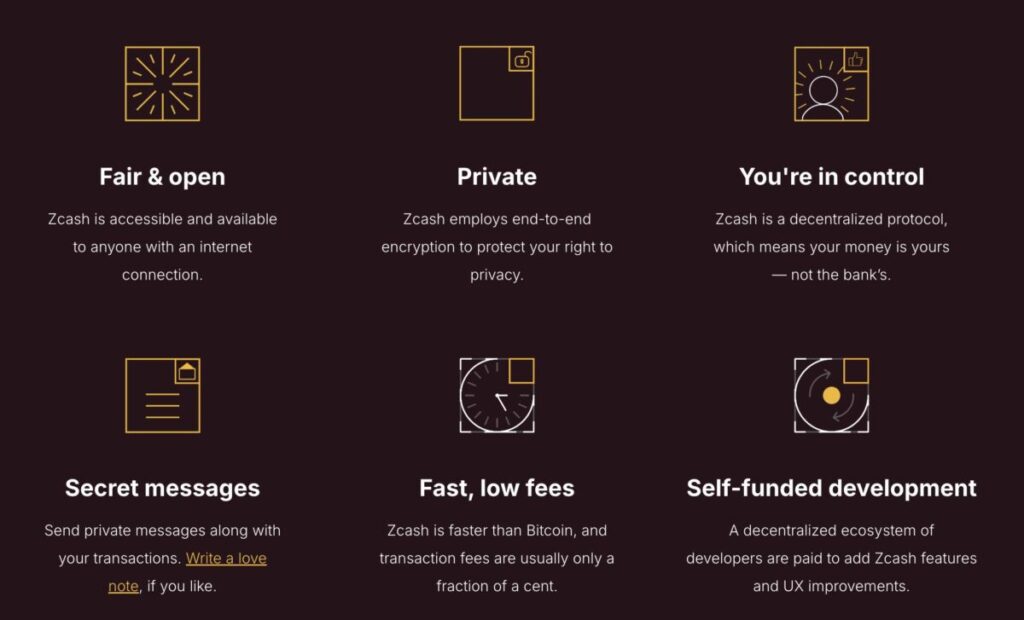

Zcash (ZEC) launched in 2016 as a fork of Bitcoin. It uses zk-SNARKs, a zero-knowledge proof system. This lets the network verify transactions without revealing details. It offers real privacy, not the “pseudo-anonymity” of Bitcoin.

ZEC has a fixed supply cap of 21 million coins. The current circulating supply is about 16 million. ZEC uses a “tail emission” model. From the fourth halving, the block reward will be fixed at 0.2 ZEC. This creates mild deflationary pressure and a long-term value anchor.

ZEC’s use cases go beyond private transfers. It now serves as core privacy infrastructure in Web3. It supports DeFi lending, private minting of NFTs, and cross-chain interoperability. It also shines in AI-driven anonymous data markets.

MEXC is a leading global exchange. It listed ZEC spot and futures in 2024. It offers very low fees of 0.01% and matching in milliseconds. This helps users catch opportunities with ease. Whether you trade short term or hold long term, deep liquidity on MEXC helps reduce slippage and makes trades smooth.

Drivers of the Rally: Tech Upgrades and Ecosystem Synergy

The 50% weekly rise is not random. It is the result of upgrades, ecosystem growth, and market sentiment moving together. In 2025, while the broader market is weak, ZEC stands out. Its privacy trait is resilient. It draws in institutional funds. Below we explain the main drivers.

Tech Upgrades with Big Impact

The latest network upgrade further optimizes the Orchard protocol. It was deployed at the end of October. zk-SNARK computation is more efficient now. Transaction confirmation times are under 30 seconds. Gas fees fell by 30%. These changes strengthen ZEC in high-frequency DeFi use cases.

(Source:Zcash)

They also prepare for the third halving, expected on November 15. The block reward will fall from 1.5625 ZEC to 0.78125 ZEC. Supply growth will slow to a new low. MEXC data shows that after the last two halvings, ZEC rose by an average of 300%. With added “quantum-safe” enhancements, ZEC may further secure its role as privacy infrastructure.

These upgrades help ZEC move from a niche tool to a “privacy engine” for Web3. They support AI private compute and decentralized identity.

Partners and Ecosystem Expansion

Ecosystem synergy is another key engine. Recently, the Zcash Foundation formed a strategic partnership with the ZKP Alliance, led by a16z. ZEC’s privacy layer will integrate with Ethereum Layer 2 solutions. This enables seamless cross-chain private transfers.

In early November, there was also an announcement of deep integration with Circle’s USDC. ZEC now supports private stablecoin swaps. This pushed trading volume up by 24% and the price toward a 744 USD high.

Enterprise adoption is also growing. Several European banks are testing ZEC for cross-border anonymous remittance. This shows a shift from proof-of-concept to real use.

From the MEXC view, these moves raise ZEC’s utility. They also create more futures opportunities. Users can use up to 1:100 leverage to amplify gains from the ecosystem.

Community Energy and Market Sentiment

Community power also fuels FOMO. Electric Coin Company (the core ZEC developer) held a global hackathon on November 7. More than 500 developers joined. They focused on private NFTs and DePIN. Funding for projects reached 50 million USD. This brings new energy.

On-chain data shows whale address activity up 40%. Large transfers are more frequent. Market sentiment shifted from cautious to heated. The Puell Multiple reached 2.5, a historic high, which suggests miner revenue is peaking. On MEXC, discussion volume about ZEC rose 300%, and retail participation hit a peak.

We must still beware of short-term swings from hot sentiment. But overall, this wave may lift ZEC from a privacy coin to a mainstream asset.

Risks and Rational Thinking

The rally is exciting, but we stress rational investing.

First, regulation is uncertain. In 2025, the EU’s MiCA allows more ZKP pilots. But tighter global AML checks could still hurt liquidity for privacy coins.

Second, a pullback risk is high. RSI is at 78, which is overbought. After a 50% weekly rise, the first support is around 575 USD. If it breaks, price may retest 500 USD. Traders should beware of sudden drops, especially in high-volatility periods.

The supply model is deflationary, but tail emission could dilute value in high inflation times. Competition is rising too. Monero and the newer Mina Protocol are taking some share. ZEC must keep innovating to stay ahead.

From experience, we suggest diversification. Put 10–20% of your portfolio in ZEC. Adjust with fundamentals such as the share of shielded transactions (now 25%). Avoid full leverage. Prefer spot to hedge volatility. Manage leverage and position size in futures. Too much leverage can magnify losses and cause liquidation.

In the end, invest based on your own risk tolerance, not short-term hype.

How to Buy ZEC on MEXC

You can buy ZEC on the MEXC exchange. MEXC offers low fees, fast trades, a wide list of assets, and strong liquidity. It also supports new projects, which makes it a good place for quality listings.

ZEC spot and futures are live on MEXC. You can trade with very low fees.

- Open and log in to the MEXC app or website.

- Search for “ZEC.” Choose spot or futures.

- Choose order type. Enter amount and price. Submit the order.

A friendly reminder: crypto is very volatile. Please assess your risk tolerance before investing. Diversify your portfolio. MEXC provides tools and education to help you decide. But the final responsibility is yours.

Join MEXC and Get up to $10,000 Bonus!