Summary

Amazon (NASDAQ: AMZN) represents one of the most influential companies in global technology and e-commerce. This guide provides a comprehensive overview of AMZN stock fundamentals, growth potential, and trading strategies — with a focus on how to trade tokenized AMZN stock futures on MEXC. Investors can enjoy zero trading fees, up to 50x leverage, and 24/7 trading flexibility — without the need for a U.S. brokerage account.

TL;DR

- Ticker Meaning: AMZN is Amazon.com Inc.’s official ticker symbol on NASDAQ.

- Why MEXC: 0% maker fees, global accessibility, and USDT-based settlement.

- Investment Case: Strong growth in e-commerce, AWS cloud, AI, and digital ads.

- Trading Tips: Use stop-loss orders, monitor margin ratio, and manage leverage.

- Risk Notice: Leverage amplifies both gains and losses; start small and manage risk carefully.

1.Comprehensive Overview of AMZN Stock

1.1 Meaning of the AMZN Ticker

AMZN is the stock ticker for Amazon.com, Inc.,listed on the NASDAQ Stock Exchange. The four-letter symbol uniquely identifies Amazon’s shares in the global financial markets, making it easy for investors to find and trade.

1.2 AMZN Stock Basics

- Exchange: NASDAQ

- Stock Type: Common Stock

- Sector: Technology / Consumer Discretionary

- Volatility: As a growth-oriented tech stock, AMZN exhibits relatively high price volatility — offering both strong upside potential and corresponding investment risks.

2.About MEXC: Why Trade U.S. Stock Futures Here

2.1 MEXC Exchange Overview

Founded in 2018, MEXC is a globally recognized digital asset exchange known for its “user-first” philosophy. It provides a full suite of services, including spot, futures, and leveraged trading.

Key Advantages of MEXC:

- Wide Asset Selection: 2,600+ spot pairs, 1,500+ futures contracts, and an expanding lineup of tokenized U.S. stock products.

- High Liquidity: Daily trading volume exceeds $20 billion, ensuring rapid order execution.

- Low Fees: Maker fees as low as 0%, and taker fees as low as 0.02%, offering a major cost advantage over traditional brokers.

- Global Accessibility: Supports 170+ countries and multiple languages.

- Robust Security: Cold/hot wallet separation, multi-signature protection, and full security audits.

2.2 Unique Features of MEXC U.S. Stock Futures

- 24/7 Trading: Trade around the clock — no dependence on U.S. market hours.

- High Leverage: Up to 50x leverage depending on the asset, letting traders amplify capital efficiency.

- Bidirectional Trading: Go long or short to profit in both bull and bear markets.

- Low Entry Barrier: Smaller contract sizes enable participation with limited capital.

- USDT Settlement: Margin and PnL settled in USDT, avoiding fiat on/off-ramp hassles.

- No Brokerage Account Needed: Trade tokenized U.S. stocks directly with crypto holdings.

3.Investment Value of AMZN Stock

3.1 Fundamental Analysis

Key Financial Metrics

- Revenue Growth: Annual revenue surged from $34B in 2010 to over $600B in 2024, a CAGR of 20%+.

- Profitability: AWS’s high-margin business offsets lower retail margins, driving earnings growth.

- Free Cash Flow: Amazon consistently generates strong operating cash flow, ensuring reinvestment capacity.

- Balance Sheet: Healthy liquidity, manageable debt, and high financial flexibility.

- Valuation Metrics: While P/E fluctuates due to heavy investment, investors focus on revenue, cash flow, and margins; a high P/S ratio reflects strong market confidence.

Growth Drivers

- Rising global e-commerce penetration.

- AWS cloud expansion amid digital transformation.

- Advertising business scaling rapidly due to superior conversion rates.

- Emerging market growth in India, Southeast Asia, and Latin America.

- New ventures: Healthcare, satellite internet (Project Kuiper), and autonomous logistics.

- AI integration: Generative AI improves recommendations, ad targeting, and operations.

3.2 Technical Analysis

Long-Term Trend

- Historical Performance: AMZN has grown hundreds of times since its 1997 IPO (split-adjusted).

- Trend Pattern: Long-term uptrend with intermittent corrections, consistently reaching new highs after pullbacks.

- Cyclicality: Highly correlated with the NASDAQ and overall tech sector sentiment.

Key Technical Indicators

- Moving Averages: 200-day MA as long-term support; 50-day/200-day crossovers (golden/death crosses) as signals.

- RSI: Above 70 = overbought; below 30 = oversold.

- Bollinger Bands: Tightening bands indicate volatility expansion ahead.

- Volume Analysis: Breakouts confirmed by rising volume; shrinking volume signals weakening trends.

- Support & Resistance: Round numbers and previous highs/lows often act as key levels.

Chart Patterns

- Ascending Triangle: Bullish continuation after breakout.

- Head & Shoulders: Signals potential reversal.

- Double Top/Bottom: Classic reversal formations.

- Flag Pattern: Consolidation before trend continuation.

3.3 Factors Affecting AMZN Price

Company-Level

- Quarterly earnings (revenue, AWS growth, margins).

- Forward guidance and management commentary.

- Strategic moves like acquisitions or restructuring.

- Leadership changes (e.g., transition to CEO Andy Jassy).

Industry-Level

- E-commerce adoption trends and logistics costs.

- Cloud computing competition and IT spending.

- AI, IoT, and emerging technologies.

- Rival strategies (Microsoft, Google, Walmart, Alibaba).

Macro-Level

- GDP growth, consumer sentiment, and retail data.

- Interest rates: Higher rates hurt growth-stock valuations.

- Inflation: Raises costs and impacts demand.

- FX & Geopolitics: Dollar strength and trade policies influence global revenue.

Regulatory Factors

- Antitrust scrutiny: Fines or restrictions from the U.S. and EU.

- Data privacy laws: Compliance costs under GDPR/CCPA.

- Tax policy: Changes in corporate or digital taxes.

- Labor and environmental regulations: Impact operational flexibility and costs.

4.Practical Guide: Trading AMZN Futures on MEXC

4.1 Account Setup and Funding

Visit the MEXC website or download the MEXC App, register using email or phone, and enable 2FA for security. Completing KYC verification increases withdrawal limits and unlocks additional features. Deposit USDT or other cryptocurrencies to begin trading.

4.2 Placing a Trade

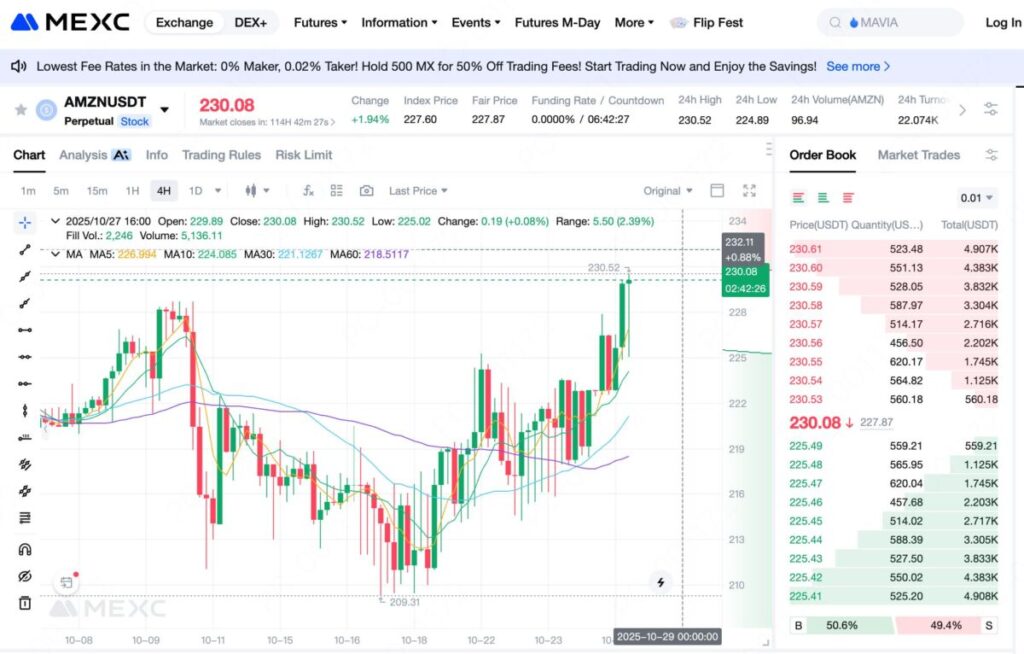

Search “AMZN” in the futures section and select the AMZNUSDT contract. Choose order type (limit, market, etc.), enter the quantity and price, and execute the trade.

4.3 Position Management and Risk Control

- Set Stop-Loss & Take-Profit: Immediately after opening a trade, define exit levels to protect capital and secure profits.

- Monitor Margin Ratio: Stay above maintenance margin levels to avoid liquidation. Consider adding margin or closing part of a position in volatile markets.

- Scale Entries: Use a pyramid approach instead of full allocation at once, reducing exposure to timing errors.

- Regular Review: Record trade rationale, process, and results to improve over time.

5.FAQs

Q1: Is trading AMZN futures on MEXC legal?

Yes. MEXC operates under multiple international jurisdictions with relevant licenses. However, users must comply with their local regulations before trading.

Q2: Does “zero-fee” mean no costs at all?

Zero trading fees refer to no commission charged by MEXC, but costs like funding rates and network withdrawal fees may still apply.

Q3: Does the MEXC AMZN futures price equal NASDAQ’s spot price?

MEXC’s tokenized futures track the underlying NASDAQ stock, but minor basis differences can occur due to funding rates and market supply-demand dynamics.

Q4: Are leveraged trades risky?

Yes. Leverage amplifies both profits and losses. Even small market moves can trigger liquidation. Start with low leverage and apply strict stop-loss rules.

Q5: How to improve trading success?

Develop a plan, combine technical and fundamental analysis, manage risk strictly, and keep learning through post-trade reviews.

Q6: Is my MEXC account secure?

MEXC applies multi-layered protection — cold wallet isolation, multi-signature systems, and external audits. Users should also use strong passwords and 2FA.

Q7: Do AMZN perpetual futures expire?

No. MEXC offers perpetual contracts without expiry. Positions can be held indefinitely, subject to periodic funding payments.

6.Conclusion

MEXC provides a powerful platform for trading AMZN tokenized stock futures — combining zero trading fees, high leverage, 24/7 trading access, and crypto-based settlement. These advantages make it ideal for active traders, small-cap investors, and global participants seeking exposure to leading U.S. equities.

However, high leverage also means high risk. Beginners should start small, focus on risk management, and build discipline before scaling up. Whether in stocks or crypto, rational trading and continuous learning remain the foundation of long-term success.

Join MEXC and Get up to $10,000 Bonus!