As Bitcoin reclaims market dominance in 2025, a new wave of infrastructure innovation is emerging. Building on foundational work from 2024, this year has seen a surge of Bitcoin Layer 2 activity, from Botanix’s EVM-compatible mainnet launch and Bitlayer’s BitVM-based bridge rollout to Rootstock’s ecosystem expansion and renewed Lightning Network growth.

This momentum signals that Bitcoin’s scaling era has truly arrived. Layer 2 networks are positioning Bitcoin to compete directly with Ethereum and other smart contract platforms, evolving from purely a store of value into programmable financial infrastructure. Understanding these Bitcoin scaling solutions has become essential for navigating Bitcoin’s next chapter.

1. Why Bitcoin Needs Layer 2 Solutions

Bitcoin’s original design prioritized security and decentralization over transaction speed and programmability. This conservative approach created the most secure blockchain but introduced significant limitations as adoption grew.

Bitcoin’s base layer processes approximately 7 transactions per second with 10-minute block times. During high network activity, transaction fees can surge to $20-50 per transfer, making Bitcoin impractical for everyday payments. This capacity limitation isn’t a flaw—it’s a deliberate trade-off maintaining security through requiring every node to validate every transaction.

Beyond scaling, Bitcoin faces competition from platforms like Ethereum and Solana that enable developers to build complex applications. Bitcoin’s intentionally limited scripting language prevents the programmable contracts that power decentralized finance, NFTs, and other crypto applications.

Layer 2 networks address these limitations by processing transactions off Bitcoin’s main chain while inheriting its security properties. These solutions enable faster transactions, lower fees, and expanded functionality without changing Bitcoin’s base layer protocol.

2. Understanding Layer 2 Technology

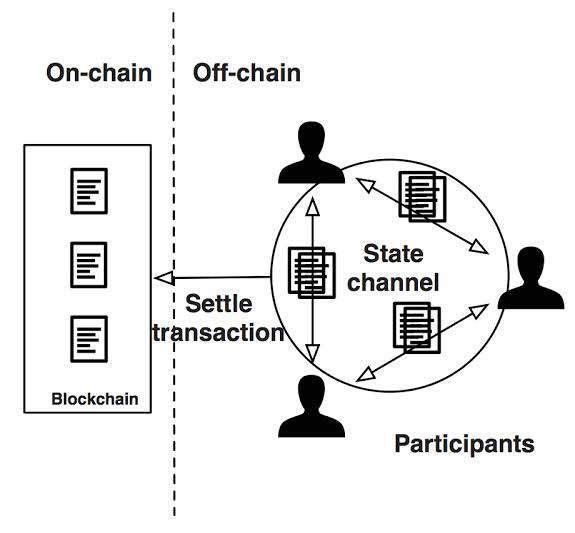

Layer 2 solutions move transaction processing off Bitcoin’s blockchain while maintaining cryptographic connections for security. Different approaches achieve this through various technical methods.

State Channels: The Lightning Network uses payment channels allowing unlimited off-chain transactions between parties. Only channel opening and closing touch Bitcoin’s blockchain, enabling instant payments with minimal fees. This works excellently for frequent payments but doesn’t easily support complex smart contracts.

Sidechains: Projects like Stacks and Rootstock operate as separate blockchains that periodically anchor to Bitcoin for security. These chains implement features Bitcoin doesn’t support natively, smart contracts, faster blocks, different programming languages, while inheriting Bitcoin’s security through cryptographic commitments. The trade-off involves introducing additional trust assumptions beyond Bitcoin’s base layer.

Rollups: Experimental Bitcoin rollups process transactions off-chain and post compressed data back to Bitcoin. Projects like Botanix pioneer EVM-compatible rollups that would allow Ethereum developers to deploy contracts secured by Bitcoin, though this technology remains less mature than Ethereum’s rollup ecosystem.

3. Major Bitcoin Layer 2 Solutions

3.1 Lightning Network

Launch: Operational since 2018

Use Case: Fast, low-cost Bitcoin payments

Advantages: Proven technology, growing adoption, instant settlement

Limitations: Requires channel liquidity, limited to payments

Lightning processes millions of transactions monthly through interconnected payment channels. Major exchanges and payment processors have integrated Lightning support, making it the most adopted Bitcoin Layer 2 by transaction volume.

3.2 Stacks

Launch: Mainnet operational, Nakamoto upgrade 2024

Use Case: Bitcoin-secured smart contracts and DeFi

Advantages: Mature developer ecosystem, native Bitcoin integration

Limitations: Additional trust assumptions beyond Bitcoin

Stacks enables smart contracts that settle on Bitcoin, creating DeFi applications, NFTs, and programmable assets. The Nakamoto upgrade introduced Bitcoin finality, transactions achieve Bitcoin-level security once confirmed on the base chain.

3.3 Rootstock (RSK)

Launch: Operational since 2018

Use Case: Ethereum-compatible smart contracts on Bitcoin

Advantages: EVM compatibility, Bitcoin miner security

Limitations: Centralized federation for Bitcoin peg

Rootstock brings Ethereum Virtual Machine compatibility to Bitcoin, allowing developers to deploy Solidity smart contracts secured by Bitcoin miners. This lets Ethereum developers port applications without learning new programming languages.

3.4 Emerging Solutions

BitVM enables complex computation verification on Bitcoin without protocol changes. Botanix develops EVM-compatible rollups for Bitcoin. RGB implements client-side validation for smart contracts and asset issuance. These experimental solutions showcase ongoing innovation expanding Bitcoin’s capabilities.

4. Bitcoin vs. Ethereum Layer 2s: Two Roads to Scalability

While both Bitcoin and Ethereum developed Layer 2 solutions for scalability, fundamental differences between these blockchains result in significantly different approaches.

The utility of Layer 2 solutions lies in tapping into main chain security while increasing scalability. Bitcoin and Ethereum Layer 2s share this goal but differ significantly in technical implementation, as the base layer blockchains were designed for distinct purposes.

Ethereum was built as a programmable platform with native smart contract capabilities. Its Layer 2s rollups like Arbitrum and Optimism extend existing programmability while reducing costs. Bitcoin Layer 2s must add functionality absent from the base layer, making implementation more complex and varied.

Ethereum rollups process transactions off-chain and post compressed data back, with the base layer verifying correctness through cryptographic proofs. Bitcoin’s limited scripting makes similar rollups significantly more challenging, leading to more diverse approaches—payment channels, sidechains, and client-side validation.

Ethereum Layer 2s share the same programming environment as the base layer. Developers deploy Solidity contracts to Arbitrum with minimal modifications. Bitcoin Layer 2 developers face steeper learning curves, Stacks uses its own Clarity language, Rootstock implements separate EVM infrastructure, and RGB requires understanding unfamiliar client-side validation concepts.

5. Key Use Cases Driving Adoption

5.1 Payments and Remittances

Lightning Network has made Bitcoin viable for everyday transactions through instant settlement and sub-cent fees. Cross-border remittances represent a particularly compelling use case, enabling near-instant international transfers for minimal cost versus traditional services charging 5-10% with multi-day settlement.

5.2 Stablecoins on Bitcoin

Multiple Layer 2 solutions now support stablecoin issuance anchored to Bitcoin’s security. Bringing stablecoins to Bitcoin via Layer 2s could capture market share from existing chains while providing users Bitcoin-level security for dollar-denominated digital assets.

5.3 Decentralized Finance

Stacks and Rootstock host active DeFi ecosystems with decentralized exchanges, lending protocols, and synthetic assets. While smaller than Ethereum’s DeFi sector, these applications demonstrate complex financial primitives can operate on Bitcoin-secured infrastructure.

5.4 NFTs and Digital Assets

Stacks supports NFT marketplaces and collections, while Ordinals inscriptions demonstrated demand for Bitcoin-native digital collectibles. Layer 2 solutions enable more complex NFT functionality, dynamic NFTs, gaming assets, programmable royalties, while maintaining lower costs and security connections to Bitcoin.

6. Conclusion

Bitcoin Layer 2 networks represent the blockchain’s evolution from single-purpose digital gold into infrastructure supporting diverse applications. Through different technical approaches—payment channels, sidechains, and experimental rollups, these solutions extend Bitcoin’s capabilities while maintaining security connections to the world’s most established blockchain.

The fundamental distinction between Bitcoin and Ethereum Layer 2s reflects their different purposes. While Ethereum Layer 2s optimize existing smart contract capabilities for lower costs, Bitcoin Layer 2s add entirely new functionality absent from Bitcoin’s conservative base layer.

Understanding how these Layer 2 solutions work provides important context for Bitcoin’s role beyond simple value storage. Whether enabling instant payments through Lightning, smart contracts through Stacks, or EVM-compatible applications through Rootstock, Layer 2 technology is expanding what’s possible to build on Bitcoin.

As blockchain technology matures, the distinction between “Bitcoin the asset” and “Bitcoin the infrastructure” will likely become more pronounced. Layer 2 solutions bridge these concepts, allowing Bitcoin to maintain core properties of security and decentralization while supporting the programmability modern applications require.

The development of Bitcoin Layer 2 ecosystems demonstrates ongoing innovation within cryptocurrency’s most established network. Understanding these solutions, their capabilities, and their limitations provides an essential foundation for comprehending Bitcoin’s evolving position in the broader digital economy.

Explore Bitcoin Layer 2 tokens like STX on MEXC and learn more about the infrastructure expanding Bitcoin’s capabilities.

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up