TL;DR

1) Next-Generation Stablecoin Protocol: Reservoir moves beyond the limitations of first-generation stablecoins with a new design paradigm.

2) Diverse Product Suite: Includes rUSD, srUSD/wsrUSD, trUSD, and a permissionless lending market to meet different user needs.

3) Addressing the Five Core Challenges of Stablecoins: Strikes a balance between decentralization, stability, capital efficiency, scalability, and utility.

4) Multi-Collateral Architecture with RWA Integration: Combines digital assets with real-world assets to diversify risk and expand scale.

5) Transparent Risk Controls and Long-Term Vision: Built on an on-chain balance sheet and automated risk management mechanisms to drive stablecoins toward cross-chain adoption and real-world use cases.

1. Reservoir Overview

1.1 Project Positioning

Reservoir is a decentralized stablecoin protocol built on Ethereum and extended to multiple mainstream networks. Its core design objective is to move beyond the limitations of first-generation stablecoins (Stablecoin 1.0) and address the “Stablecoin Pentalemma”: decentralization, stability, capital efficiency, scalability, and utility.

According to Reservoir, a stablecoin with true long-term viability must satisfy all five conditions simultaneously. Only in this way can it overcome issues such as the inequitable yield distribution of centralized stablecoins, the limited scalability of decentralized stablecoins, the high risks of single-asset collateral, and the implicit de-pegging risks of algorithmic stablecoins, ultimately becoming foundational infrastructure for the next-generation financial system.

1.2 Market Opportunity

Stablecoins are the most critical intermediary asset in the crypto financial system. Over the past decade, centralized stablecoins such as USDT and USDC have dominated the market, but most of the yield accrues to custodial institutions, leaving users unable to share the returns. Decentralized stablecoins, while addressing some centralization constraints, have struggled to achieve large-scale adoption due to limited governance efficiency and restricted asset supply.

At the same time, real-world assets (RWA) are rapidly being tokenized on-chain; from government bonds to commercial paper and a wide range of credit assets. This has created growing demand for stablecoins that can support and integrate these assets. Reservoir is built precisely on this trend: through a multi-collateral architecture that combines digital assets with RWAs, it not only ensures asset quality but also expands scalability, positioning itself as a financial gateway capable of supporting the next trillion dollars in assets.

2. Reservoir Tokenomics

Reservoir’s native token, RSV, serves as the core driver of the protocol. It functions not only as the medium for transaction fees and network incentives but also as a foundational tool for governance and risk management. Holders can participate in governance through staking, deciding on key parameters such as interest rates and collateral asset onboarding.

- The total supply of RSV is 1,000,000,000 tokens.

- Its allocation plan and vesting schedule have been publicly disclosed on the official Reservoir website and X account.

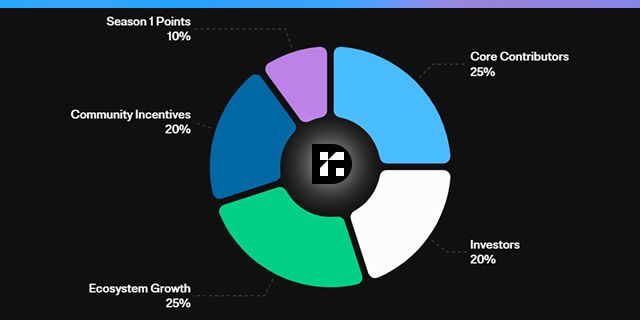

2.1 Token Allocation

- Early User Rewards: 10%

- Community Incentives: 20%

- Ecosystem Development: 25%

- Investors: 20%

- Core Contributors: 25%

This structure ensures strong participation from early users while also providing long-term incentives to support sustainable growth.

2.2 Token Vesting Schedule

Season 1 Points: Rewards for early community members (contributors from the 0 to 1 stage). These tokens unlock at TGE and can be claimed and staked to support long-term participation.

Core Contributors: Allocated to protocol builders, team members, and advisors, with a vesting schedule of a 1-year cliff and 36 months linear vesting.

Investors: Strategic backers who supported Reservoir’s vision and early development, also subject to a 1-year cliff and 36 months linear vesting.

Ecosystem Growth: Held by the foundation to drive the expansion of rUSD within the DeFi ecosystem, covering technical development, risk assessment, audits, and more.

Community Incentives: Reserved for future airdrops, staking rewards, community grants, and partnership programs.

3. Product Design

Reservoir’s product suite is built around rUSD, its core stablecoin, and gradually expands into yield-bearing and term-based assets to meet different user needs for stability and returns.

3.1 rUSD: The Core Stablecoin of the Protocol

rUSD is the core stablecoin of the Reservoir protocol, issued as an overcollateralized ERC-20 token. Users can mint or redeem it at a 1:1 ratio, backed by a diversified mix of digital assets and real-world assets. This design ensures both peg stability and on-chain transparency, making rUSD the foundation of the entire Reservoir ecosystem.

3.2 srUSD and wsrUSD: Yield-Bearing Assets

Building on rUSD, Reservoir offers two yield-bearing assets: srUSD and wsrUSD. The key difference lies in their interest accrual mechanisms:

- srUSD accrues interest on a daily basis and includes a small burn fee, making it more suitable for medium- to long-term holding.

- wsrUSD accrues interest per block without fees, designed for users who prefer greater flexibility.

These two designs provide users with more liquidity options, enabling them to maintain flexibility while still earning stable returns.

3.3 trUSD: Smart Contract-Based Term Yield Product

trUSD is the first smart contract-based term yield product in the crypto space. By locking funds for a specific period, users receive fixed cash flow payments. Unlike traditional floating-rate products, trUSD adopts a “fixed term and fixed return” model, providing Reservoir with a stable source of long-term capital. These funds can support DeFi yield strategies as well as RWA allocations, further enhancing the protocol’s capital efficiency and stability.

4. Architecture and Risk Management

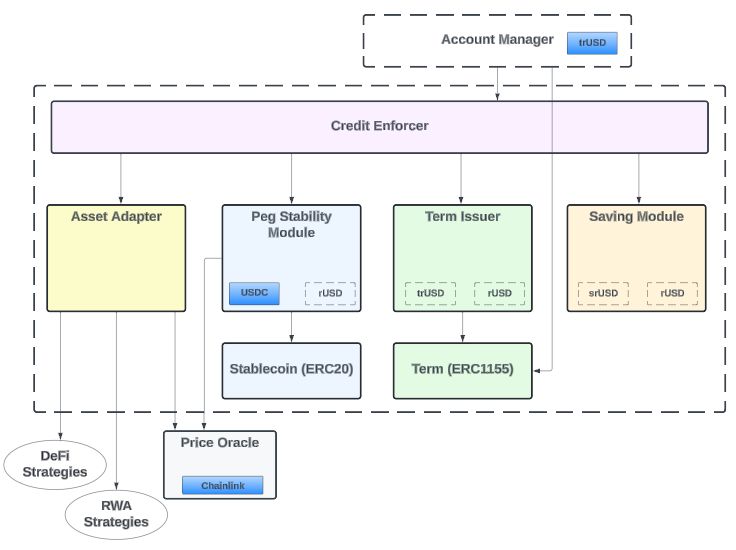

To ensure stable system operation, Reservoir implements a multi-layered risk control framework. At its core is the Credit Enforcer, a key smart contract that automatically checks liquidity ratios, asset ratios, and capital ratios during every asset interaction. If potential risks are detected, the transaction is immediately reverted. This mechanism ensures that the protocol remains solvent under all circumstances.

In addition, the Peg Stability Module (PSM) maintains the 1:1 peg between rUSD and USDC, reinforcing market confidence. Reservoir also provides on-chain “Proof of Reserves” through a transparent balance sheet, allowing all collateral assets to be publicly verified. These mechanisms draw inspiration from the Basel III framework in traditional finance, adapted and restructured for a decentralized environment.

5. Community and Ecosystem Development

According to Reservoir’s official statements, community-related initiatives are still in the planning stage. A portion of RSV tokens has been reserved in the token allocation for future community incentives and ecosystem growth, such as airdrops, staking rewards, community grants, and potential partnership programs. The specific rules and timelines will be announced through official channels.

In terms of governance, the whitepaper notes that protocol governance will oversee due diligence, onboarding, and management of RWAs, as well as set related risk and asset allocation parameters. However, no public governance proposals or voting timelines have been disclosed yet.

For the latest updates, please refer to official announcements from Reservoir.

6. Market Opportunities and Challenges

As real-world assets (RWAs) are increasingly brought on-chain, the role of stablecoins has expanded beyond simply maintaining price stability. Market demand now emphasizes capital efficiency and cross-chain utility. Reservoir addresses these needs through its multi-collateral architecture, diversified product suite, and cross-chain compatibility, opening up broader market potential. Looking ahead, it has the opportunity to expand into DeFi, NFTs, gaming, and cross-chain payments, while also serving as a key entry point for industries such as healthcare, entertainment, and traditional finance into the blockchain ecosystem.

However, the evolution of stablecoins also comes with challenges. First, balancing decentralization with governance efficiency and decision-making flexibility remains a persistent difficulty for all decentralized stablecoin protocols. Second, while RWA integration enhances scalability, it also brings added complexity in terms of compliance, auditing, and cross-sector collaboration. Lastly, with intense competition in the stablecoin market, Reservoir must consistently differentiate itself across security, yield, and ecosystem adoption in order to stand out over the long term.

7. Conclusion

Reservoir is not just another stablecoin project, it is a practical implementation of next-generation stablecoin design. By addressing the “Stablecoin Pentalemma,” it seeks a new balance between decentralization and stability, builds a bridge between yield and security, and extends the boundaries of stablecoin utility through RWA integration. With this architecture, Reservoir has the potential to become a pivotal protocol at the intersection of multi-chain finance and real-world assets, driving stablecoins into their true next-generation phase.

Recommended Reading:

- Why Choose MEXC Futures? Gain deeper insight into the advantages and unique features of MEXC Futures to help you stay ahead in the market.

- How to Participate in M-Day Learn the step-by-step methods and tips for joining M-Day and don’t miss out on over 80,000 USDT in daily Futures bonus airdrops.

- MEXC Futures Trading Tutorial (App) Understand the full process of trading Futures on the app and get started with ease.

Join MEXC and Get up to $10,000 Bonus!

Sign Up

-拷贝-211x150.jpg)