Credit Suisse (CS), one of the largest Swiss Banks is having bank run concerns. CS could be shutdown as well as SVB.

(Source: Image by macrovector on Freepik)

According to news and data, it has been said that the CS had difficulty 5 times in a row with huge losses with their earnings.

As the Credit Suisse was about to be face bank run problems, the Saudi National Bank stopped supporting Credit Suisse. And due to the happening, the stock price dramatically fall more than 30 percent.

Moreover, the US bank stock index crashed as well.

However, to prevent the problem that happens with Credit Suisse, Swiss central bank claimed that they will support liquidity if it is needed. After the statement from Swiss central bank, Nasdaq, SP500, Dow bounced back to where it should be.

Other than the CS incident, there were macro reports coming out. Including PPI index, retail sales, and CPI, and most of the macro reports were bad. This is a great signal from the FED to pause or lower the interest rate as they repeatedly stated that they are going to rely on labor market, inflation data, and so on.

Technical Analysis

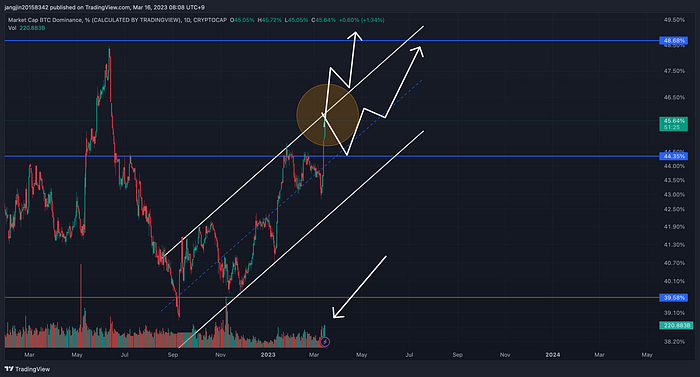

The Bitcoin dominance chart is an important data to look out for when trading or investing in Bitcoin market. Right now, dominance is having problem of breaking the resistance of the parallel channel. If dominance chart breaks the current resistance, it could make Bitcoin volatility up and lead Bitcoin break the current 25k area.

As said above, the main resistance is the 25k area forming a huge wick above 25k. If Bitcoin breaks 25k completely, many longs or buying pressure would be in.

Analyzing crypto market with technical analysis has a purpose to either trade or invest in to crypto. With a perspective of analyzing the chart, 25k area is a great place to take short. This could mean that the short liquidity will maybe push the market downward.

Looking at the Bitcoin chart, BTC price bounced hardly from 19.8k, more than 20 percent up to 26k with large wick. However, as predicting the shorts going to take down Bitcoin harder from 25k, it may seem that Bitcoin could have a correction at a fib 0.5 level.

Conclusion

In conclusion, the main fundamental and macro event was the Credit Suisse bankrun concern. Moreover, PPI and lots of economic reports came out bad, making FED probably pause interest rate.

From the technical analysis view, 23k might be the critical level of corrective wave for Bitcoin.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about crypto industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Get up to $10,000 Bonus!

Sign Up