World Liberty Financial’s highly anticipated WLFI token launch began at September 1, 2025 at 8:00 AM Eastern Time across multiple exchanges including MEXC. After raising $550 million from more than 85,000 investors, the Trump family-backed DeFi project is preparing for what many consider the most politically significant cryptocurrency launch in digital asset history.

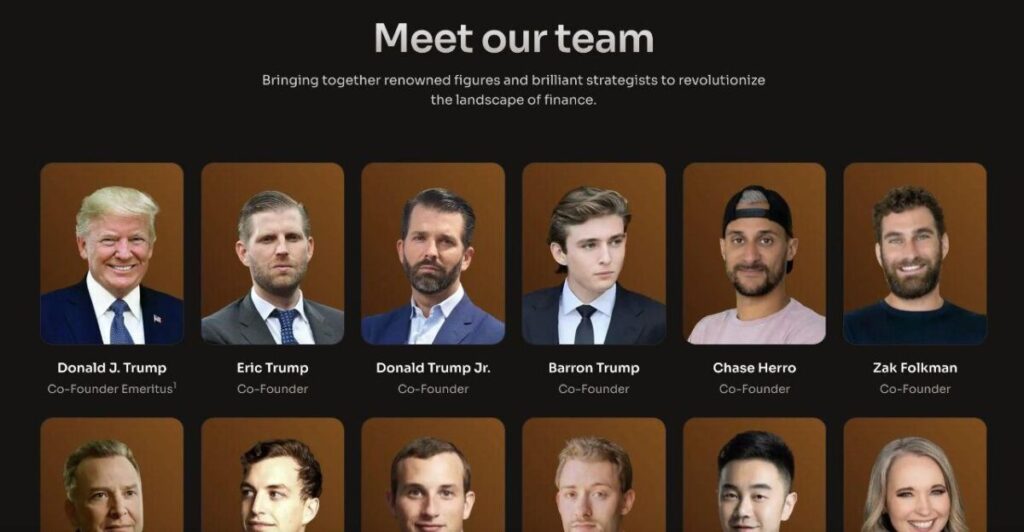

The project recently activated its Lockbox feature this week, allowing presale participants to prepare their wallets for the upcoming trading debut. With Donald Trump Jr. and other Trump family members actively backing the initiative, World Liberty Financial represents a unprecedented convergence of mainstream American politics with decentralized finance innovation.

MEXC has confirmed WLFI will be listed in the Innovation/Assessment Zone with pre-market trading available, positioning the exchange as a primary venue for this historic launch. The combination of political branding, substantial funding, and professional exchange support sets the stage for significant market attention when trading begins.

1. The $550 Million Funding Success: Verified Achievement

World Liberty Financial’s fundraising accomplishment represents one of the largest cryptocurrency project raises outside of major infrastructure protocols, with verified participation from over 85,000 individual investors across multiple funding rounds.

1.1 Confirmed Funding Structure and Investor Participation

According to verified reports, World Liberty Financial successfully raised $550 million through private funding rounds, with some sources indicating the total may approach $600 million when including all investor commitments. This substantial funding was achieved through two distinct presale phases priced at $0.015 and $0.05 per token, representing significant investor confidence in the project’s political brand and technical roadmap.

The broad investor base of more than 85,000 participants indicates genuine grassroots interest beyond typical institutional cryptocurrency funding rounds. This diverse investor foundation provides World Liberty Financial with a substantial community of stakeholders who have financial incentives to promote and utilize the platform upon launch.

The funding structure’s two-tier pricing demonstrates market validation, with the price increase from $0.015 to $0.05 reflecting growing investor confidence and demand during the fundraising process. This progression suggests sustainable interest rather than initial speculation that faded over time.

1.2 Investor Profile and Community Building

The participation of over 85,000 investors represents a unique achievement in cryptocurrency fundraising, where many projects struggle to build genuine communities beyond a small number of large institutional backers. This broad participation base provides World Liberty Financial with natural marketing reach and community engagement that money cannot purchase.

The investor profile likely includes both traditional cryptocurrency participants and political supporters attracted to the Trump family association, creating a hybrid community that bridges political and crypto ecosystems. This crossover appeal could drive adoption from user segments that wouldn’t typically engage with DeFi protocols.

The substantial community of financial stakeholders provides World Liberty Financial with built-in demand for platform services while creating natural advocacy for the project’s success across social media and political networks.

1.3 Trump Family Involvement and Political Positioning

Verified reports confirm active involvement from Donald Trump Jr. and other Trump family members in World Liberty Financial’s development and promotion. This high-profile political association creates unique positioning within the cryptocurrency space where political branding has typically been limited to community-driven meme projects.

The Trump family’s participation provides World Liberty Financial with brand recognition and political legitimacy that no other DeFi project can match, while also creating potential risks associated with political developments and changing public sentiment toward the Trump brand.

The political positioning strategy appears designed to appeal to American voters and investors who view cryptocurrency adoption as aligned with American financial leadership and innovation, creating market differentiation based on patriotic themes rather than purely technical features.

2. September 1st Launch Mechanics: Token Release and Trading Structure

World Liberty Financial has structured the WLFI token launch with careful attention to managing initial supply and creating sustainable market conditions during the critical first weeks of trading.

2.1 Controlled Token Release Schedule

When trading begins September 1st at 8:00 AM Eastern Time, presale investors will be able to access 20% of their token allocations immediately, providing initial market liquidity while preventing massive selling pressure that could destabilize prices during launch.

The remaining 80% of presale allocations will remain locked pending community governance votes, giving WLFI token holders democratic control over future supply releases. This governance mechanism aligns with decentralized finance principles while preventing traditional token dump scenarios that damage newly launched projects.

Notably, no tokens held by team members, advisors, or co-founders will unlock during the initial trading phase, eliminating insider selling concerns that often plague new cryptocurrency launches. This decision demonstrates commitment to long-term value creation rather than short-term profit extraction.

2.2 MEXC Integration and Trading Infrastructure

MEXC’s confirmed listing of WLFI in the Innovation/Assessment Zone reflects the exchange’s recognition of the project’s significant market potential while maintaining appropriate risk management protocols for new token launches. This listing category provides traders access while implementing additional monitoring and risk controls.

The exchange’s pre-market trading feature allows qualified users to establish positions before official spot market trading begins, providing price discovery mechanisms and liquidity building during the critical launch period. This infrastructure helps ensure orderly market conditions when full trading commences.

MEXC’s global reach and professional trading infrastructure position the exchange to handle significant volume and attention that WLFI’s political association and funding success are likely to generate during initial trading periods.

2.3 Lockbox Activation and User Preparation

World Liberty Financial activated its Lockbox feature this week, allowing presale participants to prepare their wallets and verify token allocations before trading begins. This preparation period addresses technical issues that could interfere with smooth market entry and user access to purchased tokens.

The Lockbox system provides presale investors with advance access to view their holdings and understand the platform interface without trading pressure, reducing confusion and technical problems that often characterize new token launches when users attempt to access their allocations simultaneously.

This systematic approach to launch preparation reflects professional project management designed to minimize technical issues while maximizing user satisfaction during the transition from private fundraising to public market trading.

3. World Liberty Financial Platform: DeFi Infrastructure and Token Utility

Beyond its role as a tradeable asset, WLFI serves as the governance token for World Liberty Financial’s comprehensive DeFi platform, which includes lending, borrowing, and stablecoin functionality built on Ethereum infrastructure.

3.1 Core DeFi Platform Features

World Liberty Financial operates as a complete DeFi ecosystem centered around its native USD1 stablecoin, which provides the foundation for lending and borrowing services within the platform. This integrated approach allows users to access comprehensive financial services while maintaining exposure to WLFI governance tokens.

The platform’s Ethereum-based infrastructure provides access to established DeFi protocols and liquidity while incorporating unique governance mechanisms tied to WLFI token ownership. This approach combines proven technical foundations with innovative political positioning.

Smart contract functionality enables automated lending, borrowing, and yield generation without traditional intermediaries, while governance features allow WLFI holders to influence platform development and strategic decisions.

3.2 WLFI Token Utility and Governance Functions

WLFI tokens provide holders with voting rights on platform governance issues including protocol parameters, partnership arrangements, and strategic development priorities. This democratic participation aligns with American political values while giving token holders direct influence over their investment outcomes.

Beyond governance, WLFI tokens offer utility functions including fee discounts on platform services, staking rewards for network participation, and potential access to exclusive features or content related to American political and economic themes.

The multi-functional utility design creates natural demand for WLFI tokens from platform users engaging with financial services rather than purely speculative trading, potentially providing more stable demand patterns than single-purpose tokens.

3.3 USD1 Stablecoin Integration

The platform’s USD1 stablecoin serves as a bridge between traditional dollar-denominated value and DeFi functionality, allowing users to maintain stable purchasing power while accessing yield generation and lending opportunities within the World Liberty ecosystem.

USD1’s integration with WLFI governance creates interconnected value propositions where stablecoin adoption drives demand for governance tokens while WLFI holders influence stablecoin monetary policy and platform development.

This integrated approach positions World Liberty Financial as a comprehensive alternative to traditional banking services while maintaining the political branding and American identity themes that differentiate the platform from purely technical DeFi competitors.

4. Market Analysis: Political DeFi and Competitive Positioning

World Liberty Financial enters the DeFi market with unique positioning that combines established blockchain technology with unprecedented political branding, creating new market categories that didn’t previously exist in cryptocurrency.

4.1 Political Cryptocurrency Sector Emergence

WLFI represents the most professionally developed entry in the emerging political cryptocurrency sector, with substantial funding and technical infrastructure that distinguish it from community-driven political meme tokens that lack serious development resources.

The timing of WLFI’s launch coincides with increased political focus on cryptocurrency policy and American financial technology leadership, creating potentially favorable conditions for projects that explicitly support American crypto innovation and adoption.

Previous politically-themed cryptocurrency projects have typically been speculative meme tokens without genuine utility or development teams, leaving substantial opportunity for professionally managed projects with real DeFi functionality and political legitimacy.

4.2 DeFi Market Integration Strategy

Within the established DeFi ecosystem, World Liberty Financial faces competition from mature protocols like Aave, Compound, and MakerDAO that have achieved significant scale and network effects. However, the political differentiation creates unique competitive advantages that purely technical projects cannot replicate.

The Trump family brand provides marketing reach and community loyalty that could accelerate user acquisition compared to DeFi projects that must build communities purely through technical features and token incentives.

Integration with American political networks and patriotic themes could drive adoption from user segments that wouldn’t typically engage with DeFi protocols, expanding the total addressable market beyond existing cryptocurrency demographics.

4.3 Institutional and Retail Interest Potential

WLFI’s political positioning creates opportunities for institutional investment from politically-aligned family offices, investment funds, and organizations that might avoid cryptocurrency exposure without clear American political themes and leadership involvement.

The substantial individual investor base from presale rounds provides grassroots marketing reach and community engagement that could drive organic adoption more effectively than traditional cryptocurrency marketing campaigns focused on technical features.

Conservative-leaning investors who have been skeptical of cryptocurrency due to regulatory uncertainty or political concerns might find WLFI’s explicit American positioning and Trump family involvement more acceptable than anonymous or international cryptocurrency projects.

5. Trading Considerations and Risk Assessment

WLFI’s unique characteristics require specialized analysis that accounts for both typical cryptocurrency market dynamics and political factors that could create additional volatility and opportunity.

5.1 Volatility Expectations and Market Dynamics

WLFI’s September 1st launch will likely experience significant volatility as traders attempt to establish fair value for a token with limited direct comparables in cryptocurrency markets. Political news cycles and media coverage could create additional price swings beyond typical new token volatility.

The controlled initial supply release of only 20% of presale allocations could amplify price movements if demand significantly exceeds immediately available tokens, creating potential for both rapid appreciation and sharp corrections based on sentiment changes.

Political developments involving the Trump family, cryptocurrency regulation, or broader market conditions could create rapid sentiment shifts that affect WLFI pricing independently of the underlying DeFi platform’s technical performance or user adoption.

5.2 MEXC Trading Tools and Infrastructure

MEXC’s comprehensive trading platform provides essential risk management tools for navigating WLFI’s expected volatility while capitalizing on opportunities created by unique political and market dynamics surrounding the launch.

The exchange’s advanced order types including stop-losses, take-profits, and conditional orders will be crucial for managing positions during volatile initial trading when political news or market sentiment could create rapid price movements.

Pre-market trading capabilities allow qualified users to establish positions before full market trading begins, providing early price discovery and positioning opportunities for traders who understand the political and technical factors likely to influence WLFI’s performance.

5.3 Long-Term Investment Thesis and Risk Factors

WLFI represents a unique investment thesis combining American political themes with legitimate DeFi infrastructure, creating potential for sustained value appreciation if the platform successfully executes its technical roadmap while maintaining political relevance.

The governance utility of WLFI tokens provides long-term value beyond speculative trading, as token holders gain democratic participation in platform development and strategic decisions that could significantly impact future growth and profitability.

However, political risks including regulatory scrutiny, changing public sentiment toward the Trump brand, or electoral developments could create challenges that purely technical DeFi projects don’t face, requiring careful consideration of political factors alongside traditional cryptocurrency investment analysis.

6. Conclusion: Historic Launch Approaches

World Liberty Financial’s WLFI token launch on September 1st represents a significant moment in cryptocurrency history where established political influence meets decentralized finance innovation. The verified $550 million funding from over 85,000 investors demonstrates substantial demand for politically-themed DeFi platforms that combine American identity with blockchain technology.

MEXC’s confirmed listing provides professional trading infrastructure for what promises to be one of 2025’s most watched cryptocurrency launches. The exchange’s Innovation/Assessment Zone classification and pre-market trading capabilities offer appropriate risk management while providing access to this unique market opportunity.

The success or failure of WLFI’s market debut will likely influence future development of politically-themed cryptocurrency projects while testing whether American political branding can create sustainable competitive advantages in the competitive DeFi ecosystem.

For investors and traders, WLFI offers exposure to an unprecedented combination of political influence and blockchain technology, with the potential for significant returns balanced against unique political and regulatory risks that require careful consideration and appropriate position sizing.

The countdown to September 1st continues, with all stakeholders preparing for a launch that could establish new categories within cryptocurrency markets while advancing the integration of American political themes with decentralized finance innovation.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!

Sign Up