Key Highlights:

- Redefining On-Chain Derivatives Trading: Superp introduces an on-chain order book matching mechanism that operates without oracles, enabling fairer and more transparent price discovery.

- Minimalist Architecture for Better UX: By eliminating complex LP models and market-making mechanisms, Superp offers intuitive and efficient order matching with a lower learning curve.

- Three Innovative Products for Diverse Needs: NoLiquidation Perp, Meme Perp, and Alpha Perp each provide unique features balancing yield potential and risk management.

- Points System to Drive Community Engagement: Users can collect “Sugar” and upgrade their Ice Cream Truck to earn potential token airdrops and access other ecosystem benefits.

- Built for High-Leverage and Advanced Users: With leverage support up to 10,000x, Superp caters to professional traders and quantitative strategy developers alike.

While Uniswap sparked explosive growth across the DeFi ecosystem, centralized exchanges still dominate the derivatives space. This is largely due to structural limitations in current DeFi derivatives protocols, such as oracle delays and manipulation, slippage and liquidation risks, low capital efficiency, and high operational complexity.

Superp was built to address these pain points. It not only reimagines the design logic of perpetual contracts but also delivers a streamlined and user-friendly experience—ushering in a new era of decentralized trading.

1. What Is Superp?

Superp is a decentralized perpetual Futures protocol built on BNB Chain. Through its innovative “Super Perps” mechanism and oracle-free architecture, Superp delivers a fairer, more scalable, and highly efficient DeFi derivatives trading experience. By moving away from traditional DeFi models, Superp addresses common on-chain issues such as slippage, oracle attacks, and fragmented liquidity. It introduces a fully on-chain, oracle-free price discovery mechanism, enhancing security, transparency, and decentralization.

Superp offers up to 10,000x leverage for derivatives traders, providing unprecedented flexibility and an innovative user experience. It is specifically designed for:

- Users who want to engage in Futures trading but do not trust centralized platforms

- Advanced DeFi traders seeking deep liquidity and low fees

- Developers or institutions looking to deploy quant strategies or grid trading systems natively on-chain.

2. Superp Tokenomics

As of now, the team has not released detailed tokenomics. Please refer only to official announcements and beware of online rumors that may lead to asset loss.

Although the token mechanism has not yet been disclosed, Superp has introduced a points system built around its future token. Users can earn points called Sugar to upgrade their Ice Cream Cart and actively contribute to the Superp ecosystem. Sugar can be earned through regular campaigns and will be redeemable for token airdrops in the future.

2.1 How to Earn Sugar

Superp currently offers five official ways to earn Sugar:

1) Purchase: Buy Sugar directly to speed up Ice Cream Cart upgrades.

2) Complete Tasks: Visit the Earn page and complete various tasks to earn Sugar.

3) Invite Friends: Share your invite link with friends; earn Sugar when they join successfully.

4) Free Claim: Claim free Sugar every 8 hours on the Airdrop page.

5) Event Rewards: Participate in platform campaigns and special events for bonus Sugar.

2.2 What Is the Ice Cream Cart?

The Ice Cream Cart is the core of Superp’s points system, gamifying user engagement and increasing the chances of earning rewards. It plays a central role in the platform’s ecosystem—users can upgrade their cart with Sugar to unlock larger future airdrops of the SUP token.

Users spend Sugar to upgrade their cart. As the level increases, more Sugar is required. Importantly, the cart level directly affects how much in token airdrops a user may receive in the future.

3. Technical Innovations of Superp

3.1 Super Perps Mechanism: Breaking Away from Oracle-Based Pricing

In Superp:

- All trades are executed through an on-chain order book.

- Prices are determined exclusively by counterparties, with no reliance on external data feeds.

- Price discovery and liquidation are achieved entirely without oracles.

This design offers several significant advantages:

- Elimination of slippage: Trades are executed at clearly defined prices agreed upon by both parties, enhancing execution certainty.

- Resilience against oracle manipulation: The system is inherently protected from common exploits, such as flash loan-based oracle attacks.

- Enhanced transparency and fairness: All orders are fully visible and verifiable on-chain, reinforcing trust in the trading process.

3.2 Market Maker-Free Model: Simplified Market Structure

Superp eliminates the need for traditional AMM or LP models and does not rely on complex liquidity pools like those in GMX or dYdX. Instead, traders match directly with each other, with no third-party market makers or liquidity providers. Benefits include:

- Extremely high capital efficiency with demand-driven matching.

- No need for “liquidity mining” incentives.

- Reduced protocol inflation and token emission pressure.

3.3 Liquidation Mechanism: Prices Derived from Real Trade Data

Superp derives its pricing curve directly from on-chain order book data, forming liquidation thresholds based on actual trade execution. This allows the platform to determine fair and stable liquidation prices based on completed transactions. Liquidations are triggered and executed by Keeper nodes, ensuring both efficiency and transparency.

4. Superp Product Suite

4.1 NoLiquidation Perp(Profit Swap Contract,PSC)

NoLiquidation Perp is an innovative product that allows users to gain exposure to the potential returns of an asset for a fixed fee over a set period—without liquidation risk or additional costs.

Key features include:

Low Cost: Users pay a fixed fee upfront for access to future returns on a given asset.

No Liquidation: Once purchased, the contract runs through the full duration without risk of being liquidated.

No Slippage: Trades are executed at a preset price, unaffected by market fluctuations.

Zero Trading Fees: Users only pay the fixed cost of the product, with no hidden or extra fees.

Unlimited Leverage: As the contract nears expiry, its cost naturally decreases, effectively increasing leverage, up to 10,000x—allowing users to amplify returns with minimal capital input.

4.2 Meme Perp (Total Return Swap, TRS)

Meme Perp is a decentralized coin-margined derivatives platform that allows users to long or short newly listed tokens, available for trading as soon as 10 minutes after launch.

Key features include:

User Collateralization: Assets remain secure, and yields are generated through trading fees.

Long/Short Capability: Both positions require collateral, offering transparent risk management and return structures linked to market performance.

Liquidation Mechanism: Fair and automated liquidations protect all parties and enhance platform stability.

4.3 Alpha Perp

Alpha Perp is tailored for high-growth alpha tokens listed on Binance, offering a leverage trading experience optimized for performance and risk management. Building on the core logic of TRS-based Meme trading, Alpha Perp introduces enhanced risk controls, curated asset pools, and refined incentive models.

Key features include:

Token Risk Profiling: Each Meme token receives its own LTV ratio, interest rate cap, and liquidation tolerance.

Curated Markets: Focused exclusively on high-potential Binance-listed Alpha tokens.

Dynamic Interest Ranges: Borrowing costs adjust flexibly based on market volatility—rewarding stable positions and penalizing riskier behavior.

Liquidation Protection: A dual-oracle system significantly reduces the chance of erroneous liquidations.

5. The Next Frontier in Decentralized Trading

Superp breaks away from DeFi’s traditional reliance on oracles and liquidity pools, reconstructing its trading mechanism from first principles. Through its unique on-chain matching system and simplified transaction process, Superp offers a more transparent, efficient, and user-friendly alternative for decentralized derivatives trading.

On the product level, its diversified contract offerings provide flexibility to accommodate various user needs. As the project continues to evolve and its tokenomics are gradually unveiled, Superp is well-positioned to carve out a meaningful role in the decentralized derivatives space, delivering a more trustworthy and open on-chain trading experience.

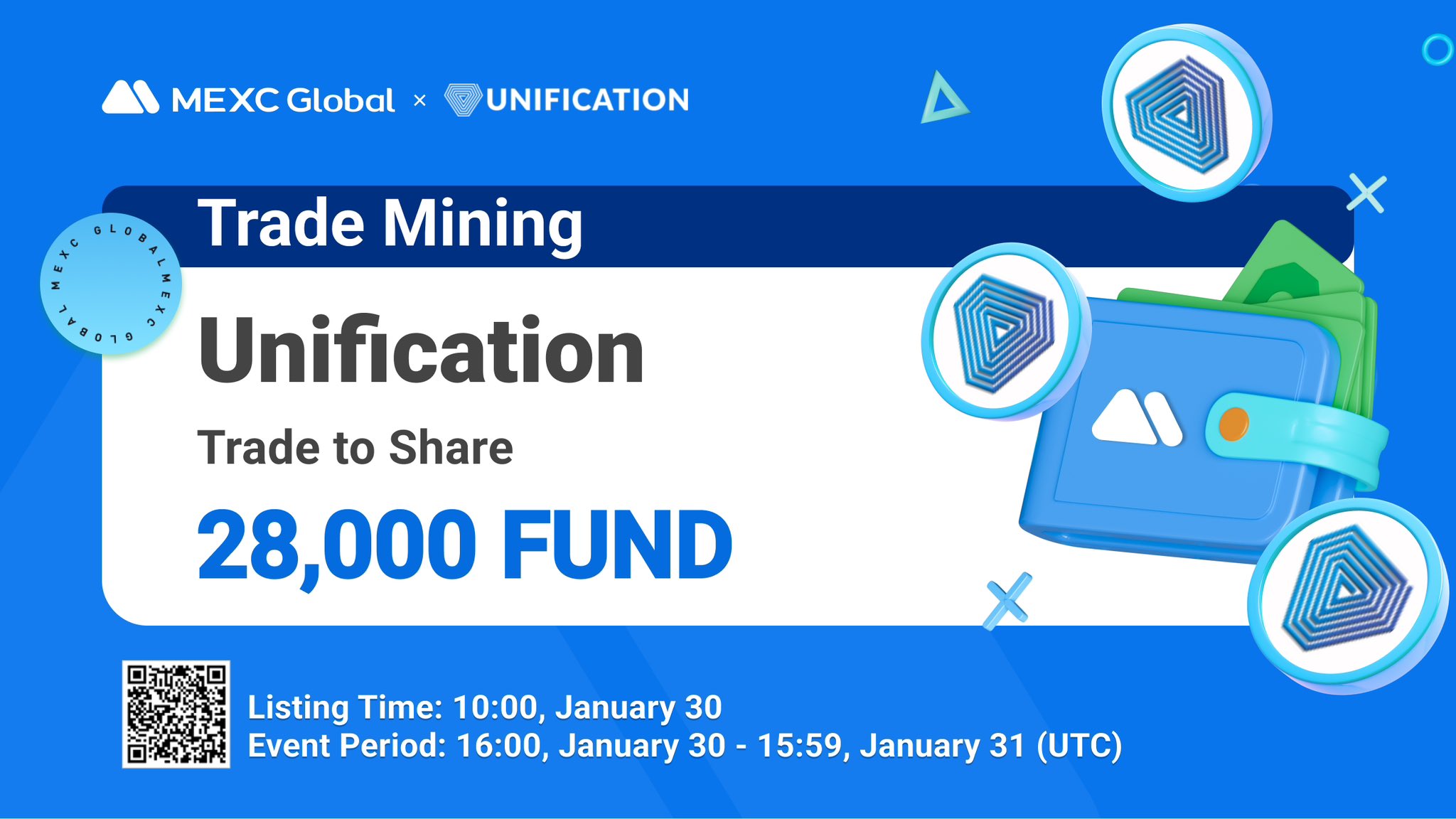

Join MEXC and Get up to $10,000 Bonus!

Sign Up