Kinto is a modular exchange or MEX. It is designed to provide users with the best opportunities in DeFi through a custom-built blockchain and a non-custodial smart wallet. Unlike traditional centralized (CEX) or decentralized exchanges (DEX), Kinto merges the best of both worlds, offering users a secure, compliant, and seamless trading experience.

With its unique user-owned KYC model, account abstraction, and cross-chain liquidity solutions, Kinto stands out as an innovative platform that bridges DeFi with traditional finance.

Kinto (K) Listing: Launch Date Uncovered

The highly anticipated Kinto (K) listing is scheduled to debut on MEXC, a major cryptocurrency exchange known for featuring innovative blockchain projects. This significant market entry provides investors with their first opportunity to trade the token powering this security-focused Layer-2 platform.

MEXC will list Kinto (K) with the following schedule:

- Deposit: Already opened

- K/USDT Trading (Innovation Zone): March 31, 2025, 15:00 UTC

- K/USDC Trading (Innovation Zone): March 31, 2025, 15:20 UTC

- Withdrawal Availability: April 1, 2025, 15:00 UTC

- MEXC Convert Integration: March 31, 2025, 16:00 UTC

The MEXC Convert feature will allow traders to exchange K tokens with other cryptocurrencies at fixed rates without slippage or fees, providing enhanced liquidity and trading flexibility from day one of the listing.

Who is The Founder of Kinto?

Kinto was founded by a team of blockchain developers and financial experts aiming to create a secure and compliant DeFi ecosystem. The project is backed by a strong community governance model where users actively participate in decision-making.

The vision behind Kinto is to eliminate barriers in DeFi by integrating on-chain KYC, institutional-grade compliance, and seamless onboarding. The project enables users to hold real-world assets (RWA) on-chain, participate in decentralized finance, and access opportunities unavailable on traditional platforms.

Meanwhile, the name “Kinto” is derived from the phrase “golden road.” This name reflects the project’s vision of creating a seamless and secure pathway for users to access decentralized finance (DeFi) while maintaining compliance and institutional-grade security.

By choosing “Kinto,” the founders aimed to symbolize a smooth, optimized journey into blockchain finance, where both retail and institutional users can navigate DeFi without the usual barriers of security concerns, complex onboarding, or regulatory uncertainty. The name encapsulates the idea of bridging traditional finance with DeFi, making it more accessible to a broader audience.

History of Kinto

Kinto began as Engen, a launch program that ran from November 2023 until May 17, 2024, when Kinto officially launched. The Engen program was designed to reward early adopters who contributed to the network’s growth and development before its mainnet debut. Participants in Engen received Engen soulbound tokens, granting them the status of Kinto Founding Members with exclusive governance rights.

During this phase, Engen holders played a crucial role in shaping Kinto’s foundational policies through proto-governance proposals. These proposals were approved by the community and set the stage for Kinto’s future operations, governance framework, and mining incentives. As a reward for their early support, Engen holders received allocations of $K tokens and a permanent 15% mining bonus within the Kinto ecosystem.

Once the Engen phase concluded, Kinto emerged as a fully operational modular exchange that combines the best elements of centralized and decentralized finance. It introduced key features such as user-owned KYC, passkey authentication, and blockchain-level security to ensure a seamless and compliant DeFi experience. The transition from Engen to Kinto marked the evolution from a community-driven experimental phase to a full-fledged DeFi ecosystem with a strong governance model, institutional-grade security, and cross-chain liquidity solutions.

What is the Difference Between Kinto and K Token?

Kinto is the name of the blockchain and ecosystem, while K is the governance token of the platform. Holding K tokens allows users to participate in governance decisions and access exclusive benefits, such as boosted mining rewards.

Key Features of Kinto (K)

Kinto is a modular exchange designed to bridge the gap between centralized and decentralized finance. It offers a secure, user-friendly, and highly scalable ecosystem that brings institutional-grade security to DeFi. Below are the core features that make Kinto unique:

1. User-Owned KYC (Self-Sovereign Identity)

Unlike traditional KYC models, Kinto allows users to verify their identities without linking personally identifiable information (PII) to their on-chain wallets. This ensures users maintain control over their personal data while still meeting regulatory requirements. KYC is required to access Kinto, but the process is handled by third-party identity providers, ensuring privacy and security.

2. Passkey Authentication

Kinto eliminates the need for passwords by using passkeys, which provide a more secure and seamless login experience. Users can access their accounts through biometric authentication, such as Face ID or Touch ID, or device-based PINs. This method enhances security while removing the risks associated with traditional passwords and two-factor authentication.

3. Account Abstraction

Kinto simplifies the crypto experience by implementing account abstraction, allowing users to interact with DeFi applications without managing private keys or installing browser extensions. Instead, they can use familiar authentication methods like username/password, mobile device keys, or 2FA, making onboarding more accessible to new users.

4. Kinto ID

Every user who completes KYC receives a Kinto ID, an NFT that grants access to the Kinto network. This NFT is unique, cannot be transferred, and is required for all transactions on Kinto. Furthermore, the Kinto ID ensures sybil resistance, making the network more secure while maintaining user sovereignty.

5. Cross-Chain Liquidity Management (Musubi)

Meanwhile, Kinto goes beyond traditional DeFi platforms by actively managing liquidity across multiple blockchain networks, including Ethereum, Arbitrum, Base, and Hyperliquid. Through Musubi, Kinto optimizes liquidity usage, ensuring users can access the best trading opportunities across different chains while minimizing slippage and inefficiencies.

6. Non-Custodial Smart Wallet

Kinto provides a smart wallet that is fully non-custodial, meaning users have complete control over their funds. The wallet integrates advanced security features while maintaining ease of use, allowing users to interact with the ecosystem without complex setups.

7. Institutional-Grade Compliance and Security

Kinto enhances blockchain security by embedding KYC, anti-money laundering (AML) measures, insurance, and fraud monitoring at the network level. This makes it one of the safest DeFi platforms for both retail and institutional investors.

8. Mining Program for Passive Rewards

Users can participate in Kinto’s mining program by simply depositing capital. The program is designed to reward users based on the amount and duration of their deposits, making it accessible with a minimum deposit as low as 20 dollars via Base or Arbitrum. Those who participated in Kinto’s early launch program, Engen, receive additional benefits, such as a permanent 15 percent bonus on mining rewards.

9. Two-Layer On-Chain Governance

Kinto operates under a decentralized governance model where major protocol decisions are made through on-chain voting. The governance system consists of nine elected guardians, known as Nios, who oversee key protocol parameters, the sequencer, and the treasury. Nios are elected by token holders on a rolling six-month basis, ensuring continuous community involvement in Kinto’s future development.

Tokenomics of K Token

The K token serves as the governance and utility token within the Kinto ecosystem. While detailed tokenomics have not been fully disclosed, K holders can expect governance rights, staking opportunities, and rewards for participating in the network.

Initial K Token Supply and Inflation Model

Kinto launched with an initial total supply of 10 million K Tokens. The tokenomics framework allows for governance to introduce a capped yearly inflation of up to 5 percent. However, if inflation is ever activated, the maximum supply will never exceed 15 million tokens. This ensures controlled issuance while maintaining the token’s value over time.

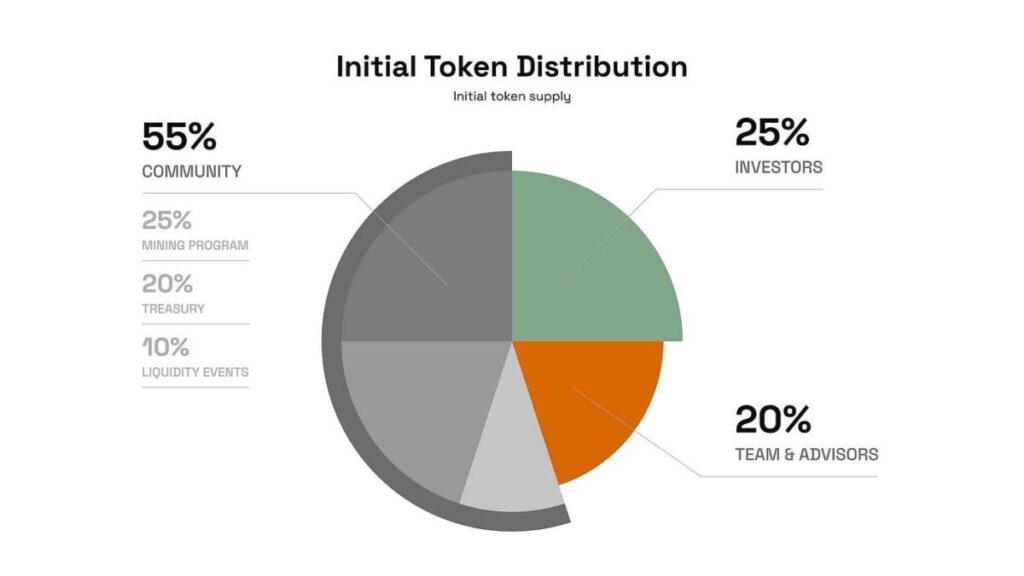

K Token Allocation and Circulating Supply at Launch

The distribution of K Tokens follows a carefully structured model to balance incentives among investors, contributors, and the community.

- 18.5 percent of the total supply has already been sold across three funding rounds, raising a total of 7 million dollars. The latest round, conducted in January 2024, valued K Token at 10 dollars per token.

- Upon listing, 33 percent of the total supply will be in circulation. This includes:

- 20.5 percent allocated to investors

- 10 percent allocated to Engen participants and mining rewards

- 2.5 percent designated for liquidity events and exchange listings

This high initial float ensures a relatively low fully diluted valuation (FDV) at launch, distinguishing Kinto from most other projects that start with artificially low circulating supply.

Vesting Schedule and Team Lock-Up

To maintain long-term stability and prevent excessive early sell-offs, Kinto has implemented a structured vesting schedule:

- Team members have a three-to-four-year vesting period, with an initial one-year lock that began when the token was deployed on June 30, 2024.

- To prioritize investors and early adopters, the team has voluntarily extended their lock period until October 1, 2025. This move demonstrates long-term commitment and aligns team incentives with the project’s growth.

By structuring its token distribution with a high initial float, controlled inflation, and long-term team vesting, Kinto ensures a sustainable and fair token economy that supports both early participants and future adopters.

What Makes Kinto (K) Different from Other Blockchains?

While most platforms fall into either fully decentralized but security-challenged networks or private, isolated systems with limited interoperability, Kinto (K) creates a largely unexplored third category: a secure, compliant blockchain that maintains full connection to Ethereum’s vibrant ecosystem.

By combining the best aspects of both worlds, Kinto (K) offers high-security guarantees and built-in compliance tools while still benefiting from Ethereum’s liquidity, developer community, and interoperability.

The following table demonstrates how Kinto (K)’s MEX model delivers comprehensive advantages across security, trading capabilities, real-world asset support, and user experience compared to traditional alternatives:

| Feature | MEX(Kinto) | CEX | DEX | Crypto Wallets |

|---|---|---|---|---|

| Security | Complete suite: KYC/AML, insurance protection, non-custodial control, full recovery options | Limited: Missing insurance and non-custodial capabilities; requires sharing personal information | Partial: Non-custodial and private, but lacks insurance and security recovery options | Moderate: Non-custodial with privacy, but limited insurance or recovery features |

| Trading | Comprehensive: Trading, swapping, staking, onramping, and lending | Strong trading features but typically limited lending options | Strong in swapping but limited in staking, onramping, and lending services | Limited primarily to swapping and staking |

| Real-World Asset Support | Complete: Supports tokenized stocks and maintains AML compliance | Limited: Generally lacks tokenized stock options | Very limited: Neither stocks nor AML compliance | Minimal: No stock support or AML features |

| User Experience | Seamless: Single platform for all financial services | Fragmented: Strong in some areas, weak in others | Limited: Good for swaps but missing several key services | Basic: Strong privacy but limited functionality |

Functions of the K Token

K Token ($K) is the core utility and governance asset of the Kinto ecosystem. It serves multiple roles within the network, ensuring decentralization, security, and incentivization for users. Below are its key functions.

Governance and Decision-Making

K Token holders have the power to participate in Kinto’s governance system. They can propose and vote on key protocol changes, network upgrades, and treasury allocations. This decentralized governance structure ensures that the community has direct influence over the network’s future development.

Staking and Mining Rewards

Users can stake K Tokens to secure the network and earn rewards. Kinto’s mining program allows participants to deposit assets and earn K Tokens as incentives. The staking mechanism encourages long-term holding and active participation in the ecosystem.

Liquidity Provision and Incentives

K Token is used to provide liquidity within the Kinto ecosystem. Participants who contribute liquidity to decentralized exchanges and other financial protocols within Kinto can receive K Tokens as rewards. This mechanism enhances market efficiency and trading depth.

Payment for Network Services

K Token is utilized for transaction fees and access to premium features within the ecosystem. This includes payments for advanced DeFi tools, institutional services, and potential real-world asset integrations that Kinto plans to support.

Exclusive Benefits for Engen Participants

Users who participated in the Engen launch program are entitled to additional perks, including priority governance participation and a permanent 15 percent bonus in the mining program. These benefits further integrate K Token into Kinto’s incentive structure.

By combining governance, staking, liquidity, and transaction-based utility, K Token plays a vital role in maintaining the functionality and decentralization of the Kinto network.

The Future of Kinto

Kinto plans to expand its ecosystem by integrating more real-world assets, enhancing cross-chain liquidity, and introducing additional DeFi features. With its focus on security, compliance, and usability, Kinto aims to bridge the gap between traditional finance and blockchain technology.

Is Kinto Better Than Other DeFi Platforms?

Compared to other DeFi solutions, Kinto offers unique features such as user-owned KYC, passkey authentication, and seamless real-world asset integration. While some platforms provide higher decentralization, Kinto balances compliance and security, making it appealing for institutional and retail users alike.

Recent News Regarding Kinto

- Kinto launched its mainnet in May 2024

- Engen launch participants received governance benefits and mining bonuses

- The K token is set to be listed on or before March 31, 2025

- Kinto’s liquidity engine, Musubi, extends support across multiple chains, including Ethereum, Arbitrum, and Base

Where to Buy K Tokens

Once the K token is listed, it will be available on:

- Centralized exchanges (CEX), such as MEXC

- Decentralized exchanges (DEX), including those supporting Kinto’s modular blockchain

How to Buy K Tokens on MEXC

- Sign Up/Login – Create an account on MEXC.

- Deposit Funds – Add USDT or other supported currencies.

- Search for K – Locate the K/USDT trading pair.

- Place Your Order – Choose market or limit order and buy K.

- Store Securely – Transfer to a personal wallet if needed.

What to Do After Buying K Tokens

After purchasing K tokens, there are several ways to maximize its potential, whether you are a trader, investor, or long-term holder.

Trade Crypto at MEXC’s Spot and Futures Market

There are many hot trending tokens for you to choose from at MEXC’s spot and futures markets, providing opportunities for both short-term and long-term traders. Spot trading allows users to buy and sell K at real-time market prices, while futures trading enables speculation on price movements with leverage, amplifying potential gains. Furthermore, MEXC’s high liquidity ensures smooth order execution, making it an ideal platform for both novice and experienced traders.

Join MEXC Airdrop+

MEXC Airdrop+ is an exclusive platform where users can deposit tokens and complete missions to earn more tokens!. Gain access to early-stage projects and earn from a huge prize pool simply by depositing your tokens and trade! This offers a risk-free way to accumulate new assets while maintaining your investment.

Why Trade Crypto on MEXC?

MEXC stands out as one of the best exchanges for trading tokens due to its superior trading conditions and user-friendly features.

Low Trading Fees

One of MEXC’s biggest advantages is its competitive fee structure. With some of the lowest trading fees in the industry, users can execute trades at minimal cost, maximizing their profits. Low fees are especially beneficial for high-frequency traders who make multiple transactions daily.

High Liquidity for Seamless Trading

Liquidity is a crucial factor in trading, and MEXC offers deep liquidity for crypto trading, ensuring smooth order execution with minimal price slippage. Whether you’re placing small trades or executing large orders, you can do so efficiently without impacting the market price significantly.

Robust Security Measures

Security is a top priority at MEXC. The exchange implements industry-leading security protocols, including multi-layer encryption, cold wallet storage, and real-time monitoring, to protect user funds from potential threats. These robust measures ensure that your crypto holdings remain secure at all times.

Diverse Trading Options

MEXC provides a variety of trading options, catering to different trading strategies. In addition to spot trading, users can access leveraged futures contracts, allowing them to maximize their gains on market movements. Staking and passive earning options are also available, making MEXC a one-stop platform for crypto investors.

Explore More MEXC Features

MEXC offers a range of innovative tools and platforms to enhance your trading experience.

Airdrop+

Airdrop+ is MEXC’s exclusive feature that rewards users with free token airdrops. By holding or trading specific tokens, users can receive bonus airdrop rewards from upcoming projects. This is an excellent way to accumulate additional crypto assets without extra investment.

DEX+

For those who prefer decentralized trading, MEXC’s DEX+ provides a seamless and secure way to trade without relying on centralized intermediaries. DEX+ offers full control over your assets, enhanced privacy, and access to liquidity pools for optimized trading.

Price Predictions

MEXC provides expert-driven token price prediction insights, helping traders stay informed about potential market trends. With accurate analysis and real-time data, users can make strategic decisions based on informed market projections.

Crypto Calculator

Managing your investments is easier with MEXC’s Crypto Calculator, which helps users calculate potential profits, losses, and rewards. Whether you’re planning trades or evaluating long-term returns, this tool provides essential financial insights at a glance.

FAQs

1. What makes Kinto (K) different from other Layer-2 solutions?

Kinto (K) distinguishes itself through built-in KYC/AML systems, non-custodial smart contract wallets, and native insurance protection. It bridges traditional finance security with DeFi flexibility while maintaining full connection to Ethereum’s ecosystem.

2. How does Kinto (K)’s mining program work?

Kinto (K)’s mining program rewards users based on their deposit amount and duration. Participants need only deposit a minimum of $20 via Base or Arbitrum. Early Engen program participants receive a permanent 15% bonus on mining rewards.

3. Is Kinto (K) suitable for institutional investors?

Yes, Kinto (K) is specifically designed for institutional adoption. Its built-in compliance features, insurance protection, and ability to support real-world asset tokenization address key regulatory requirements that have previously prevented institutional DeFi participation.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing. Always conduct your research before making financial decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up