If you’re entirely new to Web3 and crypto. This article will take you through the tech rabbit hole.

What is Web 3?

It’s probably most helpful to think about Web 3 in the context of previous internet paradigms, Web 1 and Web 2:

Web 1

(1980s – early 2000’s) The first phase of the Internet, Web 1, was mainly about providing the everyday consumer with online content and information.

- As consumers could only read information or content online, and not yet interact with it, Web1 was incredibly static.

- When you think about Web 1, think of Internet Explorer, Yahoo, or Netscape. While Web 1 was read-only, the companies we associate with Web 1 were built on open protocols (meaning pretty much any person or organization could build on the internet and know they were subject to the same rules as the next person or organization).

Web 2

Web 2 is the version of the internet most of us know and use today. Where Web 1 was static and “read-only,” Web 2 was “read-write,” and interactive. Under Web 2, the Internet became more usable: Web 2 was dynamic and users could consume, interact with, and create content on the Internet themselves.

- Along the way, the internet became largely dominated by the four behemoths we know today as Apple, Amazon, Facebook, and Google. Web2 also saw an explosion in the use of smartphones, and most of the internet use was through mobile apps and hardware built by these companies. While this meant more people could participate in the internet, it also meant the internet was becoming increasingly controlled by the leading digital platforms.

- Why is this a problem? In the centralized internet, we know today, Apple can take a 30% cut on all paid-app downloads and in-app purchases, Twitter and Facebook can de-platform the POTUS, and the everyday consumer has less privacy, security, and control over their online information than ever before.

Web3

Web 3 is the future internet we’re moving towards. It is a decentralized internet. Under Web 3, the Internet belongs to everyone. Furthermore, a collective “we” governs it rather than centralized entities. The Web 3 world is one that has open-source protocols at its foundation. Web3 is about rearchitecting internet services and products so that they benefit people rather than entities.

Web1: Read

Web2: Read-Write

Web3: Read-Write-Own

Web3 analogs (from left to right): Showtime, Audius, Mirror, Bitclout, Filecoin & Arweave, Livepeer, The Graph, Decentraland

Crypto Basics: let’s Start from Square 1

What is a Blockchain?

Blockchain is an immutable, digital ledger that facilitates the process of recording transactions and tracking assets in a network. It constantly updates itself and shares across many computers in a network.

How Does a Blockchain Work?

Each transaction record is a “block” of data. Furthermore, each block connects to the ones before and after it, forming a chronological “chain” of data as an asset moves or ownership of an asset changes. The blocks confirm the exact time and sequence of transactions, and the blocks link securely together to prevent any block from being altered or a block being inserted between two existing blocks. Each additional block strengthens the verification of the previous block and hence the entire blockchain, making the blockchain immutable.

But how does it really work?

Blockchain networks are driven by systems of aligned incentives. A well-functioning public blockchain requires a community of users, node operators, developers, and miners, who all play roles in a mutually beneficial network ecosystem.

A blockchain is maintained by a distributed network of parties (“miners” or “validators,” depending on the kind of chain). These parties produce blocks jointly via consensus. In simple terms, the parties vote on how to process a set of transactions—or in other words, how to construct the next block. The block with majority support is the one that is written permanently onto the chain.

What Are the Benefits of Blockchain Technology?

Trust: Blockchain’s decentralized nature means that information is stored and synchronized across a number of computers and is tamper-resistant, creating trust in the data. Consensus on data accuracy is required from all network members, and all validated transactions are immutable because they are recorded permanently. No one, not even a system administrator, can delete a transaction.

What are Nodes?

Nodes are the “boots on the ground” of blockchain networks. They are the physical computer hardware that runs their respective platform’s blockchain software. Nodes serve several critical functions:

- They vote on and validate blocks of transactions

- They communicate with other nodes to agree on the state of the blockchain

- They store the history (state) of the blockchain as a universal source of truth

- They are the endpoints of the network that enable users to access and interact with applications built on the network.

What are Smart Contracts?

Smart contracts are programs (chunks of code) stored on a blockchain that automatically execute when predetermined conditions are met. They are typically used to automate the execution of an agreement so that all participants can be immediately certain of the outcome, without any intermediary’s involvement or time loss. Smart contract applications include everything from games to logistics tools to DeFi dapps.

Let’s go a bit deeper!

Consensus Mechanisms in Blockchains

PoW (Proof of Work)

- Under PoW, a distributed network of miners around the world race to solve increasingly difficult cryptographic problems in order to create a new block on the blockchain containing the new transactions. Solving these problems requires a lot of energy. When a block is entered into the blockchain, the transactions in it officially become part of the record. Miners who successfully create a block are rewarded with freshly minted tokens and all of the transaction fees within the block.

PoS (Proof of Stake)

- Under PoS, participants (validators) deposit a certain number of native coins as stakes into the network of validator nodes. If a node is chosen to validate the next block, it’ll check that all the transactions within the block are valid. If everything checks out, the node signs off on the block and adds it to the blockchain. As a reward, the node receives the fees associated with the transactions inside the block and freshly minted tokens. If a validator approves fraudulent transactions, they’ll lose a part of their stake. As long as the validator’s stake is higher than what they receive from transaction fees, they can be trusted to correctly do their job.

Proof of History (technically not a consensus mechanism)

- Proof of History uses cryptographic timestamps to sequentially order each transaction that occurs on Solana to provide verifiable ordering without requiring all nodes to agree simultaneously.

What is Ethereum?

I’m so glad you asked.

Ethereum is a decentralized, blockchain-based global supercomputer that launched in 2015 to serve as the foundation for an ecosystem of interoperable, decentralized applications (dApps) powered by token economies and automated smart contracts.

- Assets and applications designed on Ethereum are built with self-executing smart contracts that remove the need for a central authority or intermediary.

- The network is fueled by its native cryptocurrency ether (ETH), which is used to pay transaction fees on the network.

- Open-source, programmable, private, and censorship-resistant, Ethereum forms the backbone of a decentralized internet, which has already spawned significant innovations like Initial Coin Offerings (ICOs), stablecoins, and decentralized finance (DeFi) applications.

What is Composability?

Composability allows anyone in a network to easily build on top of and around existing products and services to devise new use cases; use cases that many did not know were possible until they were invented. (Think about Excel, and how chaining functions creates an enormous number of potential computational pipelines. Excel’s power and flexibility grow with each additional function.) Ethereum’s composability has allowed users a high degree of freedom in being able to affect relatively complex transactions under one security framework, on one chain, and with relative ease.

What is DeFi?

DeFi refers to “decentralized finance,” an effort to transform the financial services industry by making transactions faster, cheaper, and more secure.

Think of DeFi in layers:

- The blockchain – Ethereum contains the transaction history and state of accounts.

- The assets – ETH and the other tokens (currencies).

- The protocols – smart contracts that provide the functionality, for example, a service that allows for decentralized lending of assets.

- The applications – the products we use to manage and access the protocols.

What are Gas Fees?

Gas fees are essentially the transaction fees people pay to submit a transaction to the block. It go towards incentivizing miners to spend the money required, in the form of hardware and electricity, to solve the puzzle and create the block.

Gas fees are typically measured in GWEI:

- Gwei is a denomination of ether, the native cryptocurrency of the Ethereum blockchain. 1 gwei is equal to 0.000000001 ETH.

What is an Ethereum Wallet?

An Ethereum wallet lets you access and manage an Ethereum account, serving as the gateway to bankless financial services with DeFi, the culture legos of NFTs, on-chain identity management for DAOs, and beyond.

What are dApps?

Decentralized applications (dApps) are digital applications or programs that exist and run on a blockchain or P2P network of computers instead of a single computer and are outside the purview and control of a single authority.

dApps are most commonly used for:

- NFTs

- DeFi

- Gaming

- Social

- Exchanges

Check out the most popular dApps on DappRadar

What is Staking?

Staking refers to the process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. In the context of Ethereum, stakeholders (called validators) contribute ETH to a staking pool in exchange for rewards in proportion to the size of their stake. The Ethereum network selects a winner based on the amount of ETH each validator has in the pool and the length of time they’ve had it there (rewarding the most invested participants). After the winner has validated the latest block of transactions, other validators can attest that the block is accurate; after consensus is reached, the blockchain is updated, and all participating validators receive a reward in ETH.

Learn more: Yield Farming

Learn more: Ethereum 2.0 staking (Coinbase)

What is Yield Farming?

Yield farming is the practice of staking or locking up cryptocurrencies within a blockchain protocol to generate tokenized rewards. Many DeFi projects rely on yield farming to incentivize users to contribute to the network’s liquidity and stability, since these projects do not rely on a centralized market facilitator.

What is TVL (Total Value Locked)?

Total value locked (TVL) is a metric that measures the aggregate value of all crypto assets locked in decentralized finance (DeFi) protocols via smart contracts. TVL can also refer to the amount locked on a specific protocol (such as Aave or Uniswap).

What are Stablecoins?

A stablecoin is a digital currency created with the intent of holding a stable value. The value of most existing stablecoins is tied directly to a predetermined fiat currency or tangible commodity. However, stablecoins can also achieve price stability through collateralization against other cryptocurrencies or algorithmic token supply management

Is it starting to get fun yet?? Let’s go deeper!

Wallets & Keys

- Public Key

- Your public key allows you to receive cryptocurrency transactions. It’s a cryptographic code that’s paired to a private key.

- While anyone can send transactions to the public key, you need the private key to “unlock” them and prove that you are the owner of the cryptocurrency received in the transaction. The public key that can receive transactions is usually an address, which is simply a shortened form of your public key.

- Private Key

- A private key gives you the ability to prove ownership or spend the funds associated with your public address. NEVER share your private key with anyone. If you lose your private key, you lose your cryptocurrency forever.

- If you keep cryptocurrency on an exchange (like Coinbase), then the exchange is the custodian of your private keys; you’re trusting it with your keys in the same way you’d trust a bank’s vault to hold your gold

- Wallet

- Owning cryptocurrency requires using a crypto wallet to store your funds. A crypto wallet can be hosted online, or it can be software downloaded on your phone or computer or a specialized piece of hardware, among other options.

- Regardless of the crypto wallet type, they all store public and private keys that control the associated crypto and allow you to send and receive cryptocurrency. Transactions are then completed on the blockchain using the keys held in your wallet.

- Custodial vs. Non-custodial

- Custodial: using a custodial wallet means the keys in your crypto wallet are controlled by someone else. These wallets are typically exchange or web-based wallets that you can access through your phone or desktop.

- Non-custodial: A non-custodial crypto wallet enables you to control your private keys yourself, rather than delegating the job of securing the keys to a third party, like an exchange. This is considered more secure but requires you to take more responsibility.

Learn more: Crypto Keys and Wallets

What are Tokens?

At the simplest level, tokens are just code that lives on a blockchain. But unlike other forms of money, they’re digitally native, programmable, and secured by one’s crypto wallet and private key. Cryptocurrencies are just one type of token.

- Fungible

- Fungible tokens will be used to exchange goods, store value, and make collective decisions.

- Non-fungible (NFT’s)

- NFTs (Non-Fungible Tokens) are tokens that we can use to represent ownership of unique items. They let us tokenize things like art, collectibles, and even real estate.

- NFTs can only have one official owner at a time and they’re secured by a blockchain (Ethereum & Solana are the most popular) – no one can modify the record of ownership or copy/paste a new NFT into existence.

Learn more: A Guide to Crypto Tokens (a16z)

What are DAOs?

A DAO (Decentralized Autonomous Organization) is a mechanism that enables online communities to form and coordinate economically. It is a new kind of digital and economic entity that runs as code and is owned and controlled by its members. DAOs make it possible for an online group with members from anywhere in the world to pool capital and hard-code rules — entirely in software — for how that capital will be managed and deployed. Those rules are then enforced by the underlying blockchain.

Learn more: DAO Landscape (Cooper Turley), The Dao of DAOs (Packy McCormick), a16z’s DAO Canon

What are Sidechains?

A sidechain is an external secondary blockchain protocol that is connected to a primary blockchain network (mainchain). Sidechains are typically designed to allow for the transfer of data and value between themselves and the mainchain and oftentimes use a different consensus mechanism than the mainchain.

- As a result, sidechains can allow for a higher degree of flexibility and scalability, given that systems with a significant sidechain interoperability component are often designed to cater to a broader range of enterprise and individual users

What is a Bridge?

A bridge allows independent blockchains to communicate with each other.

For example: On the Polkadot network, a bridge is used to attach parachains and the main Relay Chain to other external blockchain networks such as Bitcoin and Ethereum. Polkadot data transmits from its main Relay Chain to parachains, attached to which collator nodes assemble all the transactions

Learn more: What Are Blockchain Bridges, and Why are they Important for DeFi? (MakerDAO)

What is a Fork?

A fork happens whenever a community makes a change to the blockchain’s protocol or basic set of rules. When this happens, the chain splits — producing a second blockchain that shares all of its history with the original but is headed off in a new direction.

Most digital currencies have independent development teams responsible for changes and improvements to the network (much in the same way that changes to internet protocols allow web browsing to become better over time), so sometimes a fork happens to make a cryptocurrency more secure, add functionality, or to resolve a disagreement within the community about the cryptocurrency’s direction.

- Soft fork: Think of a soft fork as a software upgrade for the blockchain. As long as it’s adopted by all users, it becomes a currency’s new set of standards. Because the end result is a single blockchain, the changes are backward-compatible with the pre-fork blocks.

- Hard fork: A hard fork happens when the code changes so much the new version is no longer backward-compatible with earlier blocks. In this scenario, the blockchain splits in two: the original blockchain and the new version that follows the new set of rules. This creates an entirely new cryptocurrency – and is the source of many well-known coins.

What is Sharding?

Sharding is a mechanism that is used to partition a blockchain network or other type of computer network or database. Its purpose is to distribute the network’s computational and storage workload across a broader set of devices, or nodes, in order to increase the throughput and transaction speed of the entire system.

What are Layers 1 and 2?

Layer 1

- A Layer-1 blockchain (also known as the parent chain or root chain) is typically a name used to describe a main blockchain network protocol such as Ethereum or Bitcoin. Layer-1 blockchains are simply the main network that a Layer-2 scaling solution attaches to in order to improve the scalability and transaction throughput of the main chain, or Layer 1.

- The name Layer 1 comes from its relationship with Layer-2 scaling solutions such as state channels, rollups, nested blockchains, and plasma side chains

Layer 2

- Layer-2 protocols are specifically designed to integrate with the underlying blockchain to improve the transaction throughput. They rely on the consensus mechanism and security of the main chain.

- Ex. Immutable X is a Layer-2 scaling solution for NFTs on Ethereum. It allows developers to build marketplaces, games, apps, and more. While Ethereum handles only about 15 transactions per second and suffers from high gas fees, an L2 solution like Immutable X handles 9,000 transactions per second with zero gas fees. It leverages Ethereum’s well-developed security, connections, and ecosystem to help developers.

Learn more: Layer-1 Platforms

Layer 2 Scaling Solutions

Roll-ups

In short, Rollups are solutions that perform transaction execution outside Layer 1 but make transaction data available on Layer 1. By moving computation off-chain, they free up more space on-chain. Onchain data availability is crucial since it allows Ethereum to double-check the integrity of rollup transactions.

- ZK roll-ups

- ZK-rollups are one of many Layer 2 scalability solutions and work by rolling up mass transfer processing into a single transaction. ZK roll-ups use zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKs) to validate transactions. Zk-snarks refer to a proof construction where one can provide proof of certain information, e.g. a secret key, without revealing that information itself, and without any interaction between the prover and verifier.

- ZK = “Zero Knowledge”…As a “zero-knowledge proof” approach is used to present and publicly record the validity of the block on the Ethereum blockchain, ZK reduces computing and storage resources for validating the block by reducing the amount of data held in a transaction; zero knowledge of the entire data is needed.

- Optimistic roll-ups

- In optimistic rollups, batches of transaction data are posted to the main chain and presumed to be valid (optimistic) but can be challenged. Theoretically, anyone can challenge them by submitting a claim, also known as fraud-proof, to prove that a batch committed to the chain contained invalid state transitions. If the fraud-proof is valid, these invalid state transitions will be rolled back

- The challenge with optimistic roll-ups, from a usability perspective, is that batches posted to the main chain can be disputed for several days (typically 1 week) during which funds on these Layer 2s cannot be withdrawn back to the main chain – this means Layer 2 users are not liquid.

Plasma & Validium

- Plasma

- Plasma is a construction scalability method that places layer 2 blocks on top of the Ethereum blockchain in the form of a side chain. The implementation of Plasma gives the ability of hundreds of side-chain transactions to be processed offline with only a single hash of the side-chain block being added to the Ethereum blockchain. The problem with Plasma is that for a user to withdraw from the side chain, they must retain a high amount of data so that enough exists for validation; a lengthy challenge period also requires users to stay online or lose rewards.

- Validium

- Validium works very similar to ZK rollups except data is stored off-chain. Since transaction data is not published on-chain, this introduces new trust assumptions as users must trust an operator to make data available when it is needed. This is typically achieved through a committee of known entities who stake their business reputation on being reliable data providers. If an L2 node operator stops servicing withdrawal requests, this committee will make its copy of the data publicly available.

Need a Kickstart to Your Web 3 Journey? This Checklist Could Help You!

Start investing in cryptocurrencies

Create an Ethereum wallet

Create an ENS domain

- An ENS (Ethereum Name Service) domain is pretty much your web3 username. It’s a name for all your cryptocurrency addresses and decentralized websites. Instead of listing my full 42-character Ethereum address, I can use my ENS, jaydrainjr.eth (just like websites have domains instead of IP addresses)

Purchase an NFT

- Explore the most popular NFT marketplaces: OpenSea, Foundation, Rarible

Mint an NFT

- Follow your favorite creators, and galleries on Twitter to find NFTs and generative art that you like

- Mint your NFT from a Smart Contract on Etherscan (instructions here)

- Mint your own digital content as an NFT and list it on an NFT marketplace

- Great Twitter thread on how to create an NFT on OpenSea step-by-step

Yield farm

- Yield farming is staking/lending your crypto assets to smart contract liquidity pools in exchange for returns (yield) in the form of crypto. Meanwhile, returns come in the form of APY.

Join and contribute to a DAO

- Find a DAO that speaks to you or one with people that you ~vibe~ with

- You may have to purchase a membership through community tokens

- Participate in your DAO’s Discord server or Telegram chat

- Participate in governance votes

What is the Meaning of the New Web 3 Slangs?

“Gm” = good morning

“WAGMI” = We’re all gonna make it

“NGMI” = Not gonna make it

“Ape” / “apeing” = to dive into a project recklessly without research / based on momentum

“Wen Moon” = when will the value of this asset go so high it reaches the moon?

“Probably nothing” = probably not anything important (used sarcastically)

“DYOR” = Do your own research

“Rekt” = “Wrecked” (lost a ton of money)

“HFSP” = “Have fun staying poor”

“FUD” = “Fear, uncertainty, and doubt”

“HODL” = “hold on for dear life.” ( hold your crypto – don’t sell)

“Whale”= entities who own a large amount of crypto that can change the market in a single trade

“ Wen Lambo?”= when will you crypto to reach the moon so you can buy a Lamborghini.

“ Flippening”= moment in which the market cap of Ethereum overtakes the value of Bitcoin

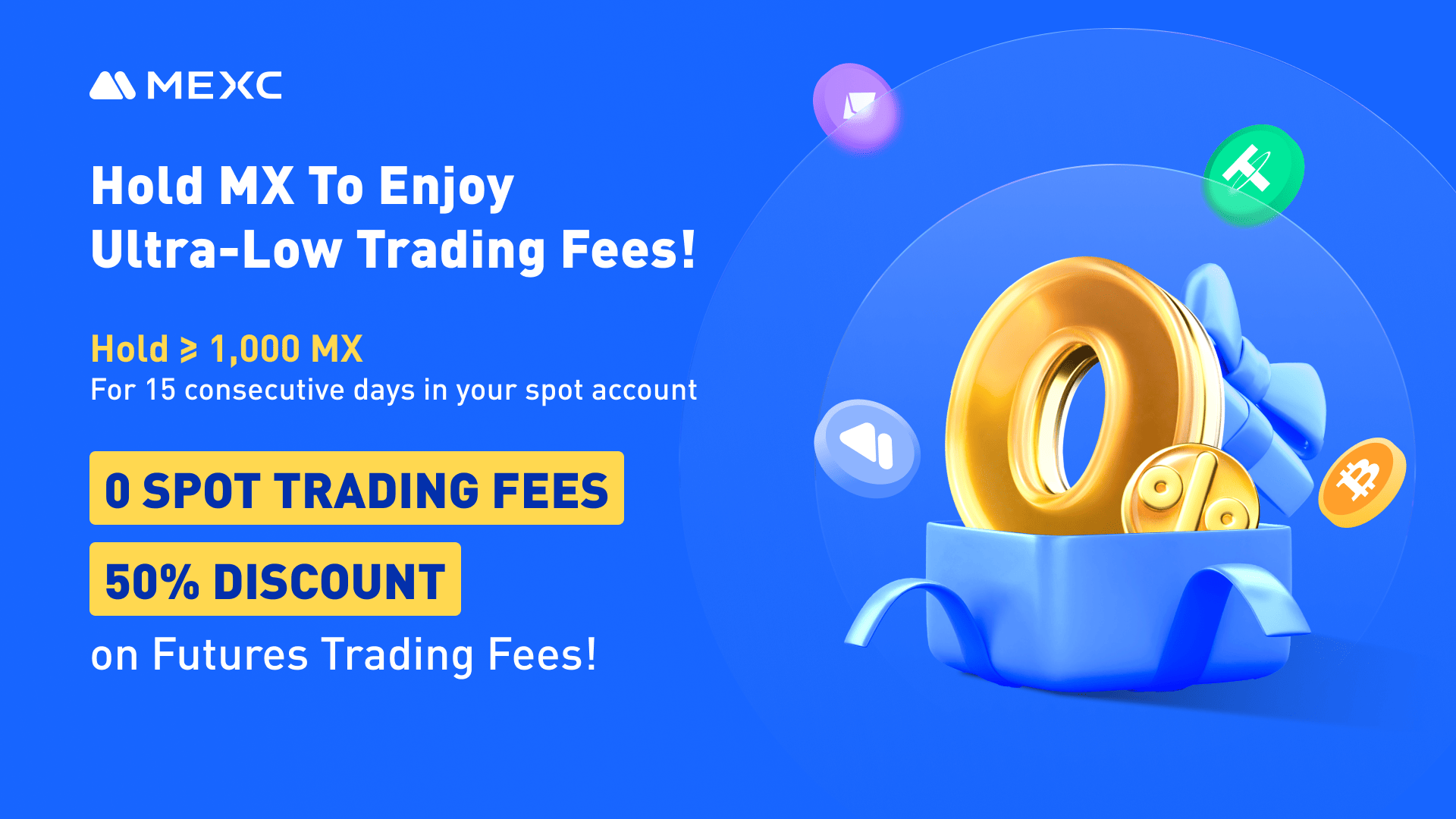

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up