TL:DR

- Inflows into Bitcoin ETFs have recovered, and have now stood at $17 billion in YTD

- Financial analyst Eric Balchunas has accused both the Bitcoin bull and bear camps of being ”reactionary” regarding the Bitcoin ETF performance

- Another stock type, Vanguard, continues to show no interest in BTC ETFs even though they are becoming increasingly popular

Bitcoin ETFs have recently been rather unpredictable, analyst Eric Balchunas has not deemed their ‘failure’ to be a genuine problem. So, even though the crypto market has been characterized by massive outflows now and then, the Bitcoin ETFs are once again bringing a lot of money.

YTD inflows for these products have exceeded $17.1 billion, so they proved to recover from the early doubts. Balchunas is convinced that the reactions typical for the supporters of crypto assets, as well as the opponents, are more pronounced compared to reactions observed among stock investors.

Bitcoin ETF Inflows Rebound

It is important to note that after a long time of experiencing net redemptions, Bitcoin ETFs are showing signs of a comeback. These products accumulated over $117 million on Tuesday, which indicates that confidence in their potential has returned.

As Balchunas says, the recent outflows that made many investors skeptical about the viability of Bitcoin ETFs, now amount to less than 1% of AUM. He still believes that it will keep getting better as history shows that redemptions within new asset classes usually become positive once market factors become stable.

Overreaction to Bitcoin ETFs?

Balchunas has negatively reacted to both camps of supporters of the cryptocurrency and detractors of the Bitcoin ETFs, stating that they are too ‘reactionary’. In contrast, the reaction to Bitcoin ETFs has been considerably more volatile than the normal fluctuation in investor sentiment. Typical equity markets, even in periods of downturns provided they are not as severe as the 2008 financial crisis or the COVID-19 market downturn.

Balchunas explains this to the fact that Bitcoin ETFs are still new having only been launched a few years back. Meanwhile, the financial giant Vanguard continues to stand apart from the hype. Despite claims from the cryptocurrency community that Vanguard may regret its decision not to enter the Bitcoin ETF space, Balchunas insists that Vanguard has no interest in these products and remains focused on traditional investments.

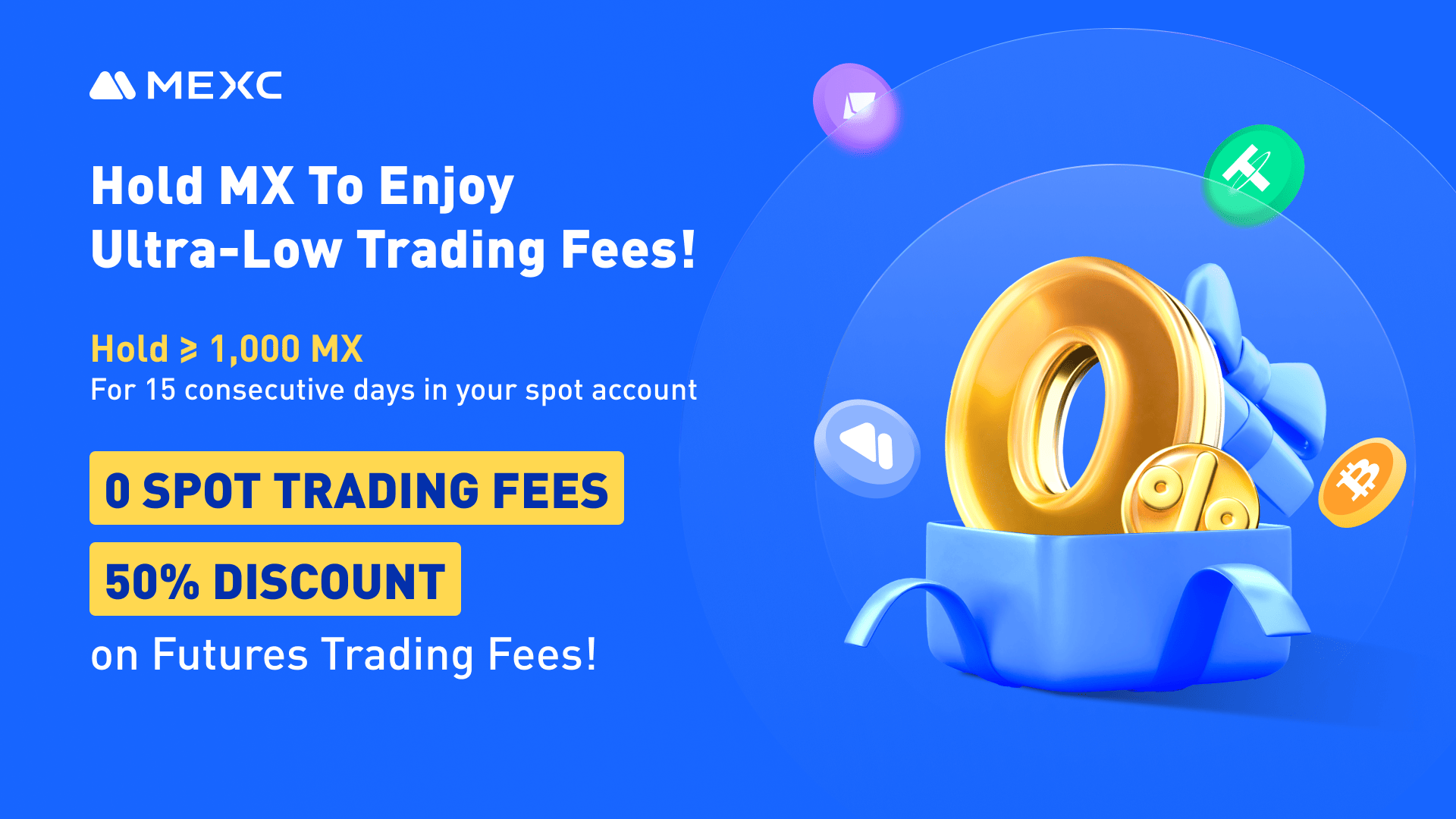

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up