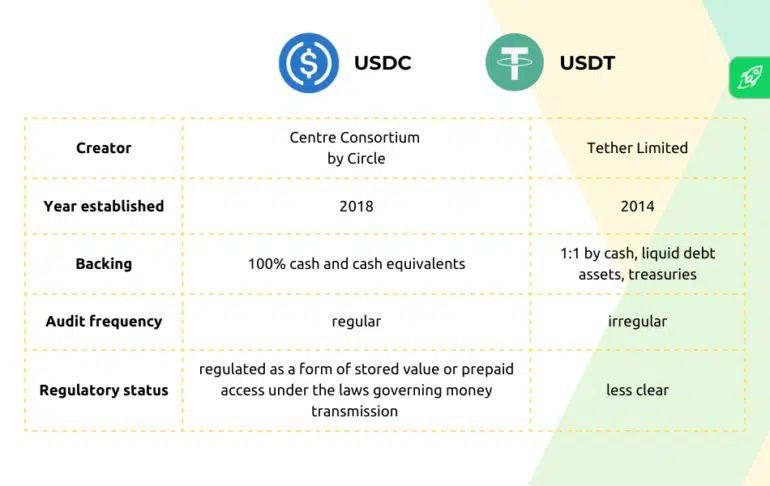

The stablecoin market has reached significant maturity by September 2025, with recent data from July 2025 showing the total market maintaining strong growth momentum. USDT continues to hold a commanding 61.8% market share while USDC has strengthened its position at $145 billion, creating an increasingly competitive landscape that reflects broader trends in cryptocurrency adoption and regulatory compliance.

The competitive dynamics between major stablecoins have intensified throughout 2025, driven by regulatory developments, institutional adoption patterns, and evolving use cases across DeFi protocols. With USDC experiencing a 500% surge in Circle’s IPO valuation and speculation about potential dominance in a projected $500 billion stablecoin market by 2030, the battle for stablecoin supremacy has significant implications for traders, institutions, and the broader cryptocurrency ecosystem.

1.Current Market Landscape: USDT Dominance vs USDC Growth

1.1 USDT Maintains Market Leadership at 62% Share

USDT’s continued dominance with 61.8% market share reflects the power of network effects and established trading relationships across global cryptocurrency markets. Despite regulatory pressures, including Europe’s MiCA legislation creating compliance challenges, USDT has maintained its position as the primary trading pair and liquidity provider across most cryptocurrency exchanges.

The resilience of USDT‘s market position demonstrates several key advantages:

Universal Exchange Integration: Listed on virtually every major cryptocurrency exchange globally, providing unmatched accessibility for traders and institutions

Multi-Chain Ecosystem: Available across Ethereum, Tron, Binance Smart Chain, and numerous other networks, enabling seamless cross-chain transactions

Emerging Market Preference: Particularly popular in regions with currency instability, capital controls, or limited access to traditional banking infrastructure

Trading Volume Leadership: Serves as the primary base currency for most cryptocurrency trading pairs, creating constant organic demand

1.2 USDC’s Strategic Positioning and Growth Trajectory

USDC’s growth to $145 billion market cap and strengthening institutional adoption reflects the value of regulatory compliance in attracting traditional finance participants. Circle’s strategic approach has focused on building trust through transparency and regulatory alignment:

Regulatory Compliance Focus: Monthly attestations and transparent reserve reporting have attracted institutional capital seeking compliant stablecoin exposure

Traditional Finance Partnerships: Direct relationships with banks, payment processors, and financial institutions create new demand channels

Geographic Strategy: Strong performance in US markets where regulatory clarity provides competitive advantages over less compliant alternatives

IPO Momentum: Circle’s 500% IPO valuation surge indicates market confidence in USDC’s long-term growth potential and regulatory positioning

1.3 Market Share Evolution and Competitive Dynamics

The current 62% USDT vs 32% USDC market share split represents a significant shift from historical periods when USDT controlled over 80% of the stablecoin market. This evolution indicates:

Institutional Diversification: Large institutions spreading stablecoin allocations across different risk profiles and compliance frameworks

Regulatory Risk Management: Market participants hedging regulatory uncertainty by maintaining positions in both compliant and network-dominant stablecoins

Use Case Specialization: USDT dominating retail trading and international markets, while USDC captures institutional and US-focused applications

The competitive pressure has benefited users through improved features, enhanced transparency, and better yield opportunities as both stablecoins compete for market share and user loyalty.

2.Trading Volume Analysis and Market Efficiency

2.1 Daily Trading Patterns and Liquidity

Current trading data shows USDC maintaining significant daily volume with $4.85 billion in 24-hour trading activity, demonstrating healthy market participation and liquidity depth. The most active USDC trading pair (USDC/USDT) generating over $1 billion in daily volume on major exchanges like Binance indicates strong arbitrage activity and efficient price discovery mechanisms.

Volume Distribution Analysis:

- Cross-Pair Trading: USDC/USDT remains the most liquid stablecoin pair for arbitrage opportunities

- Fiat Gateway Activity: Direct USD/USDC trading provides efficient on/off-ramps for institutional participants

- DeFi Integration: Significant volume occurring through decentralized exchanges and lending protocols

2.2 Price Stability and Peg Maintenance

Both major stablecoins have maintained tight pegs to the US dollar throughout 2025, with USDC trading at $0.9999 and minimal deviation from the $1.00 target. This stability reflects:

Robust Arbitrage Mechanisms: Active trading communities quickly correcting any price deviations from parity

Deep Liquidity Pools: Sufficient market depth to absorb large transactions without significant price impact

Institutional Market Making: Professional market makers providing continuous liquidity and price stability

Reserve Transparency: Clear backing mechanisms reducing market uncertainty about peg maintenance capability

3.How to Trade Stablecoins on MEXC: Strategies and Opportunities

3.1Available Trading Options and Pairs

MEXC provides comprehensive stablecoin trading infrastructure with multiple options for different strategies:

3.1.1 Primary Trading Pairs:

- USDT Markets: Access to 500+ cryptocurrencies using USDT as base currency

- USDC Trading: Direct USDC/USDT arbitrage opportunities with tight spreads

- Fiat Gateway: Direct USD to stablecoin conversion with competitive rates

3.1.2 Advanced Trading Features:

- Grid Trading: Automated arbitrage between stablecoin pairs during volatility

- MEXC Earn: Yield generation on USDT and USDC holdings with flexible terms

- Margin Trading: Leveraged positions for sophisticated arbitrage strategies

3.2 Arbitrage Opportunities in Stablecoin Markets

The competitive stablecoin landscape creates multiple arbitrage opportunities for informed traders:

3.2.1 Peg Deviation Trading:

- Monitor real-time prices for temporary deviations from $1.00 parity

- Execute quick arbitrage trades during brief depeg events

- Use limit orders to automatically capture arbitrage opportunities

3.2.2 Cross-Exchange Arbitrage:

- Compare USDT and USDC prices across different exchanges and DEXs

- Execute simultaneous trades to capture price differences

- Account for transaction fees and network costs in profit calculations

Yield Arbitrage Strategies:

- Compare earning rates between MEXC Earn and external DeFi protocols

- Move capital efficiently between platforms to maximize risk-adjusted returns

- Consider gas fees and lock-up periods in yield optimization decisions

3.3 Risk Management and Position Sizing

3.3.1 Regulatory Risk Hedging:

- Maintain balanced exposure between USDT and USDC to hedge regulatory developments

- Monitor regulatory announcements affecting specific stablecoins

- Consider geographic restrictions and compliance requirements for large positions

3.3.2 Liquidity Risk Assessment:

- Focus on high-volume pairs with consistent market depth

- Use MEXC’s order book analysis to assess market liquidity before large trades

- Implement stop-loss orders to manage downside risk during volatile periods

4.Market Outlook and Strategic Implications

4.1 Regulatory Developments Shaping Competition

The stablecoin competitive landscape is being increasingly influenced by regulatory clarity and compliance requirements. Europe’s MiCA legislation and evolving US regulatory frameworks create different advantages for USDT and USDC in different markets:

4.1.1 USDC Regulatory Advantages:

- Clear compliance pathway in regulated jurisdictions

- Transparent reserve backing attracting institutional capital

- Stronger position for traditional finance integration

USDT Network Advantages:

- Established global adoption and trading relationships

- Multi-chain availability providing operational flexibility

- Strong positioning in emerging markets and retail trading

4.2 Future Market Projections

Speculation about a $500 billion stablecoin market by 2030 suggests significant growth potential, but market share distribution will likely depend on:

- Institutional Adoption Patterns: Corporate treasuries and traditional finance integration favoring compliant stablecoins like USDC

- Global Market Access: International adoption continuing to favor established networks like USDT with broad exchange support

- Technical Innovation: New stablecoin mechanisms and yield-generating features potentially disrupting current market dynamics

- Regulatory Evolution: Changing compliance requirements affecting competitive positioning and market access

4.3 Investment and Trading Strategies

4.3.1 Conservative Approach:

- Focus on USDC for regulatory compliance and institutional backing

- Use MEXC Earn for steady yields without smart contract risk

- Maintain small USDT allocation for trading flexibility

4.3.2 Balanced Strategy:

- Split allocation between USDT and USDC based on use cases and regulatory preferences

- Utilize arbitrage opportunities between different stablecoin pairs

- Combine centralized earning with DeFi protocols for yield optimization

Active Trading Focus:

- Monitor arbitrage opportunities across exchanges and trading pairs

- Use automated trading tools for systematic arbitrage execution

- Maintain high liquidity positions for rapid market opportunity capture

5.Conclusion

The stablecoin market in September 2025 reflects a mature, competitive landscape where USDT’s network effects continue to provide market leadership while USDC’s regulatory compliance strategy attracts growing institutional adoption. The 62% vs 32% market share dynamic creates a healthy competitive environment that benefits users through improved features, better yields, and enhanced transparency.

The evolution toward a more balanced stablecoin ecosystem reduces systemic risk while providing users with options that match their specific needs for trading, compliance, and yield generation. This competitive dynamic drives continued innovation and improvement across both established and emerging stablecoin projects.

For traders and institutions, understanding the competitive advantages and risk profiles of different stablecoins becomes crucial for optimizing portfolio allocation and trading strategies. MEXC’s comprehensive stablecoin infrastructure provides the tools needed to capitalize on arbitrage opportunities, earn competitive yields, and manage risks effectively in this evolving market landscape.

The projected growth toward a $500 billion stablecoin market by 2030 suggests significant opportunity for users who understand market dynamics and position themselves effectively across different stablecoin ecosystems. Success requires balancing the network advantages of established players like USDT with the regulatory benefits of compliant alternatives like USDC.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!

Sign Up