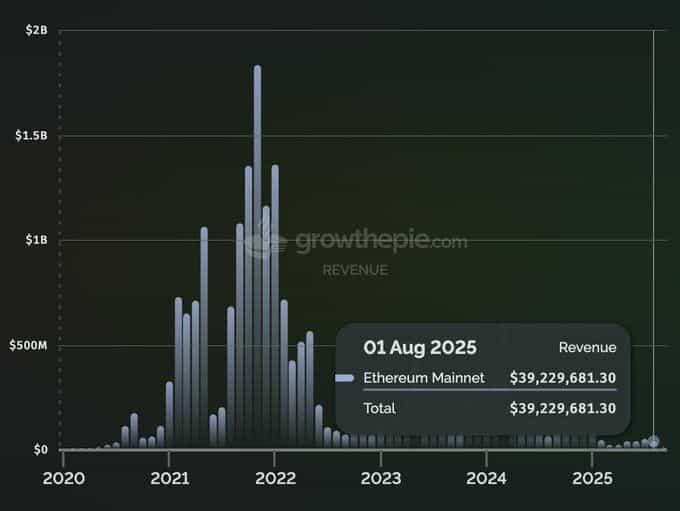

A fierce debate has erupted in the cryptocurrency community following Ethereum’s paradoxical performance in August 2025: while ETH reached new all-time highs, the network’s revenue collapsed to just $39.2 million—a devastating 75% year-over-year decline from August 2023’s $157.4 million. This represents Ethereum’s fourth-lowest monthly revenue since January 2021, when ETH traded at a fraction of current prices.

Messari’s enterprise research manager AJC sparked controversy on September 7th, arguing that “Ethereum’s fundamentals are collapsing, but it seems everyone only cares about the ETH price going up, regardless of whether the network is healthy.” The observation has divided the crypto community between those who see revenue decline as terminal weakness and others who view it as evidence of successful strategic evolution.

The reality behind Ethereum’s revenue paradox reveals a sophisticated strategic pivot that has transformed the network from a monolithic “world computer” into the foundational settlement layer for a multi-trillion-dollar decentralized economy. Understanding this transformation requires looking beyond surface-level revenue metrics to examine how Ethereum’s deliberate technical upgrades have reshaped its economic model and competitive positioning.

1.The Strategic Foundation: From Monolithic to Modular

1.1 Deliberate Technical Evolution

Ethereum’s current revenue situation results from a multi-year strategic roadmap designed to solve blockchain’s fundamental scalability trilemma. Rather than compromising decentralization for speed, Ethereum’s developers chose a modular approach where Layer 1 specializes in security and data availability while Layer 2 solutions handle transaction execution and user activity.

This transformation accelerated through key technical upgrades:

The Merge (September 2022):

Transitioned from energy-intensive Proof-of-Work to Proof-of-Stake, establishing the foundation for future scaling improvements while changing ETH’s monetary policy to include staking rewards.

The Dencun Upgrade (March 2024):

Introduced EIP-4844 “Proto-Danksharding,” creating separate data channels called “blobs” for Layer 2 networks to post transaction data at dramatically reduced costs—often 10-100x cheaper than previous methods.

1.2 Economic Engineering by Design

The Dencun upgrade represents explicit economic engineering designed to sacrifice short-term Layer 1 revenue for long-term strategic positioning. By creating cheaper data availability for Layer 2 networks, Ethereum deliberately reduced its direct fee income to enable a thriving rollup ecosystem.

This calculated decision reflects a fundamental shift from maximizing immediate revenue to building sustainable infrastructure for global-scale adoption. The upgrade’s success is measured not by Layer 1 fees collected, but by the expansion of economic activity across Ethereum’s entire ecosystem.

2.Layer 2 Explosion: Symbiosis or Vampirism?

2.1 The Case Against Layer 2s

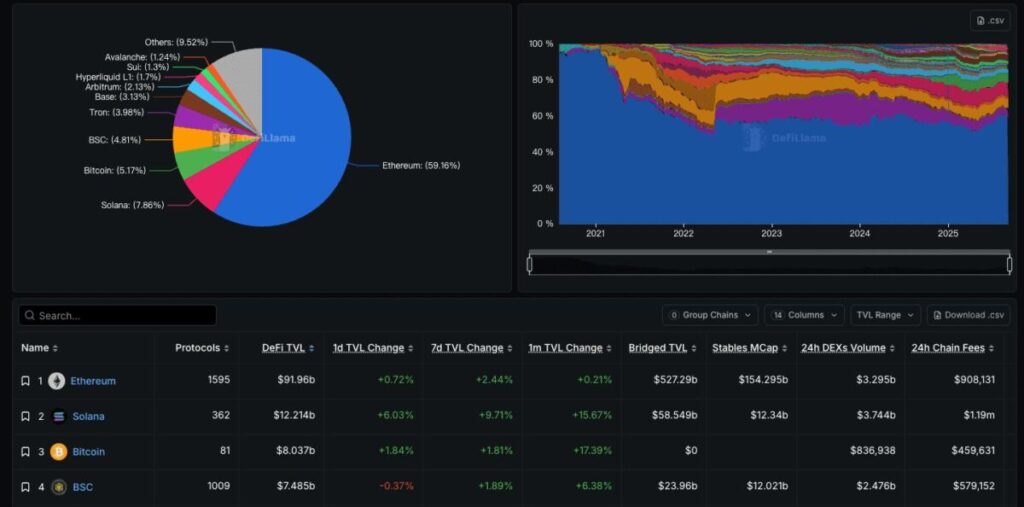

Critics argue that Layer 2 networks like Arbitrum, Optimism, and Base are “vampires” draining Ethereum’s economic vitality. Their logic appears straightforward: every transaction on Base or Arbitrum represents potential Layer 1 activity that would have generated mainnet fees. The data seems supportive—Layer 1 transaction counts have stagnated while Layer 2 volumes have exploded.

2.2 The Strategic Counterargument

This surface-level analysis misses the sophisticated economic relationship between Layer 1 and Layer 2 networks:

Layer 2s Are Paying Customers: Far from being competitors, Layer 2 networks depend on Ethereum for security and data availability. They pay consistent fees to post transaction data and state proofs to Layer 1, creating steady demand for Ethereum’s blockspace services.

Total Addressable Market Expansion: The vast majority of Layer 2 activity couldn’t exist on expensive Layer 1. Applications in gaming, social media, micro-transactions, and low-value DeFi would be economically unviable with mainnet gas costs. Layer 2s have unlocked entirely new design spaces and user categories.

Structural ETH Demand Creation: Layer 2 networks generate multiple streams of ETH demand:

– Gas payments for Layer 2 transactions

– ETH holdings for sequencer operations

– ETH as primary collateral across Layer 2 DeFi ecosystems

– ETH deposits for cross-chain bridge operations

2.3 Comparative Market Analysis

Ethereum’s modular approach contrasts sharply with competitors’ strategies:

Solana’s Monolithic Bet: Solana attempts to scale everything on a single high-performance Layer 1, generating direct fee revenue but facing different dec

Bitcoin’s Focused Mission: Bitcoin optimizes purely for secure value transfer, making fee revenue comparisons with smart contract platforms inappropriate.

Layer 2 Success Stories: Networks like Arbitrum demonstrate healthy fee generation at the application layer while contributing to Ethereum’s security through consistent Layer 1 payments.

3.How to Trade Ethereum on MEXC: Navigating the New Paradigm

3.1 Available ETH Trading Options

MEXC provides comprehensive Ethereum trading infrastructure designed for both traditional ETH exposure and Layer 2 ecosystem participation:

Spot Trading:

– ETH/USDT: Primary Ethereum pair with institutional-grade liquidity

– ETH/BTC: Direct crypto-to-crypto exposure for portfolio allocation

– ETH Staking: Participate in Ethereum’s Proof-of-Stake rewards while holding

Derivatives and Advanced Strategies:

– Ethereum Futures: Leveraged exposure to ETH price movements

– Layer 2 Token Trading: Access to ARB, OP, and other L2 governance tokens

– DeFi Token Exposure: Trade tokens from Ethereum’s expanding ecosystem

Strategic Positioning for the Modular Era

Layer 2 Ecosystem Play:

Instead of viewing Layer 2s as threats, consider them as extensions of Ethereum’s value proposition. Trade Layer 2 governance tokens like ARB and OP to gain exposure to the fastest-growing segment of Ethereum’s ecosystem.

ETH Accumulation Strategy:

Use [dollar-cost averaging] to systematically accumulate ETH, recognizing its evolution from “digital oil” to foundational reserve asset. The network’s transformation increases long-term ETH demand regardless of short-term revenue fluctuations.

Cross-Chain Arbitrage:

Monitor price differences for wrapped ETH and DeFi tokens across different Layer 2 networks. MEXC’s comprehensive token listings enable strategies that capitalize on cross-chain inefficiencies.

Risk Management Considerations

Fundamental Analysis Updates:

Traditional metrics like gas fees and Layer 1 transaction counts provide incomplete pictures of Ethereum’s health. Monitor:

– Total Value Locked across Layer 2 networks

– ETH staking participation rates

– Cross-chain bridge volumes and ETH deposits

– Layer 2 transaction growth and user adoption

Correlation Risks:

Ethereum’s increasing institutional adoption may increase correlation with traditional markets during risk-off periods. Use [portfolio diversification tools] to manage broader market exposure.

Technical Upgrade Impacts:

Future Ethereum upgrades may continue prioritizing ecosystem growth over direct Layer 1 revenue. Stay informed about roadmap developments that could affect ETH price dynamics and network economics.

4.The Evolved Bull Case: From Digital Oil to Digital Bonds

4.1 ETH as Global Settlement Infrastructure

Ethereum’s transformation positions it as the “Federal Reserve” of the decentralized economy—the ultimate settlement layer where final state is determined. Layer 2 networks batching transactions to Ethereum mirrors how financial institutions settle net positions with central banks, creating immense strategic value.

The most valuable digital real estate is Ethereum Layer 1 blockspace, providing unmatched security and immutability guarantees. This positioning supports premium valuations even with lower transaction volumes, as settlement services command higher margins than retail transaction processing.

4.2 Institutional Treasury Asset Emergence

A new trend is emerging where publicly traded companies add ETH to their balance sheets, recognizing it as both a growth asset and yield-bearing instrument through staking. This “coin-stock” model treats ETH as combining characteristics of technology stocks and bonds, creating institutional demand completely divorced from network fee revenue.

Companies like SBET and BMNR are pioneering this approach, viewing ETH as productive treasury capital that generates yields while providing exposure to blockchain technology adoption. This institutional recognition of ETH’s dual nature as asset and infrastructure supports long-term price appreciation.

4.3 Reserve Asset Status Across Layer 2s

ETH serves as the primary reserve asset and collateral across virtually every major Layer 2 DeFi ecosystem. As Layer 2 adoption accelerates, structural demand for ETH increases proportionally. This creates a positive feedback loop where Layer 2 success directly benefits ETH demand regardless of Layer 1 fee generation.

The growth of Layer 2 DeFi protocols, cross-chain bridges, and yield farming strategies all require substantial ETH deposits, creating natural demand sinks that reduce circulating supply while increasing utility.

5.Market Outlook: Metamorphosis, Not Decline

5.1 Short-Term Expectations

Ethereum’s revenue may continue declining as more Layer 2 networks launch and transaction costs further decrease through continued technical optimizations. However, this should be viewed as successful execution of the scaling roadmap rather than fundamental weakness.

Monitor total economic activity across Ethereum’s ecosystem rather than Layer 1 metrics alone. The combination of Layer 1 security services and Layer 2 transaction processing creates a more robust economic model than pure Layer 1 revenue maximization.

5.2 Long-Term Strategic Positioning

Ethereum is trading high-margin, low-volume business for lower-margin, infinitely scalable infrastructure services. This transformation mirrors how internet infrastructure companies evolved from premium services to foundational utilities that enable massive economic activity.

The network’s success will be measured by:

– Total value secured across all Layer 2 networks

– ETH demand from staking and DeFi collateral usage

– Institutional adoption as treasury reserve asset

– Economic activity enabled by Ethereum’s settlement guarantees

5.3 Competitive Advantages

Ethereum’s modular approach provides several strategic advantages:

– Sustainable Decentralization: Layer 1 can maintain security and decentralization while Layer 2s optimize for performance

– Innovation Flexibility: New Layer 2 architectures can experiment without compromising base layer stability

– Economic Specialization: Each layer optimizes for different value propositions rather than forcing compromises

– Network Effects: Success of any Layer 2 benefits the entire Ethereum ecosystem

6.Conclusion

Ethereum’s revenue paradox represents successful strategic evolution rather than fundamental decline. The network has deliberately sacrificed high Layer 1 fees to become the foundational security and data availability layer for a multi-chain ecosystem capable of scaling to billions of users.

Critics focusing on Layer 1 revenue metrics are applying outdated evaluation frameworks to a next-generation modular architecture. The true measure of Ethereum’s success lies in total economic activity secured, structural ETH demand created, and its emerging role as the reserve asset for decentralized finance.

The transformation from “digital oil” to “digital bonds” reflects Ethereum’s maturation into critical financial infrastructure. Like internet backbone providers, Ethereum’s value comes from enabling economic activity rather than directly capturing every transaction fee.

For traders and investors, understanding this evolution is crucial for proper ETH valuation and strategic positioning. MEXC’s comprehensive Ethereum ecosystem access—from ETH staking to Layer 2 token trading—provides the tools needed to participate in this transformation effectively.

The network isn’t dying; it’s metamorphosing into the foundational layer for the digital economy. The emptying of the Layer 1 “storefront” reflects business moving to the back office, where Ethereum is building the settlement infrastructure for new digital worlds.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up