Bitcoin has maintained its position around $115,000 as of September 12, 2025, capping a strong 4% weekly recovery supported by the largest institutional inflows since mid-July. Bitcoin spot ETFs recorded $1.70 billion in net inflows this week, marking the third consecutive week of positive flows as institutional investors position ahead of expected Federal Reserve rate cuts next week.

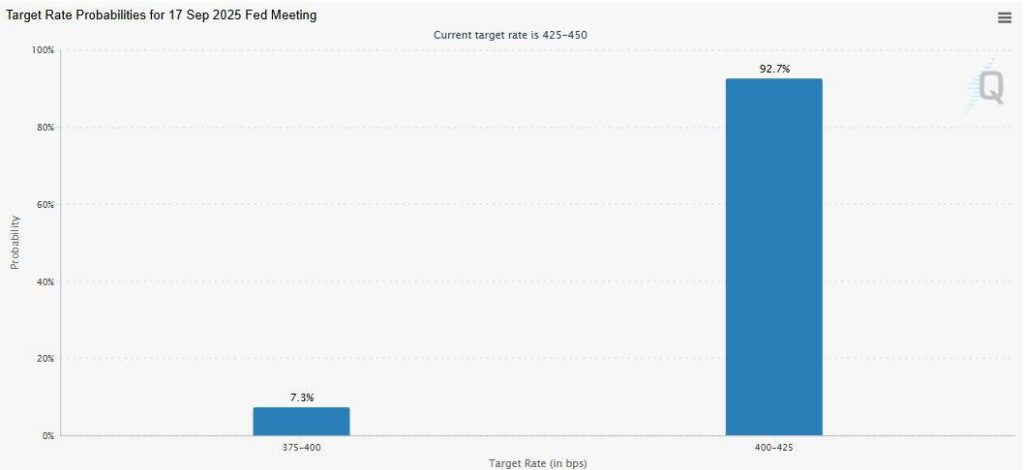

Markets are now pricing a 92.7% probability of a 25-basis-point Fed rate cut and 7.3% chance of a larger 50-basis-point reduction, following encouraging inflation data that showed producer prices cooling faster than expected. The combination of institutional demand and dovish Fed expectations has pushed Bitcoin through key technical levels, with analysts targeting the psychological $120,000 resistance as the next major milestone.

Corporate demand has intensified alongside institutional flows, with MicroStrategy acquiring an additional 1,955 BTC worth $217.4 million and Japanese firm Metaplanet adding 136 BTC to their holdings. This sustained accumulation from both institutional and corporate treasuries demonstrates growing confidence in Bitcoin’s long-term value proposition amid an improving macroeconomic backdrop.

1.Institutional Demand Drives $1.7B Weekly Inflows

1.1 Record ETF Participation Signals Market Confidence

The $1.70 billion in Bitcoin ETF inflows represents the strongest weekly institutional demand since mid-July 2025, indicating renewed appetite for Bitcoin exposure among traditional finance participants. This institutional accumulation has provided crucial support for Bitcoin’s recovery from early September lows and established a foundation for potential further gains.

The scale of institutional participation demonstrates that professional investors are positioning for a favorable macroeconomic environment, particularly with Federal Reserve rate cuts appearing increasingly certain. Historical patterns show that institutional flows often precede significant price movements, as these participants typically deploy substantial capital based on fundamental analysis rather than short-term technical factors.

1.2 Corporate Treasury Accumulation Accelerates

MicroStrategy’s latest acquisition of 1,955 BTC for $217.4 million brings their total holdings to 638,460 BTC, reinforcing their strategy of using Bitcoin as a primary treasury reserve asset. The timing of this purchase, coinciding with improved market sentiment and technical breakout patterns, suggests strategic positioning ahead of potential monetary policy shifts.

Metaplanet’s addition of 136 BTC, expanding their holdings to 20,136 BTC, reflects growing adoption of Bitcoin treasury strategies among international corporations. This Japanese investment firm’s continued accumulation provides geographic diversification to corporate Bitcoin demand and demonstrates the global nature of institutional adoption trends.

Hong Kong-based QMMM Holdings announced plans for a $100 million digital asset treasury focused on Bitcoin, Ethereum, and Solana, indicating that corporate adoption is expanding beyond traditional Bitcoin-only strategies to include broader cryptocurrency allocations.

1.3 Stablecoin Reserves Signal Additional Buying Power

On-chain data reveals that Binance recorded over $6.2 billion in net stablecoin inflows earlier this week, with total stablecoin reserves on the exchange reaching an all-time high near $39 billion. These reserves represent “dry powder” available for cryptocurrency purchases and suggest significant latent buying pressure exists in the market.

The accumulation of stablecoin reserves typically precedes periods of increased buying activity, as traders and institutions position capital for deployment during favorable market conditions. The current record levels of stablecoin reserves provide substantial firepower for potential Bitcoin purchases if momentum continues building.

2.Federal Reserve Policy Creates Bullish Backdrop

2.1 Inflation Data Supports Rate Cut Expectations

Recent US economic data has strengthened the case for Federal Reserve rate cuts, with Producer Price Index (PPI) declining to 2.6% annually in August from 3.1% in July. Core PPI, excluding food and energy, fell to 2.8% from 3.4%, indicating broad-based disinflationary pressures that support monetary easing arguments.

Consumer Price Index (CPI) data showed mixed results, with headline inflation rising to 2.9% annually but core inflation holding steady at 3.1%. However, rising weekly jobless claims to 263,000 – the highest since October 2021 – provided additional evidence of labor market softening that reinforces rate cut expectations.

2.2 Market Positioning for Policy Easing

CME Group’s FedWatch tool indicates overwhelming market consensus for Fed rate cuts, with only 7.3% probability assigned to a larger 50-basis-point reduction. This positioning reflects confidence that economic conditions warrant monetary easing while expecting a measured approach rather than emergency-style cuts.

The Fed policy backdrop creates several supportive factors for Bitcoin:

- Lower opportunity cost for holding non-yielding assets

- Increased liquidity in financial markets

- Enhanced risk appetite among institutional investors

- Potential dollar weakness supporting alternative stores of value

2.3Historical Context for Bitcoin and Fed Policy

Previous Fed rate cutting cycles have generally provided supportive environments for Bitcoin, though the correlation has evolved as the asset has matured and attracted institutional adoption. The current cycle presents unique dynamics given Bitcoin’s integration into traditional portfolio construction and corporate treasury strategies.

Unlike previous cycles driven primarily by retail speculation, the current environment features institutional infrastructure and regulatory clarity that could amplify Bitcoin’s response to accommodative monetary policy while potentially reducing extreme volatility.

3.Technical Analysis: $120K Target in Focus

3.1 Key Support and Resistance Levels

Bitcoin’s technical structure shows consolidation around $115,000 with immediate resistance at $116,000 on the daily timeframe. Weekly analysis indicates the July low of $107,429 continues providing crucial support, while the psychological $120,000 level represents the primary upside target.

The 50-day Exponential Moving Average at $113,112 has been reclaimed on the daily chart, providing technical confirmation of the recovery trend. Weekly momentum indicators show improvement, with the Relative Strength Index at 59 indicating room for further gains without immediate overbought conditions.

3.2 Momentum and Volume Analysis

Daily chart analysis reveals bullish crossover in momentum indicators, with the MACD generating buy signals that remain in effect. However, weekly MACD shows a bearish crossover from early September that provides some caution for longer-term momentum sustainability.

Trading volume patterns support the current recovery, with institutional accumulation creating steady demand that differs from retail-driven volatility patterns. The measured nature of recent price action suggests professional participation and systematic accumulation rather than speculative momentum.

3.3 Risk Scenarios and Technical Levels

If Bitcoin fails to sustain above $115,000, the 50-day EMA at $113,112 represents the first technical support level. A break below this level could target the weekly support zone around $107,429 established in early September.

Conversely, a decisive break above $116,000 daily resistance opens the path toward $120,000, where significant psychological resistance and potential profit-taking could create temporary consolidation before any further advance.

4.How to Trade Bitcoin on MEXC: Capitalizing on Fed Policy Momentum

4.1Available Trading Options for Institutional-Style Positioning

MEXC provides comprehensive Bitcoin trading infrastructure designed to capture opportunities during Fed policy-driven momentum:

Spot Trading for Long-Term Positioning:

- BTC/USDT: Primary Bitcoin pair with institutional-grade liquidity

- BTC/USD: Direct fiat exposure for traditional finance participants

- Dollar-Cost Averaging: Systematic accumulation strategies similar to corporate treasury approaches

Derivatives for Enhanced Exposure:

- Bitcoin Futures: Up to 125x leverage for amplified Fed policy reactions

- Grid Trading: Automated strategies within established $113K-$116K range

- Options Strategies: Structured approaches for volatility around Fed announcements

4.2Strategic Approaches for Fed Policy Events

- Institutional Momentum Strategy: Follow institutional flows by monitoring ETF data and corporate announcements for entry signals. Place accumulation orders near technical support levels ($113,112 and $107,429) to participate in institutional buying patterns.

- Fed Policy Breakout Strategy: Position for potential $120K breakout using conditional orders triggered above $116K resistance. This approach captures momentum if Fed cuts exceed expectations or guidance proves more dovish than anticipated.

- Risk-Managed Accumulation: Implement systematic buying similar to corporate treasury strategies using MEXC’s DCA features. This approach reduces timing risk while maintaining consistent exposure during institutional adoption phase.

4.3 Position Management and Risk Controls

- Volatility-Adjusted Sizing: Despite institutional support, Fed policy announcements can generate significant volatility. Reduce position sizes by 25-30% around policy events to account for potential gap movements or unexpected hawkish surprises.

- Technical Stop-Loss Levels: Use trailing stops above key technical levels to protect gains while allowing continued participation in upside momentum. Place stops below $113,112 for medium-term positions or $107,429 for longer-term strategic accumulation.

- Portfolio Integration: Consider Bitcoin’s correlation with traditional risk assets during Fed events. Use MEXC’s portfolio tools to monitor overall exposure and maintain appropriate diversification during high-impact policy periods.

5.Market Outlook: $120K Target and Beyond

5.1Fed Policy Scenario Analysis

- Base Case (25bps Cut): Bitcoin likely continues toward $120K psychological resistance with institutional flows providing steady support. Technical breakout above $116K could generate momentum toward this target within coming weeks.

- Dovish Surprise (50bps Cut): Larger rate cuts could accelerate Bitcoin’s advance beyond $120K as institutional and corporate demand intensifies. However, such aggressive easing might also signal deeper economic concerns that create broader market volatility.

- Hawkish Hold: Unexpected Fed pause could pressure Bitcoin back toward $113K-$107K support zone, though institutional accumulation trends may limit downside compared to previous cycles.

5.2Institutional Adoption Implications

The current institutional accumulation cycle differs from previous Bitcoin rallies due to corporate treasury strategies and regulated ETF infrastructure. This institutional foundation may provide greater price stability during corrections while supporting sustained upward momentum during favorable policy environments.

MicroStrategy’s continued accumulation strategy and expanding corporate adoption suggest that Bitcoin is transitioning toward a strategic asset allocation rather than purely speculative investment, potentially reducing sensitivity to short-term sentiment while increasing responsiveness to fundamental factors like Fed policy.

5.3Long-Term Strategic Considerations

Bitcoin’s evolution toward institutional asset status creates new dynamics for Fed policy sensitivity. While lower rates generally support Bitcoin valuations, the relationship may become more nuanced as institutional adoption progresses and correlation patterns with traditional assets evolve.

The $120K psychological level represents more than technical resistance – it establishes Bitcoin’s credibility as a major asset class worthy of significant institutional allocations. Successful breakthrough and sustainability above this level could catalyze additional corporate adoption and institutional product development.

6.Conclusion

Bitcoin’s stabilization around $115,000 supported by $1.7 billion in weekly institutional inflows demonstrates the growing maturation of cryptocurrency markets and their integration with traditional finance. The combination of corporate treasury accumulation, regulated ETF infrastructure, and favorable Federal Reserve policy expectations creates a constructive backdrop for continued institutional adoption.

The technical setup targeting $120,000 reflects both momentum factors and fundamental institutional demand that differentiates the current cycle from previous speculative phases. Success in reaching and sustaining these levels would represent significant validation of Bitcoin’s evolution toward mainstream institutional acceptance.

MEXC’s comprehensive trading infrastructure provides the tools needed to participate in this institutional-driven momentum while managing the risks inherent in Fed policy-sensitive markets. The platform’s combination of spot, derivatives, and systematic investing features enables strategies ranging from corporate treasury-style accumulation to sophisticated institutional arbitrage approaches.

As Bitcoin continues evolving from speculative asset to institutional portfolio component, understanding the interplay between Fed policy, institutional flows, and technical momentum becomes crucial for successful participation in this transformation. The current environment offers compelling opportunities for those who can navigate the intersection of traditional monetary policy and cryptocurrency market dynamics.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!

Sign Up