1.From Chasing Gains to Securing Returns: A New Mindset for Crypto

There was a time when crypto was all about wild bets — chasing pumps, 20x leverage, and YOLO-ing into memecoins.

But the market has changed.

Now, smart investors are shifting gears.

It’s no longer about how high your yield looks — it’s about actually receiving it.

Forget the hype. Forget gambling on the next altcoin moonshot. Forget staring at charts 18 hours a day.

Instead:

Allocate to stablecoin strategies

Earn passive, consistent income

Reinvest — let compound interest do the work

Why? Because in crypto, consistency beats chaos. Bear or bull, the best strategy is the one that pays — quietly, steadily, week after week.

When others are chasing stories, you’re stacking stablecoins. When the market is volatile, your yield is stable. When the cycle turns, you’re already ahead.

This isn’t playing it safe. It’s playing it smart.

The name of the game? Survive. Stack. Compound. Repeat.

2.What Are Stablecoin Yield Strategies in 2025?

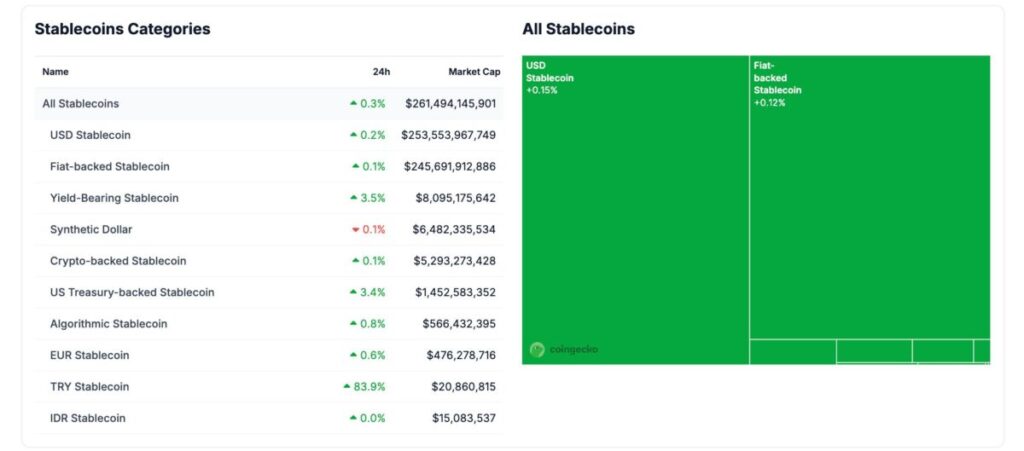

Stablecoin yield strategies refer to crypto investment mechanisms where users deposit stablecoins — such as USDT, USDC, DAI, or crvUSD — into various platforms to earn predictable returns. Unlike volatile tokens, stablecoins maintain a 1:1 peg to fiat currencies (typically USD), offering a low-risk entry point into crypto-based yield generation.

3.Why Stablecoin Yields Matter in 2025

As of September 2025, the crypto market is maturing. While Bitcoin hovers around $110,000 and Layer 2 ecosystems grow rapidly, macro uncertainty and increased regulation have pushed more users toward capital-efficient, risk-adjusted yield strategies.

Stablecoins offer:

– Principal stability

– Predictable APYs (ranging 4%–15%)

– Access to CeFi and DeFi tools

– Low volatility, high liquidity

4.CeFi Opportunities: Where to Earn Stablecoin Yields

Centralized finance (CeFi) platforms offer simple and intuitive interfaces for earning yield, often ideal for beginners or users who want fewer moving parts.

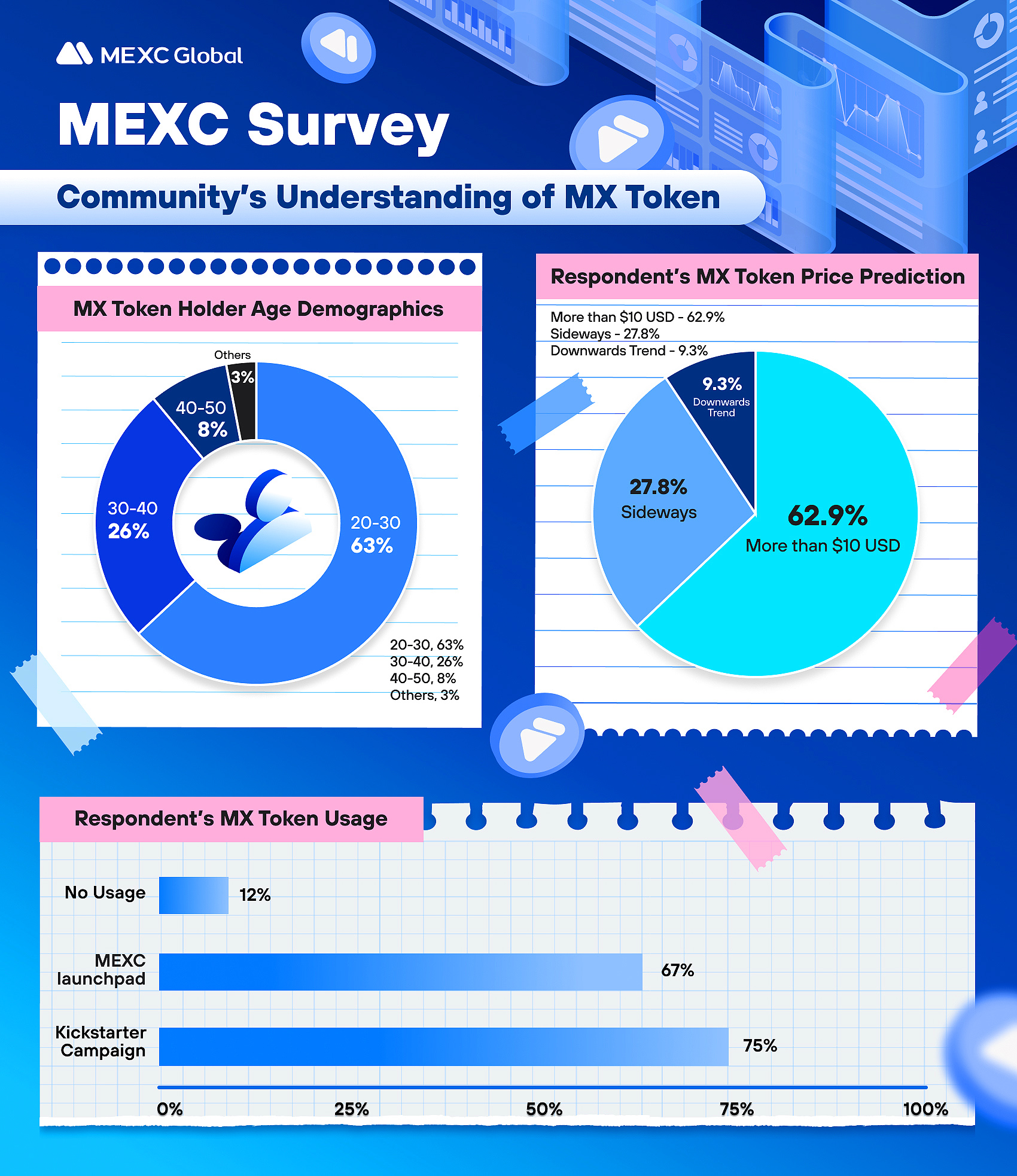

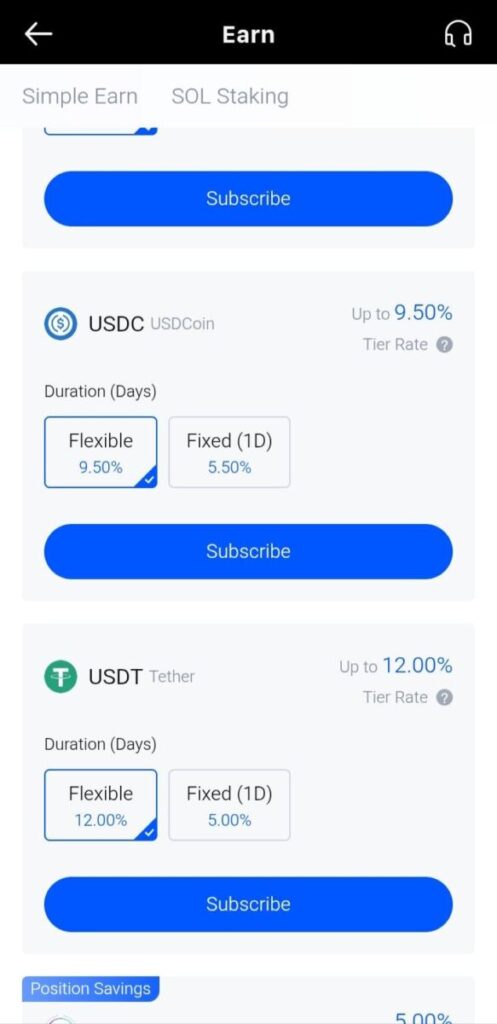

5.MEXC Flexible Savings

MEXC provides secure, flexible earning products for stablecoins like USDT and USDC — perfect for passive income seekers.

Key Features:

– Supported Assets: USDT, USDC and other major stablecoins

– APY Range: Flexible rates between 5% – 10% depending on market conditions

– Withdrawal: Complete flexibility with no lock-up periods required

– Compound Interest: Automatically reinvested to maximize returns

Why it works:

– No lock-ups, full control over your funds

– Great for idle balances on your trading account

– Managed by a platform with robust security infrastructure

6.DeFi Yield: Top On-Chain Stablecoin Strategies

DeFi continues to be a hotbed for innovation — offering higher yields, greater flexibility, and composability. However, these strategies come with more complexity and exposure to smart contract risk.

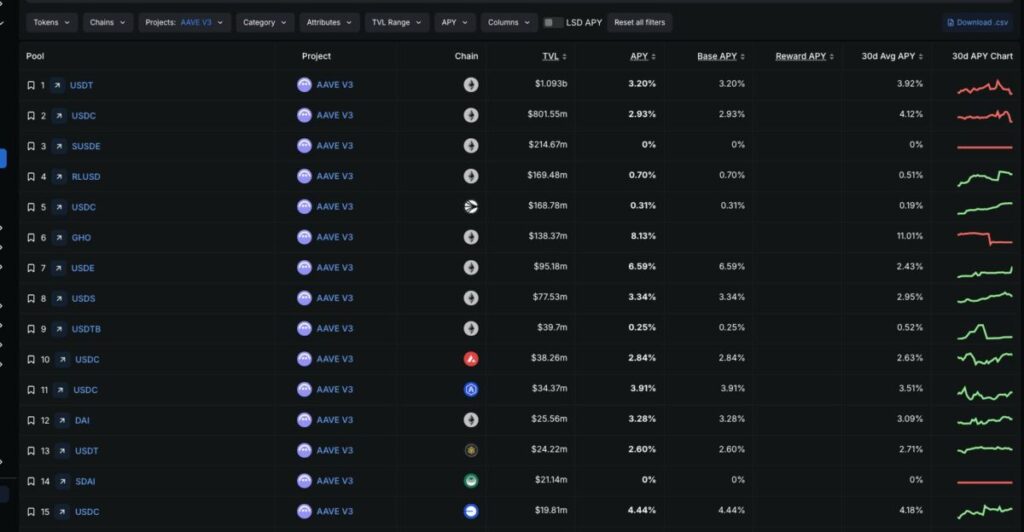

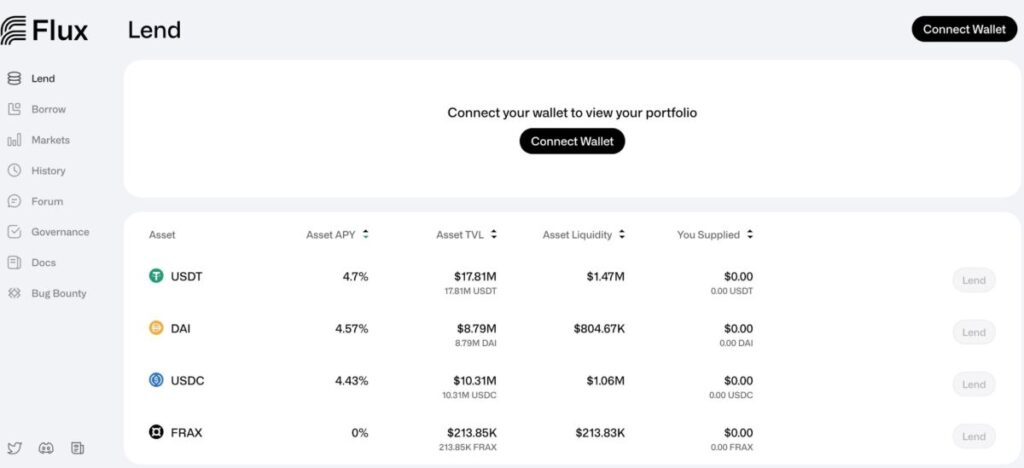

6.1 Lending Protocols (e.g., Aave v3, Compound)

How it works: Lend your stablecoins to borrowers; earn dynamic interest

– APY Range: 3% – 6%

– Top Assets: USDT, USDC, DAI, crvUSD

– Blockchains: Ethereum, Base, Optimism, Solana, Tron

Aave v3 now supports real-world collateral and modular risk tranching, offering better capital efficiency and lower default risk.

Pros: High liquidity, protocol maturity

Risks: Interest rate fluctuation, smart contract vulnerabilities

6.2. Stablecoin LPs + Liquid Staking Combinations

Use stablecoins in liquidity pools or combine them with LSTs (Liquid Staking Tokens) for enhanced returns.

Popular combinations in 2025 include:

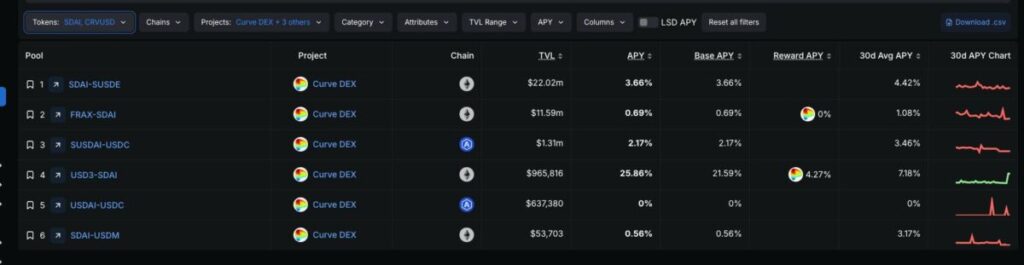

– Curve’s sDAI/crvUSD pool — boosted by Curve gauges

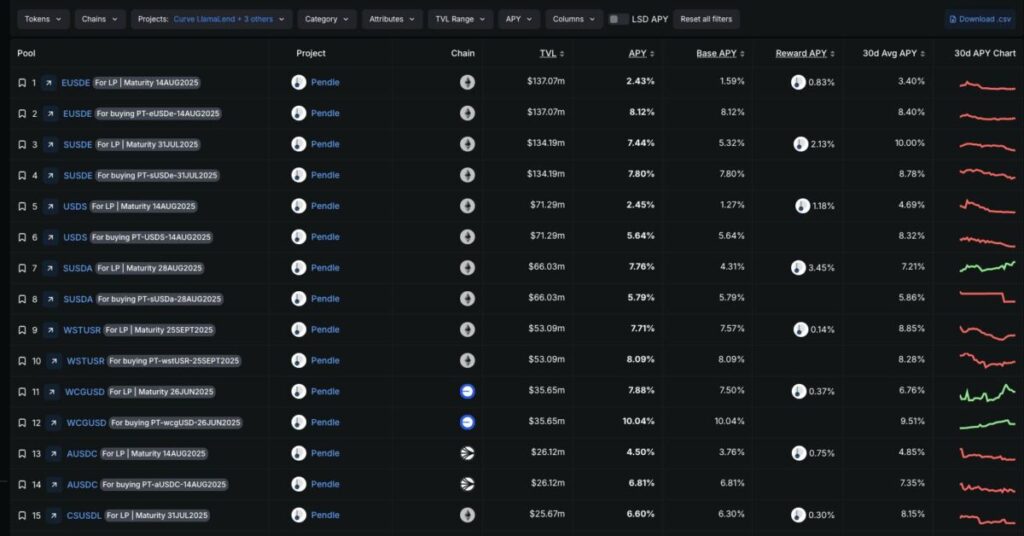

– Pendle: Fixed APY markets for tokenized yields

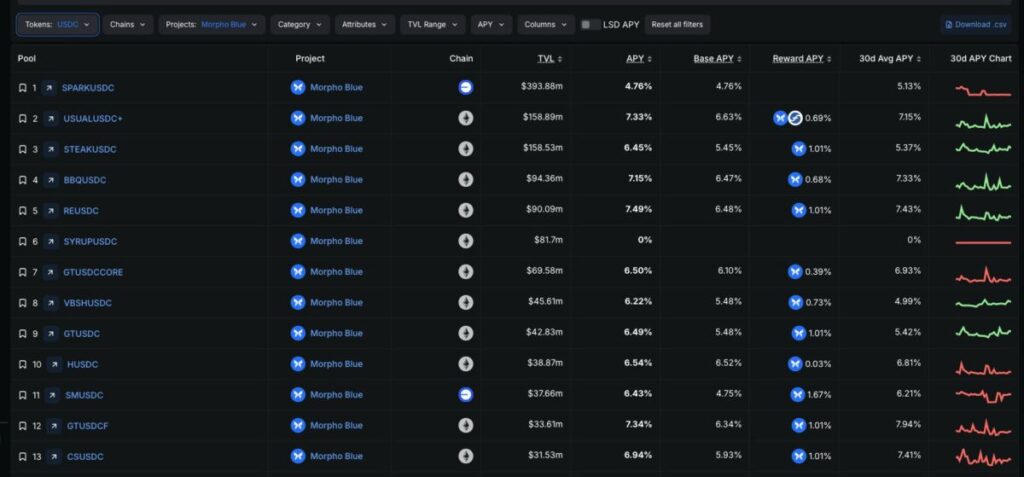

– Morpho Blue: Risk-isolated USDC lending vaults

Estimated APY: 10% – 18%, depending on lock-in and volatility exposure

Use Pendle to lock in future yield on stablecoins until Q4 2025 with transparent rate risk.

6.3 Real-World Asset (RWA) Protocols

Tokenized exposure to U.S. Treasuries and real estate debt has exploded in 2025.

Ondo Finance offers exposure to U.S. Treasuries with yields ranging from 4.43% to 4.7%. Their tokenized Treasury products provide institutional-grade backing through government securities, making them attractive for conservative yield seekers.

Maple Finance focuses on liquid digital assets with higher yield potential between 7% and 9.4%. Their platform connects institutional borrowers with lenders, offering enhanced returns through carefully vetted credit opportunities.

OpenEden specializes in short-term Treasury bills, delivering around 4.01% yields through their T-Bill vault. Their approach emphasizes capital preservation while providing steady, predictable returns.

Benefits across RWA protocols:

– Fully KYC’ed and integrated with MetaMask

– Attractive for institutions and DAOs managing treasury reserves

– Note: Some RWA protocols have regional restrictions

Yield Strategy Comparison: CeFi vs DeFi

Centralized Finance (CeFi) Platforms like MEXC:

– Ease of Use: Simple, user-friendly interfaces ideal for beginners

– Yield Potential: Moderate returns typically ranging from 4% to 8%

– Custody: Centralized custody with platform security guarantees

– Risk Profile: Platform and counterparty risk, but regulated environments

– Best For: Beginners, passive users, and those prioritizing simplicity

Decentralized Finance (DeFi) Protocols:

– Ease of Use: More technical, requires wallet management and protocol knowledge

– Yield Potential: Higher returns possible, often 6% to 15% or more

– Custody: Self-custody through personal wallets, full user control

– Risk Profile: Smart contract risks, potential depegging, but no platform dependency

– Best For: Advanced users, yield farmers, and those comfortable with technical complexity

7.Key Risks and How to Manage Them

Yield ≠ Guaranteed. Even stablecoin strategies involve multiple types of risk:

7.1Major Risks

– Depegging: USDC and DAI have experienced temporary depegs under stress

– Platform Insolvency: CeFi risk (e.g., Celsius, FTX)

– Smart Contract Bugs: DeFi exploits are common

– Liquidity Lockups: Especially in LP farming or fixed tranches

8.Risk Mitigation Tips

– Use audited and battle-tested platforms

– Avoid over-concentration in one protocol

– Diversify between CeFi and DeFi

– Monitor peg health (e.g., via Chainlink price feeds)

– Store funds in hardware wallets or insured custodial accounts

9.Strategic Considerations for MEXC Users

MEXC users have unique advantages when implementing stablecoin yield strategies:

Platform Integration Benefits

- Seamless fund management between trading and yield generation

- Institutional-grade security with regulatory compliance

- Flexible withdrawal options for capitalizing on market opportunities

- Comprehensive portfolio view combining trading and earning positions

10.Optimization Strategies

- Use MEXC Earn for base yield on idle trading balances

- Monitor DeFi opportunities for higher yield potential

- Maintain liquidity for trading opportunities while earning passive income

- Leverage MEXC’s risk management tools for overall portfolio protection

11.Final Thoughts: Stable Doesn’t Mean Stagnant

In 2025, building wealth in crypto doesn’t always mean chasing volatility.

Stablecoins have evolved into a powerful foundation for sustainable returns, and platforms like MEXC make it easier than ever to tap into this growing corner of the market.

Whether you’re parking idle funds in flexible savings, or exploring advanced on-chain strategies, stablecoins can do more than just sit in your wallet — they can work for you.

12.Ready to Earn?

– Start with MEXC Earn — flexible, safe, and beginner-friendly

– Already using DeFi? Try combining your stablecoins with Pendle, Aave v3, or Curve’s latest meta pools

– Remember: In crypto, it’s not about timing the market — it’s about time in the market

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up