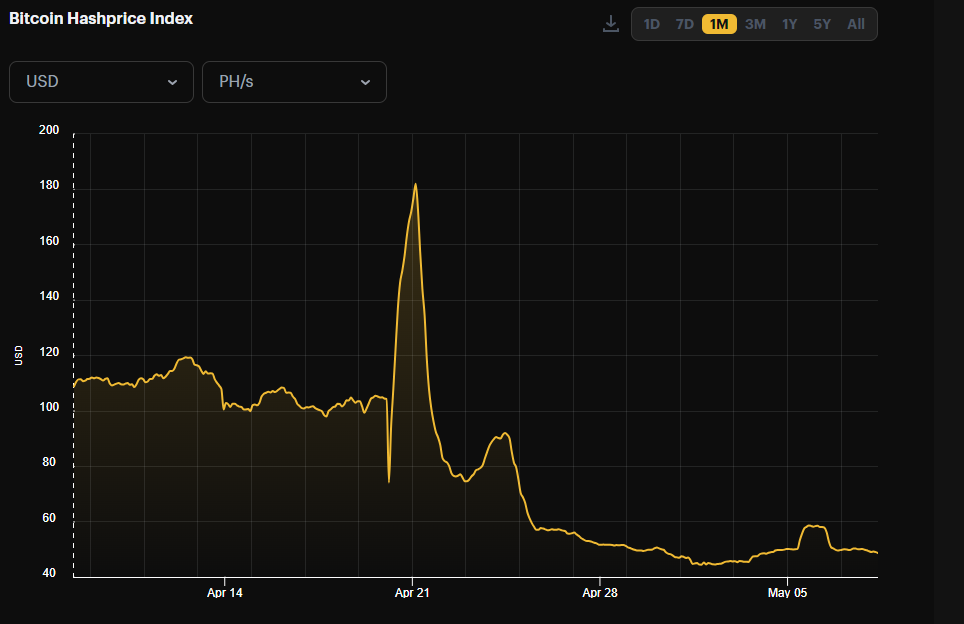

Bitcoin (BTC) has remained on an upward trajectory since the start of 2023, leaving behind the bearishness that plagued the market throughout last year. Despite the marked upswing, the asset has faced prevailing volatility in 2023, leading to fluctuations, especially in the last 30 days.

Bitcoin’s price stood at roughly $27,500 exactly 30 days ago. At its current value, the asset has registered a 3% drop in the past 30 days amid the recent mix of bearish and bullish events. Bitcoin reclaimed the $28,000 price territory on March 20 for the first time in nine months amid a rally that began on March 10.

This came on the heels of the emerging banking crisis in the United States following the implosions of Silvergate and Silicon Valley Bank. A mild devaluation of the dollar along with the brief USDC depeg event prompted investors to move their funds from USD-backed stablecoins to BTC. This led to an inflow of money into BTC, providing support for its rally to $28,000.

The asset soon faced resistance at the $28,000 territory but the bulls continued to champion a comeback in an effort to keep it above the zone. This resulted in a period of consolidation, with BTC trading at a range between $26,500 and $28,600. A lack of significant market-impacting developments kept the asset in this range for over a week.

BTC Defies a Growing Trend of Investor Angst

Notably, FUD surrounding Binance, the world’s largest exchange by trade volume, erupted on March 27, as the US Commodity Futures Trading Commission (CFTC) filed charges against the platform for violations of commodity regulations. BTC dropped by 3% on the day the charges were filed, but soon staged another comeback.

The Federal Reserve also approved an increase in interest rate by a quarter percentage point on March 22, raising the benchmark rate to a range of 4.75% and 5%. The central bank further hinted at further rate hikes to solidify its victory over inflation. This contributed little to the growing investor angst, as market watchers already expected the trend.

Moreover, the broader regulatory landscape in the United States continued to tilt towards unfavorable territories, compounding investors’ concerns. Coinbase disclosed that it had received a Wells Notice from the US SEC amid the regulatory agency’s crackdown on crypto and crypto staking services.

Paxos also received a Wells Notice from the SEC six weeks prior, but the growing concerns surrounding Binance and the US regulatory climate did little to hamper Bitcoin’s run. The asset defied the prevalent market conditions.

BTC printed two consecutive winning candles after March 27, setting the stage for the reclamation of $29,000. The asset reclaimed $29,000 on March 30, hitting a 9-month high of $29,184 before facing stern opposition that brought it below $28,000 once more.

Hurdles on the Journey to $30,000

Bitcoin eventually ended the month of March with an impressive 23% gain, adding over $5,000 to its value. The crypto asset closed the month at a price of $28,464, starting off April with a fresh mission to establish a firm position above the $29,000 zone.

However, BTC registered three consecutive losing candles on the first three days into April, dropping to a low of $27,200. Following a week of consolidation, the asset once again $29,000 on April 10, rallying to a high of $29,770, its highest point in the year at the time.

This upsurge provided enough support for Bitcoin’s next target, as the asset eventually surpassed the $30,000 mark on April 11 for the first time this year. BTC’s upswing persisted despite occasional hurdles stationed by the bears, with the asset gearing up to reach its next price target at $31,000.

However, the upsurge faced a massive roadblock on April 19 coinciding with SEC Chair Gary Gensler’s Congress oversight hearing session. Amid a series of nail-biting inquiries, Gensler refrained from confirming or denying that assets such as Ethereum (ETH) and XRP are securities, contributing to the existing regulatory uncertainty.

Reports of the session dominated the crypto scene, but this appeared to have had a negative effect on Bitcoin’s value. BTC ended April 19 with a 5% decline, shedding off over $1.5K from its value. The asset broke below the $30,000 and $29,000 zones, plummeting to $28,800.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about cryptocurrency industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Get up to $10,000 Bonus!

Sign Up