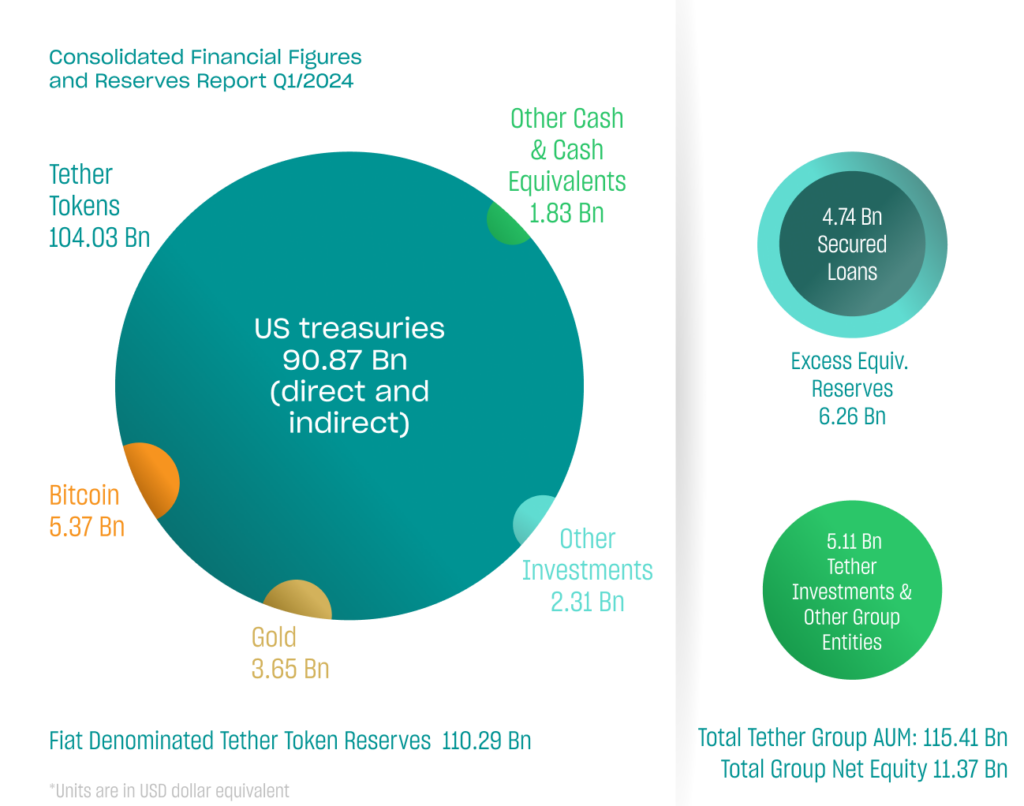

In a landmark attestation report for the first quarter of 2024, Tether Holdings Limited has demonstrated its continued financial strength and commitment to transparency. The report, conducted by leading accounting firm BDO, reveals that the stablecoin giant achieved a staggering net profit of $4.52 billion in Q1, setting a new record for the company.

Furthermore, a major driver of Tether’s surging profits was the strong performance of its U.S. Treasury holdings. Roughly $1 billion of the quarterly profits came from net operating income, primarily generated by these Treasury investments. The remainder was attributed to mark-to-market gains on the company’s bitcoin and gold positions.

Tether Reports Increase in Treasury Holdings

Notably, Tether also reported an unprecedented increase in its direct and indirect ownership of U.S. Treasury securities, which now exceeds $90.8 billion. This includes Treasury securities held outright as well as indirect exposure through reverse-repurchase agreements collateralized by Treasury securities and money market fund investments.

This achievement underscores Tether’s dedication to maintaining a highly liquid and secure reserve base.

For the first time, Tether disclosed the net equity of its consolidated group, which stood at an impressive $11.37 billion as of March 31, 2024. This represents substantial growth from the $7.01 billion in equity reported at the end of 2023.

The attestation also highlighted that Tether increased its excess reserves, held as a buffer for its stablecoin offerings, by $1 billion to reach nearly $6.3 billion.

In terms of the assets backing Tether’s stablecoins specifically, the report confirmed that a robust 90% are held in cash and cash equivalents, reflecting the company’s strong liquidity position. Tether’s stablecoin issuance also showed remarkable growth, with over $12.5 billion in new USDt entering circulation in Q1 alone.

Beyond its core stablecoin business, the attestation noted that Tether Group holds over $5 billion in strategic investments across key sectors like AI, renewable energy, peer-to-peer communications, and Bitcoin mining.

While not counted as part of the stablecoin reserves, these investments demonstrate Tether’s broader commitment to its mission.

Tether CEO Paolo Ardoino hailed the Q1 attestation as proof of the company’s industry leadership in transparency and risk management. “Tether continues to shatter records with a new profit benchmark of $4.52 billion, reflecting the company’s sheer financial strength and stability,” he stated. Ardoino further noted that:

“In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.”

Tether Invests $200 Million in Blackrock Neurotech

Tether’s attestation report comes just two days after the company announced that it had “made a strategic investment of $200 million into Blackrock Neurotech.” This investment makes Tether the major stakeholder in Blackrock Neurotech.

As Tether’s stablecoin offerings continue their robust growth and the company further diversifies its strategic investments, it appears well-positioned to cement its dominance in the rapidly evolving digital asset landscape. With its commitment to transparency and financial stability, Tether is setting a high standard for the industry to follow.

USDT Statistics Data

USDT Current Price: $0.9988

Market Cap: $110.5B

USDT 24-Hour Volume: $72.1B

USDT Circulating Supply: 110.6B

Total Supply: 113B

USDT Market Ranking: #3

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!