Key Insights:

- The stablecoin surge drove Bitcoin to $30K, boosting investor purchasing power.

- Stablecoins provide stability in volatile crypto markets, attracting investors for wealth preservation.

- Cryptocurrency whales accumulate stablecoins during Bitcoin stability, signaling future market opportunities.

The collective market capitalization of leading stablecoins, including USDT, USDC, BUSD, DAI, TUSD, and USDP, experienced a significant upswing in the past week. This surge in stablecoin value played a pivotal role in enhancing the purchasing power of crypto investors, subsequently propelling Bitcoin to the $30,000 mark. As this trend unfolds, sustained increases in cryptocurrency markets may hinge on major investors’ strategic accumulation of stablecoins when Bitcoin remains relatively stable.

What is Happening to the Crypto Market?

The cryptocurrency market is known for its inherent volatility, with assets like Bitcoin often experiencing dramatic price fluctuations. In this volatile landscape, stablecoins have emerged as a haven for investors seeking to safeguard their assets from the wild price swings that characterize cryptocurrencies. Stablecoins are digital currencies designed to maintain a stable value. This is achieved by pegging their worth to traditional fiat currencies or other assets.

The surge in the combined market capitalization of USDT, USDC, BUSD, DAI, TUSD, and USDP indicates growing confidence in stablecoins as a reliable store of value within the crypto ecosystem. Investors have increasingly turned to these stable assets to hedge against market uncertainty, as they provide a means to preserve wealth and facilitate transactions without the price risk associated with other cryptocurrencies.

This rise in stablecoin market capitalization has a ripple effect on the broader crypto market, particularly on Bitcoin. Bitcoin, often considered the flagship cryptocurrency, experienced a notable surge in its price, crossing the $30,000 threshold. This milestone is significant for Bitcoin and the entire cryptocurrency space, as it signals renewed interest and optimism among investors.

Why is Stablecoin So Good?

One key factor contributing to the success of stablecoins is their liquidity and ease of use. Traders and investors can swiftly move in and out of positions using stablecoins, providing a seamless bridge between the crypto and traditional financial worlds. This liquidity has made stablecoins attractive for institutions and individual investors.

To understand the potential for further sustained market growth, it’s crucial to examine the behavior of cryptocurrency whales, large investors who hold significant amounts of digital assets. When Bitcoin remains relatively stable, these whales often seek to accumulate stablecoins. This strategic move allows them to be well-prepared for future market opportunities, whether buying assets at lower prices during market dips or taking advantage of new investment prospects.

Current Bitcoin Price

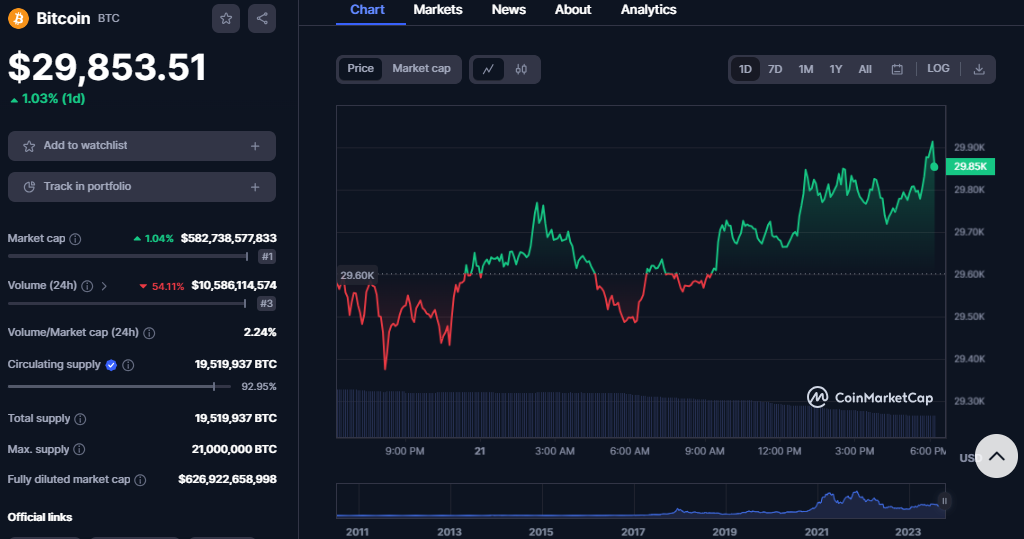

As of the time of writing, Bitcoin is exchanging hands at around $29,850, recording a 24-hour gain of 1.03% since yesterday’s close. BTC has been forming higher lows and lower highs on the daily chart, which is indicative of further gains in the short term.

However, the BTC/USD pair has faced stiff resistance at the $30,000 level and is struggling to break above that mark. This resistance has been tested several times this week, but the bulls have failed to sustain above it each time. BTC must close above the current support level to confirm a bullish trend and potentially move toward the next resistance at $32,000.

In conclusion, the recent surge in stablecoin market capitalization has undoubtedly played a pivotal role in boosting Bitcoin’s price to $30,000. This trend underscores the growing importance of stablecoins in the crypto ecosystem to preserve wealth and facilitate efficient transactions. As cryptocurrency whales accumulate stablecoins while Bitcoin maintains stability, the potential for sustained market growth becomes increasingly evident. This strategic approach by major investors could pave the way for further advancements in the crypto space, ultimately reshaping the landscape of digital finance.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!