In a newly released report by leading crypto research firm CCData, the stablecoin market has shown remarkable growth, reaching a two-year high in total market capitalization. This surge comes amidst a backdrop of significant challenges for central bank digital currencies (CBDCs) across the globe.

Stablecoins Mark Impressive Performance in May

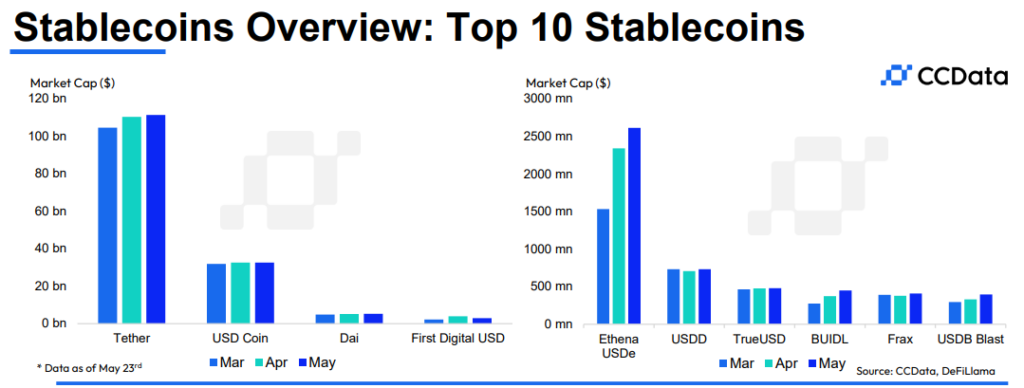

According to the CCData report, May 2024 saw the total market cap of stablecoins climb to an impressive $161 billion, a level not seen since April 2022. This milestone marks the eighth consecutive month of growth and signifies a complete recovery from the market downturn that followed the TerraUSD collapse in 2022.

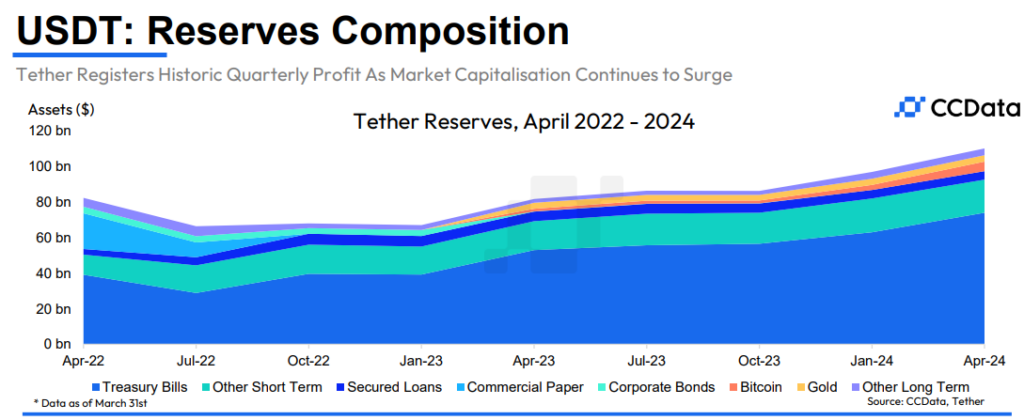

Leading the pack is Tether (USDT), which achieved an all-time high market cap of $111 billion. The stablecoin giant also reported record quarterly profits of $4.52 billion, primarily attributed to gains in their US Treasury bill holdings, which now account for 67.1% of Tether’s reserves.

Circle’s USDC also experienced substantial growth, with its market cap increasing for the sixth straight month to reach $32.6 billion. This growth coincides with a recent surge in demand for USDC, which recorded its all-time high monthly trading volume on centralized exchanges in March.

CBDCs Continue to Stumble

While stablecoins are enjoying a period of growth and stability, the CCData report highlights the ongoing struggles faced by CBDCs.

In the United States, the House of Representatives recently passed the “CBDC Anti-Surveillance State Act,” a bill that prohibits the Federal Reserve from issuing a CBDC to implement monetary policy. This move raises questions about the future of a US-backed digital currency.

Here’s a post from US Rep. Eli Crane on the subject.

Similarly, Brazil has announced a delay in its CBDC pilot program, now slated to begin in 2025 rather than the initially planned 2024 launch. The postponement is attributed to concerns over privacy safeguards.

The report also sheds light on the slow adoption of Nigeria’s e-Naira CBDC, which has only seen 29.3 billion NGN ($63.5 million) in transactions since its launch in October 2021—a mere 7.3 billion NGN increase since March 2023.

Stablecoin Trading Volume Dips

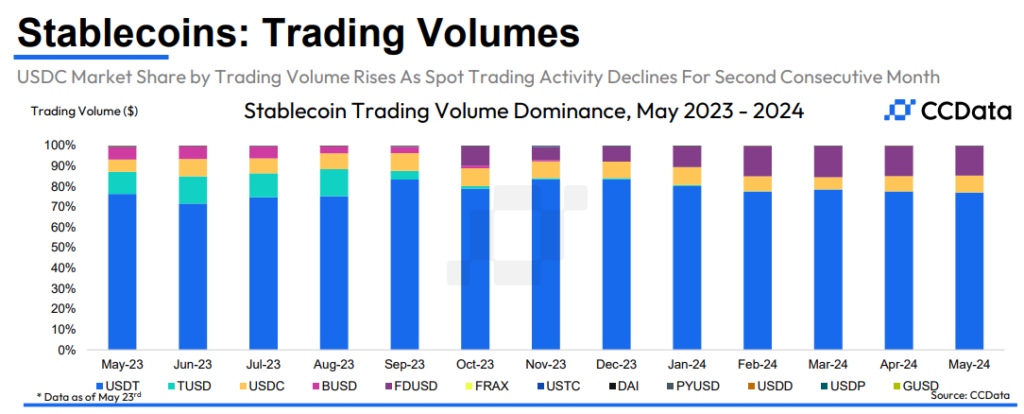

The CCData report further delves into stablecoin trading volumes, noting a slight dip in April following seven months of consistent growth. Centralized exchanges (CEXs) recorded $1.46 trillion in stablecoin trades, with USDT maintaining its dominance with a 77% market share.

USDC saw its share rise to 8.27%, a 4-month high, while newcomer First Digital USD (FDUSD) experienced a decrease in its market share by trading volume to 14.5%.

Concerns over potential regulatory challenges for stablecoins have also surfaced, particularly in light of the upcoming Markets in Crypto Assets (MiCA) regulations in Europe. These regulations may pose compliance issues for Tether and other stablecoin issuers.

Final Word

Looking ahead, the stablecoin market appears poised for further growth, bolstered by increasing demand and a maturing regulatory environment.

As for CBDCs, their future remains uncertain, with the coming months and years likely to be crucial in determining their viability and role within the global financial system.

One thing, however, seems clear: the world of digital assets is evolving rapidly, and both stablecoins and CBDCs are set to play a significant role in shaping the future of finance.

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up