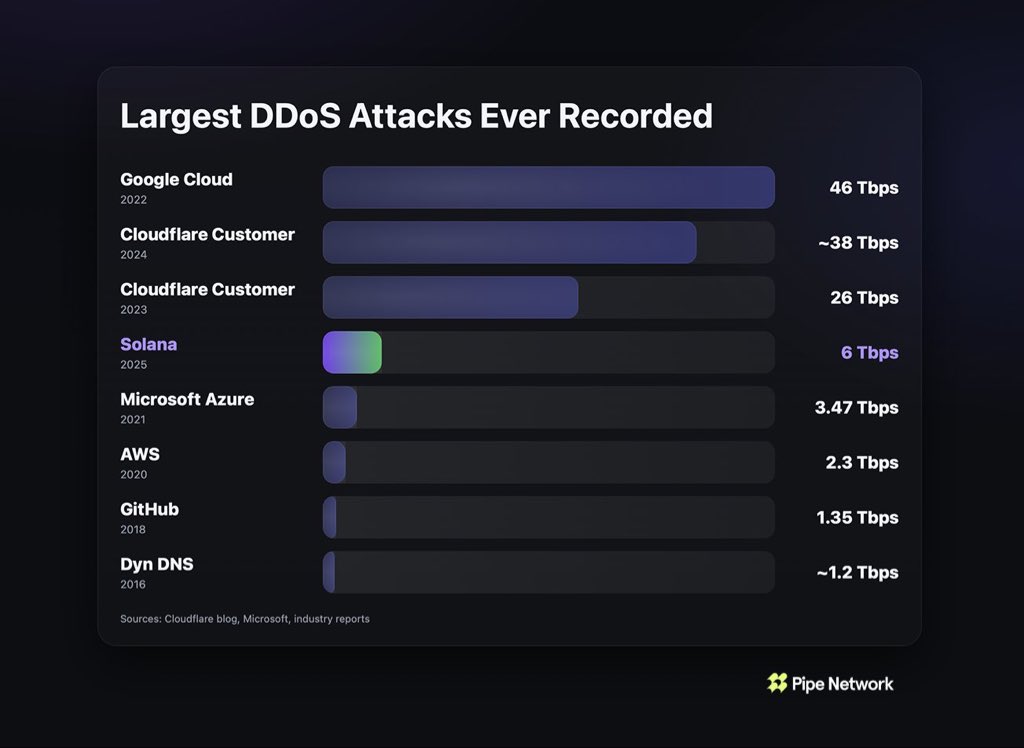

For one week, Solana has been under siege by one of the most powerful cyberattacks in internet history—and most users never noticed. Solana disclosed that its blockchain had been under a sustained distributed denial-of-service attack for the past week, with peak malicious traffic nearing 6 terabits per second (Tbps), ranking as the fourth-largest DDoS attack ever recorded across any distributed system.

What makes this story remarkable isn’t just the scale—it’s the outcome. Despite the volume, network performance remained steady. Blocks continued to be produced on schedule, and on-chain data confirmed that transactions were consistently finalized in sub-second confirmations. While the attack would typically cripple most systems, Solana’s infrastructure absorbed billions of packets per second without a single second of downtime, silencing long-standing critics who have questioned the network’s reliability since its troubled 2021-2022 period.

The attack places Solana in unprecedented company—alongside Google Cloud (46 Tbps), Cloudflare (38 Tbps), and Microsoft Azure (15.72 Tbps)—as one of the few systems to withstand internet-scale assaults. For a public blockchain to achieve this level of resilience marks a watershed moment for crypto infrastructure credibility.

The Attack: Week-Long Assault at Industrial Scale

The situation was first highlighted by the account SolanaFloor on X (formerly Twitter) on December 16, 2025. The post described a week-long DDoS campaign peaking near 6 Tbps and emphasized that network metrics showed “no impact” on performance.

Attack Specifications:

- Duration: 7+ consecutive days (December 9-16, 2025)

- Peak Traffic: ~6 Tbps (terabits per second)

- Packets Per Second: Billions

- Historical Ranking: 4th largest DDoS attack ever recorded

- Network Impact: Zero measurable disruption

Pipe Network said of the ongoing attack via X today: “The ongoing DDoS attack on Solana is one of the largest in internet history. 6 Tbps volumetric attack translates to billions of packets per second. Under that kind of load, you’d normally expect rising latency, missed slots, or confirmation delays”.

Yet that’s not what happened. “Median tx confirmation ~450ms,” the team wrote, adding that p90 remains under 700ms and slot latency is holding at 0–1 slots. In practical terms, if you’re a regular user or trader, you might not even know anything’s happening.

How Solana Stayed Online: Engineering vs. Brute Force

The resilience wasn’t accidental. According to the team, the apparent calm on-chain was not a matter of luck. Instead, they argue it was the result of deliberate engineering choices around parallel processing, validator coordination, and protocol optimization.

Key Technical Advantages:

Parallel Processing Architecture: Unlike blockchains that process transactions sequentially, Solana’s design handles thousands of operations simultaneously across its 200+ validators. When malicious traffic floods the network, legitimate transactions aren’t queued behind junk packets—they’re processed in parallel streams that can’t be easily overwhelmed.

QUIC Protocol Enhancements: Recent QUIC protocol enhancements played a key role. By improving transport-layer efficiency and congestion control between clients and validators, these upgrades helped ensure that legitimate traffic could still be prioritized and processed quickly, even while malicious packets flooded the network.

Validator Distribution: Validators remained online, applications continued operating, and users were able to submit and confirm transactions without visible delay. The 200+ validator network meant no single point of failure could be exploited to cascade into system-wide disruption.

Industrial-Scale Target Recognition: David Rhodus, founder of Permissionless Labs (and a contributor to Pipe Network), said: “This puts Solana among the most heavily DDoSed targets in internet history. It reinforces that blockchains are now Tier-1 DDoS targets. This is not ‘script kiddie’ activity — 6 Tbps is industrial-scale”.

Historical Context: Solana’s Redemption Arc

The successful defense represents a dramatic reversal from Solana’s troubled past. The attack contrasts sharply with Solana’s 2021-2022 experience, when similar DDoS incidents caused extended network failures. A May 2022 attack marked the seventh network outage that year, fueling criticism of the chain’s reliability.

Previous Failures:

- September 2021: 17-hour outage during token sale

- January 2022: Multiple hours offline

- May 2022: Seventh outage of the year

- 2021-2022 Total: Seven major network disruptions

The network has not reported an outage since May 2023, reflecting infrastructure improvements including Firedancer, a validator client designed to boost network performance built by Jump Crypto.

Helius CEO Mert Mumtaz noted that the network withstood weeks of sustained attack, with users remaining unaware of the assault due to engineering improvements, writing on X: “solana has been under a colossal DDoS attack for at least over a week now btw. the fact that you havent experienced it is a big testament to the level of engineering present here.”

Founder Response: “Bullish”

Solana co-founder Anatoly Yakovenko characterized the attack as validation rather than threat. Disclosing the assault on December 9, he described it as “the worst active threat against the network” while noting that network timing remained unaffected, with slot latency at zero throughout. He characterized the situation as bullish and suggested that attackers were spending roughly as much as the chain generates in revenue just to send it traffic.

His technical assessment emphasized how validator count helps resilience: “Validators count helps if the previous leader can finish their block while the current one is being hit”, explaining the handoff dynamics that prevent attack propagation.

Market Impact: SOL Price Holds Despite FUD

While the attack generated headlines, SOL price action remained surprisingly stable:

Current Price Performance (December 16-17, 2025):

- SOL Price: ~$126-$135 range

- 24h Change: -1% to +2% (varied by exchange)

- Weekly Performance: Down ~8% (broader market correlation)

- Volume: $6.02 billion (24h)

Solana drops over 1% on Tuesday, risking the $126 support level with the third straight bearish candle, but the Solana blockchain remains stable amid an ongoing DDoS attack reaching 6 Tbps, with no signs of technical delays or disruptions.

Notably, SOL’s decline mirrors broader crypto market weakness rather than attack-specific selling. The fact that the network maintained functionality prevented the panic selling that typically follows major infrastructure issues.

Broader Ecosystem Implications

Most-Watched Blockchain Status: Solana has emerged as the most watched blockchain network of 2025, capturing more blockchain-specific attention than any other for the second year running. According to recent data from CoinGecko, Solana accounted for roughly 26.8% of all blockchain-related searches, mentions, and on-chain activity.

Institutional Confidence: JP Morgan recently used Solana to issue $50 million in US commercial paper on-chain, which again shows that big financial firms are becoming more interested in using Solana’s speed and low fees for real financial products.

Sui Network Comparison: The resilience contrasts sharply with competing networks. The Sui network was also targeted by a DDoS attack yesterday, resulting in delays in block production and periods of degraded network performance, highlighting that not all next-generation blockchains can withstand industrial-scale assaults.

What This Means for Blockchain Infrastructure

The successful defense answers a critical question facing crypto adoption: can decentralized networks handle real-world stress at internet scale?

Enterprise Viability: For financial institutions considering blockchain infrastructure, uptime under attack is non-negotiable. Solana’s performance provides a proof point that decentralized systems can match or exceed centralized alternatives for mission-critical applications.

Security Model Validation: The attack tested whether Solana’s design philosophy—optimizing for speed while maintaining decentralization—creates security vulnerabilities. The answer appears to be no: parallel processing and validator distribution proved more resilient than skeptics predicted.

Competitive Positioning: As Ethereum grapples with L2 fragmentation and other L1s struggle with adoption, Solana’s demonstrated resilience under fire strengthens its narrative as the high-performance alternative for demanding applications.

Conclusion: From Fragile to Fortress

Three years ago, Solana endured seven outages and earned a reputation for fragility. Today, it absorbed the fourth-largest cyberattack in internet history without dropping a single transaction. The transformation isn’t just technical—it’s philosophical proof that decentralized infrastructure can achieve reliability matching or exceeding centralized systems.

For SOL holders and ecosystem participants, the week-long test under fire provides confidence that the network can handle extreme adversarial conditions. For the broader crypto industry, it demonstrates that blockchain infrastructure has matured to the point of withstanding threats that would cripple most traditional systems.

The attackers spent millions attempting to disrupt Solana. They achieved nothing except validating the network’s engineering. As Yakovenko noted—that’s bullish.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up