NVIDIA (Stock Symbol: NVDA), as the world’s leading artificial intelligence chip manufacturer, has consistently been a focal point for investors in the tech sector. This article provides comprehensive coverage of NVIDIA’s latest stock price information, fundamental company analysis, and a detailed guide on trading NVIDIA US stock contracts through the MEXC trading platform. Whether you’re an AI concept stock investor or a cryptocurrency trader, this guide will help you fully understand strategies, risks, and practical steps for NVIDIA stock futures trading.

The rise of the artificial intelligence wave has made NVIDIA one of the brightest stars in the technology sector. From gaming graphics cards to AI chips, NVIDIA has consistently remained at the forefront of technological innovation. For investors looking to participate in NVIDIA stock investment, traditional securities accounts aren’t the only option. US stock futures trading services offered by cryptocurrency trading platforms like MEXC allow you to flexibly trade NVIDIA stock using digital assets like USDT, enjoying the advantages of 24/7 trading, leverage capabilities, and bidirectional trading.

1. NVIDIA Stock Current Price & Market Performance

1.1 Important Note About NVIDIA Stock Price

Since my knowledge cutoff date is the end of July 2025, I cannot provide real-time NVIDIA stock prices for October 15, 2025. Stock prices fluctuate continuously, so to obtain the latest NVIDIA stock price information, you can check through the following channels:

Real-time Price Inquiry Channels:

- Visit the MEXC trading platform to view NVDAUSDT contract real-time prices

- Use Google to search for “NVDA stock price” or “NVIDIA stock price”

1.2 NVIDIA Stock Historical Performance Review

NVIDIA has experienced significant stock price growth over the past few years. After the AI boom began in early 2023, NVIDIA’s stock price experienced explosive growth, with annual gains exceeding 200%. Entering 2024, while experiencing some volatility, the overall trend remained upward, primarily benefiting from strong data center business growth and sustained robust demand for AI chips.

Notably, NVIDIA conducted a 10-for-1 stock split in June 2024, which numerically lowered the stock price but didn’t affect total market capitalization or shareholder equity. This move aimed to increase stock liquidity and allow more investors to participate.

1.3 NVIDIA’s Market Capitalization Standing

NVIDIA is currently one of the world’s largest tech companies by market cap, ranking alongside giants like Apple and Microsoft. Its market cap reflects the market’s optimistic expectations for the long-term prospects of the AI industry and demonstrates NVIDIA’s dominant position in the AI chip sector.

2. NVIDIA Company Fundamental Analysis

2.1 Company Profile & Core Business

Founded in 1993 and headquartered in Santa Clara, California, NVIDIA initially gained fame producing GPUs (Graphics Processing Units), primarily for computer gaming. However, with technological evolution, NVIDIA successfully expanded GPU technology into multiple high-growth areas including artificial intelligence, data centers, and autonomous driving.

2.2 Competitive Advantage Analysis

NVIDIA’s success isn’t coincidental but built on multiple core competitive advantages.

Technological leadership is NVIDIA’s greatest moat. The company possesses deep technical expertise and extensive patents in GPU architecture design, parallel computing, and AI acceleration. Its CUDA software platform has become the de facto standard for AI development, creating a powerful ecosystem lock-in effect.

Ecosystem advantages are equally significant. Major global AI companies like OpenAI, Google, and Meta are important NVIDIA customers. A massive developer community continuously contributes tools and applications to the CUDA platform, forming a virtuous cycle.

Supply chain integration capabilities are also noteworthy. Although NVIDIA operates a fabless model, it has established deep partnerships with top foundries like TSMC, securing priority access to cutting-edge process capacity.

In brand influence, NVIDIA has become synonymous with AI and high-performance computing. It has established powerful brand recognition among both enterprise clients and consumers, providing natural advantages for new product launches.

2.3 Financial Performance Highlights

NVIDIA’s financial data consistently exceeds market expectations. Company revenue maintains high-speed growth, with gross margins sustained at high levels of 60-70%, exceptionally rare in the hardware industry. Strong profitability provides ample funding for R&D investment and shareholder returns.

The company’s balance sheet is healthy with abundant cash reserves and virtually no net debt. This financial strength allows NVIDIA to flexibly respond to market changes and make strategic investments and acquisitions.

Regarding shareholder returns, NVIDIA implements an aggressive stock buyback program and regularly pays dividends, though dividend yields remain relatively low. Management prefers allocating funds toward R&D and growth investments, consistent with characteristics of high-growth tech companies.

3. NVIDIA Stock Investment Value Assessment

NVIDIA’s long-term bullish case centers on its dominant position in the accelerating AI revolution. The company stands at the core of global AI infrastructure, benefiting from surging demand for high-performance chips powering generative AI, data centers, and cloud services. Major tech giants—Microsoft, Google, and Amazon—are expanding AI capital expenditures worth hundreds of billions of dollars, positioning NVIDIA as the primary hardware beneficiary. Continuous product innovation, such as next-generation B-series GPUs, and strong pricing power driven by supply constraints further consolidate its leadership. Meanwhile, emerging sectors like autonomous driving, robotics, and the metaverse could become NVIDIA’s next growth frontiers.

However, the company also faces multiple risk factors. Its lofty valuation leaves little margin for disappointment, and intensifying competition—from AMD and in-house chips developed by major clients—could pressure market share. Regulatory restrictions, particularly on advanced chip exports to China, add uncertainty, while potential antitrust scrutiny and supply chain dependencies (notably on TSMC) pose additional vulnerabilities. Moreover, the sustainability of the current AI investment boom remains unclear; any slowdown in adoption could trigger demand contractions.

Given these dynamics, NVIDIA is most suitable for long-term investors with strong conviction in the AI sector and tolerance for volatility. Short-term speculation carries high risk due to valuation sensitivity and event-driven price swings. A gradual, dollar-cost-averaging approach may help mitigate timing risk, while professional traders can tactically adjust positions around market cycles and earnings catalysts to capture both trend and volatility opportunities.

4. MEXC Platform NVIDIA Stock futures trading Guide

4.1 MEXC Platform Overview

MEXC is a globally recognized digital asset trading platform founded in 2018, serving over 10 million users worldwide. The platform supports spot trading, futures trading, margin trading, and other trading methods, with a rich product lineup including hundreds of cryptocurrencies and tokenized US stock contracts.

MEXC’s advantages include high liquidity, low fees, user-friendly interfaces, and robust security measures. The platform employs cold-hot wallet separation, multi-signature technology, and other methods to protect user assets, providing 7×24 customer support.

4.2 NVIDIA Stock Contract Product Features

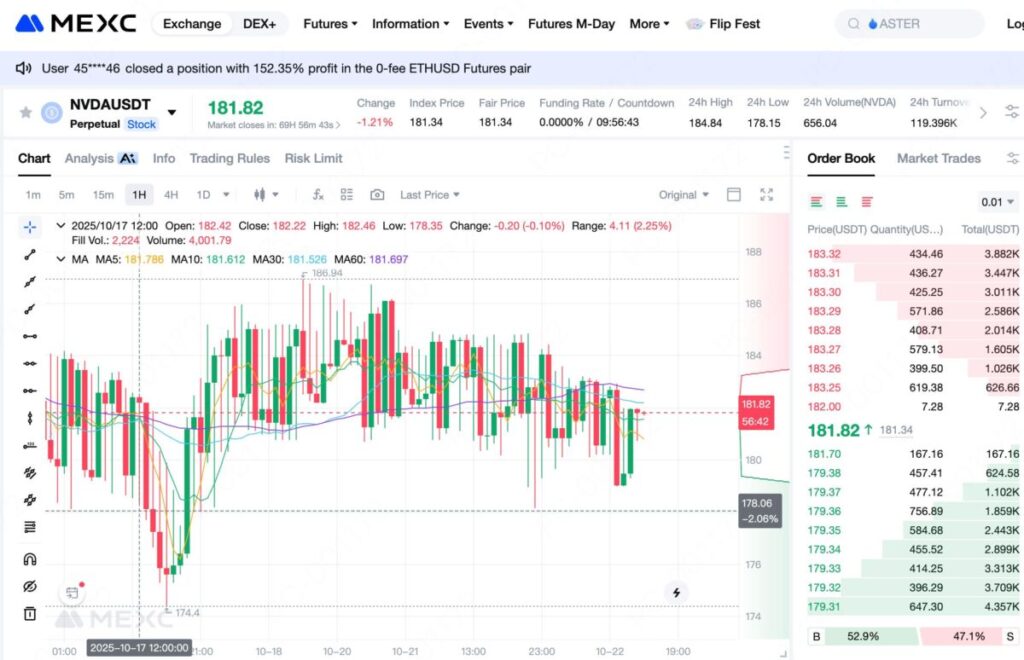

On the MEXC platform, NVIDIA stock contracts typically trade as NVDAUSDT, a perpetual contract product.

Main features include:

Perpetual contracts have no expiration date, allowing you to hold positions indefinitely until actively closing. Unlike traditional futures requiring periodic settlement, this provides greater flexibility.

Leverage trading is supported, typically offering 1x to 100x leverage options. Higher leverage means controlling larger positions with less capital, amplifying both gains and risks. Beginners should start with lower leverage, like 5x or 10x.

Bidirectional trading mechanisms allow both long (buy) and short (sell) positions. In traditional stock investing, shorting typically requires borrowing shares with complex procedures and numerous restrictions, while futures trading makes shorting as convenient as going long.

Using USDT as margin and settlement currency—a stablecoin pegged to the US dollar—avoids price volatility risks of other cryptocurrencies. You don’t need actual NVIDIA stock or US dollars, only USDT to participate in trading.

24/7 trading isn’t restricted by traditional US stock market trading hours. Even during US stock market closures on weekends or holidays, you can still trade NVIDIA contracts, though liquidity may decrease during these times.

5. Detailed Steps for Trading NVIDIA Contracts on MEXC

Step One: Register & Verify Account

First, visit the MEXC official website or download the official mobile application. Click the registration button, choosing either email or phone number registration. After filling in required information and setting a strong password, the system will send a verification code to your email or phone. Enter the verification code to complete registration.

After successful registration, strongly recommend immediately enabling two-factor authentication (2FA). Go to security settings, bind Google Authenticator or another authentication app. This step significantly enhances account security, preventing unauthorized access.

To increase trading limits and comply with regulations, complete KYC identity verification. Enter the personal center’s identity verification page, upload ID photos and personal information as prompted. Basic verification typically takes only minutes, while advanced verification may take several hours to one day. After verification, your account functions will be fully accessible.

Step Two: Deposit USDT

To trade NVIDIA contracts, you first need USDT in your account. MEXC supports multiple deposit methods.

If you already have USDT on another exchange or wallet, you can directly transfer to MEXC. Enter the deposit page, select USDT currency, choose network type (TRC20 recommended for low fees and fast speed), copy your MEXC deposit address, then send USDT from external wallet or exchange to that address. Usually arrives within minutes.

If you don’t have USDT yet, you can purchase directly using credit or debit cards. MEXC supports various fiat payment methods, though specific availability varies by region. Additionally, the platform offers P2P trading functionality, allowing peer-to-peer purchases of USDT with local currency.After deposit completion, USDT displays in your spot account. Note that futures trading requires transferring funds from spot account to contract account.

Step Three: Transfer Funds to Contract Account

On MEXC platform, spot and contract accounts are separate. Enter asset management page, find account transfer function. Select transfer from spot to contract account, choose USDT currency, enter transfer amount. Suggest not transferring all funds at once, keeping some in spot account as backup.

After confirming transfer, funds immediately arrive in contract account and you can start trading. Transfer is instant and fee-free, allowing flexible fund allocation between spot and contract accounts anytime.

Step Four: Find NVIDIA futures trading Pair

Enter MEXC’s futures trading page. Search “NVDA” or “NVIDIA” in the trading pair list, find NVDAUSDT perpetual contract. Click the trading pair, and the page displays NVIDIA’s real-time price chart, market depth, recent transaction records, and other information.

Trading interfaces typically include several main sections: left side shows price charts and technical indicators, middle displays order book showing buy/sell orders, right side is trading panel for placing orders, bottom shows your current positions and order history.

Spend time familiarizing yourself with interface layout and functions. You can adjust chart timeframes, add technical indicators, view funding rate history—these tools will help make better trading decisions.

Step Five: Set Trading Parameters

Before placing orders, configure several key parameters.

Leverage selection is crucial. Click leverage settings button to see options from 1x to 100x. For volatile tech stocks like NVIDIA, beginners should choose 5-10x leverage. Even experienced traders should cautiously use leverage exceeding 20x. Remember, higher leverage means greater liquidation risk.

Order types mainly include two. Market orders execute immediately at current best price, suitable for quick entries. Limit orders let you set desired execution price, only executing when market price reaches your set price, suitable for specific price targets.

Position mode offers cross margin and isolated margin. Cross margin uses all available account balance as margin, with greater risk and reward. Isolated margin keeps each position’s margin independent; one position’s liquidation doesn’t affect others, offering more controllable risk. Beginners should use isolated margin mode.

Step Six: Open Position

After setting all parameters, you can start trading.

If you expect NVIDIA stock price to rise, choose long (open long/buy). In the trading panel, enter your desired contract quantity or margin amount. The system automatically calculates required margin and potential profit/loss. After verifying accuracy, click “Buy/Long” button and confirm order.

If you expect price decline, choose short (open short/sell). Process similar to going long, just opposite direction. When shorting, note that if price rises, you’ll lose money, making stop-loss settings especially important.Market orders execute immediately, viewable in position list. Limit orders wait in order book for execution, viewable in pending orders, with option to cancel unfilled limit orders anytime.

Step Seven: Set Take-Profit and Stop-Loss

Setting take-profit and stop-loss immediately after opening positions is good risk management practice. In position list, find your NVIDIA position and click “TP/SL” button.

Stop-loss price should be set according to your risk tolerance. Generally suggest maximum single trade loss not exceeding 2-5% of account funds. For example, using 10x leverage going long, you might set stop-loss 5-10% below entry price.

Take-profit price is based on your profit targets. Can reference technical analysis resistance levels or set fixed profit percentages like 20% or 30%. Some traders prefer setting multiple take-profit levels, taking profits in stages.

After setting, when market price touches stop-loss or take-profit levels, the system automatically closes positions without manual operation. This proves especially useful during rapid market movements or when you can’t actively monitor.

Step Eight: Monitor Positions & Close

During holding period, closely monitor market dynamics and position status. In position list, you can view in real-time: entry price, current market price, position quantity, unrealized profit/loss (floating P&L), used margin, and available margin.

Pay special attention to liquidation price—the price level triggering forced liquidation. If market price approaches liquidation price, consider adding margin or partially closing positions to reduce risk.

When deciding to close, you can choose market close or limit close. Market close immediately closes all or part of position at current price, suitable for quick exits. Limit close lets you set desired closing price, automatically closing when market reaches that price.

After closing, profit/loss immediately settles to your contract account balance. You can view detailed information for each trade in trade history, including entry price, exit price, holding time, fees, and final P&L.

6. NVIDIA Stock futures trading Strategies

NVIDIA’s strong price momentum and clear trend behavior make it well-suited for trend-following strategies. Traders can track moving averages to identify directional bias—when short-term MAs cross above long-term ones, it often signals bullish continuation, while downward crosses suggest possible corrections. The key lies in patience: wait for confirmation, ride established trends, and use trailing stops to secure profits without exiting too early.

Breakout trading is another effective approach, especially around high-volatility events such as earnings or product launches. Identifying key support and resistance zones allows traders to react swiftly when price breaks through with volume expansion. Distinguishing real from false breakouts is essential—true breakouts are supported by strong volume and news catalysts, while false ones reverse quickly. Tight stop-losses are critical for managing risk in these setups.

An event-driven strategy focuses on major catalysts like quarterly earnings, GPU releases, or CEO Jensen Huang’s public addresses. These moments often trigger large short-term price swings. Traders can position ahead of earnings based on market expectations or trade post-release volatility. Likewise, regulatory headlines—such as U.S. export restrictions—can shift NVIDIA’s business outlook and trigger rapid repricing. Monitoring the corporate calendar and macro news flow helps anticipate these moves.

For seasoned participants, arbitrage strategies can also unlock opportunities. Statistical arbitrage exploits price discrepancies between NVIDIA and correlated assets such as AMD or the Philadelphia Semiconductor Index. Event-based arbitrage leverages options or perpetual futures to capture volatility around major announcements while limiting directional risk. Though complex, these tactics can enhance portfolio efficiency when executed with precise risk control.

7.Risk Management & Trading Discipline

Capital Management Principles

Effective risk control is the foundation of consistent trading. Each trade should risk no more than 2–3% of total capital, with single positions ideally limited to 20–30%. Use calculated position sizing and strict stop-loss levels to avoid excessive drawdowns. Leverage amplifies both profit and loss—new traders should use minimal leverage and scale up gradually with experience.

Stop-Loss Strategies

Always define and respect stop-loss levels before entering trades. A fixed-percentage stop (e.g., 5–10%) works for simplicity, while technical stops—set below support or above resistance—align better with price structure. Time-based stops also prevent capital from stagnating in unproductive trades. Above all, never widen or cancel stop-losses; discipline is key to long-term survival.

Psychological Stability

Emotional control separates professionals from amateurs. Avoid overconfidence after wins or revenge trading after losses. Accepting that losses are part of the process—profitability depends on maintaining a positive risk-reward ratio, not perfect accuracy. Keeping a detailed trading journal to review decision logic and outcomes helps refine strategies and improve consistency over time.

8. NVIDIA Stock & Market Correlation Analysis

NVIDIA’s price action remains closely tied to broader tech sector trends, particularly the Nasdaq Composite and Philadelphia Semiconductor Index. As a high-beta stock, NVIDIA typically amplifies sector movements—outperforming during tech rallies , but correcting more sharply when sentiment weakens. Tracking sector rotation, index momentum, and fund flows provides valuable context for positioning in NVIDIA futures, as strong overall tech performance usually enhances its upside potential.

At the same time, NVIDIA’s valuation and trading rhythm are shaped by external dynamics. Competition from AMD can temporarily influence sentiment, though NVIDIA’s dominance in AI chips generally secures a premium. Broader macro factors—such as U.S. Interest-rate expectations, economic growth outlook, and chip export regulations—also play critical roles. Rate-cut cycles and rising enterprise IT spending tend to favor NVIDIA’s growth narrative, while tightening policy or trade restrictions may cap its near-term momentum.

9.Frequently Asked Questions (FAQ)

Q1: Is now a good time to invest in NVIDIA stock?

This question has no simple answer, depending on multiple factors. Long-term, if you believe the AI industry will continue growing, NVIDIA as industry leader still holds investment value. However, valuation risks warrant attention. NVIDIA’s current P/E and P/S ratios sit at historical highs, with prices fully reflecting the market’s optimistic expectations.

Q2: What’s the difference between trading NVIDIA contracts on MEXC versus buying actual stock?

Main differences include several aspects:

Ownership difference: Trading on MEXC involves derivatives contracts; you don’t own actual NVIDIA stock, thus no voting rights or dividend entitlements. Buying actual stock confers company equity and corresponding rights.

Leverage functionality: MEXC contracts support leveraged trading, controlling larger positions with less capital, amplifying both gains and risks. Traditional stock investing typically doesn’t use leverage or only limited margin.

Trading flexibility: futures trading allows bidirectional operations; shorting as convenient as going long. Traditional stock shorting requires borrowing shares with complex procedures and numerous restrictions.

Trading hours: MEXC provides 24/7 trading, unrestricted by US stock market hours. Traditional stocks only trade during US market open periods.

Settlement method: MEXC uses USDT settlement, requiring no USD or securities account. Traditional stock investing requires USD and brokerage accounts.

Holding costs: Contract positions pay funding rates; long-term holding costs are higher. Stocks lack such fees, suitable for long-term investment.

Choose based on investment objectives, time horizons, and risk preferences.

Q3:How volatile is NVIDIA stock?

NVIDIA is a high-volatility stock. Its 30-day historical volatility typically ranges 40-70%, far above market averages. Around major events (earnings releases), single-day swings may reach 5-15%, sometimes even more extreme.High volatility presents both opportunity and risk. For short-term traders, volatility provides profit potential; for long-term investors, volatility may cause psychological stress and paper losses.

Q4: Is the MEXC platform safe? Are my funds secure?

MEXC is a long-established trading platform that prioritizes asset security through multi-layered safeguards. It employs cold-hot wallet separation with multi-signature verification and bank-grade encryption, while offering users enhanced account protections such as 2FA, IP and withdrawal whitelisting. The exchange operates under multiple regulatory licenses, adheres to AML and KYC standards, and maintains a dedicated risk reserve fund. Nevertheless, traders should remain cautious—avoid storing excess funds on exchanges, regularly withdraw profits, and diversify holdings across platforms to minimize potential risks.

Q5:If I encounter problems trading, how do I contact MEXC customer service?

MEXC provides multiple customer service channels:

Live chat: Log into MEXC website or app, click customer service icon bottom-right for real-time dialogue. This is fastest method, usually getting responses within minutes.

Ticket system: Submit issue tickets in help center, describing situation and uploading relevant screenshots. Customer service responds via email within 24 hours, suitable for non-urgent but detailed questions.

Official email: Send emails to support@mexc.com, suitable for complex issues or complaints.

Social media: MEXC has official accounts on Twitter, Telegram, and other platforms for contact or checking announcements.

FAQ: Help center has detailed FAQ documentation covering most common questions; suggest self-service inquiry first.

10.Conclusion

As a key beneficiary of the AI revolution, NVIDIA provides traders with a gateway to participate in the technology-driven market cycle. Through MEXC’s stock futures platform, investors can flexibly apply leverage, engage in two-way trading, and capitalize on volatility in both bullish and bearish conditions. Yet, given NVIDIA’s high volatility, success requires more than market intuition — it demands structured planning, disciplined execution, and careful position management. Beginners are advised to start with modest capital and conservative leverage, prioritizing risk control over short-term gains.

Before trading, it’s essential to understand NVIDIA’s fundamentals, competitive dynamics, and macroeconomic backdrop. Establish a clear plan with defined entry levels, stop-losses, and take-profit targets, then execute with emotional restraint. Remember, trading is a long-term process — consistent learning, reflection, and refinement of one’s strategy are the true foundations of sustainable profitability in the fast-evolving AI and semiconductor markets.

Join MEXC and Get up to $10,000 Bonus!

Sign Up