MicroStrategy has become a familiar name in both tech and finance, especially after becoming the largest publicly traded company holding Bitcoin in the world. Its bold strategy has reshaped how institutions think about digital assets, turning the company into a symbol of long term conviction, corporate innovation and the growing influence of Bitcoin on global markets.

1. Overview of MicroStrategy

1.1 What is MicroStrategy

MicroStrategy is an American technology company founded in 1989 by Michael J. Saylor and Sanju Bansal. It started with a consulting contract from DuPont and an initial capital of 250,000 USD. Using their MIT expertise, they developed data mining and business analytics software. This helped MicroStrategy secure a major contract with McDonald’s in 1992 and maintain revenue growth of 100 percent per year from 1990 to 1996. In 1994, the company moved its headquarters to Tysons Corner, Virginia, and officially went public in 1998.

MicroStrategy built its reputation through MicroStrategy ONE, a data analytics platform that integrates AI and ROLAP architecture, allowing enterprises to access and visualize data from multiple sources. The company also expanded into R&D by founding Alarm.com in 2000, although it faced financial restatement issues and SEC allegations at the same time. After overcoming the turmoil, MicroStrategy continued to grow, selling Alarm.com in 2009 and expanding into cloud services with MicroStrategy Cloud in 2011.

Beyond its technology products, MicroStrategy gained global attention with its aggressive Bitcoin strategy, turning the company into one of the largest institutional holders of BTC. The combination of analytics software, technological innovation, and bold financial strategy has strengthened MicroStrategy’s unique position in both Business Intelligence and digital assets.

1.2 How MicroStrategy Invests in Bitcoin?

MicroStrategy executes a bold Bitcoin investment strategy using internal capital and financial instruments to optimize returns. The company uses its cash reserves to buy Bitcoin directly while also issuing convertible bonds and secured loans to raise additional funds. Convertible bonds allow low interest borrowing due to the conversion option, while Bitcoin-backed loans enable further accumulation but come with risks if the price drops sharply.

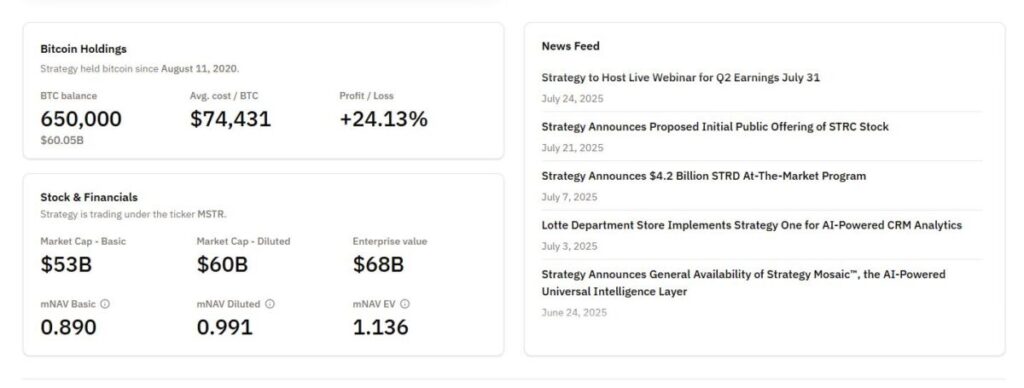

MicroStrategy’s Total Bitcoin Holdings and Profits as of December 5, 2025

This strategy reflects MicroStrategy’s belief in Bitcoin as a superior treasury asset, using leverage and price volatility to boost long term returns. As of now, the company holds 650,000 BTC worth over 60.5 billion USD, up roughly 25 percent thanks to market conditions. However, risks remain if Bitcoin price falls. MicroStrategy’s success depends on Bitcoin’s long term growth and reinforces its role as a pioneer in institutional BTC accumulation.

2. The Truth Behind MicroStrategy’s Bitcoin Buying Mode

MicroStrategy is currently facing a wave of negative news. Its stock price has dropped more than 60 percent from the top. MSCI is considering removing it from its index. JPMorgan warns of potential forced selling of up to 8.8 billion USD. Even the CEO admits they may sell Bitcoin if necessary, something Michael Saylor once insisted would never happen.

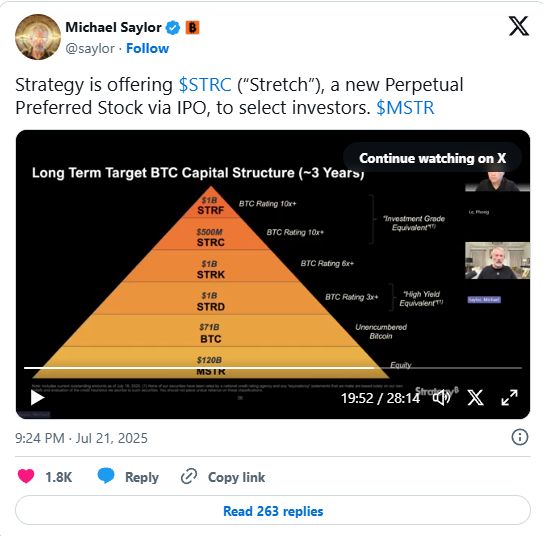

It all started during a MicroStrategy earnings presentation. Saylor showed a chart illustrating the company’s financial structure. The problem was that the diagram looked exactly like a pyramid: the bottom layer was MSTR stock, the middle was Bitcoin, and the top consisted of various financial instruments such as convertible bonds, preferred shares, and dividends. To make things worse, the abbreviations formed the word FCKD. Whether intentional or accidental, the internet noticed. A Reddit post about it gained over 2,000 upvotes and triggered intense debate.

Saylor presents the “pyramid model” of Strategy

Around 70 to 80 percent said this looked like a disguised Ponzi because the company borrows and issues shares to buy Bitcoin, betting on constant price growth. The other 20 percent defended the model, claiming MicroStrategy is using a sophisticated strategy with real Bitcoin backing it, similar to a leveraged ETF. Neutral opinions described the model as building a house on sand. It works when conditions are calm but becomes risky when the waves hit.

MicroStrategy and similar firms are known as DACO (Digital Asset Treasury Companies). Their business is simple: accumulate digital assets and generate profit through share issuance used to buy Bitcoin, hoping the price keeps rising. The key difference lies in the financial loop: Bitcoin increases which pushes the stock up which allows them to issue more stock which buys more Bitcoin which then pushes Bitcoin even higher. This creates a theoretical infinite money machine.

The efficiency of the model depends on mNAV (Market cap divided by Net Asset Value). When mNAV is greater than 1, the company sells stock at an inflated market price but buys Bitcoin at real value, boosting corporate value significantly.

For example, if mNAV equals 2, issuing 1 billion USD in new stock brings in real capital to buy Bitcoin while increasing the company’s value by 2 billion USD. Existing shareholders benefit, and new investors expect the loop to continue.

Although the model looks like a Ponzi at first glance, it is not. Unlike a fraudulent Ponzi that relies on empty promises and fake balance sheets, MicroStrategy holds real assets in Bitcoin. The company is not using new investors’ money to pay old investors in the literal sense. But it is also not a normal investment model because everything depends on one condition: Bitcoin must keep going up. If Bitcoin moves sideways or drops, the engine stops. And what happens when it stops?

3. Will MicroStrategy Be Forced to Sell Bitcoin?

Recently, Bitcoin dropped about 30 percent from its peak, and MicroStrategy stock fell more than 60 percent. The mNAV ratio, once extremely high, has fallen below 1 at times, meaning the company’s market cap was lower than the value of its Bitcoin holdings.

When mNAV is below 1, the infinite money engine becomes a money burning engine. Issuing shares dilutes existing shareholders, but not issuing shares means no capital to buy more Bitcoin. The financially logical solution is to sell Bitcoin to buy back shares, but doing so may trigger panic, push Bitcoin prices down, and further lower mNAV, tightening the spiral.

MicroStrategy currently has around 8.2 billion USD in convertible bonds and 5.8 billion USD in preferred shares. The company must pay roughly 750 to 800 million USD per year, mostly dividends for preferred shares. Previously they handled this by issuing more shares, avoiding the need to touch Bitcoin and maintaining the growth narrative. But with the stock price falling and mNAV below 1, this strategy is no longer feasible.

MicroStrategy has two options when mNAV is below 1:

Option 1: sell Bitcoin for cash. This reduces Bitcoin per share, turns Bitcoin yield negative, and hurts investor confidence.

Option 2: defer dividend payments on preferred shares. This preserves Bitcoin but damages trust and limits fundraising ability. Either way, common shareholders suffer while the company survives.

As MicroStrategy struggles with its financial puzzle, another risk emerges. MSCI is considering removing the company from its index because Bitcoin accounts for more than 50 percent of its assets, making it resemble an investment fund rather than an operating company. If removed, MSCI tracking funds could sell between 2.8 and 8.8 billion USD worth of MSTR. Saylor argues MicroStrategy is a software company with a Bitcoin treasury strategy, supported by the issuance of five new types of securities. MSCI’s decision is expected before January 15, 2026.

MicroStrategy admits they may sell Bitcoin

The story will not end with MicroStrategy if things deteriorate further. A domino effect may spread. DACOs hold around 5 percent of all Bitcoin. If one starts selling, others may be forced to follow as mNAV collapses, creating significant selling pressure. CEO Phong Le admits that if MicroStrategy sells Bitcoin, the market will panic, making the situation worse. It would resemble DeFi liquidations but on a far larger scale.

4. Conclusion

Returning to the pyramid chart Saylor presented, it reflects how the company operates. The base consists of MSTR stock which serves as the foundation for raising capital. The middle layer is Bitcoin which is accumulated using raised funds. The top layer consists of financial instruments such as convertible bonds, preferred shares, and annual dividends of 9 to 10 percent used to reward investors.

The problem is that if the middle layer (Bitcoin) shakes, the entire tower wobbles, which is why many call this model a sandcastle. Supporters argue that Bitcoin will rise long term, strengthening the foundation.

Looking back at history, Bitcoin has dropped sharply many times and then broke new highs. If this cycle continues, MicroStrategy gains, mNAV rises, the printing engine restarts, and the philosophy of never selling will be celebrated again.

If Bitcoin moves sideways, the engine cannot operate. The company still needs to pay 750 to 800 million USD per year and cannot issue new shares. It must choose between selling Bitcoin or deferring dividends. In this case, shareholder value erodes gradually.

It is clear that this is a legal business model backed by real assets and designed by people who understand financial mechanics. But its core nature is a leveraged bet on Bitcoin. Gains are amplified, and losses are magnified. The model suits those who believe Bitcoin will rise long term and can tolerate significant volatility. It is clearly not a safe way to own Bitcoin indirectly.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always do your own research, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up