Every single morning, millions of traders around the world wake up to headlines like:

“NVDA futures ripping 9% pre-market”

“Tesla futures exploding after Elon’s tweet”

“Nasdaq-100 futures signaling a massive open”

Those numbers you see on CNBC, Bloomberg, or Yahoo Finance before the NYSE even opens? That’s U.S. stock futures in action.

And right now, the easiest, fastest, and most popular way for retail traders globally to actually trade those exact same futures is on MEXC — the crypto exchange that lists 50+ U.S. stock perpetual futures contracts with deeper liquidity than anywhere else, true 24/7 trading, up to 50x leverage, and often zero fees + zero funding.

What Exactly Are U.S. Stock Futures?

A U.S. stock future is a derivative contract that tracks the price of a major index or individual stock in real time.

- You profit when the price moves in your direction (long or short)

- No need to own actual shares

- Cash-settled (usually in USDT on crypto platforms)

- On MEXC they are perpetual — no expiration date

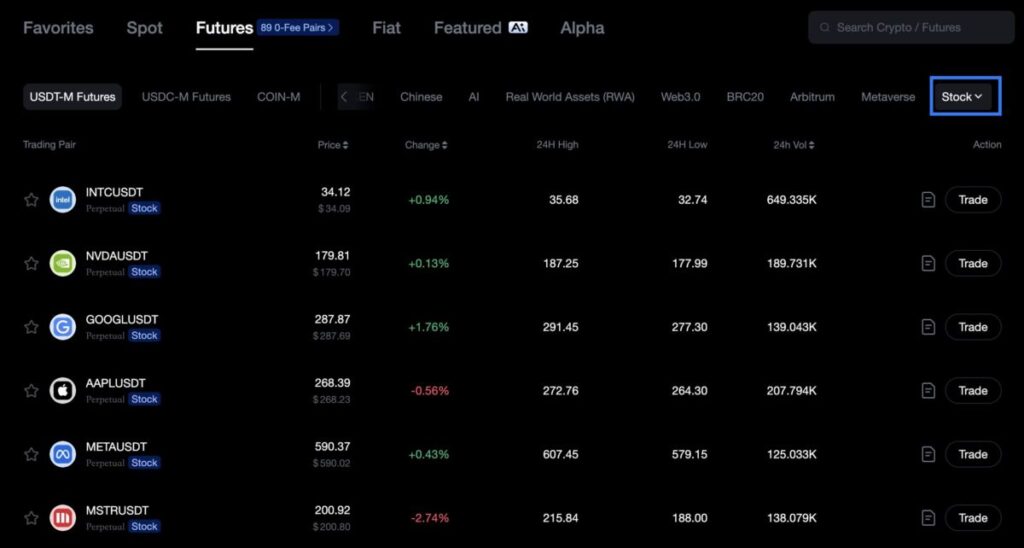

That’s literally it.The 50+ U.S. Stock Perpetual Futures You Can Trade on MEXC Right Now

| Rank | Symbol | Underlying | 24h Volume Rank |

|---|---|---|---|

| 1 | NVDAUSDT | NVIDIA | Top1 |

| 2 | TSLAUSDT | Tesla | Top2 |

| 3 | AAPLUSDT | Apple | Top 3 |

| 4 | METAUSDT | Meta Platforms | Top 5 |

| 5 | QQQUSDT | Invesco QQQ (Nasdaq-100) | Top 5 |

| 6 | GOOGLUSDT | Alphabet (Google) | High |

| 7 | AMZNUSDT | Amazon | High |

| 8 | MSFTUSDT | Microsoft | High |

| 9 | AMDUSDT | AMD | High |

| 10 | COINUSDT | Coinbase | High |

| … | + More including HOOD, PLTR, MSTR, INTC, ORCL, AVGO, etc. |

(Source:Mexc)

All contracts stay within ~0.1% of the real NASDAQ/NYSE price — the same price you see on Bloomberg or TradingView.

MEXC vs Traditional U.S. Brokers & CME Futures

| Feature | Traditional U.S. Brokers / CME | MEXC Perpetual Stock Futures |

|---|---|---|

| Single-stock futures | Almost none | 20+ (NVDA, TSLA, AAPL, etc.) |

| Trading hours | Limited pre/after-hours | True 24/7 — weekends & holidays |

| Leverage | 4–20x max | Up to 50x (most capped safer) |

| Fees | Commissions + exchange fees | Maker 0%, taker ≤0.02% (often 0%) |

| Funding rate | N/A | Usually near zero or waived |

| Minimum capital | Thousands of dollars | <$10 |

| Account approval | Days + paperwork | Instant signup — no KYC for trading |

| New-user bonus | Rare | Up to $1,000 USDT welcome package |

How to Trade U.S. Stock Futures on MEXC in Under 5 Minutes

- Go to mexc.com → Sign up with email or Google (10 seconds)

- Deposit USDT (credit/debit card, Apple Pay, bank transfer, or buy directly on-platform)

- Click “Futures” → “Stock Futures” tab

- Search NVDAUSDT, TSLAUSDT, AAPLUSDT, etc.

- Choose leverage (beginners start 5–10x)

- Long (bet up) or Short (bet down)

- Set stop-loss & take-profit (non-negotiable)

- Watch real-time P&L — close anytime, even at 3 AM

Real Trading Case: U.S. Stock Futures on MEXC

During NVIDIA’s latest earnings, thousands of MEXC users opened NVDAUSDT positions hours before the NYSE opened and banked 300–1000% returns on margin overnight.

Risk Warning (Read This Twice)

- U.S. stock futures are leveraged derivatives, A 10% adverse move at 10x leverage can wipe your entire position.

- CFTC data shows 70–80% of retail futures traders lose money.

- Only risk capital you can afford to lose completely.

- MEXC has insurance funds and auto-deleveraging (ADL) to prevent negative balances in nearly all cases.

Ready to Start Trading U.S. Stock Futures Today?

If you searched “U.S. stock futures” because you actually want to trade them — not just read about them — MEXC is the global leader for retail traders right now.→ Open your account and explore all 50+ U.S. stock perpetual futures

https://www.mexc.com/futures/stock-futures New users regularly receive up to $1,000 USDT in bonuses — enough to test the waters with almost zero out-of-pocket risk.(Affiliate Disclosure: We may earn a commission if you register through the link above.

This does not affect your trading costs.)Welcome to the new era of U.S. stock futures trading. See you on the leaderboard!

FAQ – U.S. Stock Futures on MEXC (Most Asked Questions )

- Are the contracts on MEXC the same as the “U.S. stock futures” I see on CNBC and Bloomberg?

Yes — they track the exact same underlying price (NVDA, TSLA, AAPL, Nasdaq-100, etc.) with deviation usually under 0.1%. The only difference is that MEXC contracts are perpetual (no expiry) and trade 24/7, while CNBC mostly refers to traditional CME index futures. - How close is the price to the real NASDAQ/NYSE stock price?

Typically within 0.05–0.1%. MEXC uses multiple institutional market makers and real-time price oracles, so the price you see is essentially identical to what you’d see on TradingView, Yahoo Finance, or Bloomberg — just tradable 24 hours a day. - What are the actual fees on MEXC right now?

Maker fee: 0% Taker fee: ≤ 0.02% (often reduced to 0% with VIP level or promotions) Funding rate (NVDAUSDT, TSLAUSDT, etc.): frequently near zero or fully waived for long periods. - What leverage is available and what should beginners use?

Up to 50x on some contracts, but high-volume ones like NVDA and TSLA are capped lower for safety (usually 20–30x max). Beginners should stick to 5–10x — enough power without instant liquidation risk. - Do I need KYC to trade U.S. stock futures on MEXC?

No — KYC is not required for normal trading, deposits, or withdrawals under the daily limit. Only very large withdrawals trigger a one-time verification. - Can I lose more than I deposit (negative balance)?

In 99.99% of cases, no. MEXC’s insurance fund and ADL (auto-deleveraging) system protect against negative balances even during extreme volatility. - Is MEXC safe and legitimate for trading U.S. stock futures?

Operating since 2018, 10M+ users, monthly proof-of-reserves above 100%, never hacked, and consistently ranked top 5 globally for derivatives volume. It is still considered an offshore platform — so trade responsibly and avoid storing large balances long-term. - What welcome bonus do new users get?

New accounts can claim up to $1,000 USDT in trading bonuses and fee rebates after completing simple steps (deposit + a few trades). This is enough to test real positions with almost no personal cost. - Why do most retail traders now prefer MEXC over traditional brokers for U.S. stock futures? Because MEXC offers:

- True 24/7 trading

- 50+ single-stock perpetual contracts

- Much lower fees

- Instant signup

- The ability to go long or short before the NYSE even opens

Traditional brokers simply cannot offer these benefits.

Join MEXC and Get up to $10,000 Bonus!

Sign Up